This version of the form is not currently in use and is provided for reference only. Download this version of

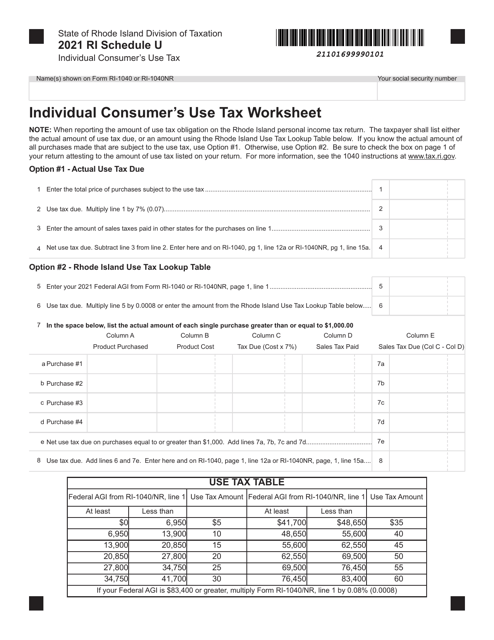

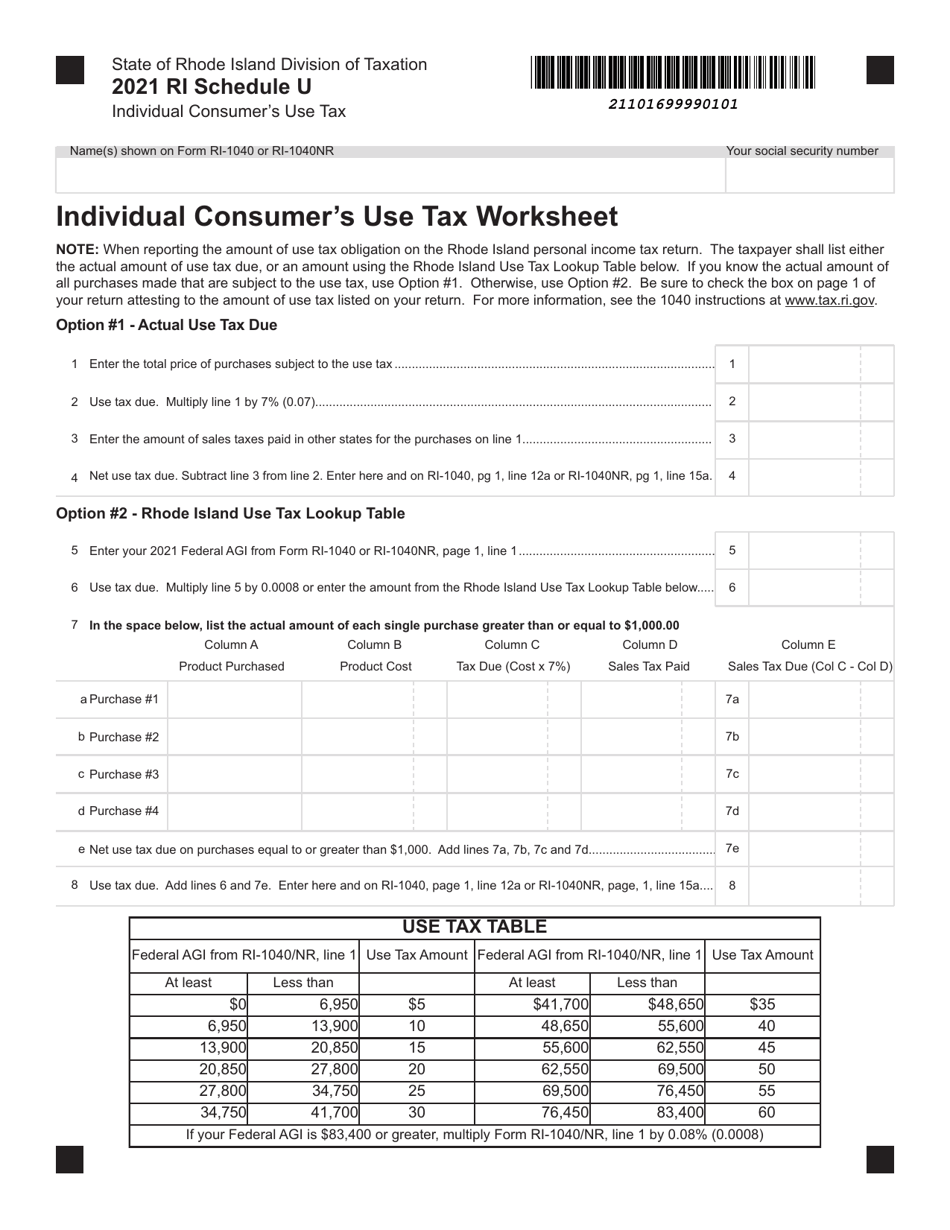

Schedule U

for the current year.

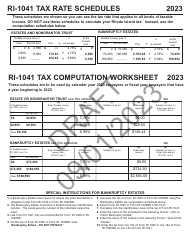

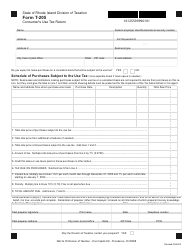

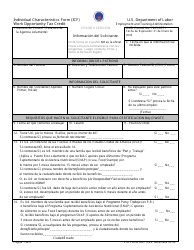

Schedule U Individual Consumer's Use Tax Worksheet - Rhode Island

What Is Schedule U?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule U?

A: Schedule U is a worksheet used for reporting individual consumer's use tax in Rhode Island.

Q: What is use tax?

A: Use tax is a tax on goods and services purchased outside of Rhode Island for use, storage, or consumption within the state.

Q: Who needs to fill out Schedule U?

A: Any Rhode Island resident who has made purchases during the year on which Rhode Island sales tax was not paid must fill out Schedule U.

Q: What information is needed to fill out Schedule U?

A: You will need to know the total amount of out-of-state purchases made during the year, the sales tax rate for the city or town where you reside, and any sales tax already paid on those purchases.

Q: How do I calculate the use tax owed?

A: To calculate the use tax owed, multiply the total out-of-state purchases by the sales tax rate and subtract any sales tax already paid on those purchases.

Q: When is the deadline to file Schedule U?

A: Schedule U must be filed by the same deadline as your Rhode Island income tax return, which is usually April 15th.

Q: What happens if I don't file Schedule U?

A: Failure to file Schedule U may result in penalties and interest assessed by the Rhode Island Division of Taxation.

Q: Can I file Schedule U electronically?

A: At this time, Schedule U cannot be filed electronically. It must be filed by mail along with your Rhode Island income tax return.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule U by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.