This version of the form is not currently in use and is provided for reference only. Download this version of

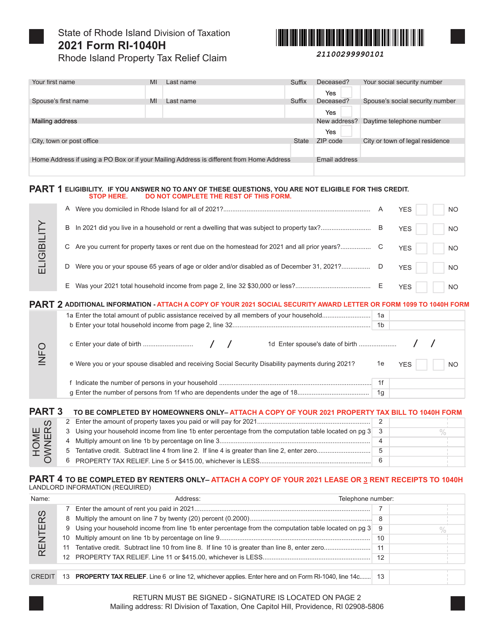

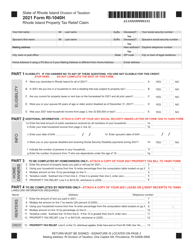

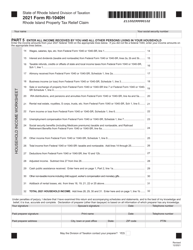

Form RI-1040H

for the current year.

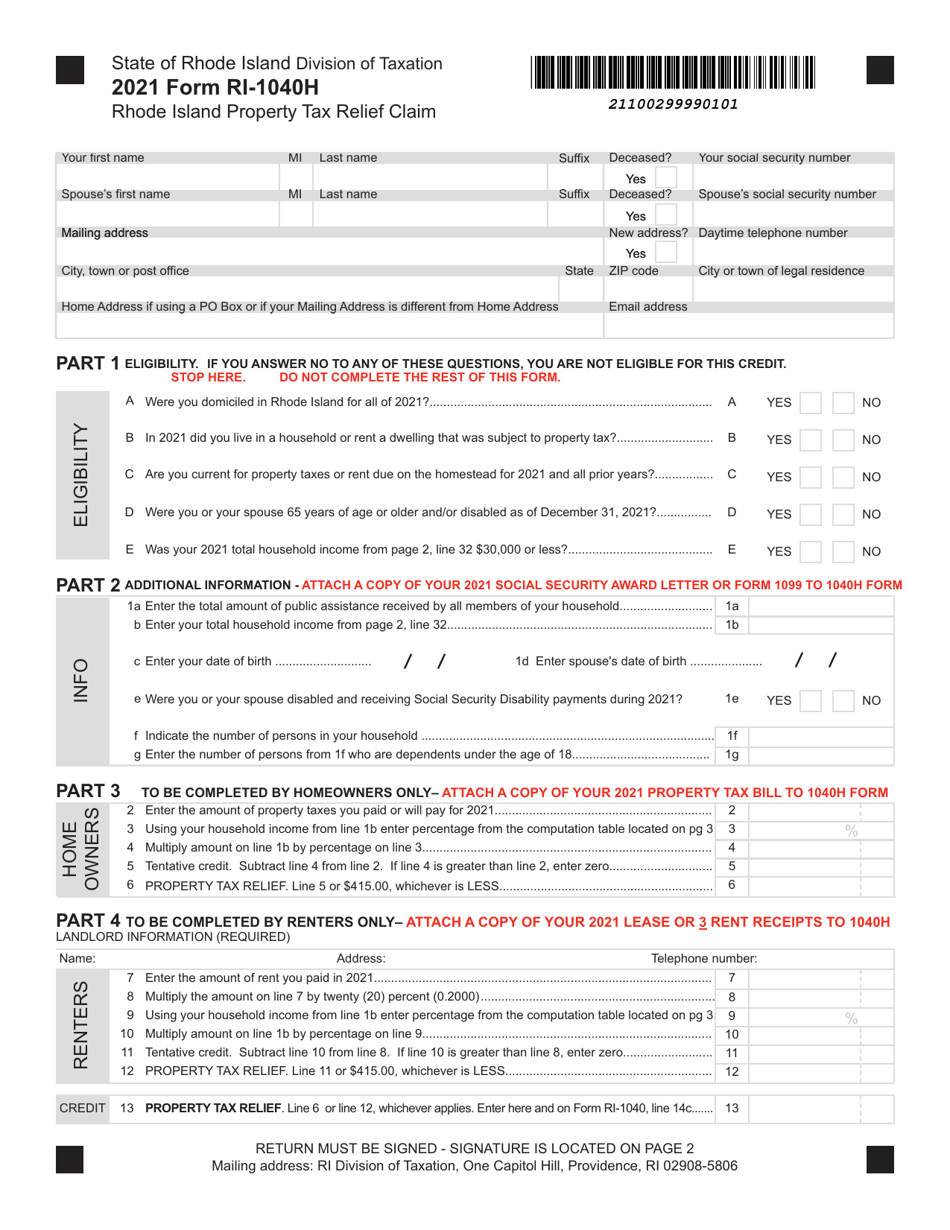

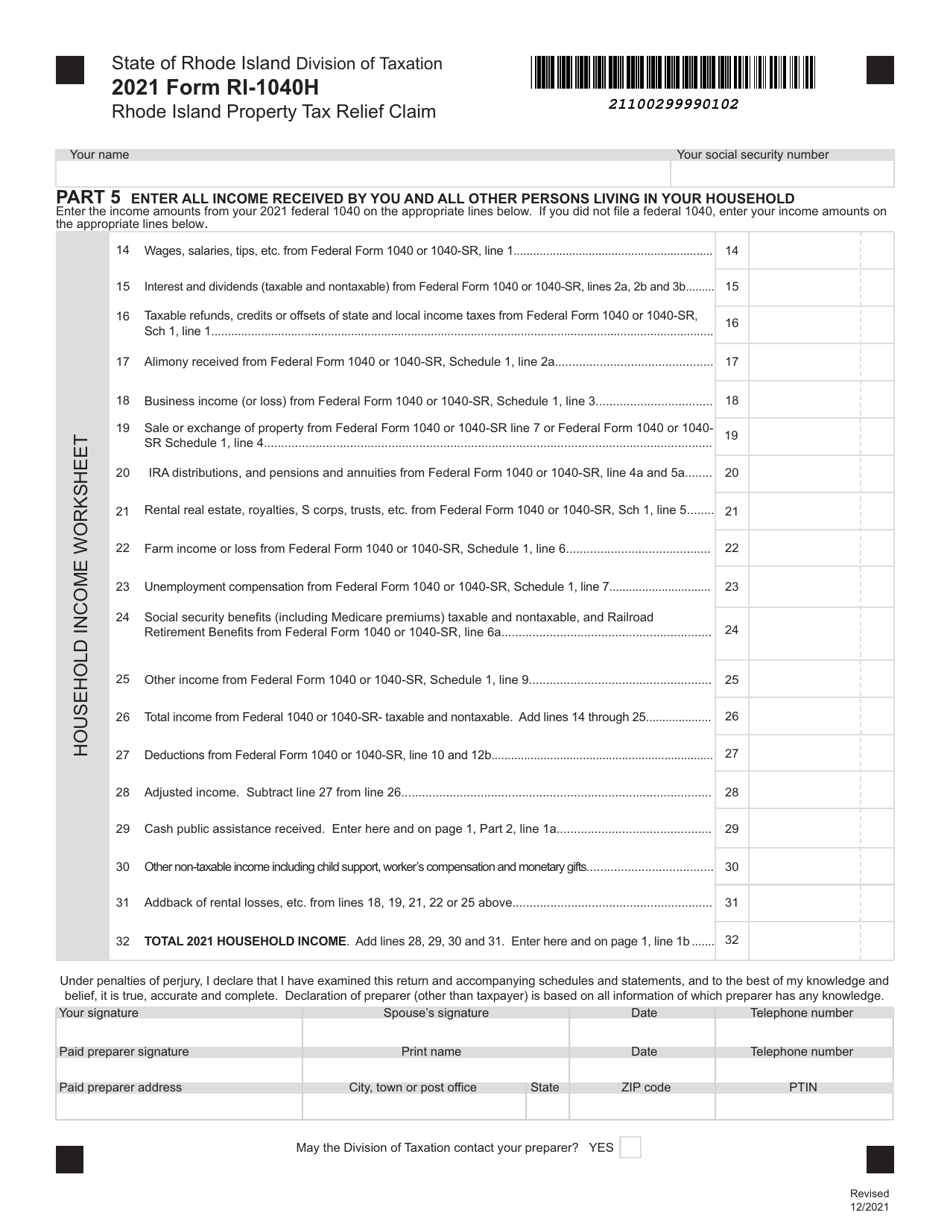

Form RI-1040H Rhode Island Property Tax Relief Claim - Rhode Island

What Is Form RI-1040H?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RI-1040H?

A: The Form RI-1040H is the Rhode Island Property Tax Relief Claim.

Q: What is the purpose of Form RI-1040H?

A: Form RI-1040H is used to claim property tax relief in Rhode Island.

Q: Who is eligible to use Form RI-1040H?

A: Homeowners in Rhode Island who meet certain income requirements may use Form RI-1040H to claim property tax relief.

Q: What is property tax relief?

A: Property tax relief refers to programs or provisions that help homeowners reduce the amount of property taxes they owe.

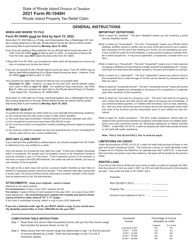

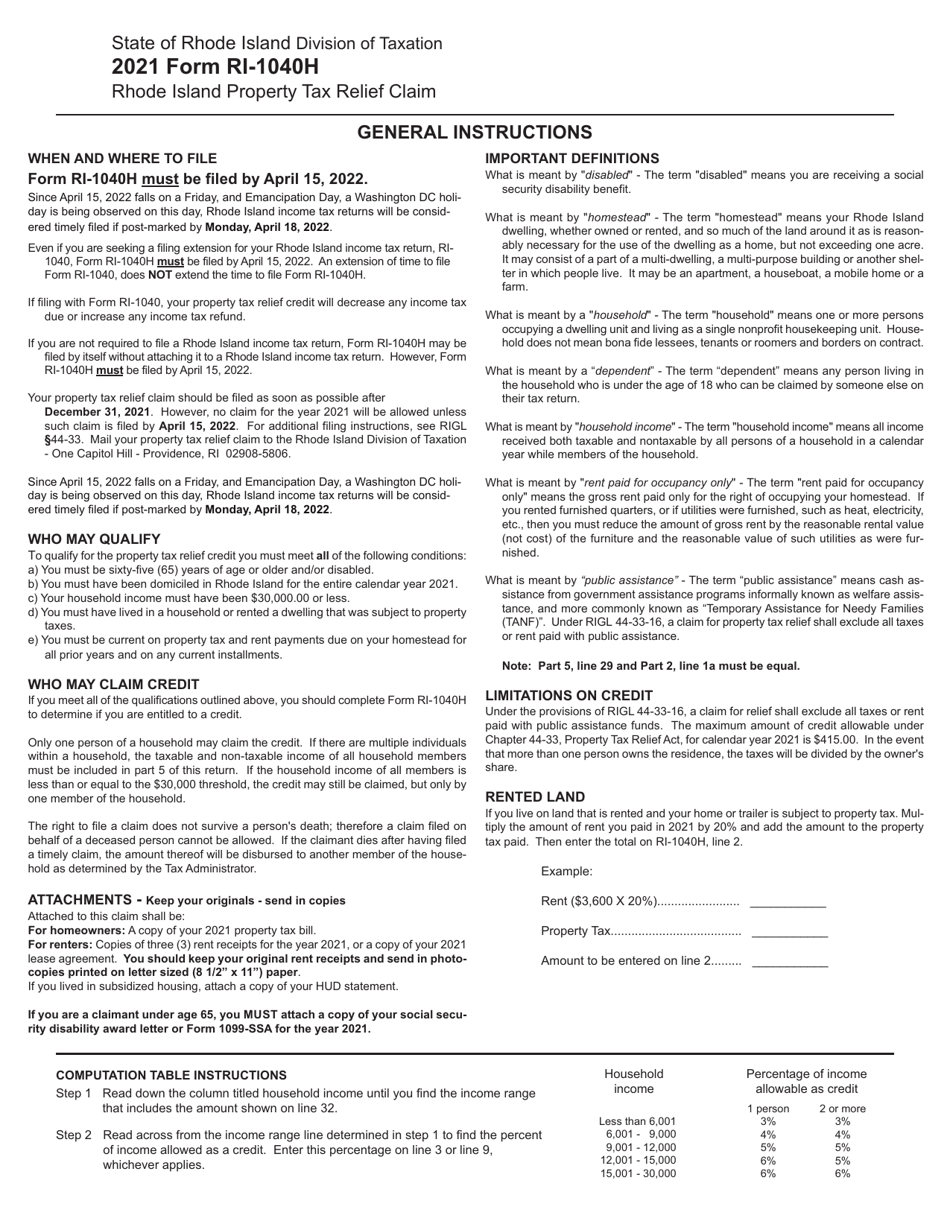

Q: When is the deadline to file Form RI-1040H?

A: The deadline to file Form RI-1040H is usually April 15th, but it may vary each year.

Q: Is there an income limit for eligibility?

A: Yes, there is an income limit for eligibility. The specific income limits can be found on the Form RI-1040H instructions.

Q: What documents do I need to include with Form RI-1040H?

A: You may need to include documents such as copies of your property tax bills and proof of income with Form RI-1040H.

Q: Can I file Form RI-1040H if I rent a property?

A: No, Form RI-1040H is specifically for homeowners in Rhode Island.

Q: Are there any other property tax relief programs in Rhode Island?

A: Yes, there may be other property tax relief programs available in Rhode Island. You can check with the Rhode Island Division of Taxation for more information.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040H by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.