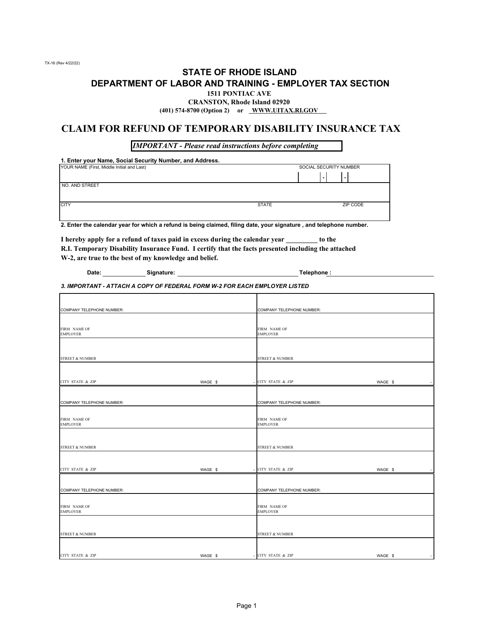

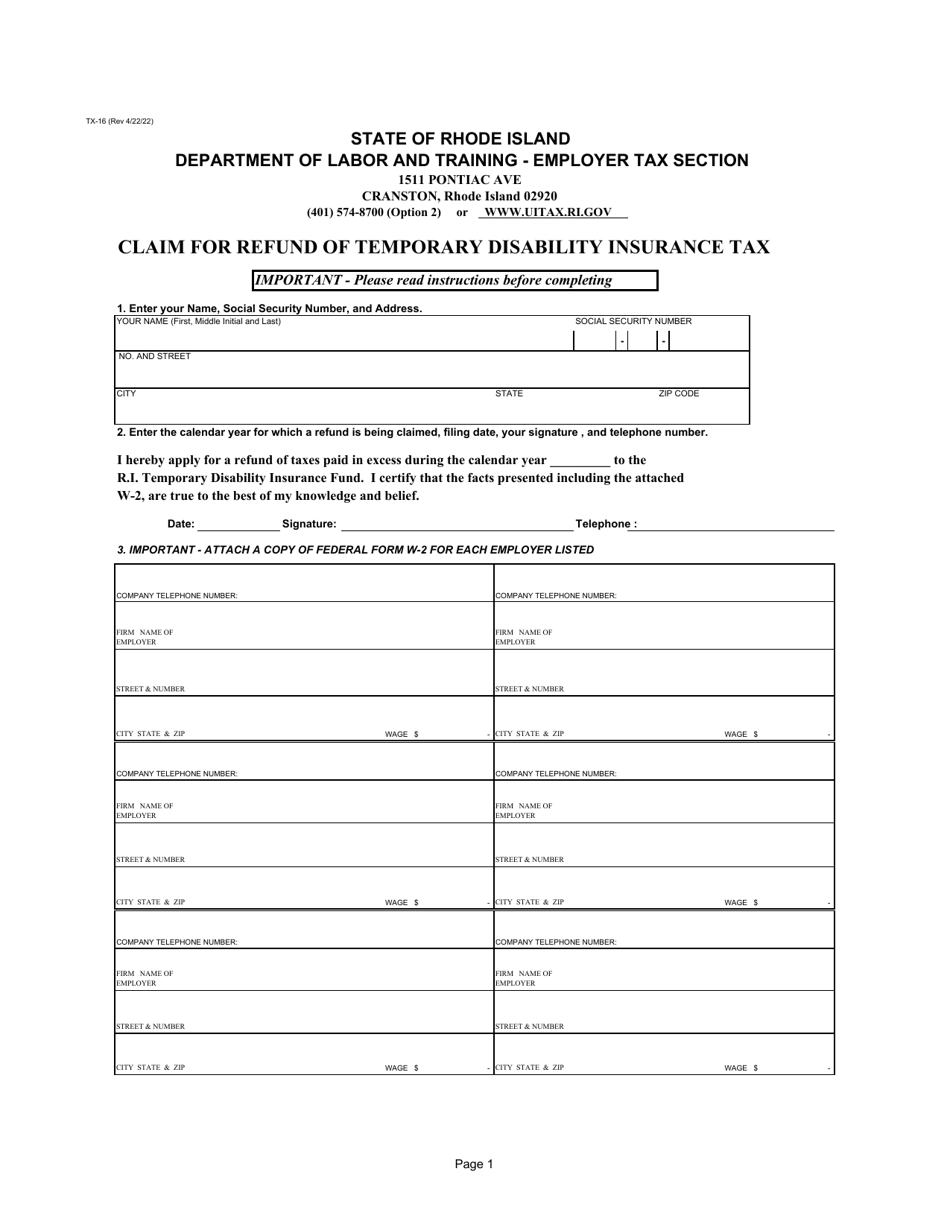

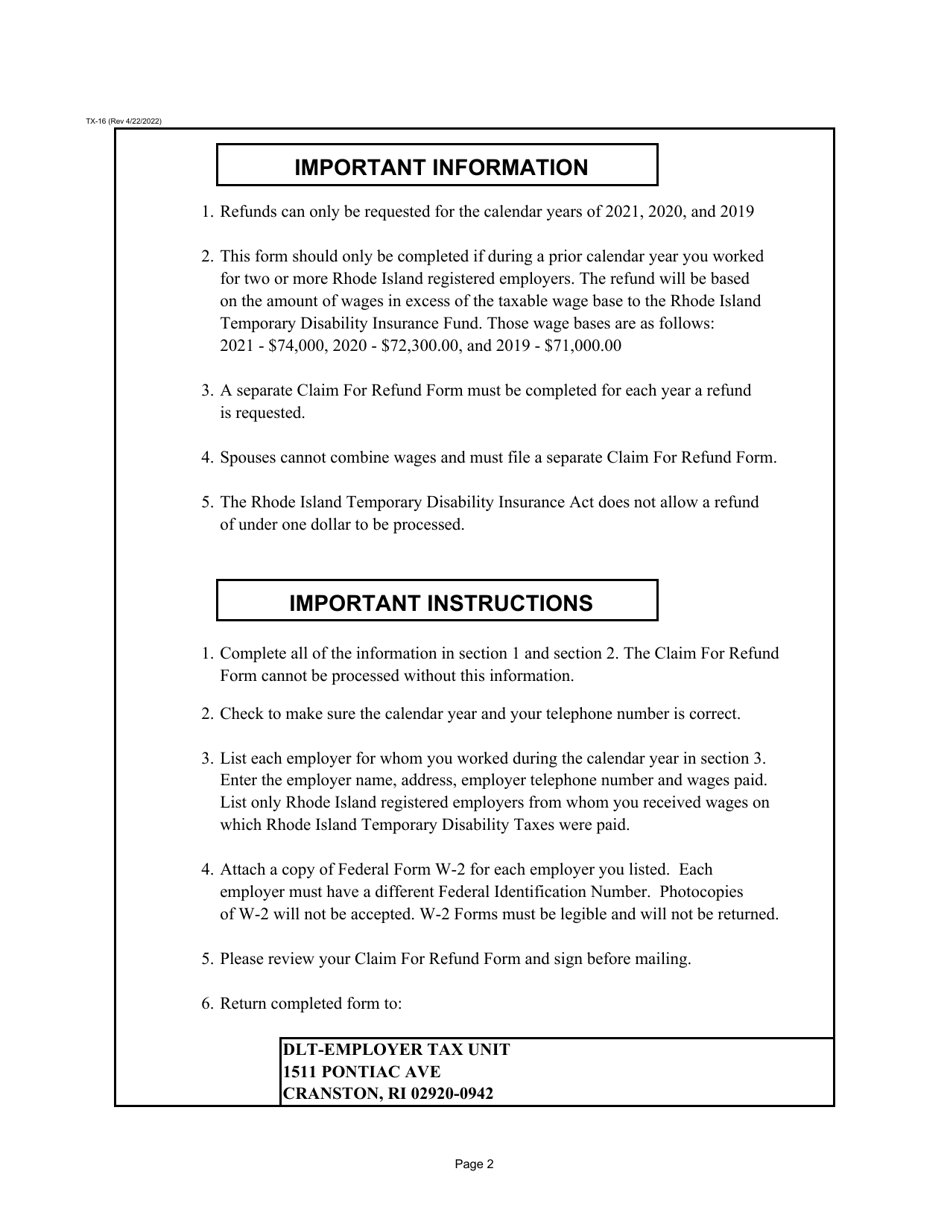

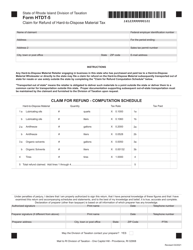

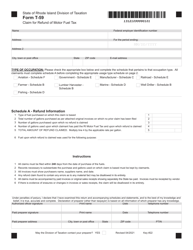

Form TX-16 Claim for Refund of Temporary Disability Insurance Tax - Rhode Island

What Is Form TX-16?

This is a legal form that was released by the Rhode Island Department of Labor and Training - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TX-16?

A: Form TX-16 is the claim for refund of Temporary Disability Insurance (TDI) Tax in Rhode Island.

Q: Who can use Form TX-16?

A: Form TX-16 can be used by individuals who want to claim a refund of the TDI Tax.

Q: What is Temporary Disability Insurance (TDI) Tax?

A: Temporary Disability Insurance (TDI) Tax is a tax imposed on wages or salary in Rhode Island to fund temporary disability benefits.

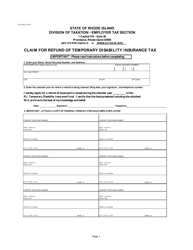

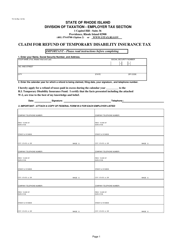

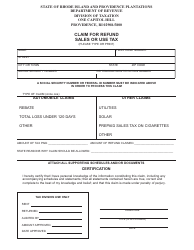

Q: What information is required on Form TX-16?

A: Form TX-16 requires you to provide your personal information, including your name, address, and Social Security number, as well as details about your wages and the amount of TDI Tax withheld.

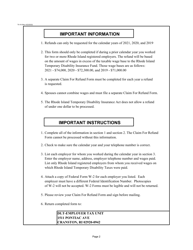

Q: When should I file Form TX-16?

A: Form TX-16 should be filed within three years from the date the tax was paid or withheld.

Q: How long does it take to process a refund claim using Form TX-16?

A: The processing time for a refund claim using Form TX-16 can vary, but it typically takes several weeks.

Q: Can I file Form TX-16 electronically?

A: No, Form TX-16 cannot be filed electronically. It must be filed by mail or in person.

Q: What should I do if I have additional questions about Form TX-16?

A: If you have additional questions about Form TX-16, you should contact the Rhode Island Division of Taxation for assistance.

Form Details:

- Released on April 22, 2022;

- The latest edition provided by the Rhode Island Department of Labor and Training;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TX-16 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Labor and Training.