This version of the form is not currently in use and is provided for reference only. Download this version of

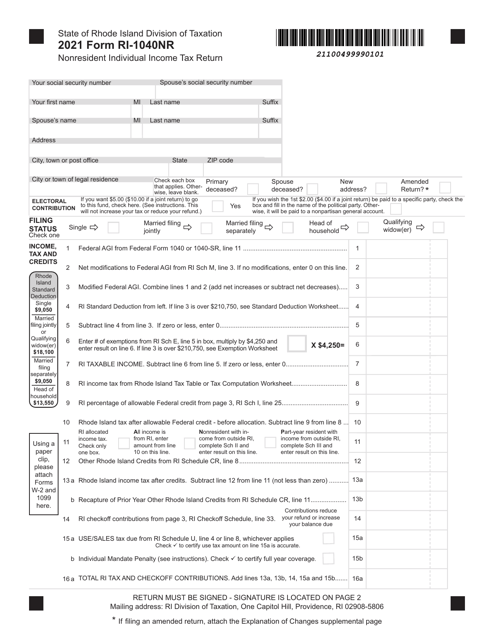

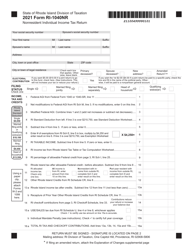

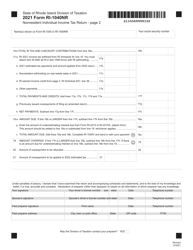

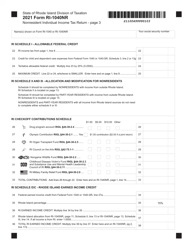

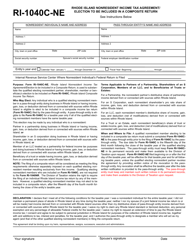

Form RI-1040NR

for the current year.

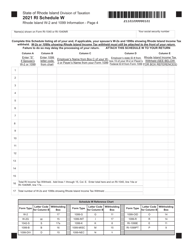

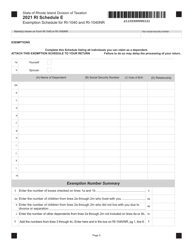

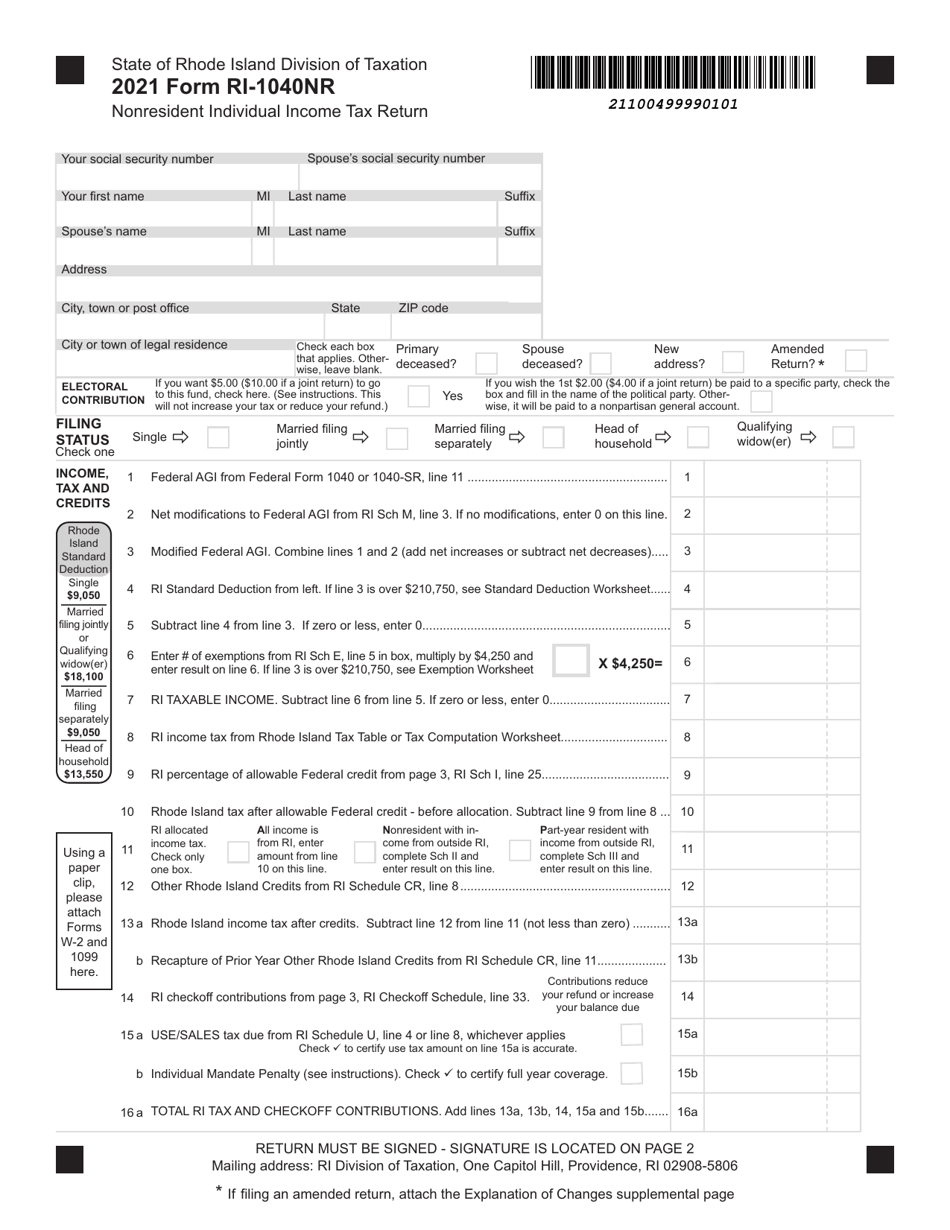

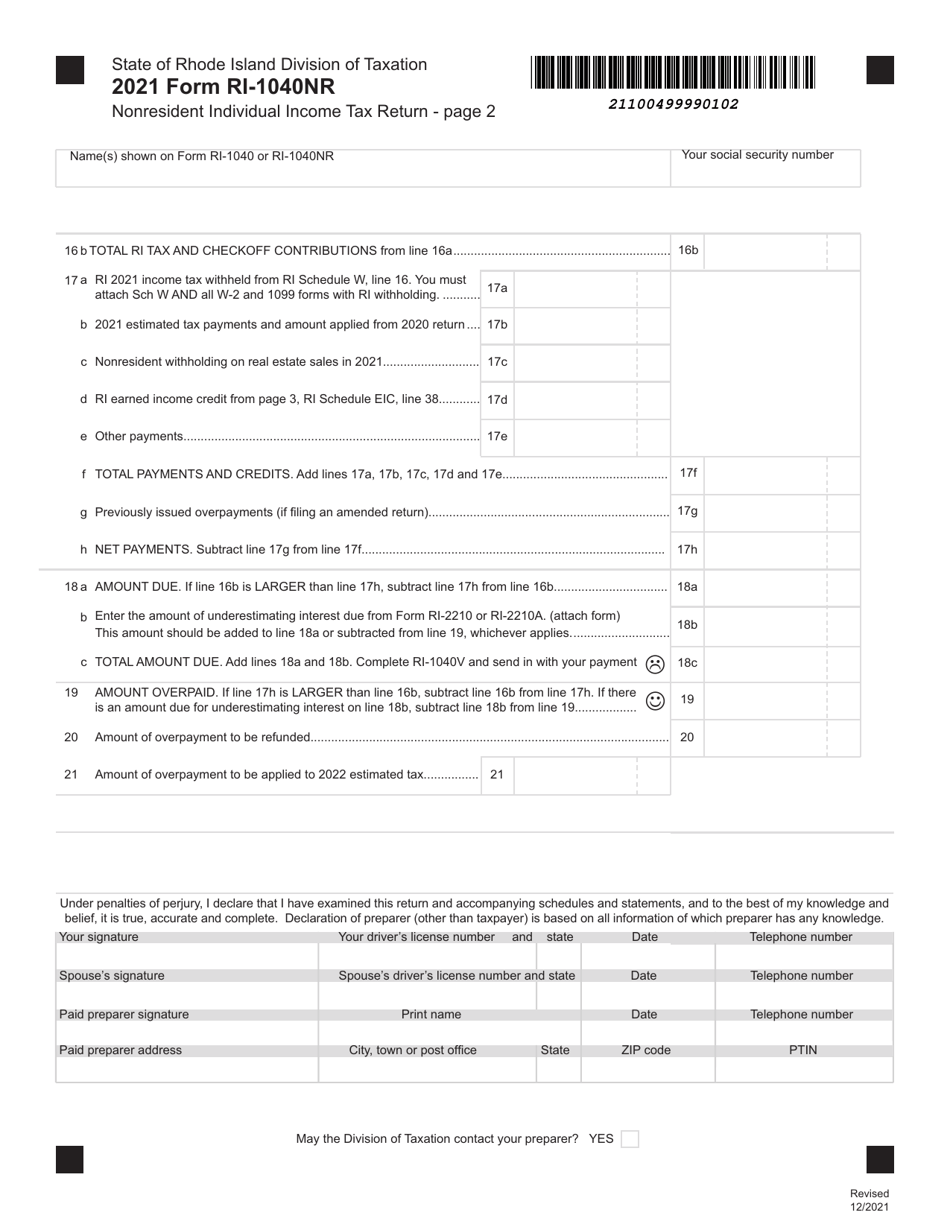

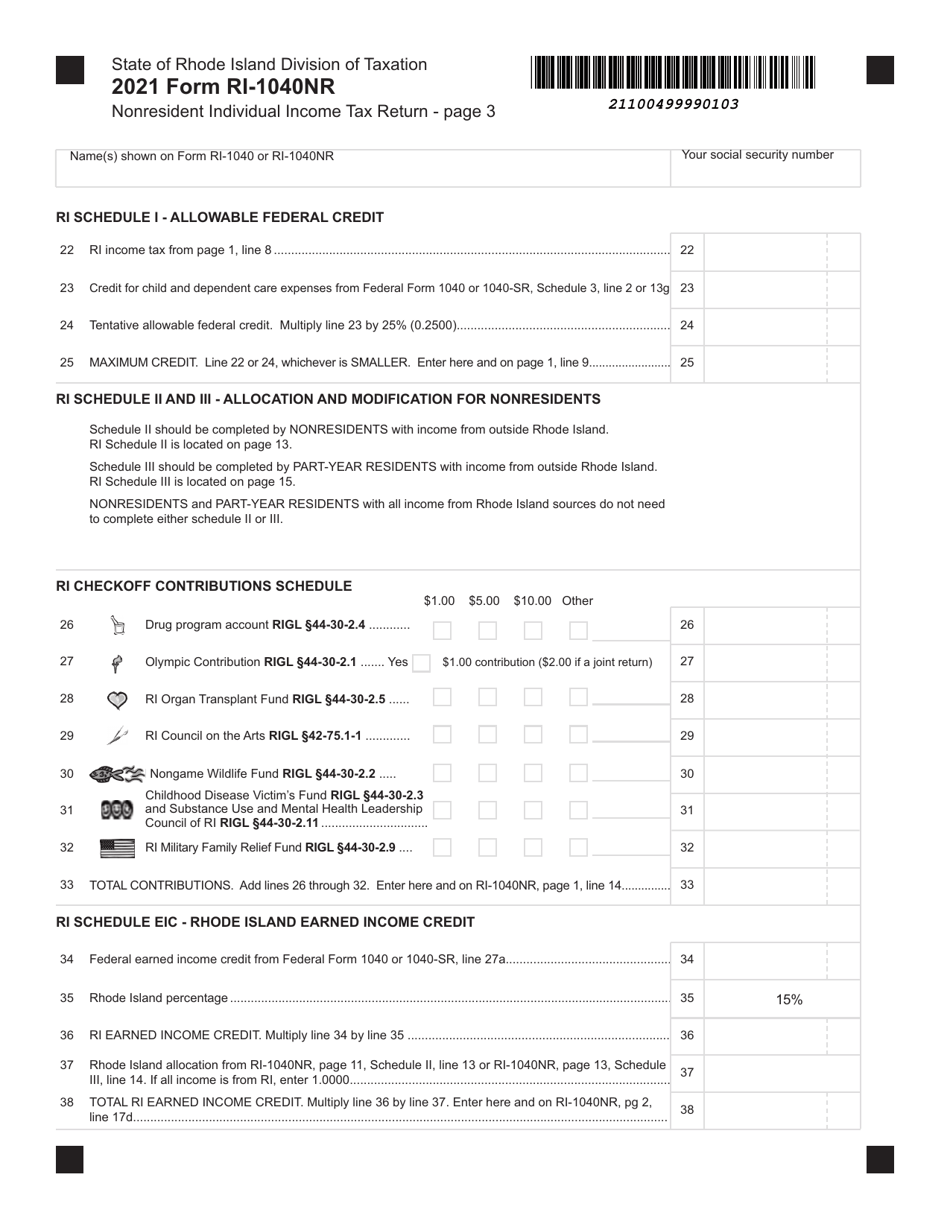

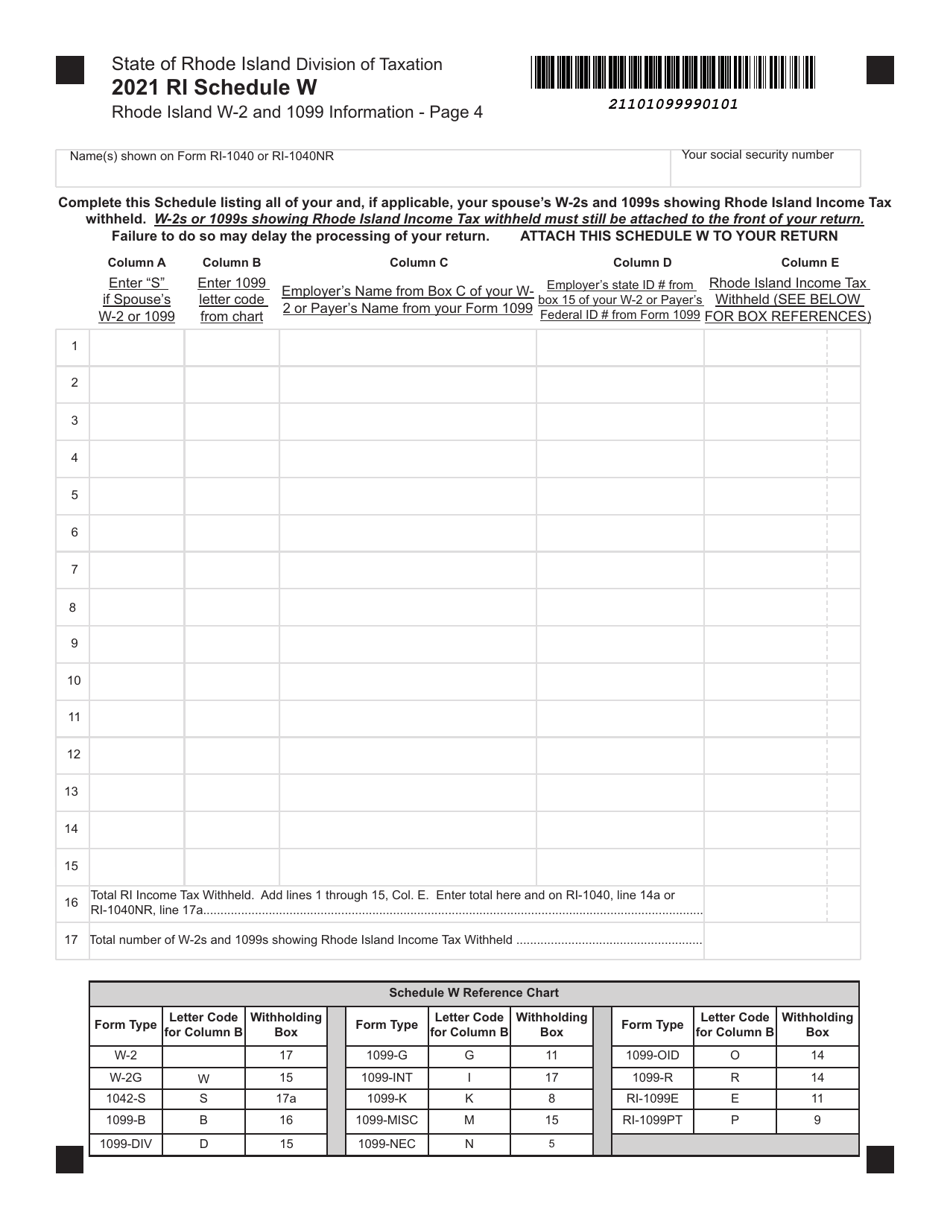

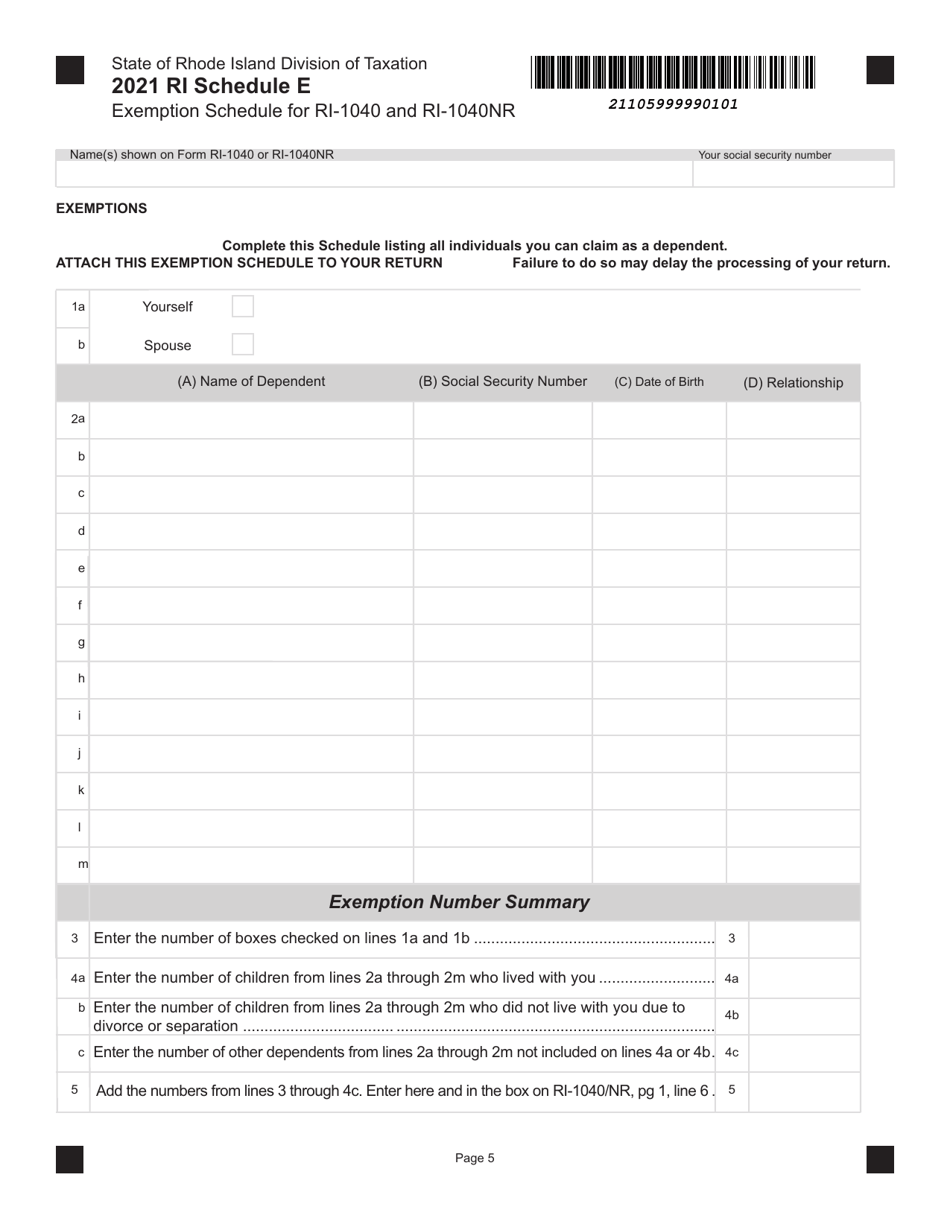

Form RI-1040NR Nonresident Individual Income Tax Return - Rhode Island

What Is Form RI-1040NR?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is RI-1040NR?

A: RI-1040NR is a form used for filing a nonresident individual income tax return in Rhode Island.

Q: Who needs to file Form RI-1040NR?

A: Nonresident individuals who earned income in Rhode Island during the tax year need to file Form RI-1040NR.

Q: What is the purpose of Form RI-1040NR?

A: The purpose of Form RI-1040NR is to report and pay any income tax owed by nonresident individuals to the state of Rhode Island.

Q: What information do I need to complete Form RI-1040NR?

A: You will need to provide your personal information, details of your income earned in Rhode Island, deductions, and any other required information.

Q: When is the deadline for filing Form RI-1040NR?

A: The deadline for filing Form RI-1040NR is usually April 15th, but may vary depending on the tax year.

Q: Are there any penalties for late filing of Form RI-1040NR?

A: Yes, there may be penalties for late filing, including additional interest and possible late payment penalties.

Q: What should I do if I can't pay the tax owed with Form RI-1040NR?

A: If you can't pay the tax owed, you should still file the form on time and contact the Rhode Island Division of Taxation to discuss payment options.

Q: Can I e-file Form RI-1040NR?

A: Yes, you can e-file Form RI-1040NR using approved tax software or through a tax professional.

Q: Can I amend my Form RI-1040NR?

A: Yes, if you need to make changes or corrections to your original filing, you can file an amended Form RI-1040NR using Form RI-1040X.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040NR by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.