This version of the form is not currently in use and is provided for reference only. Download this version of

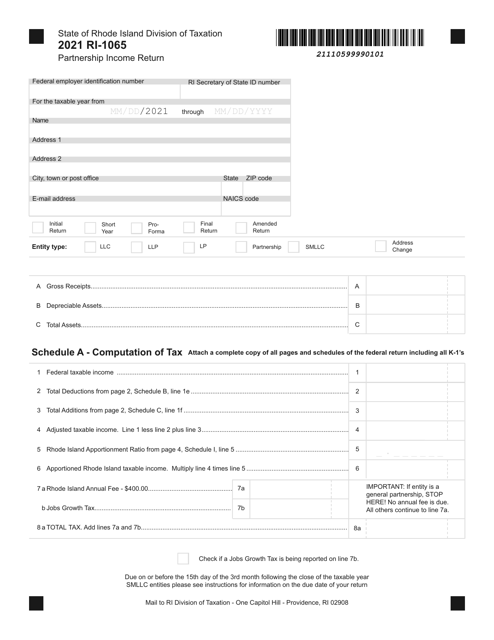

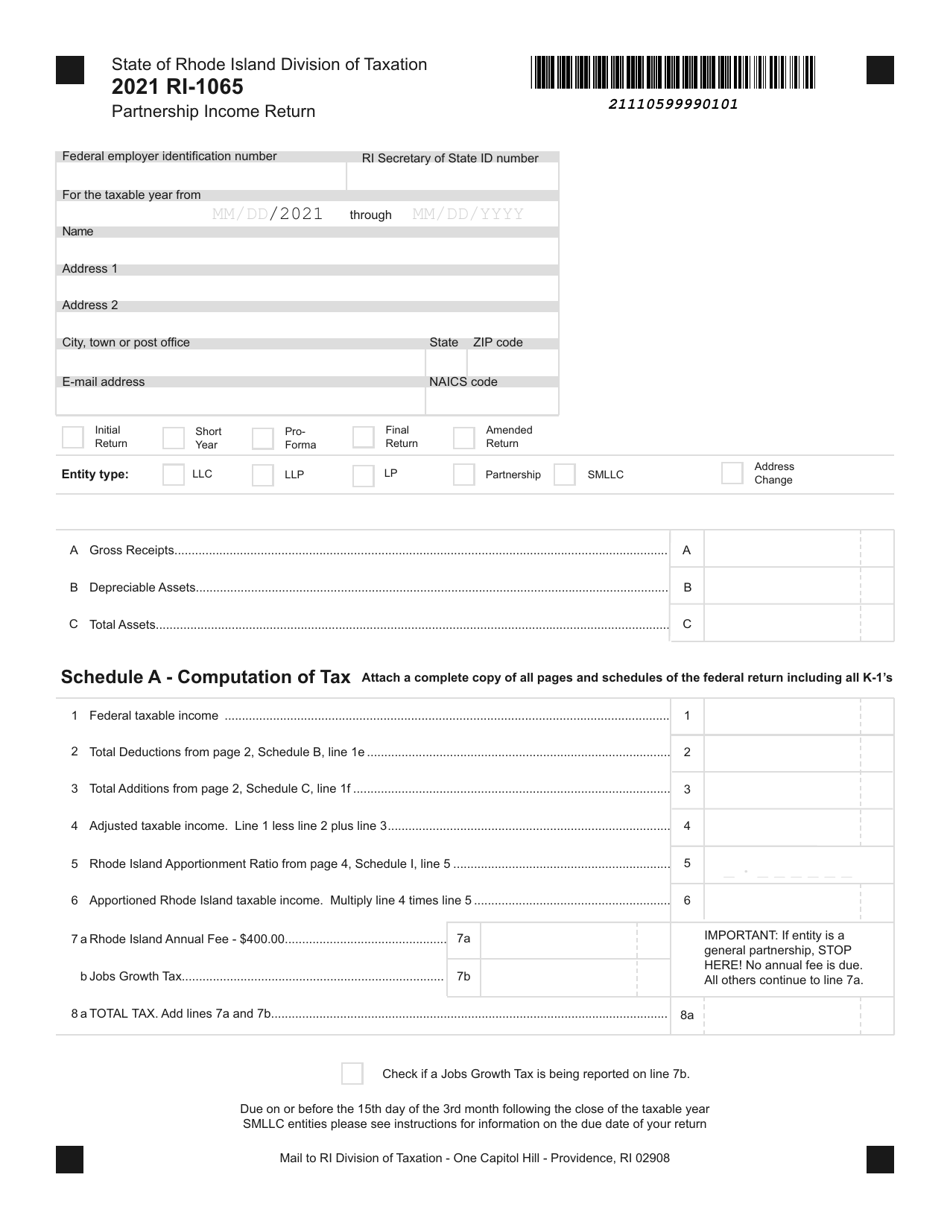

Form RI-1065

for the current year.

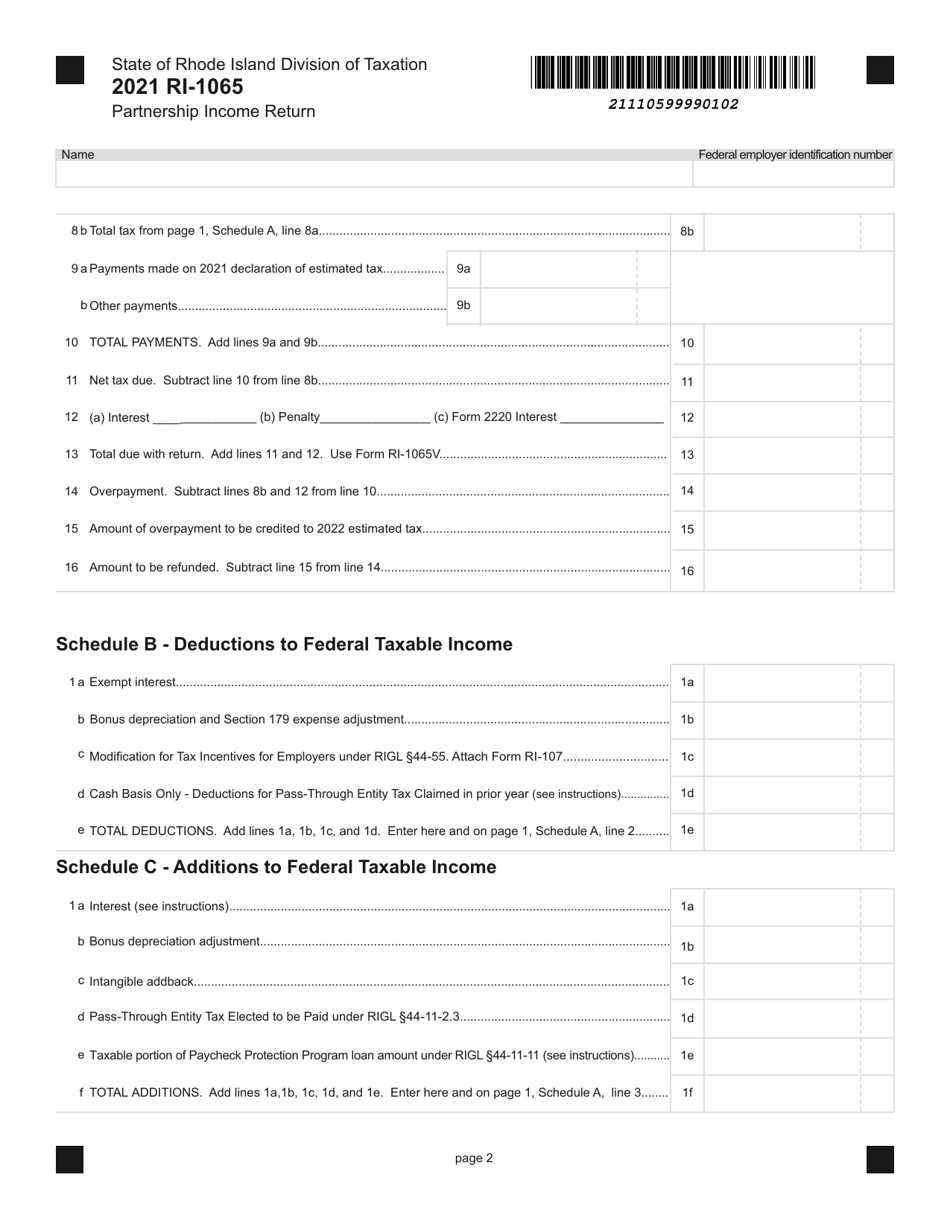

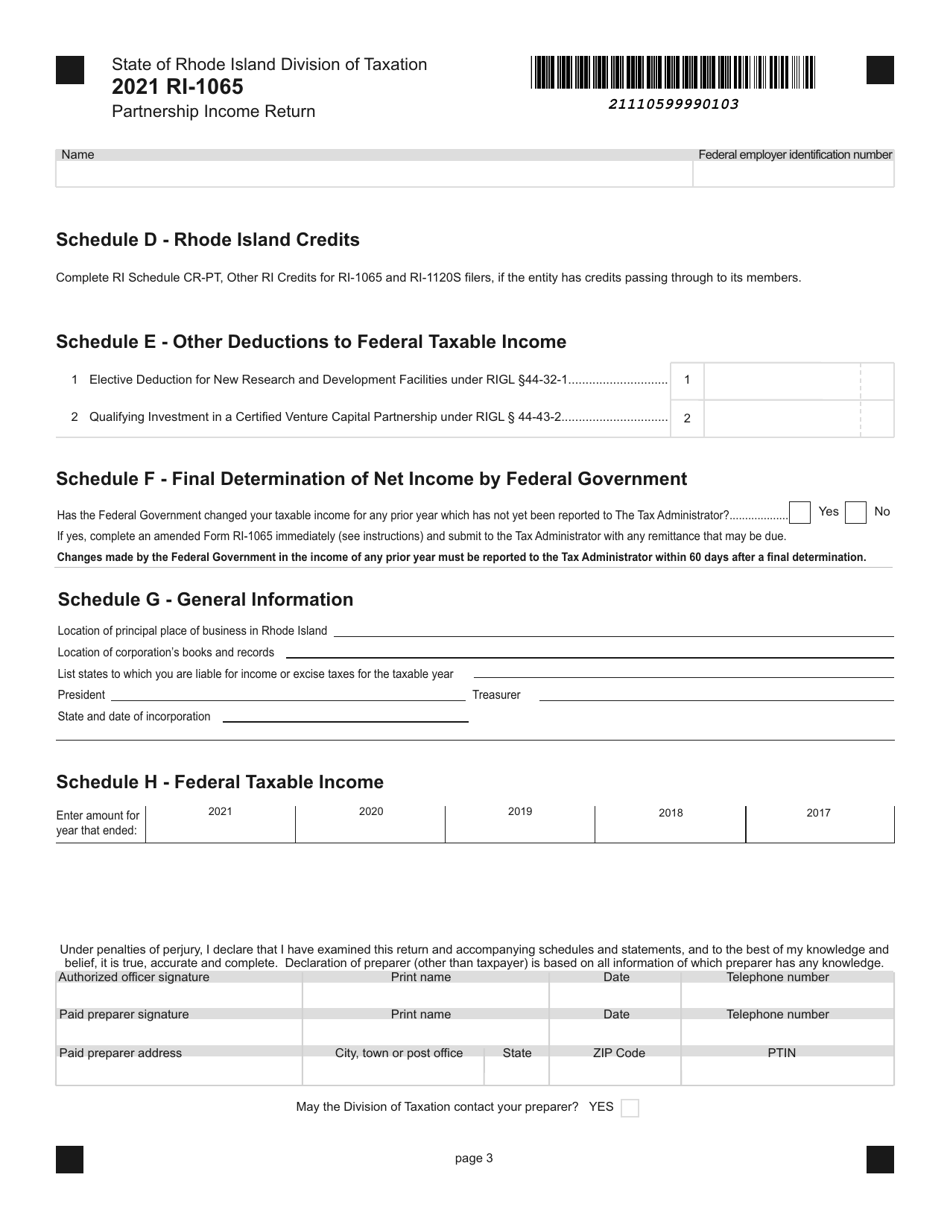

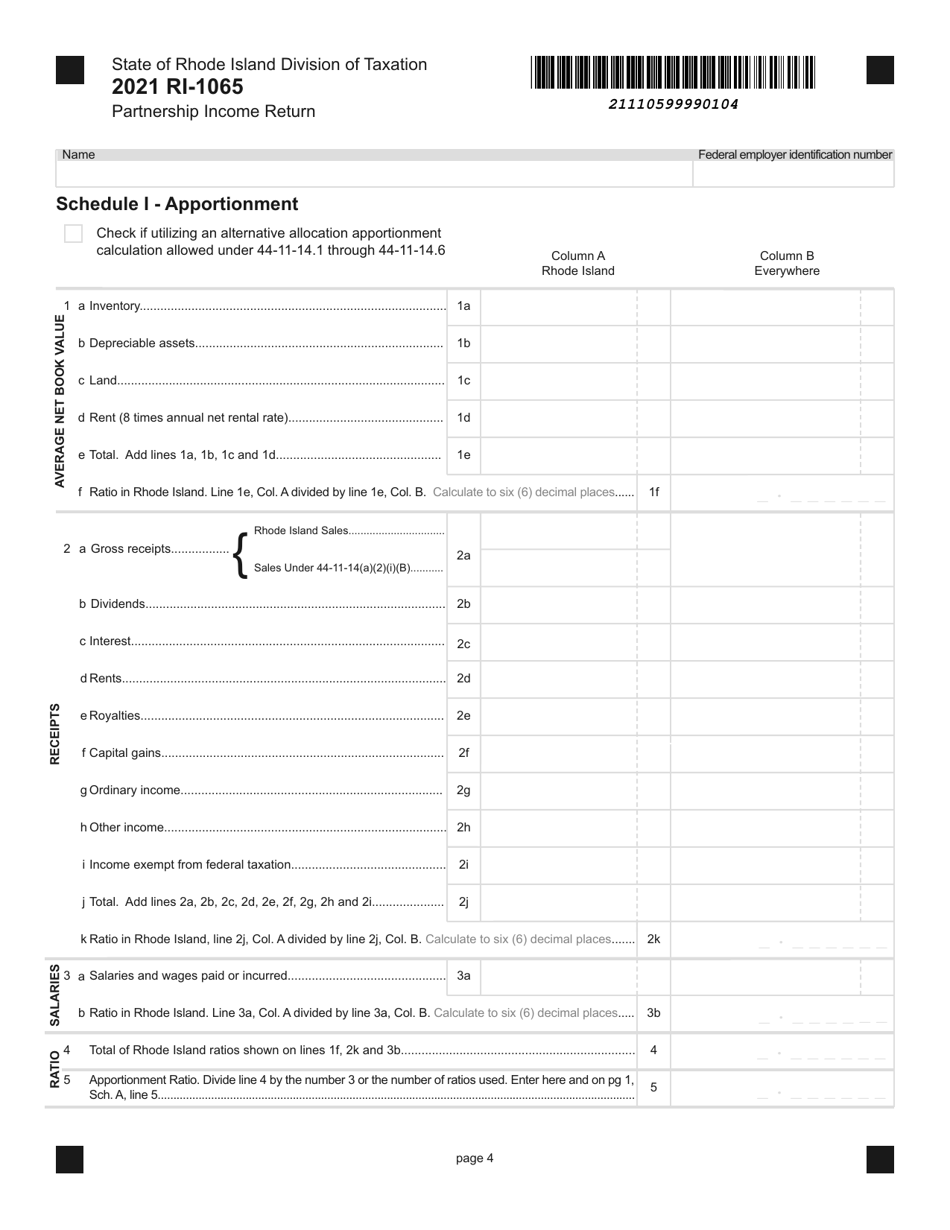

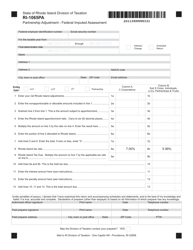

Form RI-1065 Partnership Income Return - Rhode Island

What Is Form RI-1065?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RI-1065?

A: Form RI-1065 is the Partnership Income Return for the state of Rhode Island.

Q: Who needs to file Form RI-1065?

A: Partnerships that have income or losses from Rhode Island must file Form RI-1065.

Q: When is the deadline to file Form RI-1065?

A: The deadline to file Form RI-1065 is the same as the federal deadline, which is typically April 15th.

Q: Are there any extensions available for filing Form RI-1065?

A: Yes, extensions are available for filing Form RI-1065. The extension must be requested by the original due date of the return.

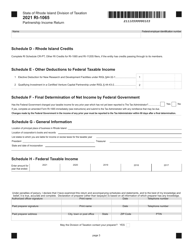

Q: What information is required on Form RI-1065?

A: Form RI-1065 requires information about the partnership's income, deductions, credits, and other relevant financial information.

Q: Are there any fees associated with filing Form RI-1065?

A: There are no fees associated with filing Form RI-1065.

Q: Do I need to include any additional forms or schedules with Form RI-1065?

A: You may need to include additional forms or schedules depending on the partnership's specific circumstances. Review the instructions for Form RI-1065 for more information.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1065 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.