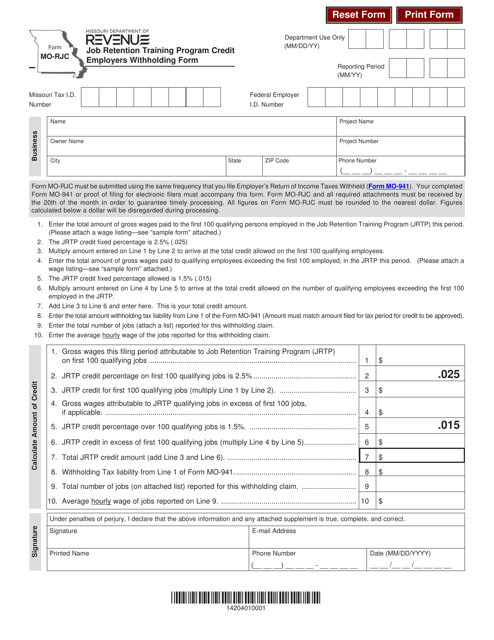

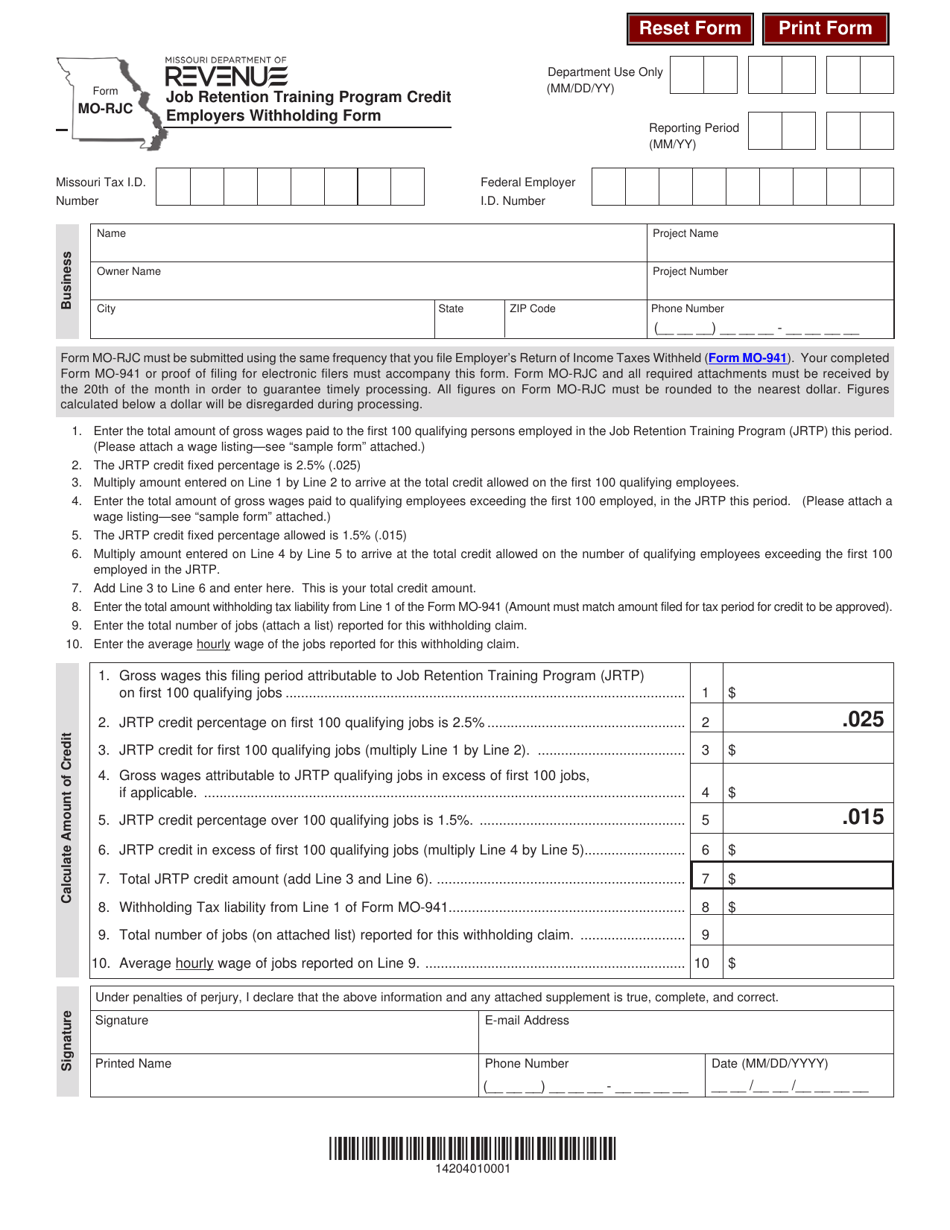

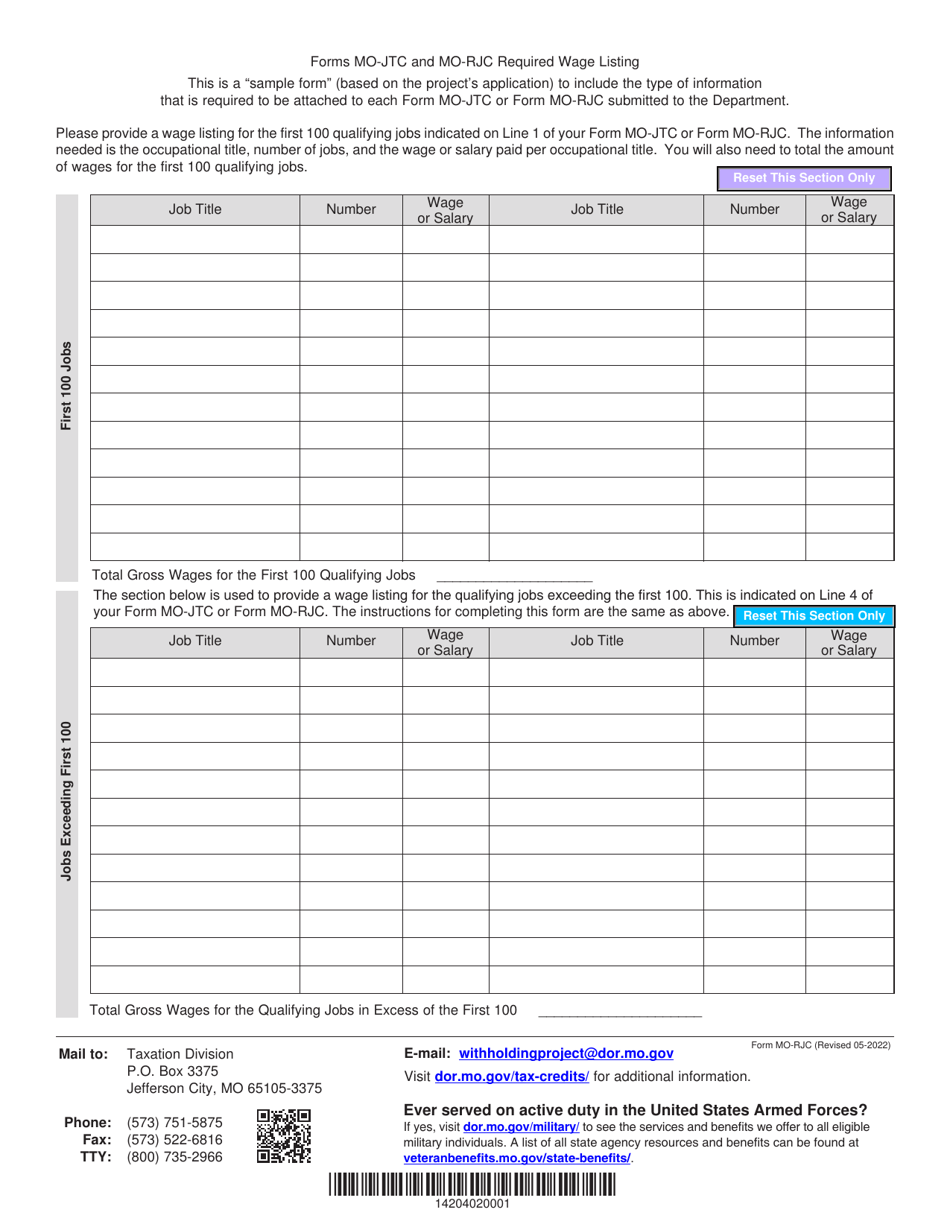

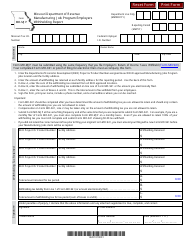

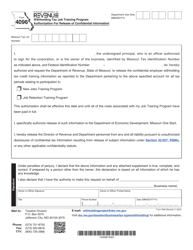

Form MO-RJC Job Retention Training Program Credit Employers Withholding Form - Missouri

What Is Form MO-RJC?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-RJC Job Retention Training Program?

A: The MO-RJC Job Retention Training Program is a program in Missouri that provides credits to employers for offering job retention training to their employees.

Q: What is the purpose of the Job Retention Training Program?

A: The purpose of the Job Retention Training Program is to encourage employers to provide training to their employees in order to help them retain their jobs.

Q: Who is eligible for the MO-RJC Job Retention Training Program credit?

A: Employers in Missouri who provide job retention training to their employees are eligible for the MO-RJC Job Retention Training Program credit.

Q: How does the MO-RJC Job Retention Training Program credit work?

A: The MO-RJC Job Retention Training Program credit allows eligible employers to claim a credit against their withholding taxes based on the training expenses they incur.

Q: How can employers claim the MO-RJC Job Retention Training Program credit?

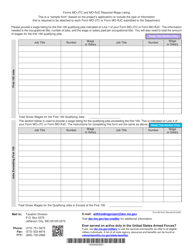

A: Employers can claim the MO-RJC Job Retention Training Program credit by filling out Form MO-RJC and submitting it to the Missouri Department of Revenue.

Q: Are there any limitations or requirements for claiming the MO-RJC Job Retention Training Program credit?

A: Yes, there are certain limitations and requirements for claiming the MO-RJC Job Retention Training Program credit. It is best to consult the official guidelines or contact the Missouri Department of Revenue for specific details.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-RJC by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.