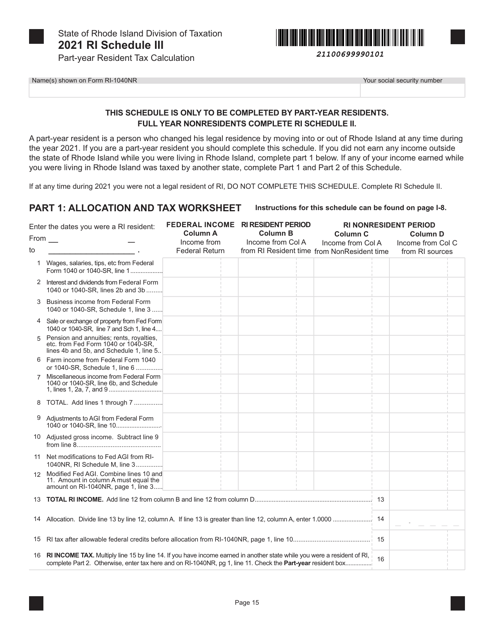

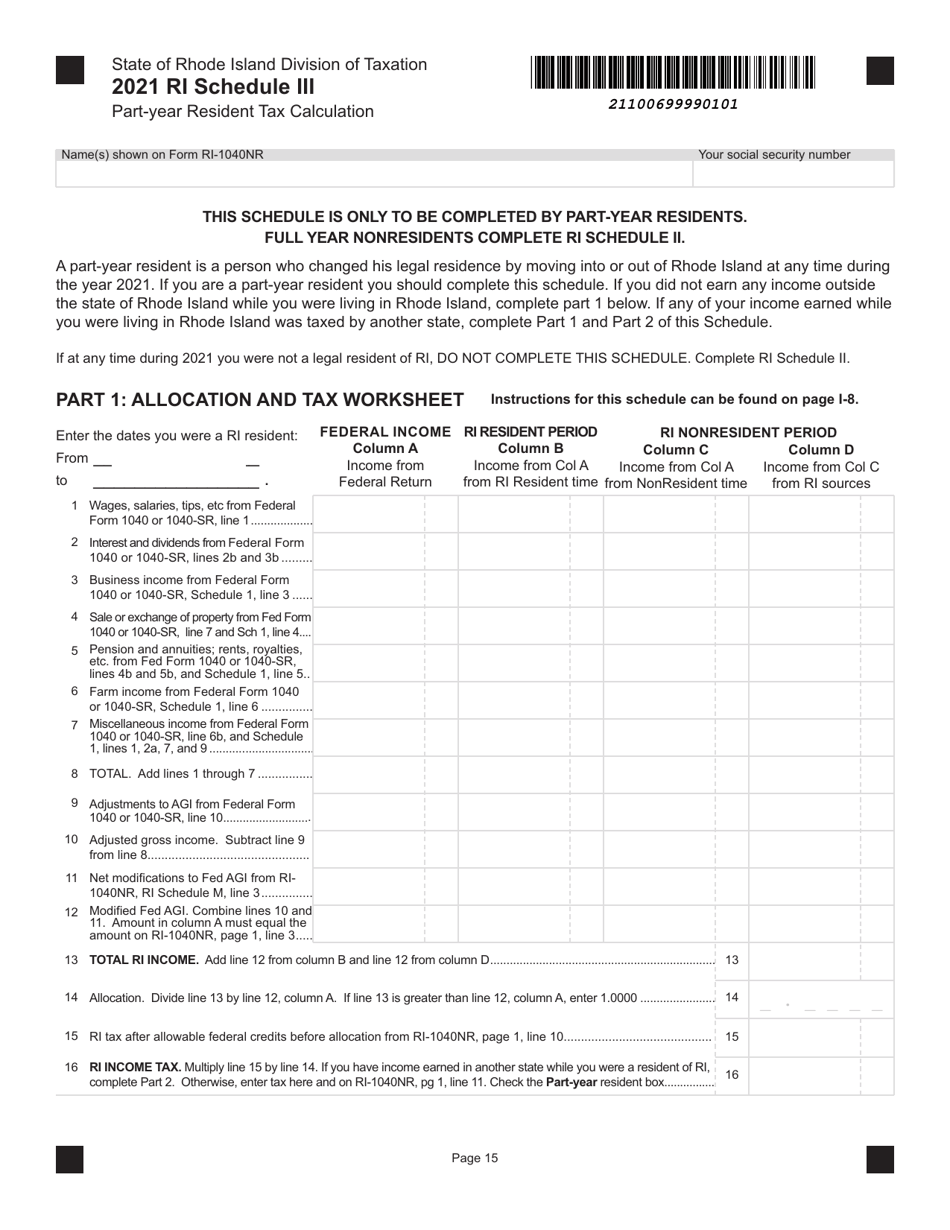

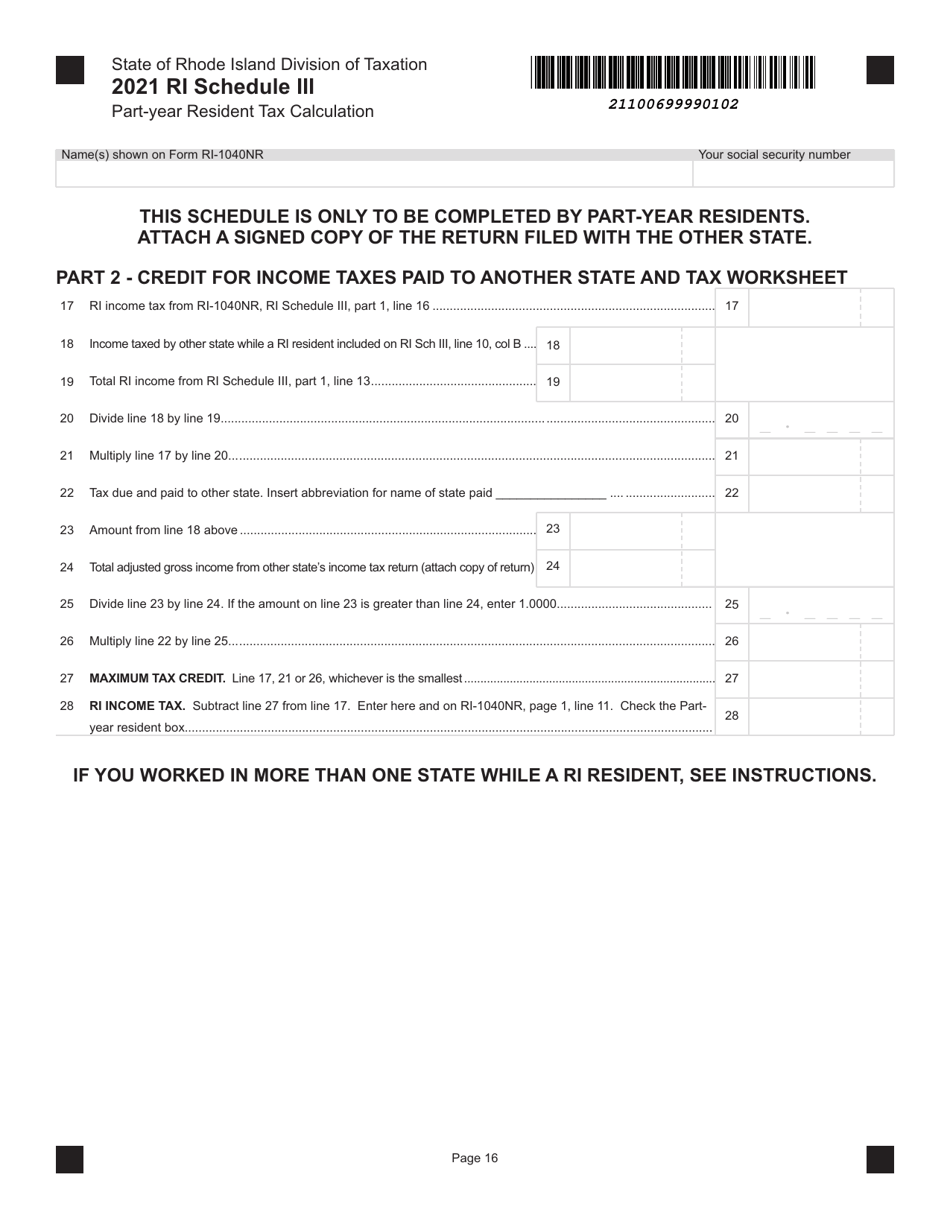

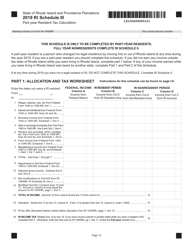

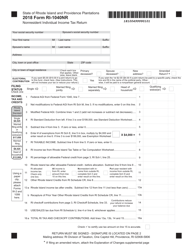

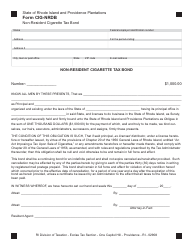

Schedule III Part-Year Resident Tax Calculation - Rhode Island

What Is Schedule III?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who is considered a part-year resident in Rhode Island for tax purposes?

A: A part-year resident in Rhode Island for tax purposes is an individual who has established or terminated Rhode Island residency during the tax year.

Q: How is a part-year resident's income taxed in Rhode Island?

A: A part-year resident's income is taxed in Rhode Island based on the portion of the year they were a resident.

Q: What is the tax rate for part-year residents in Rhode Island?

A: The tax rate for part-year residents in Rhode Island is the same as the tax rate for full-year residents.

Q: How do I calculate my tax liability as a part-year resident in Rhode Island?

A: To calculate your tax liability as a part-year resident in Rhode Island, you will need to prorate your income and apply the applicable tax rate.

Q: Do part-year residents in Rhode Island need to file a state tax return?

A: Yes, part-year residents in Rhode Island are required to file a state tax return if they meet the income filing requirements.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule III by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.