This version of the form is not currently in use and is provided for reference only. Download this version of

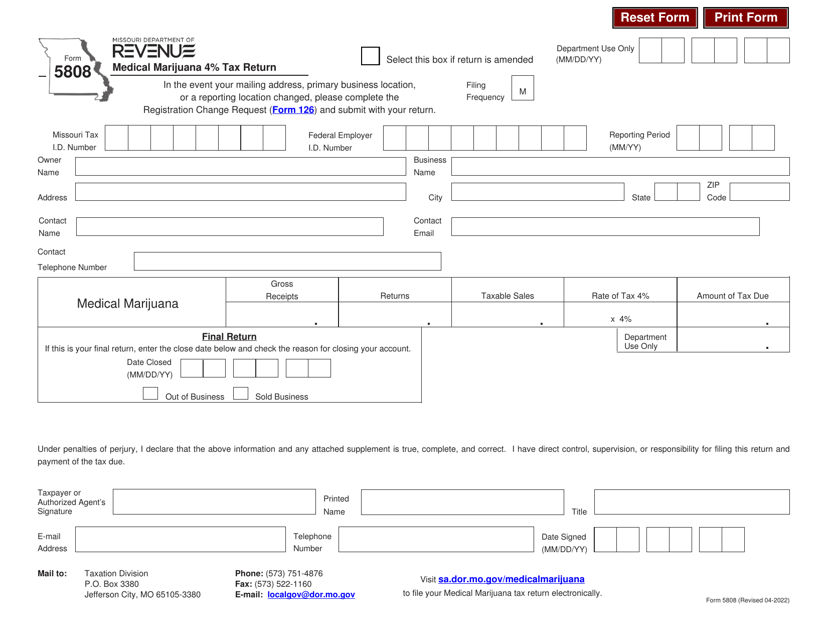

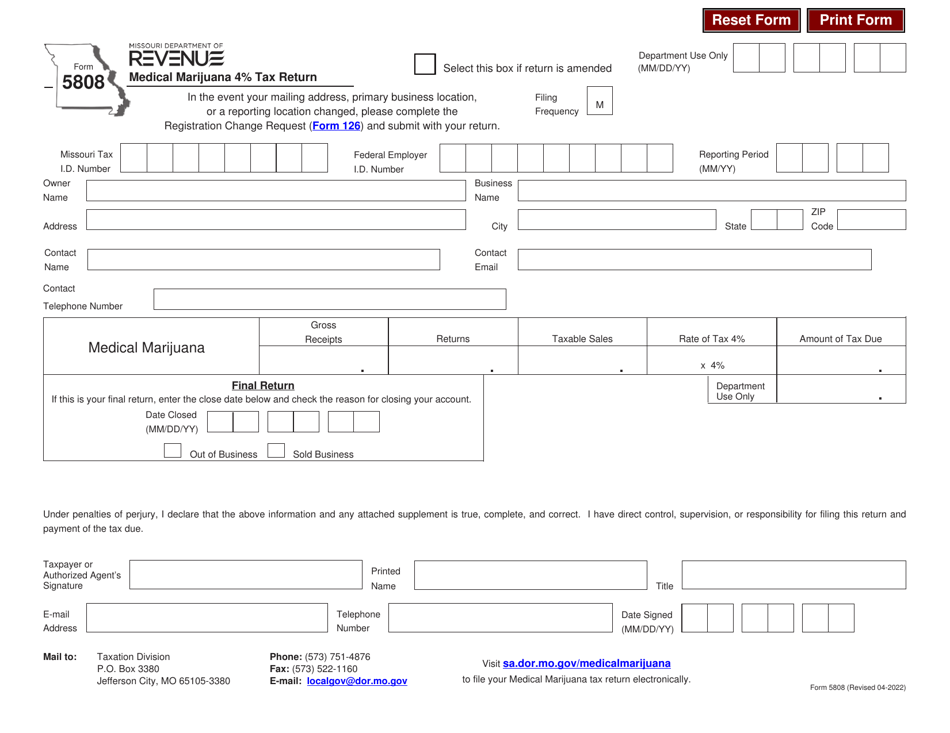

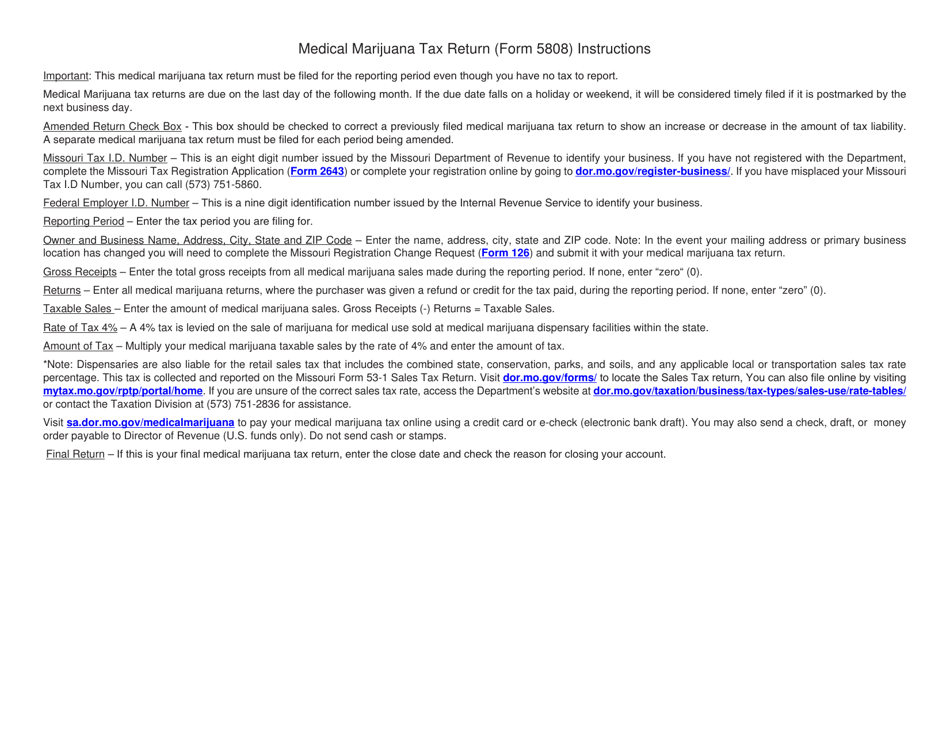

Form 5808

for the current year.

Form 5808 Medical Marijuana 4% Tax Return - Missouri

What Is Form 5808?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5808?

A: Form 5808 is a tax return form used for reporting and paying the 4% medical marijuana tax in the state of Missouri.

Q: Who needs to file Form 5808?

A: Any person or entity that is engaged in the cultivation, production, or sale of medical marijuana in Missouri must file Form 5808.

Q: What is the purpose of the medical marijuana tax?

A: The purpose of the medical marijuana tax is to generate revenue for the state and fund various programs and initiatives.

Q: How often do I need to file Form 5808?

A: Form 5808 must be filed on a quarterly basis, with the due dates being the last day of the month following the end of each calendar quarter.

Q: What information do I need to provide on Form 5808?

A: You will need to provide information such as your business name, address, gross sales of medical marijuana, and the amount of tax due.

Q: Are there any penalties for not filing or paying the medical marijuana tax?

A: Yes, there are penalties for failure to file or pay the tax, including interest charges and potential legal consequences.

Q: Can I claim any deductions or credits on Form 5808?

A: No, there are no deductions or credits available for the medical marijuana tax in Missouri.

Q: What records do I need to keep for Form 5808?

A: You should keep records of your medical marijuana sales, receipts, and any other documentation related to your business operations for a minimum of three years.

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5808 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.