This version of the form is not currently in use and is provided for reference only. Download this version of

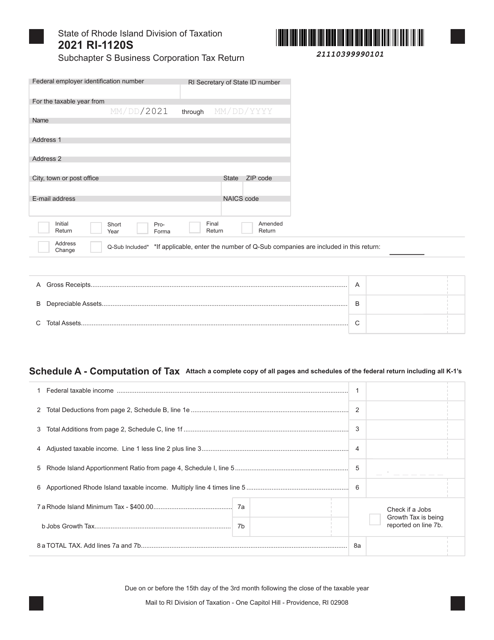

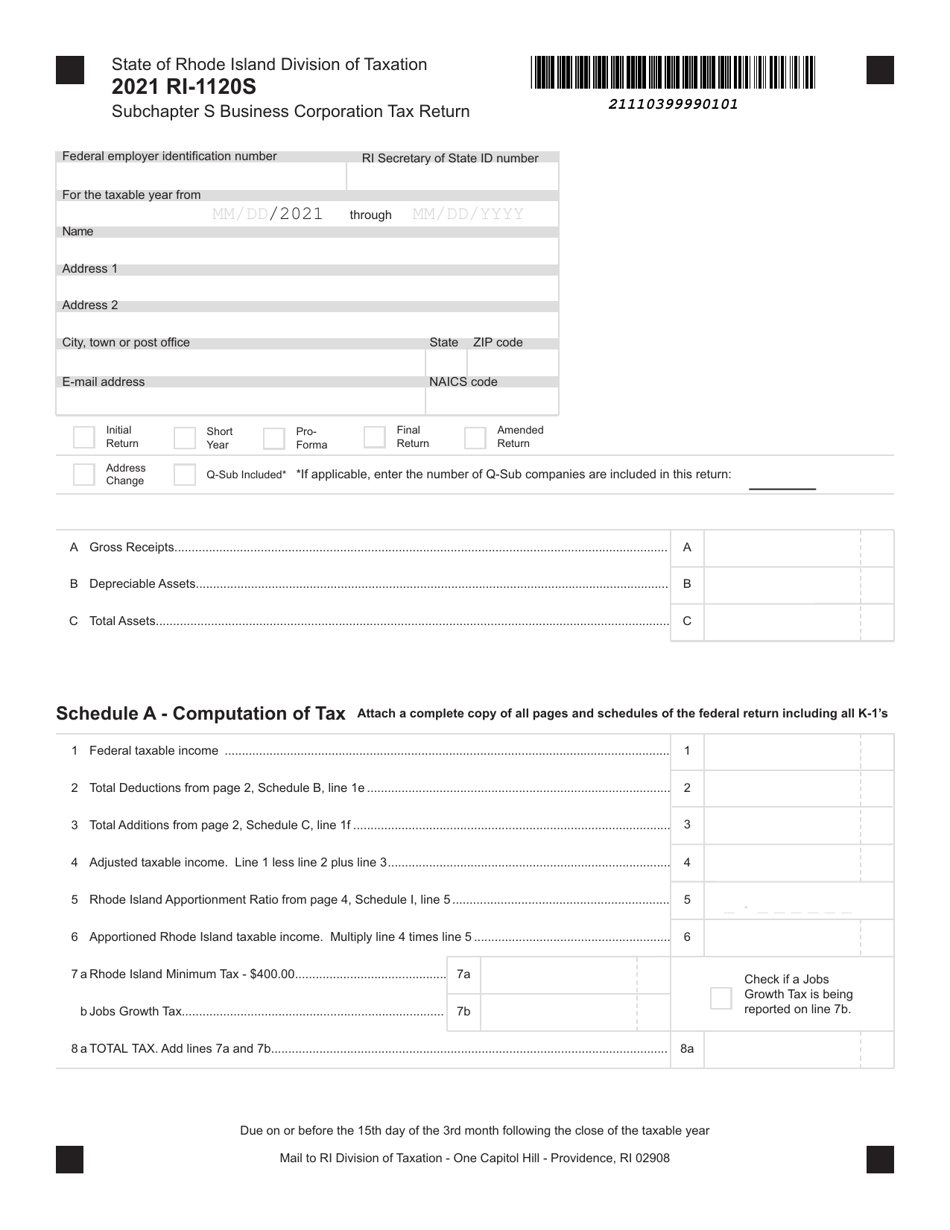

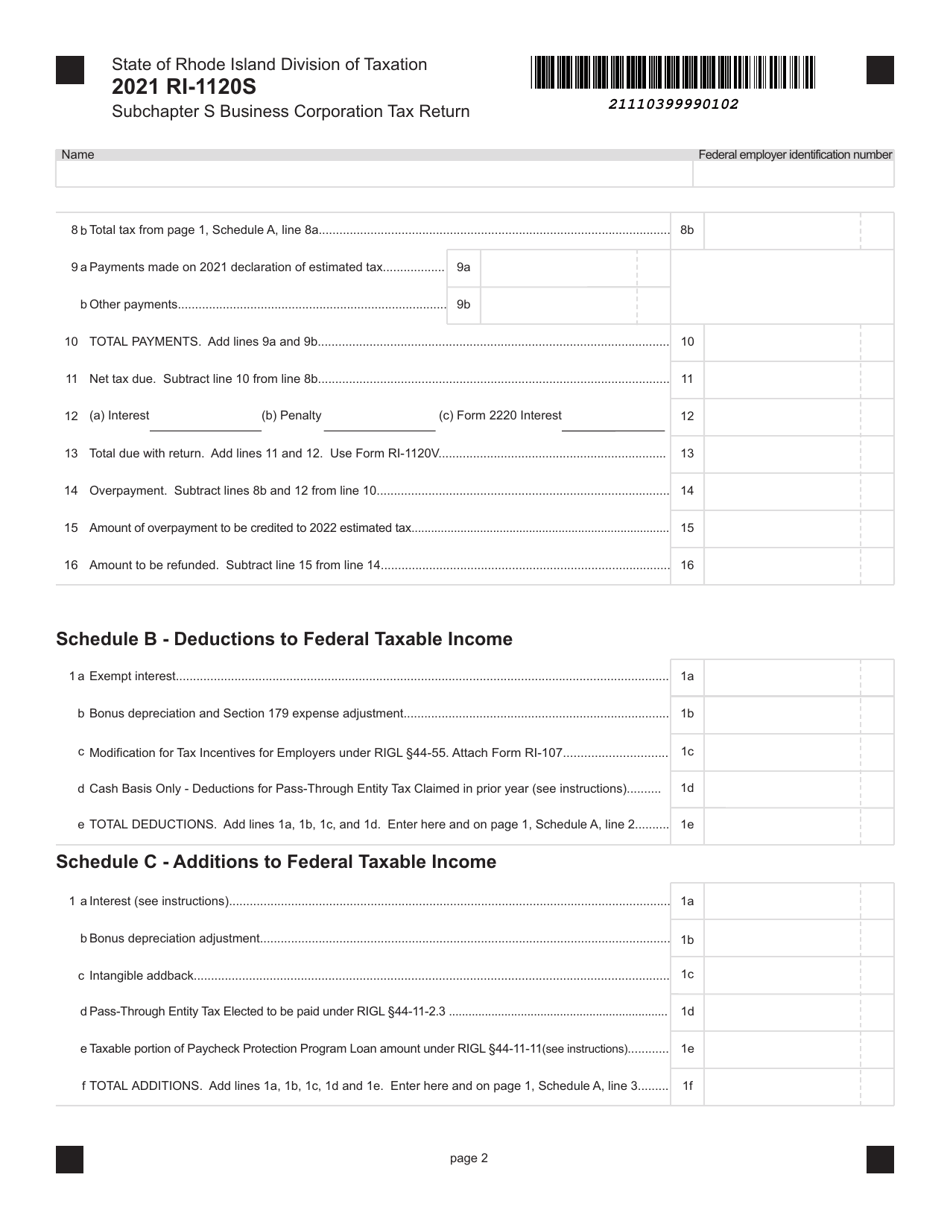

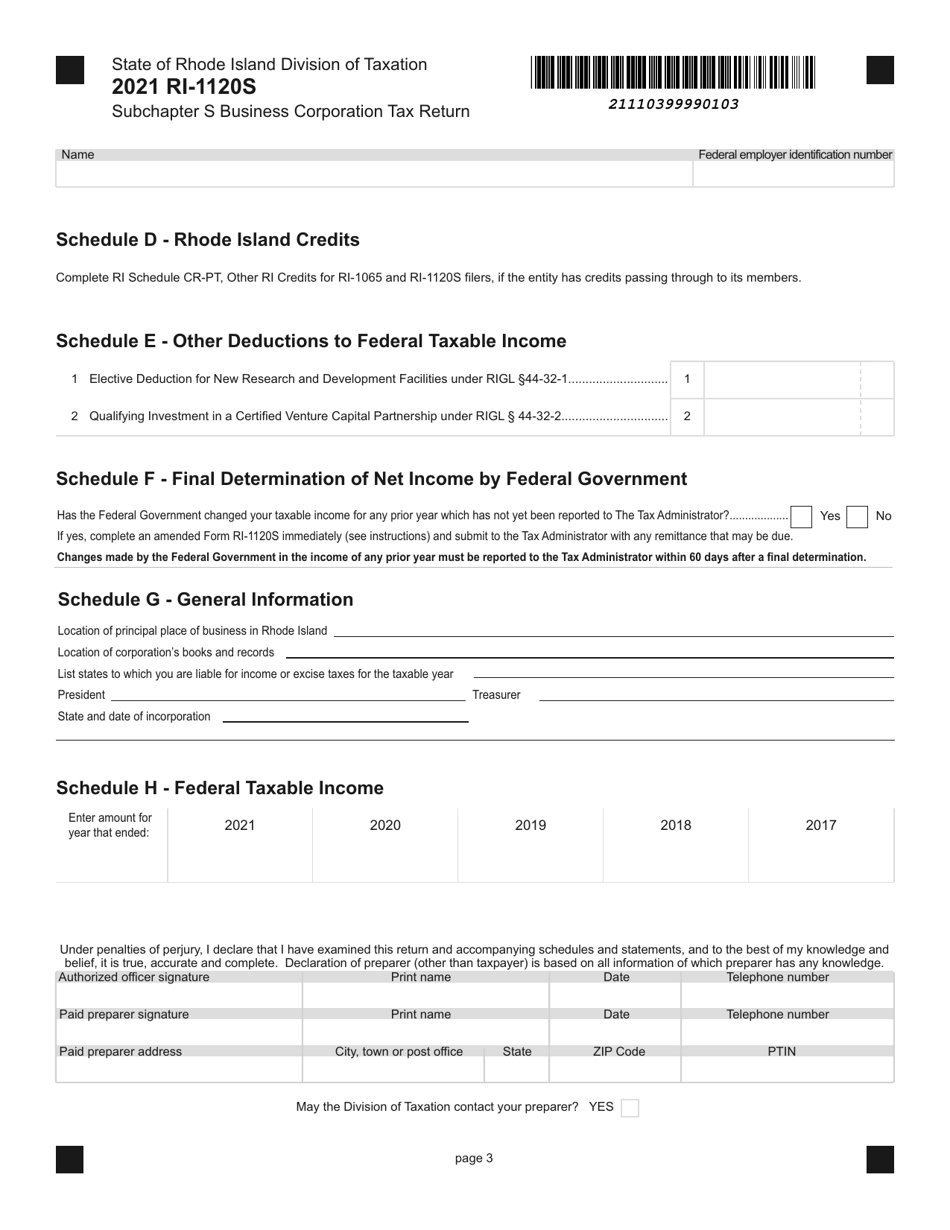

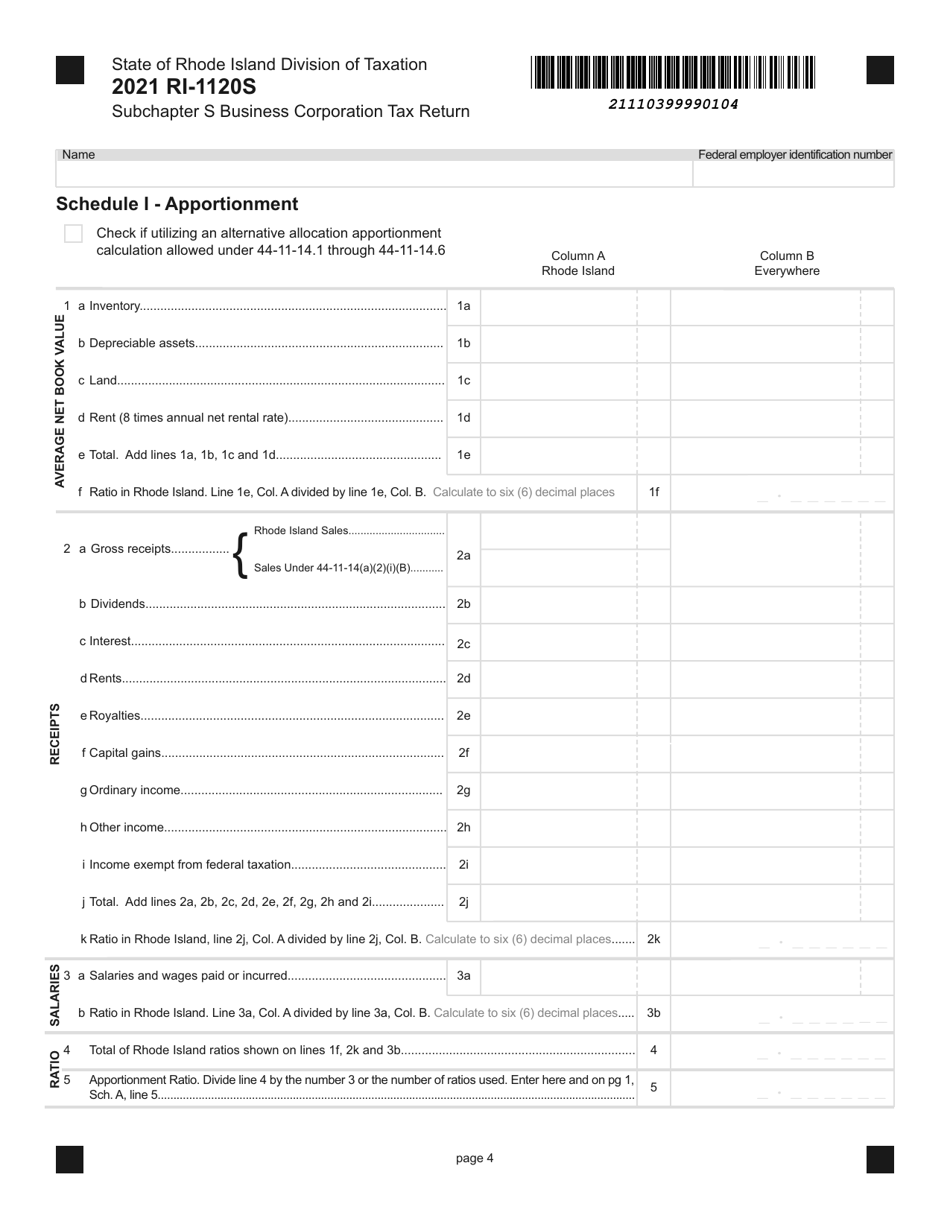

Form RI-1120S

for the current year.

Form RI-1120S Subchapter S Business Corporation Tax Return - Rhode Island

What Is Form RI-1120S?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RI-1120S?

A: Form RI-1120S is the tax return form specifically for Subchapter S Business Corporations in Rhode Island.

Q: What is a Subchapter S Business Corporation?

A: A Subchapter S Business Corporation (or S Corporation) is a specific type of corporation that elects to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes.

Q: Who needs to file Form RI-1120S?

A: Subchapter S Business Corporations in Rhode Island need to file Form RI-1120S to report their income and calculate their tax liability.

Q: When is the deadline to file Form RI-1120S?

A: The deadline to file Form RI-1120S in Rhode Island is the same as the federal deadline, which is typically March 15th.

Q: Are there any penalties for late filing of Form RI-1120S?

A: Yes, there may be penalties for late filing of Form RI-1120S, including interest charges and potential late filing fees.

Q: Is Form RI-1120S the only tax form that Subchapter S Business Corporations need to file?

A: No, Subchapter S Business Corporations also need to file federal Form 1120S to report their income to the IRS.

Q: Is there a minimum income threshold for filing Form RI-1120S?

A: Yes, Subchapter S Business Corporations in Rhode Island are required to file Form RI-1120S regardless of their income level.

Q: What supporting documents need to be included with Form RI-1120S?

A: Subchapter S Business Corporations may need to include additional schedules or forms with their Form RI-1120S, depending on their specific tax situation.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1120S by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.