This version of the form is not currently in use and is provided for reference only. Download this version of

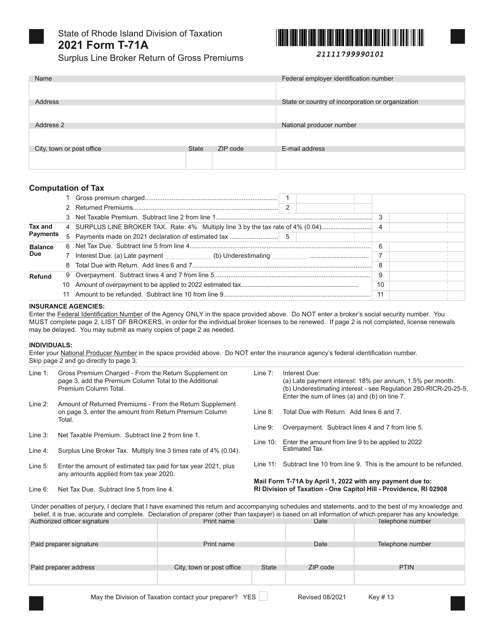

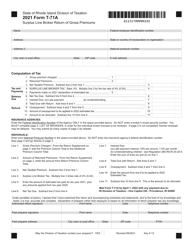

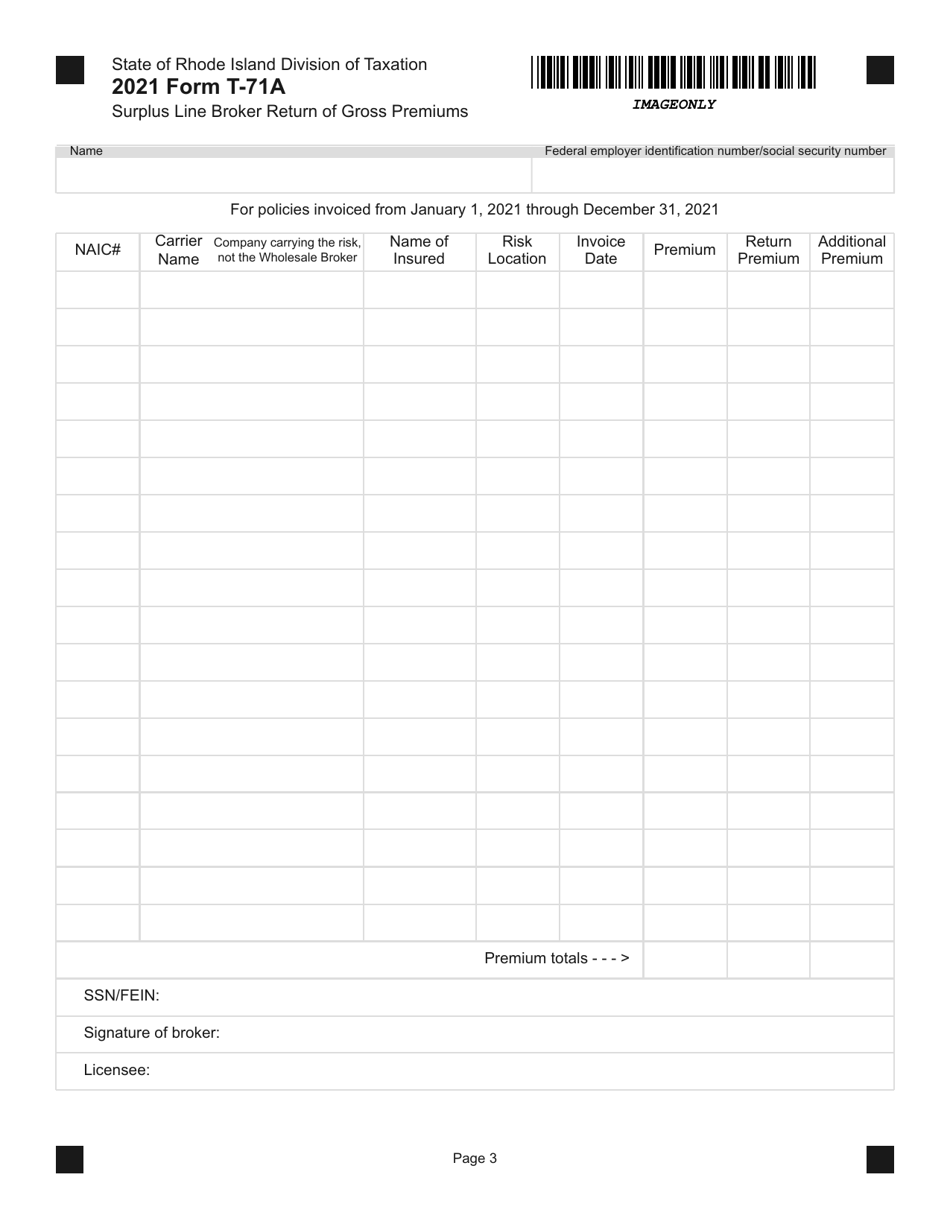

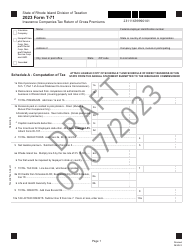

Form T-71A

for the current year.

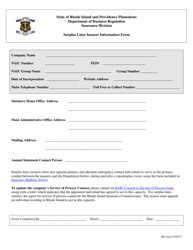

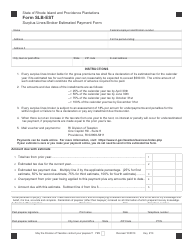

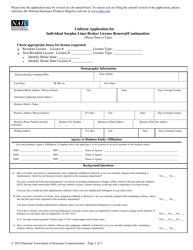

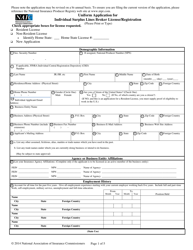

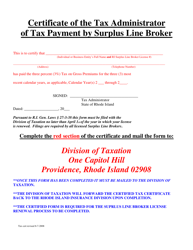

Form T-71A Surplus Line Broker Return of Gross Premiums - Rhode Island

What Is Form T-71A?

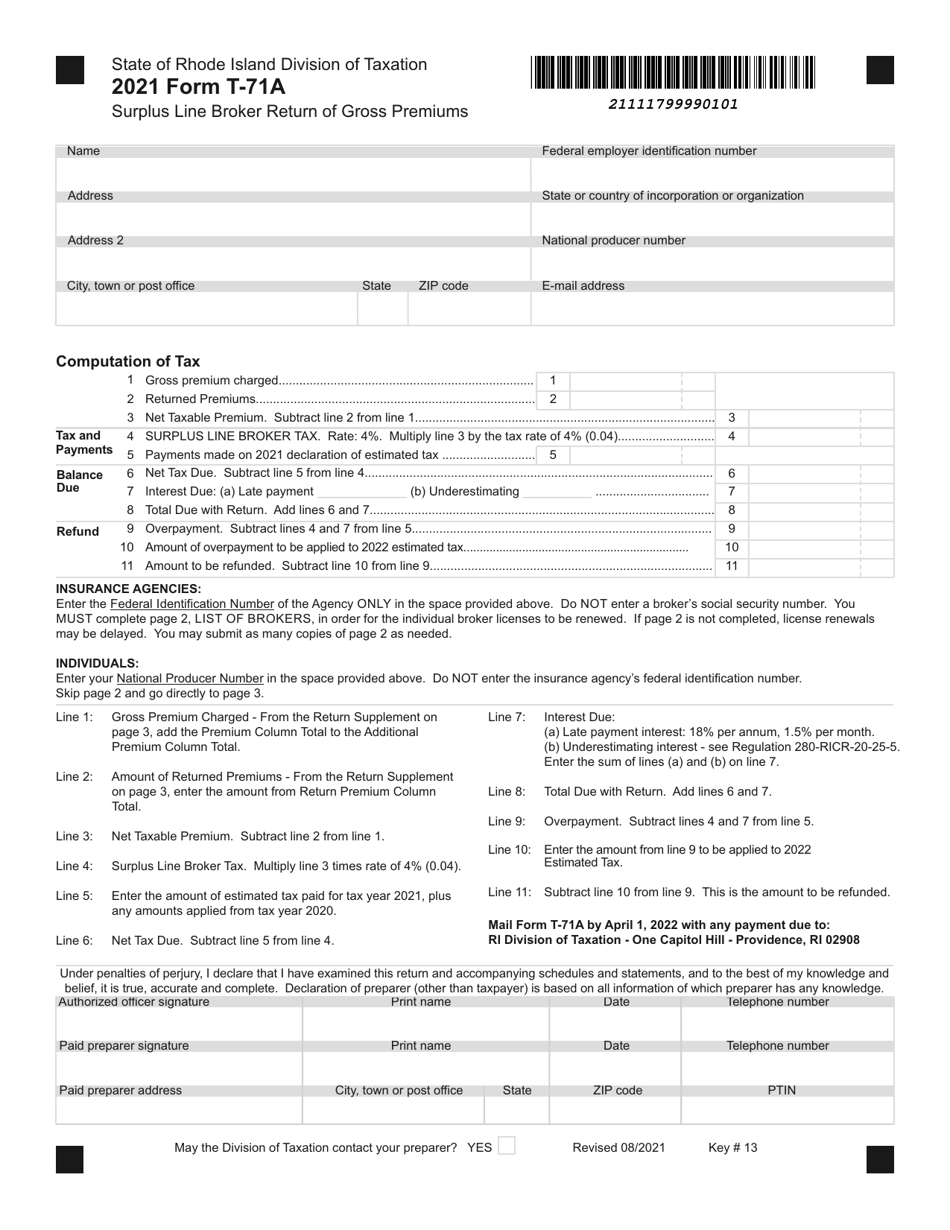

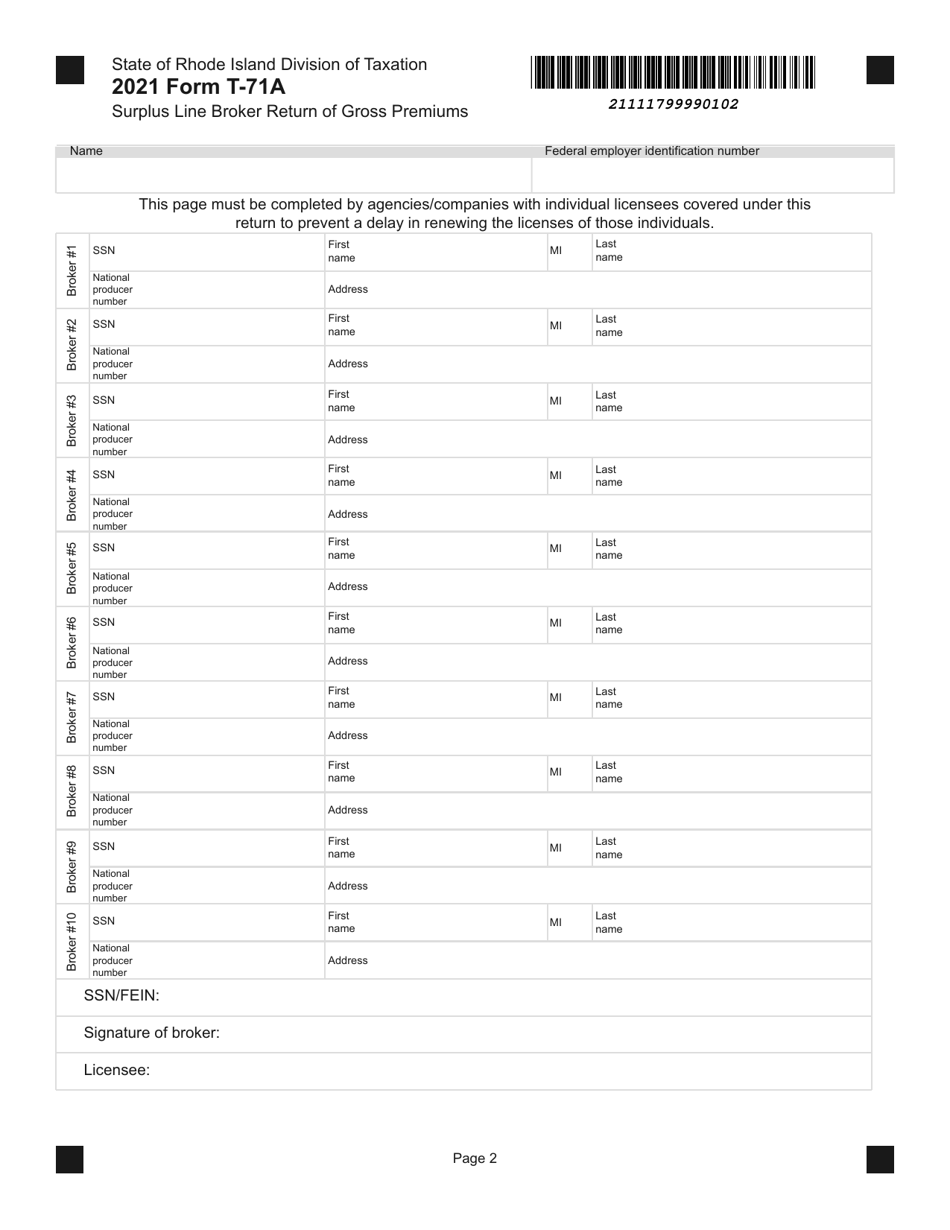

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-71A?

A: Form T-71A is the Surplus Line Broker Return of Gross Premiums form.

Q: Who is required to file Form T-71A?

A: Surplus Line Brokers in Rhode Island are required to file Form T-71A.

Q: What is the purpose of Form T-71A?

A: The purpose of Form T-71A is to report the gross premiums collected by Surplus Line Brokers in Rhode Island.

Q: When is Form T-71A due?

A: Form T-71A is due on or before March 15th of each year.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-71A by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.