This version of the form is not currently in use and is provided for reference only. Download this version of

Form T-72

for the current year.

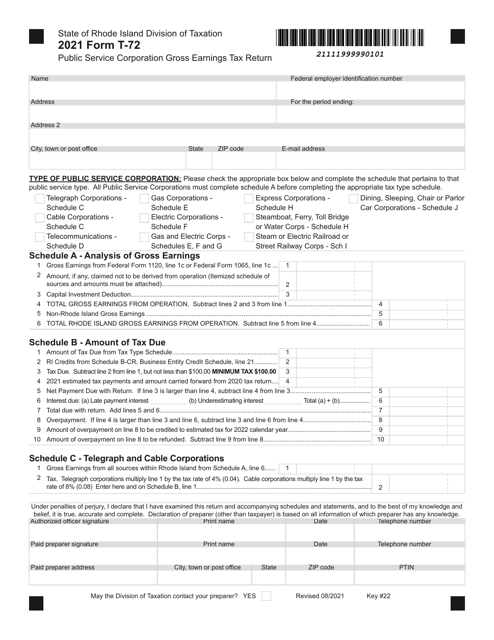

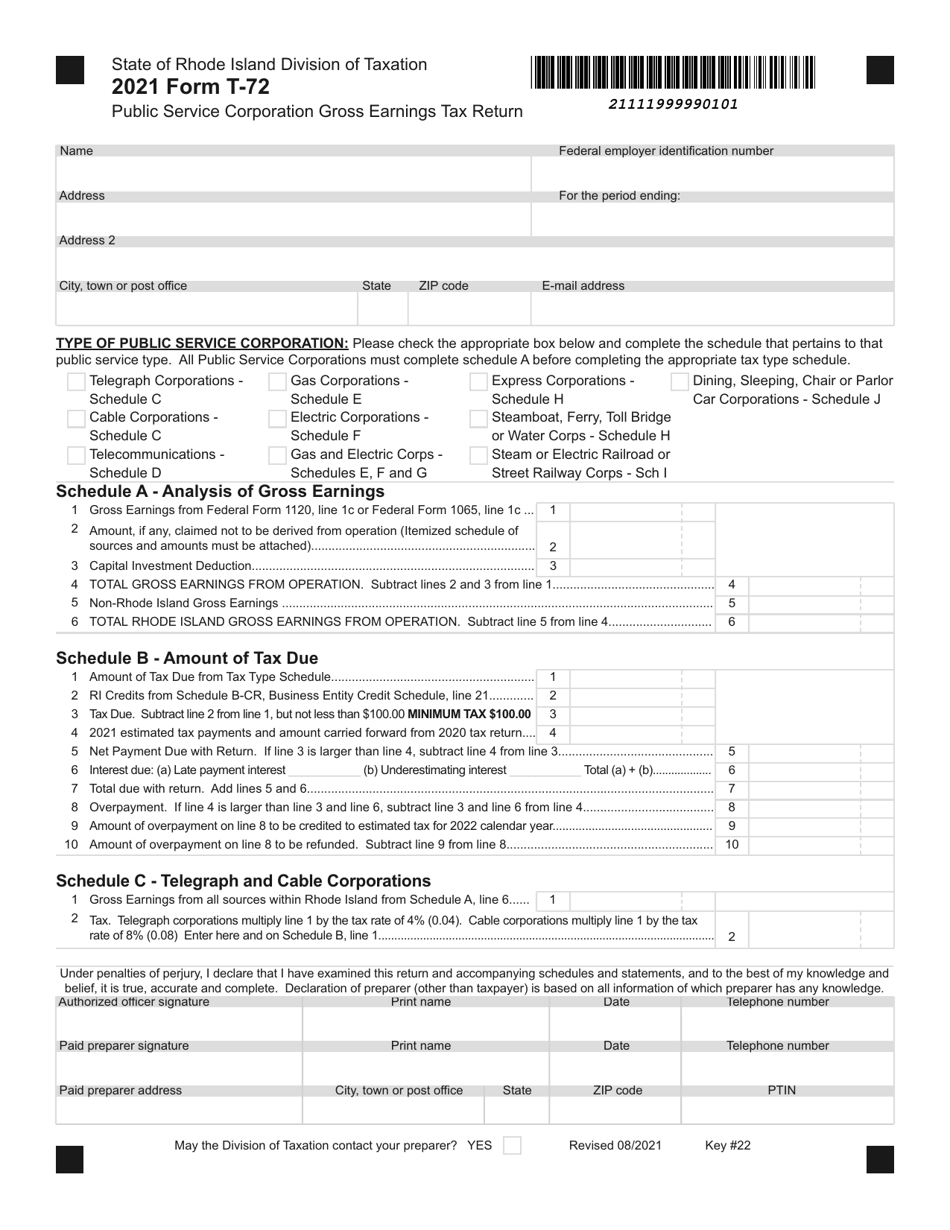

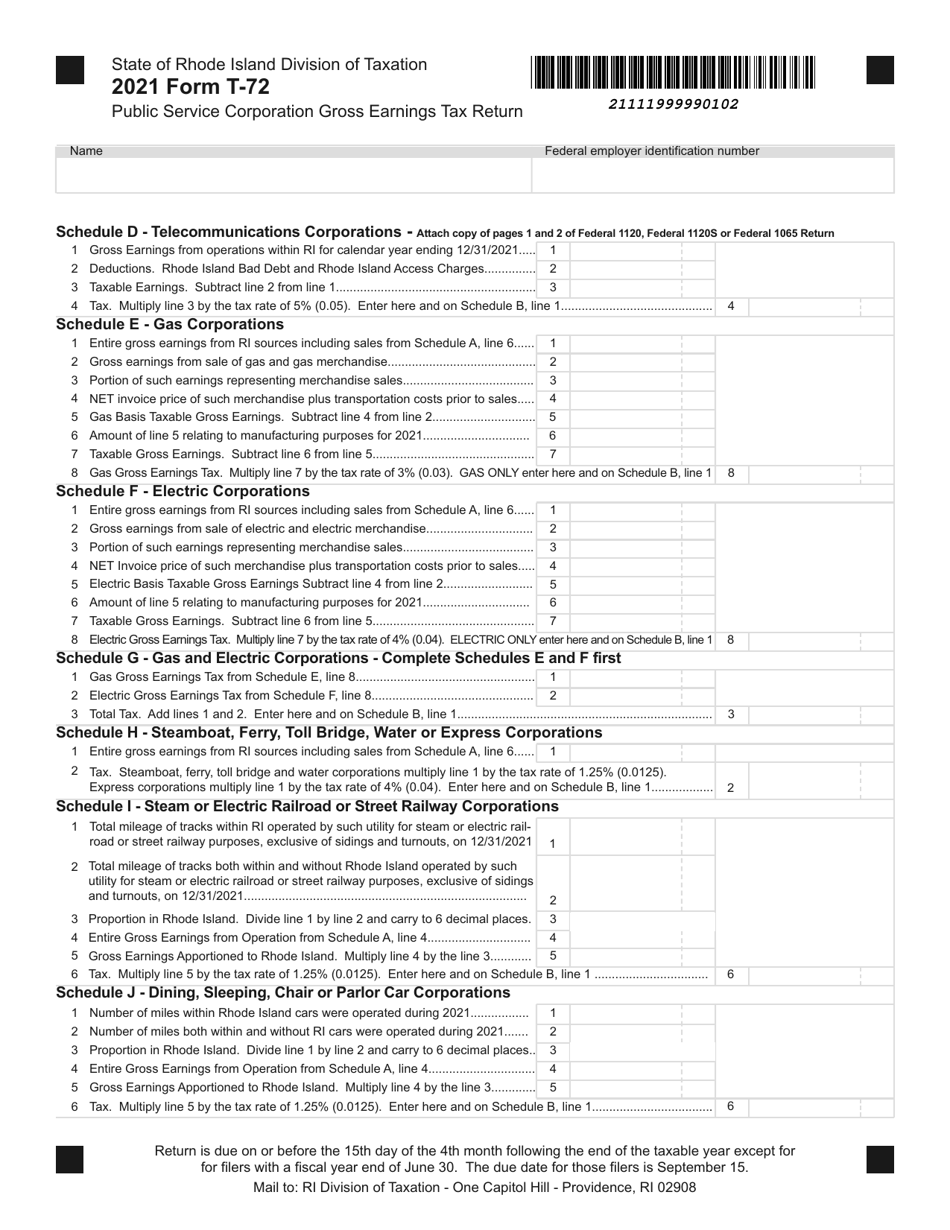

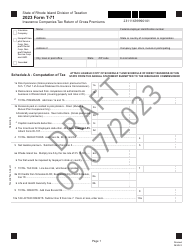

Form T-72 Public Service Corporation Gross Earnings Tax Return - Rhode Island

What Is Form T-72?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-72?

A: Form T-72 is the Public Service Corporation Gross Earnings Tax Return in the state of Rhode Island.

Q: Who needs to file Form T-72?

A: Public service corporations operating in Rhode Island need to file Form T-72.

Q: What is the purpose of Form T-72?

A: The purpose of Form T-72 is to report and calculate the gross earnings tax for public service corporations in Rhode Island.

Q: When is Form T-72 due?

A: Form T-72 is due on or before the fifteenth day of the fourth month following the close of the tax year.

Q: Is there any penalty for late filing of Form T-72?

A: Yes, there is a penalty for late filing of Form T-72. It is important to file the form on time to avoid penalties.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-72 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.