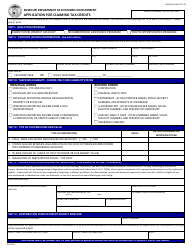

This version of the form is not currently in use and is provided for reference only. Download this version of

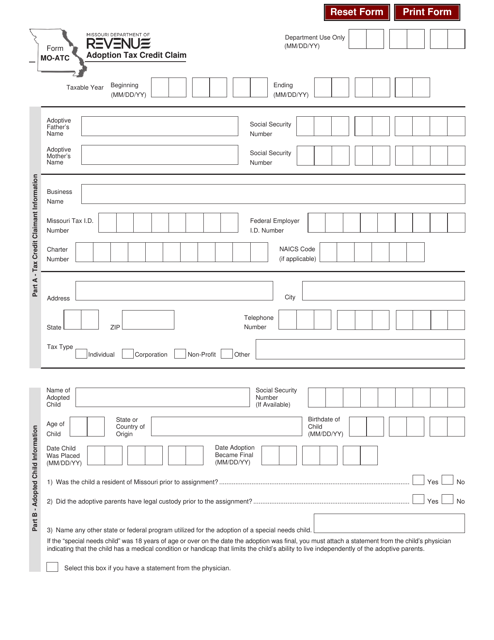

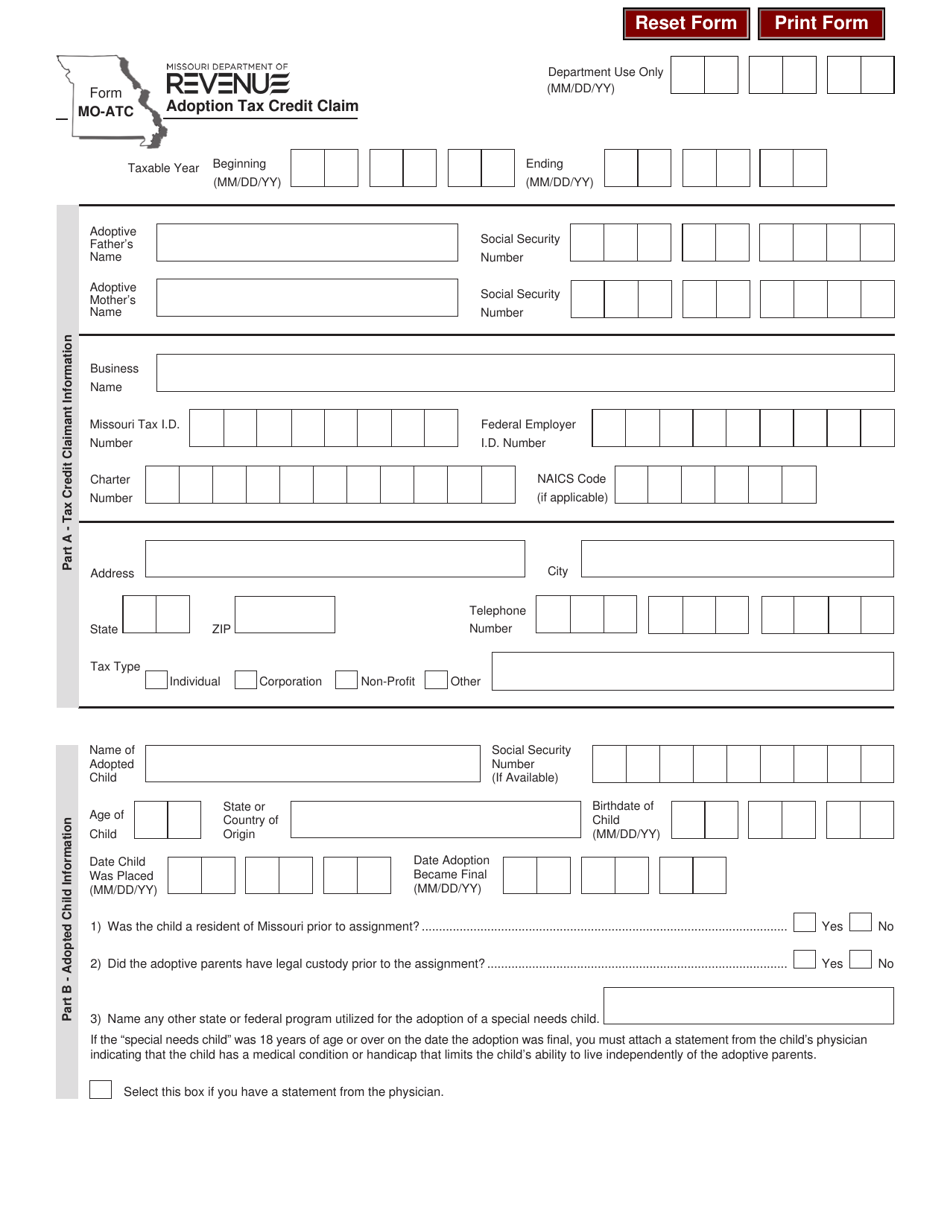

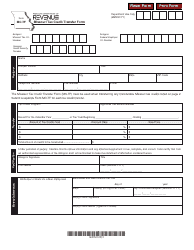

Form MO-ATC

for the current year.

Form MO-ATC Adoption Tax Credit Claim - Missouri

What Is Form MO-ATC?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

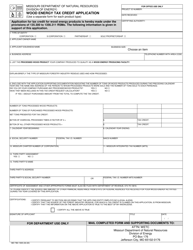

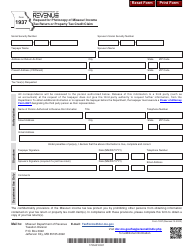

Q: What is the MO-ATC Adoption Tax Credit Claim?

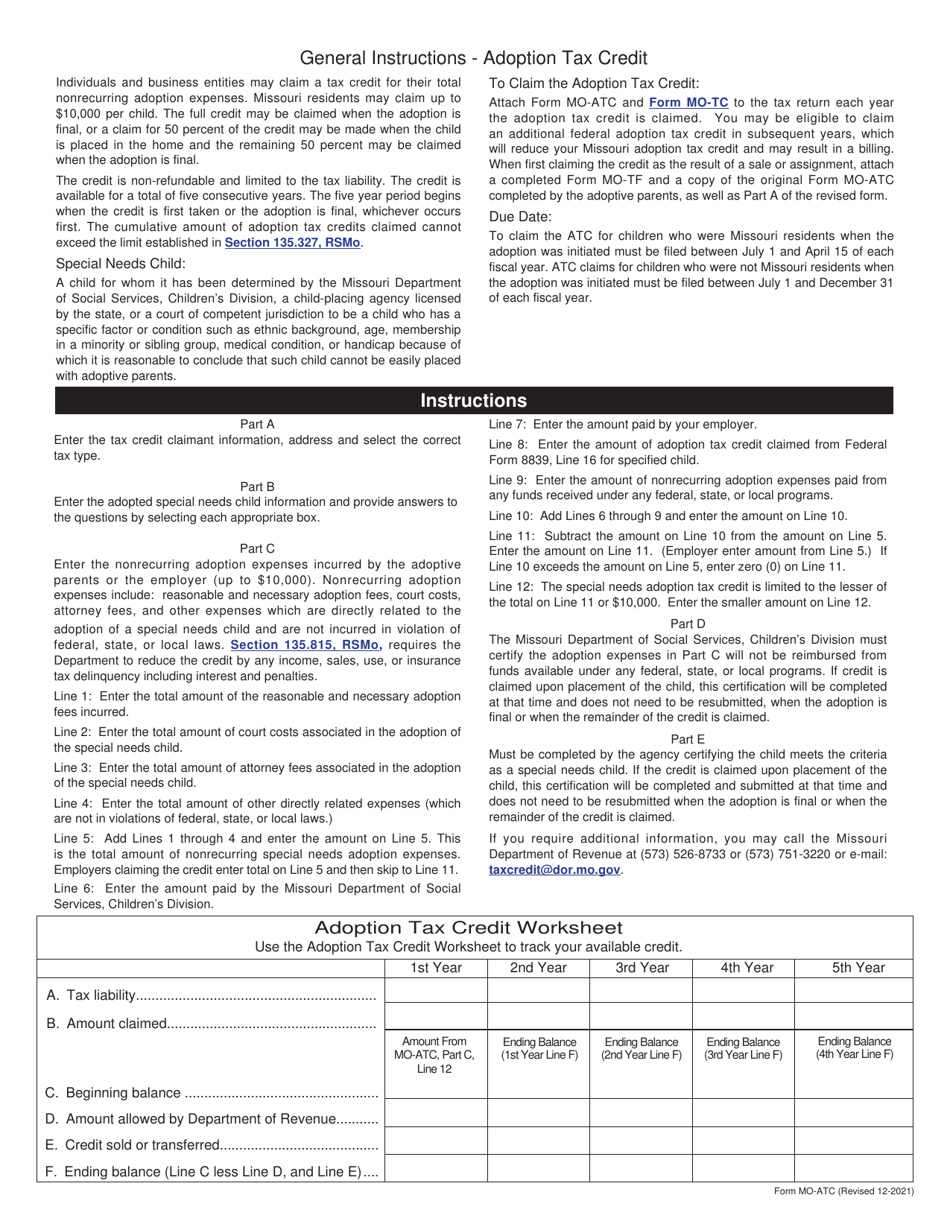

A: The MO-ATC Adoption Tax Credit Claim is a form used in Missouri to claim a tax credit for eligible adoption expenses.

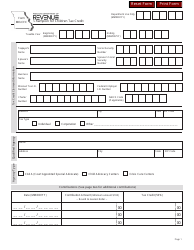

Q: Who is eligible to claim the MO-ATC Adoption Tax Credit?

A: Individuals who have adopted a child in Missouri and have incurred qualifying adoption expenses may be eligible to claim the MO-ATC Adoption Tax Credit.

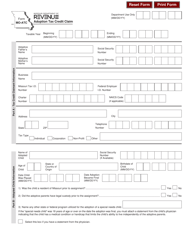

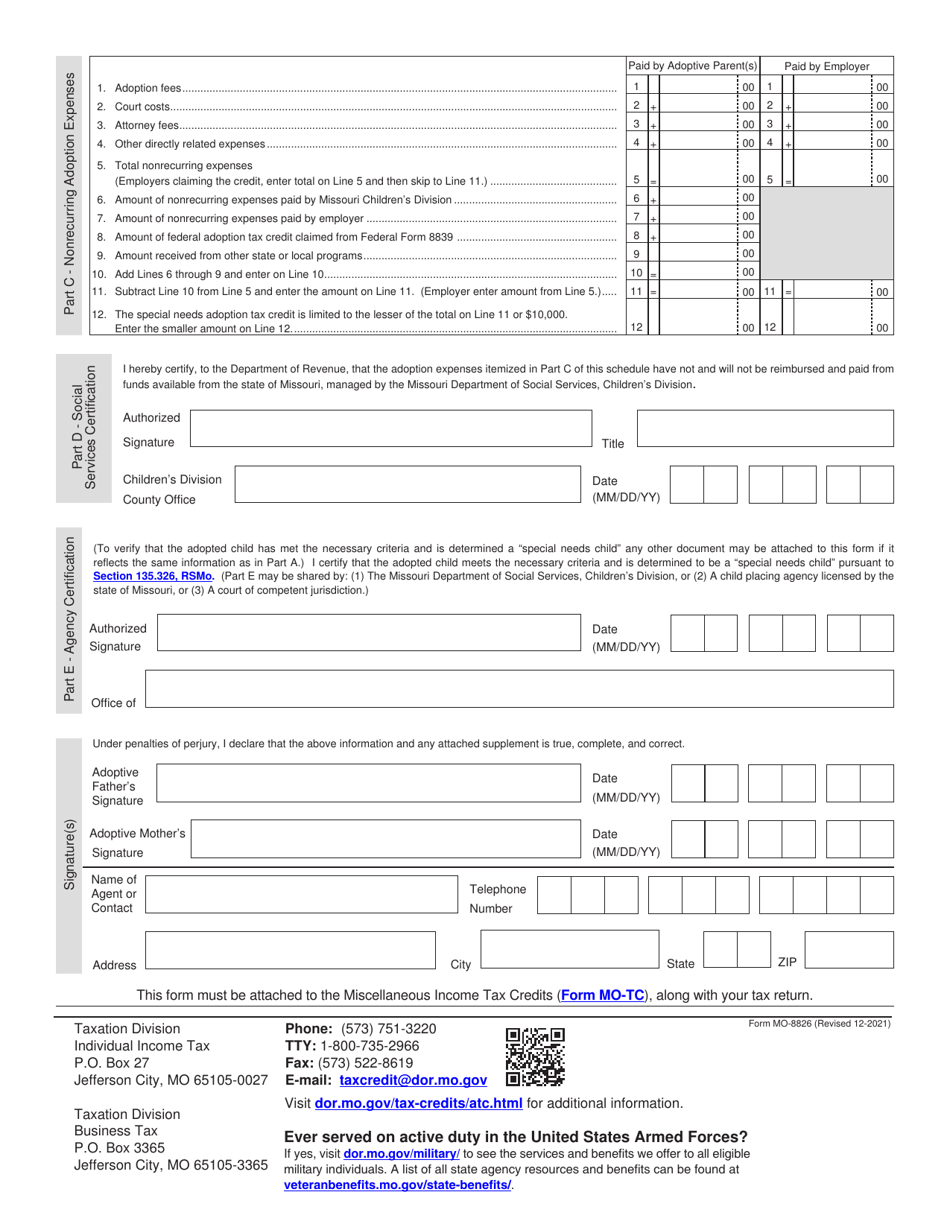

Q: What are qualifying adoption expenses?

A: Qualifying adoption expenses may include adoption fees, attorney fees, court costs, and other reasonable and necessary expenses directly related to the adoption.

Q: How much is the MO-ATC Adoption Tax Credit?

A: The amount of the MO-ATC Adoption Tax Credit can vary and is determined by the total amount of qualifying adoption expenses incurred.

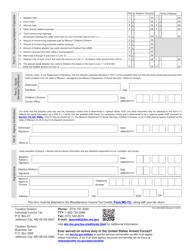

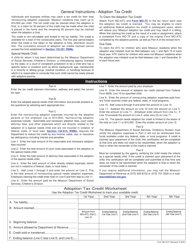

Q: How do I file the MO-ATC Adoption Tax Credit Claim?

A: To file the MO-ATC Adoption Tax Credit Claim, you need to complete and submit Form MO-ATC along with any required supporting documentation to the Missouri Department of Revenue.

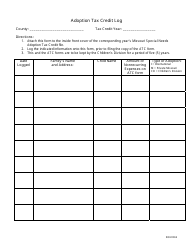

Q: When is the deadline to file the MO-ATC Adoption Tax Credit Claim?

A: The deadline to file the MO-ATC Adoption Tax Credit Claim is the same as the deadline for filing your Missouri state tax return, which is typically April 15th.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-ATC by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.