This version of the form is not currently in use and is provided for reference only. Download this version of

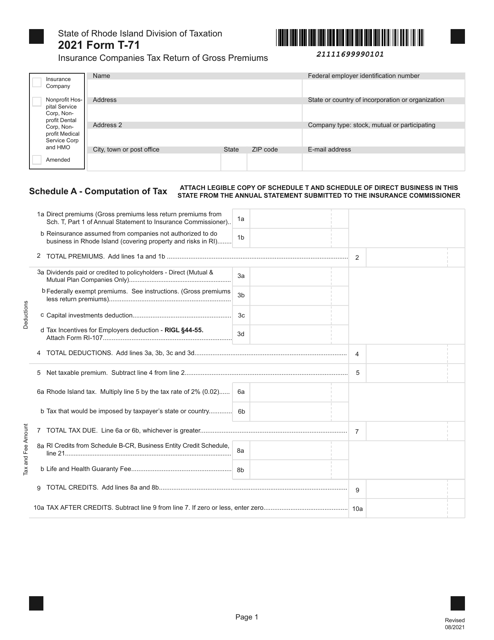

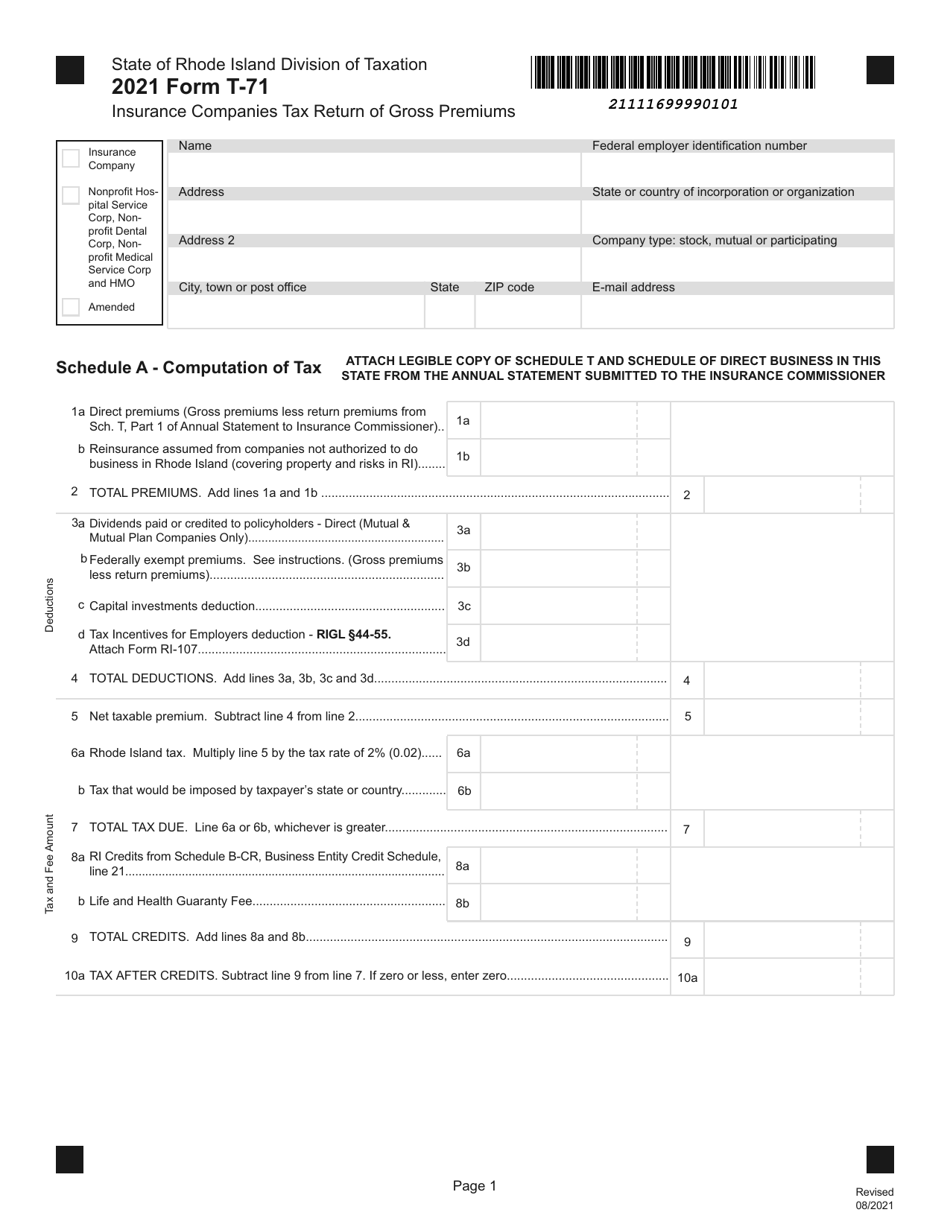

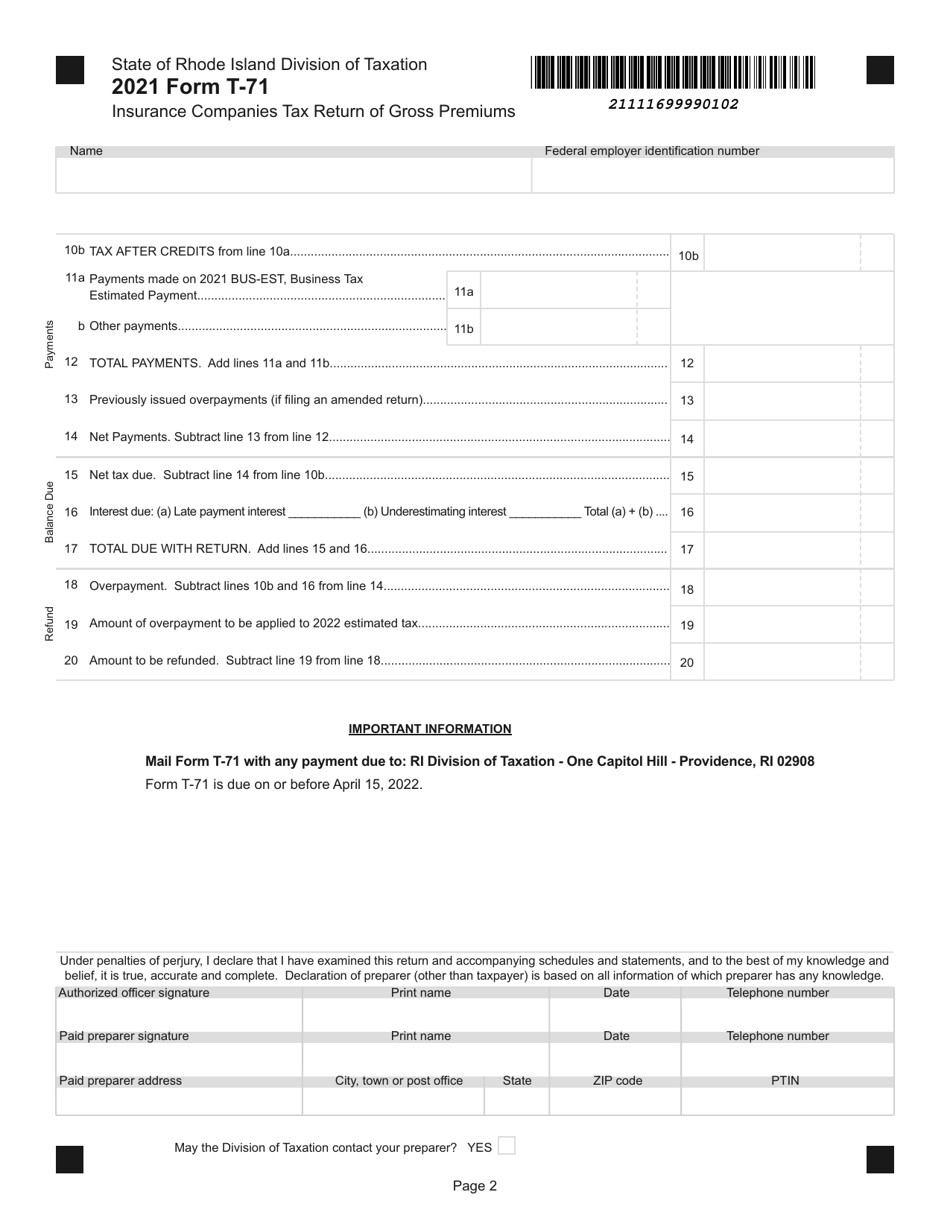

Form T-71

for the current year.

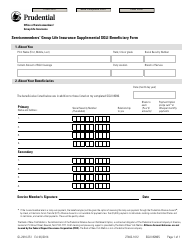

Form T-71 Insurance Companies Tax Return of Gross Premiums - Rhode Island

What Is Form T-71?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form T-71?

A: Form T-71 is a tax return specifically for insurance companies in Rhode Island.

Q: Who needs to file Form T-71?

A: Insurance companies operating in Rhode Island need to file Form T-71.

Q: What is the purpose of Form T-71?

A: The purpose of Form T-71 is to report the gross premiums collected by insurance companies in Rhode Island.

Q: What are gross premiums?

A: Gross premiums are the total amount of premiums collected by an insurance company.

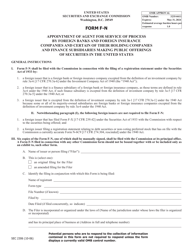

Q: Are there any exemptions to filing Form T-71?

A: Yes, certain insurance companies may be exempt from filing Form T-71. It is advised to consult the specific regulations and requirements.

Q: When is Form T-71 due?

A: Form T-71 is due on April 15th of each year.

Q: Are there any penalties for not filing Form T-71?

A: Yes, failure to file Form T-71 or filing it late can result in penalties and interest.

Q: Is there any additional documentation required to be submitted with Form T-71?

A: Depending on the specific circumstances, insurance companies may need to submit additional supporting documentation along with Form T-71. It is best to review the instructions and guidelines provided with the form.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-71 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.