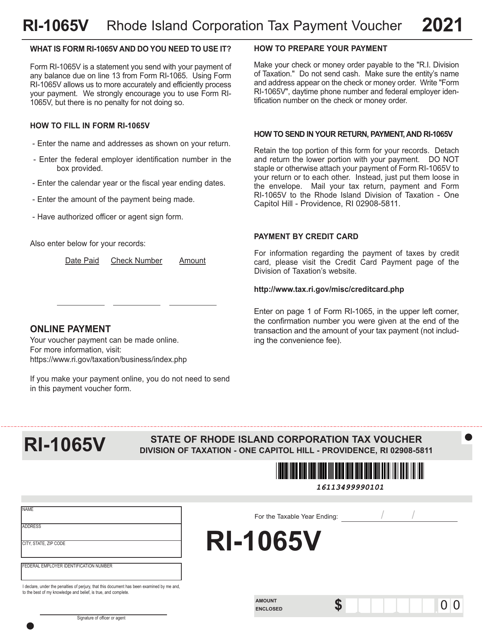

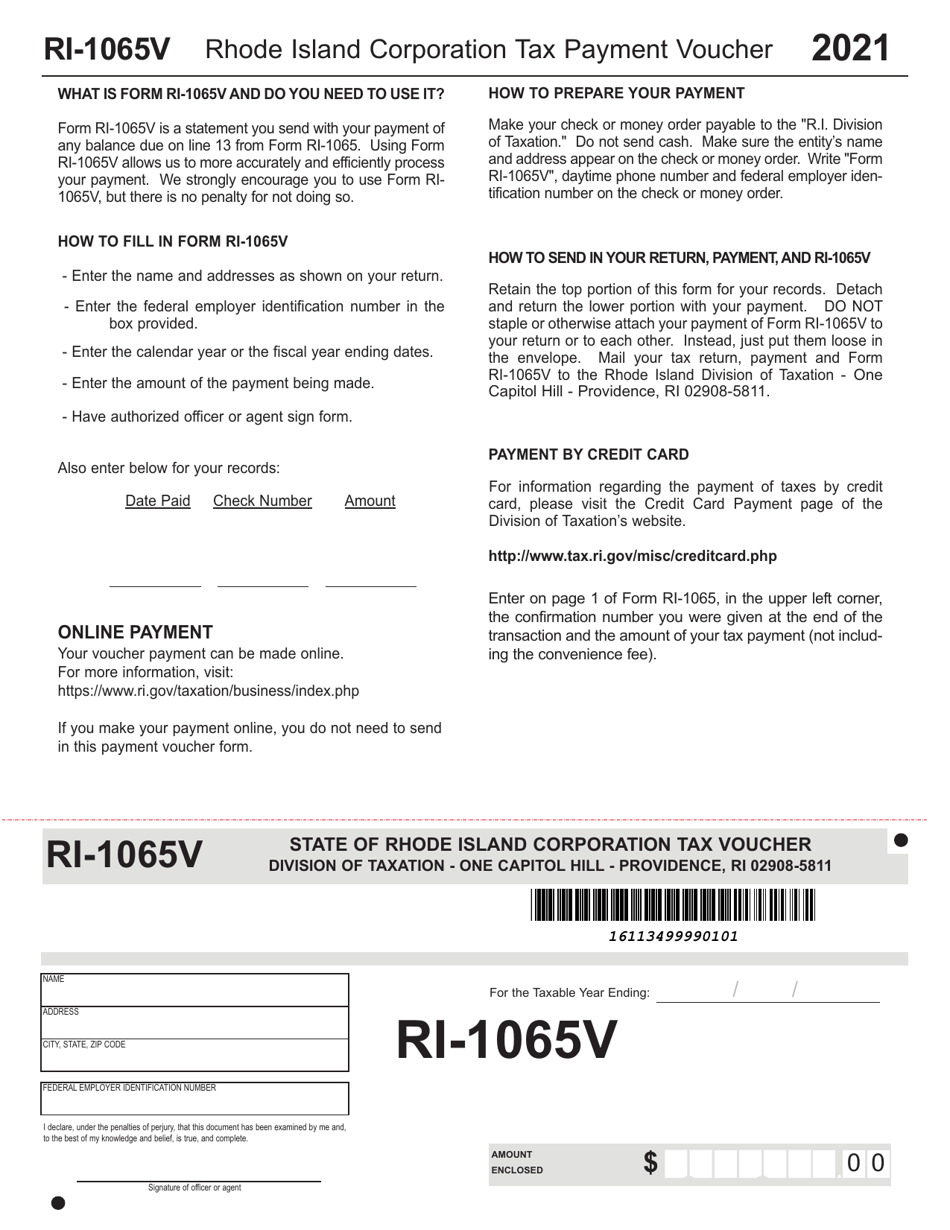

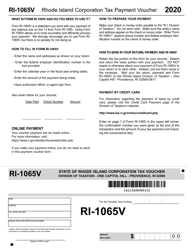

Form RI-1065V Rhode Island Corporation Tax Payment Voucher - Rhode Island

What Is Form RI-1065V?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RI-1065V?

A: Form RI-1065V is the Rhode Island Corporation Tax Payment Voucher.

Q: Who should use Form RI-1065V?

A: Form RI-1065V should be used by corporations in Rhode Island to make tax payments.

Q: What is the purpose of Form RI-1065V?

A: The purpose of Form RI-1065V is to provide a voucher for corporations to submit tax payments to the state of Rhode Island.

Q: Is Form RI-1065V required for all corporations in Rhode Island?

A: Yes, Form RI-1065V is required for all corporations in Rhode Island when making tax payments.

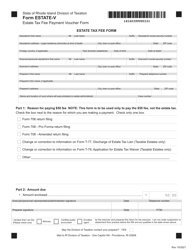

Q: What information is required on Form RI-1065V?

A: Form RI-1065V requires the corporation's name, address, federal employer identification number, and the amount of tax being paid.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1065V by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.