This version of the form is not currently in use and is provided for reference only. Download this version of

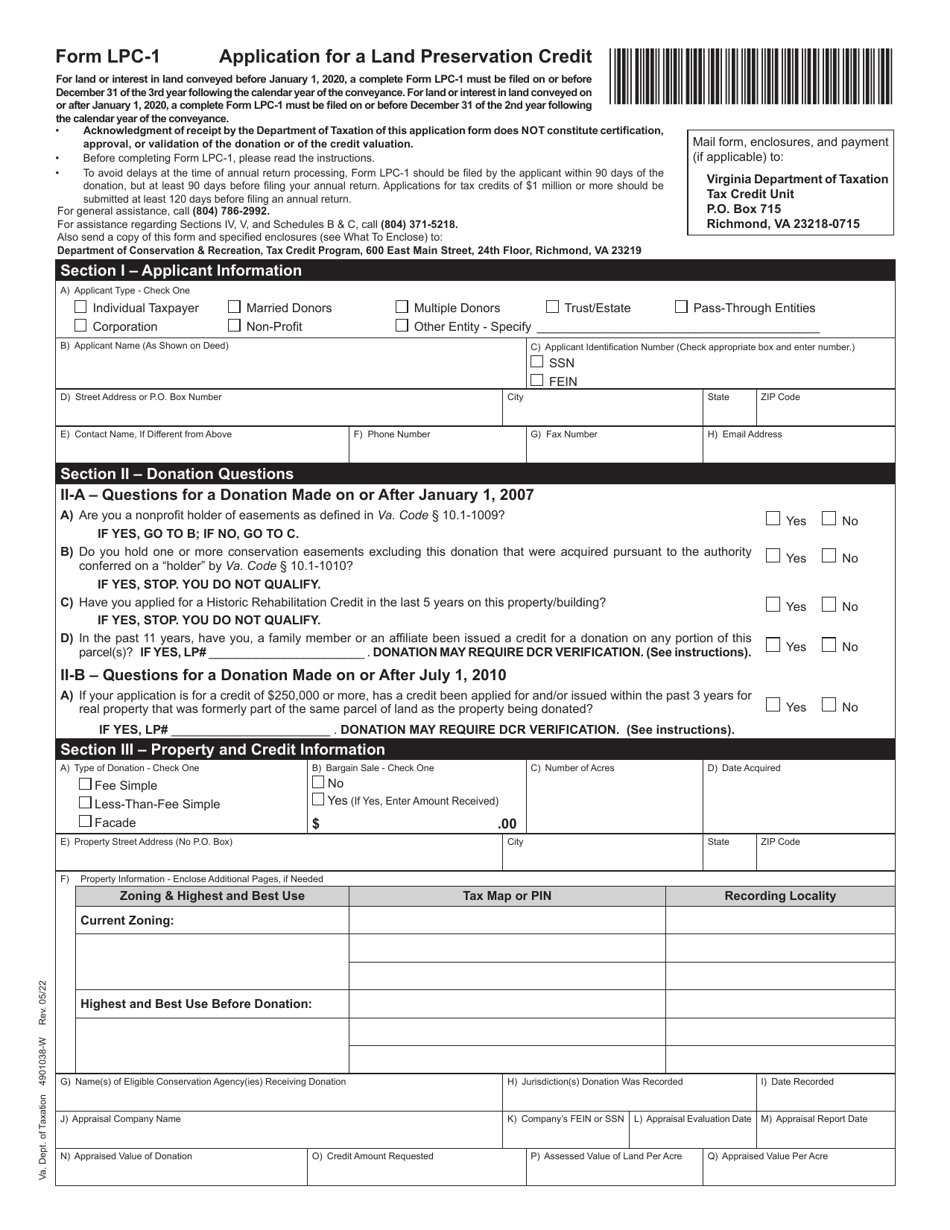

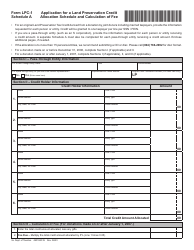

Form LPC-1

for the current year.

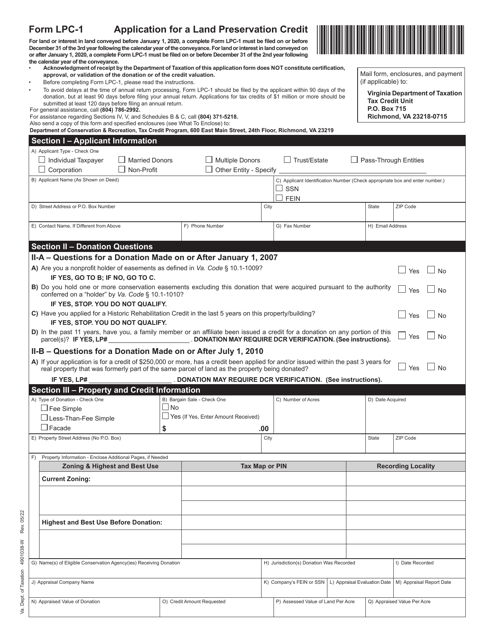

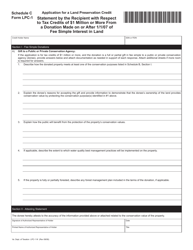

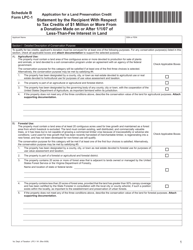

Form LPC-1 Application for a Land Preservation Credit - Virginia

What Is Form LPC-1?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form LPC-1?

A: Form LPC-1 is an application for a Land Preservation Credit in Virginia.

Q: What is the purpose of the Land Preservation Credit?

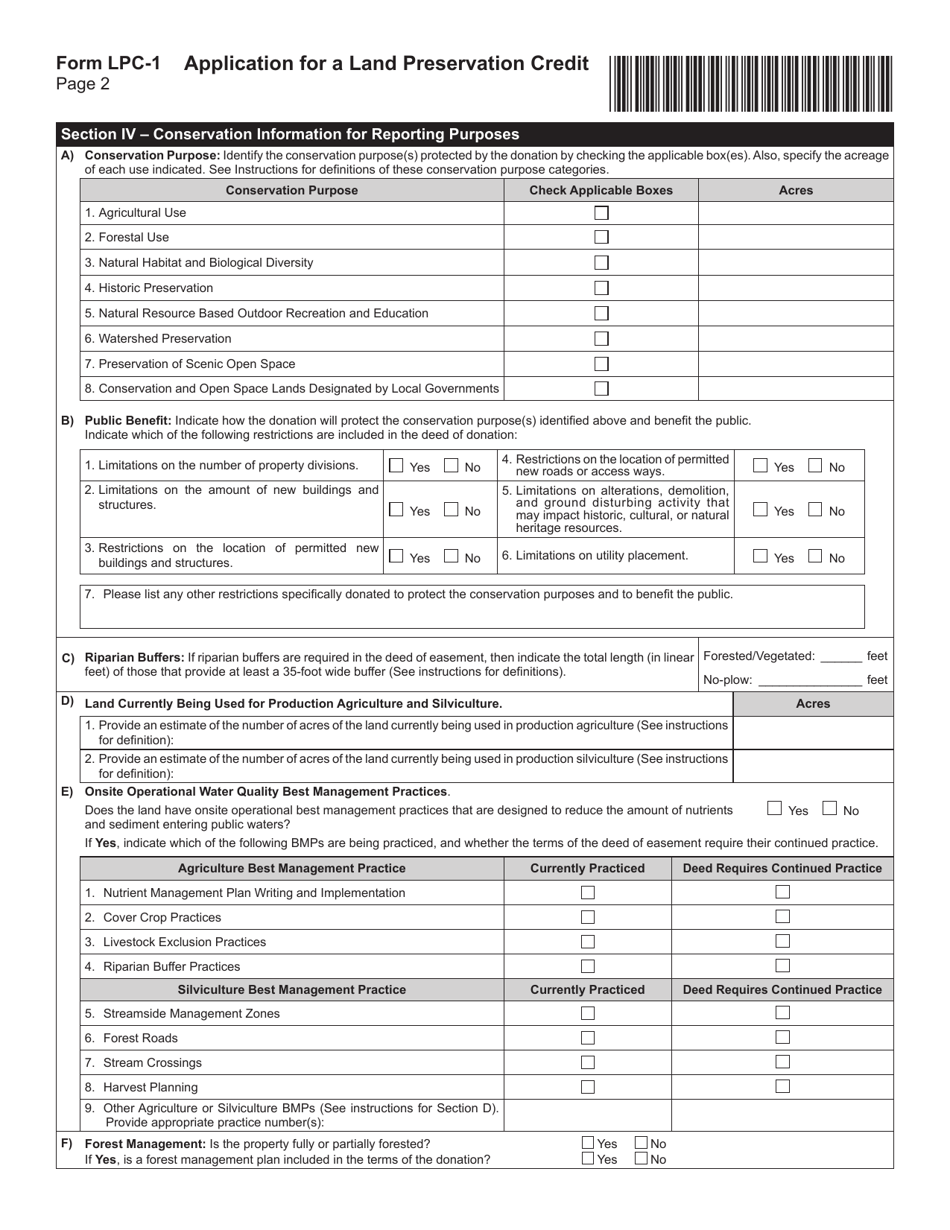

A: The Land Preservation Credit aims to encourage landowners in Virginia to preserve their land for conservation purposes.

Q: Who is eligible to apply for the Land Preservation Credit?

A: Landowners in Virginia who have placed their land under permanent conservation easements may be eligible for the credit.

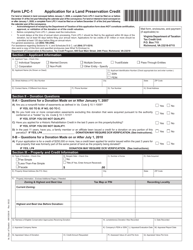

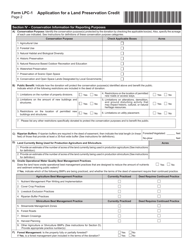

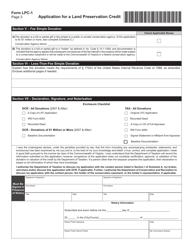

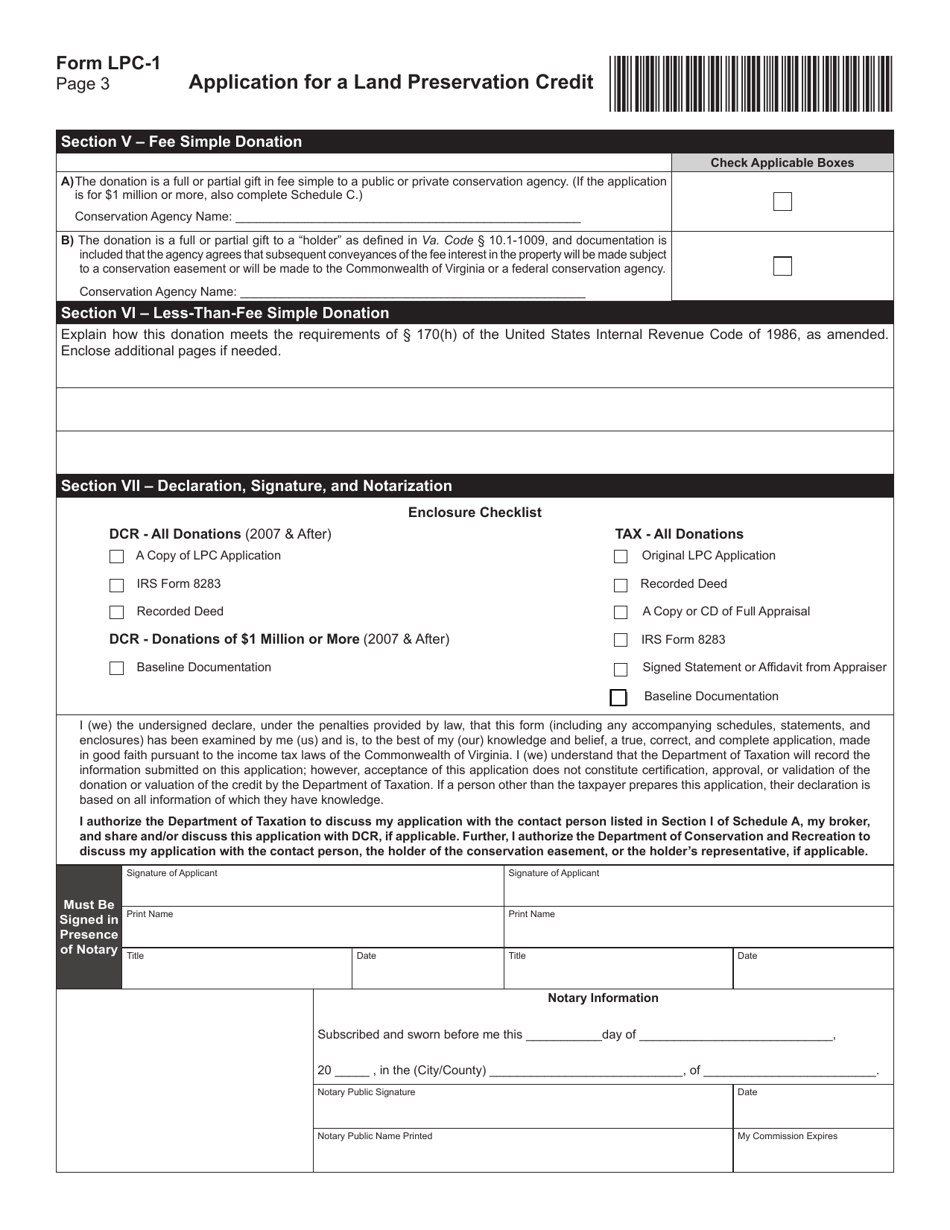

Q: What information is required on Form LPC-1?

A: Form LPC-1 requires information about the landowner, the location and characteristics of the protected land, and details about the conservation easement.

Q: What is the deadline for filing Form LPC-1?

A: The deadline for filing Form LPC-1 is the same as the deadline for filing your Virginia income tax return, which is generally May 1st of each year.

Q: Is there a fee for filing Form LPC-1?

A: There is no fee for filing Form LPC-1.

Q: Can I claim the Land Preservation Credit for multiple properties?

A: Yes, you can claim the Land Preservation Credit for multiple properties as long as each property meets the eligibility requirements.

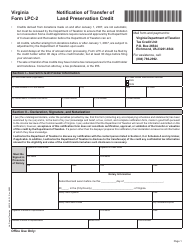

Q: What happens after I submit Form LPC-1?

A: After you submit Form LPC-1, the Virginia Department of Taxation will review the application and notify you of their decision.

Q: What if my application for the Land Preservation Credit is denied?

A: If your application is denied, you may appeal the decision within 30 days of receiving the denial notice.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LPC-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.