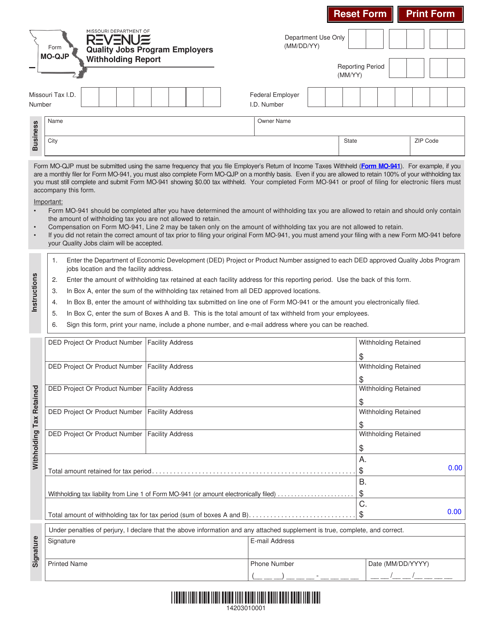

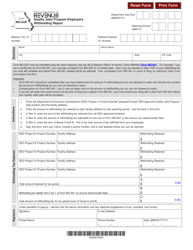

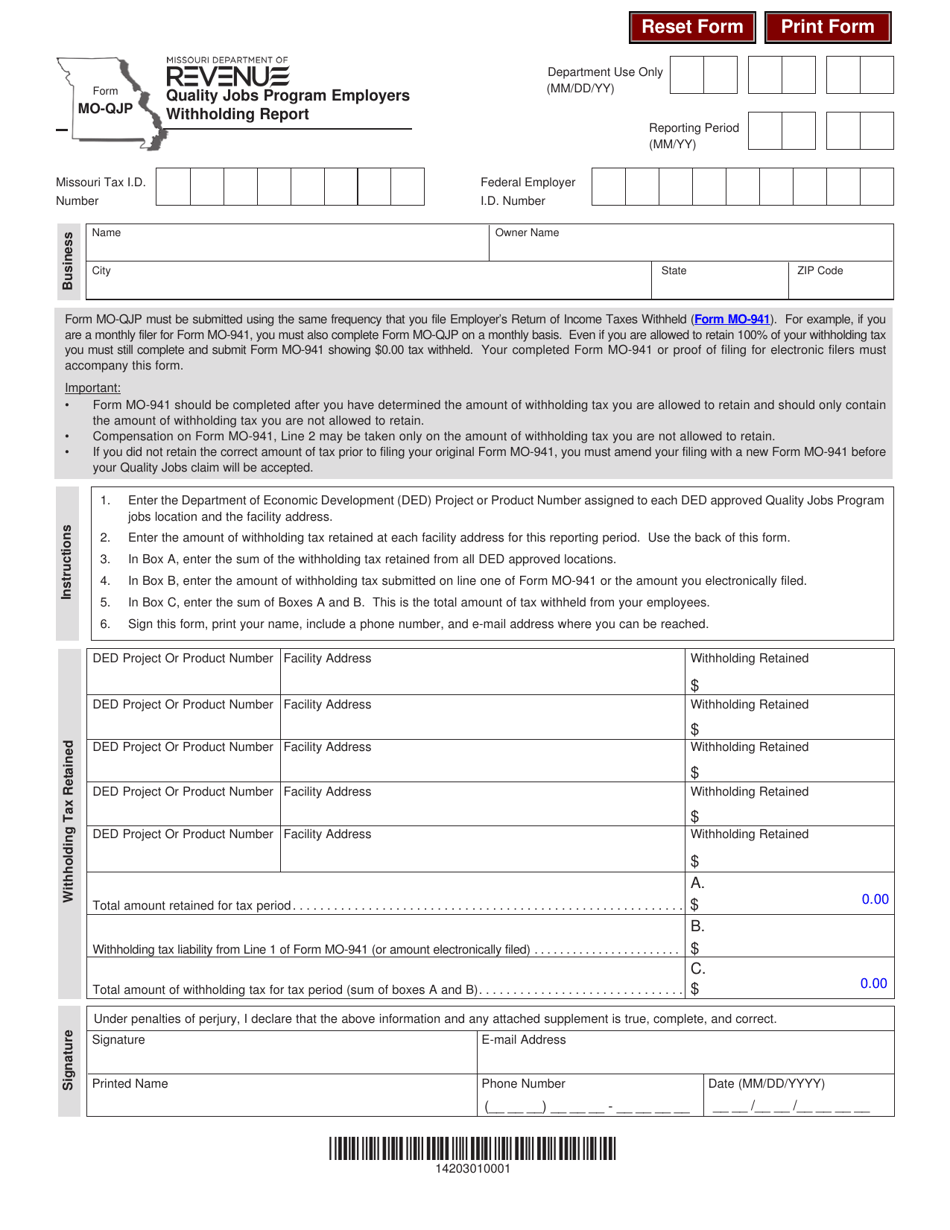

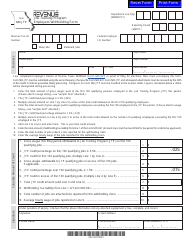

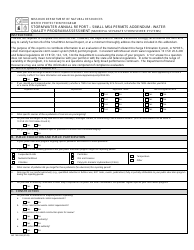

Form MO-QJP Quality Jobs Program Employers Withholding Report - Missouri

What Is Form MO-QJP?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-QJP Quality Jobs ProgramEmployers Withholding Report?

A: The MO-QJP Quality Jobs Program Employers Withholding Report is a form that employers in Missouri use to report withholding taxes for the Quality Jobs Program.

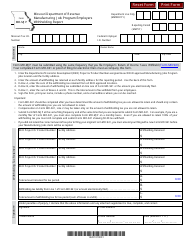

Q: Who needs to file the MO-QJP Quality Jobs Program Employers Withholding Report?

A: Employers in Missouri who are participating in the Quality Jobs Program need to file this report.

Q: What is the Quality Jobs Program?

A: The Quality Jobs Program is an economic developmentincentive program in Missouri that provides tax incentives to businesses that create new jobs and invest in the state.

Q: When is the MO-QJP Quality Jobs Program Employers Withholding Report due?

A: The report is due on a monthly basis, and the due date is the 15th of the month following the reporting period.

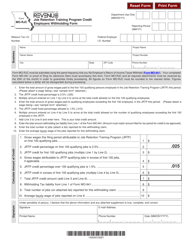

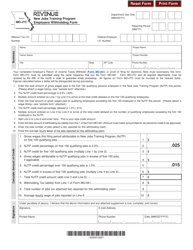

Q: What information do I need to include on the MO-QJP Quality Jobs Program Employers Withholding Report?

A: You'll need to provide information about your business, employee wages, and the withholding taxes you've deducted from their paychecks.

Q: Are there any penalties for not filing the MO-QJP Quality Jobs Program Employers Withholding Report?

A: Yes, there can be penalties for not filing the report or filing it late. It's important to submit the report on time to avoid any penalties or fines.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-QJP by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.