This version of the form is not currently in use and is provided for reference only. Download this version of

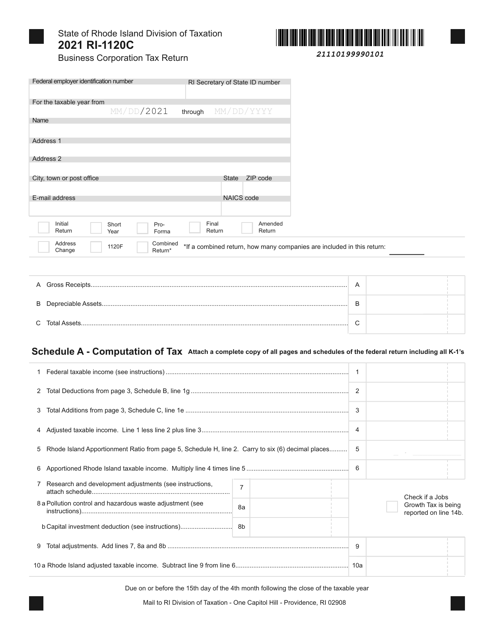

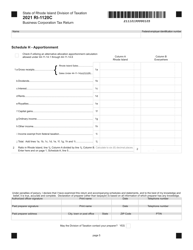

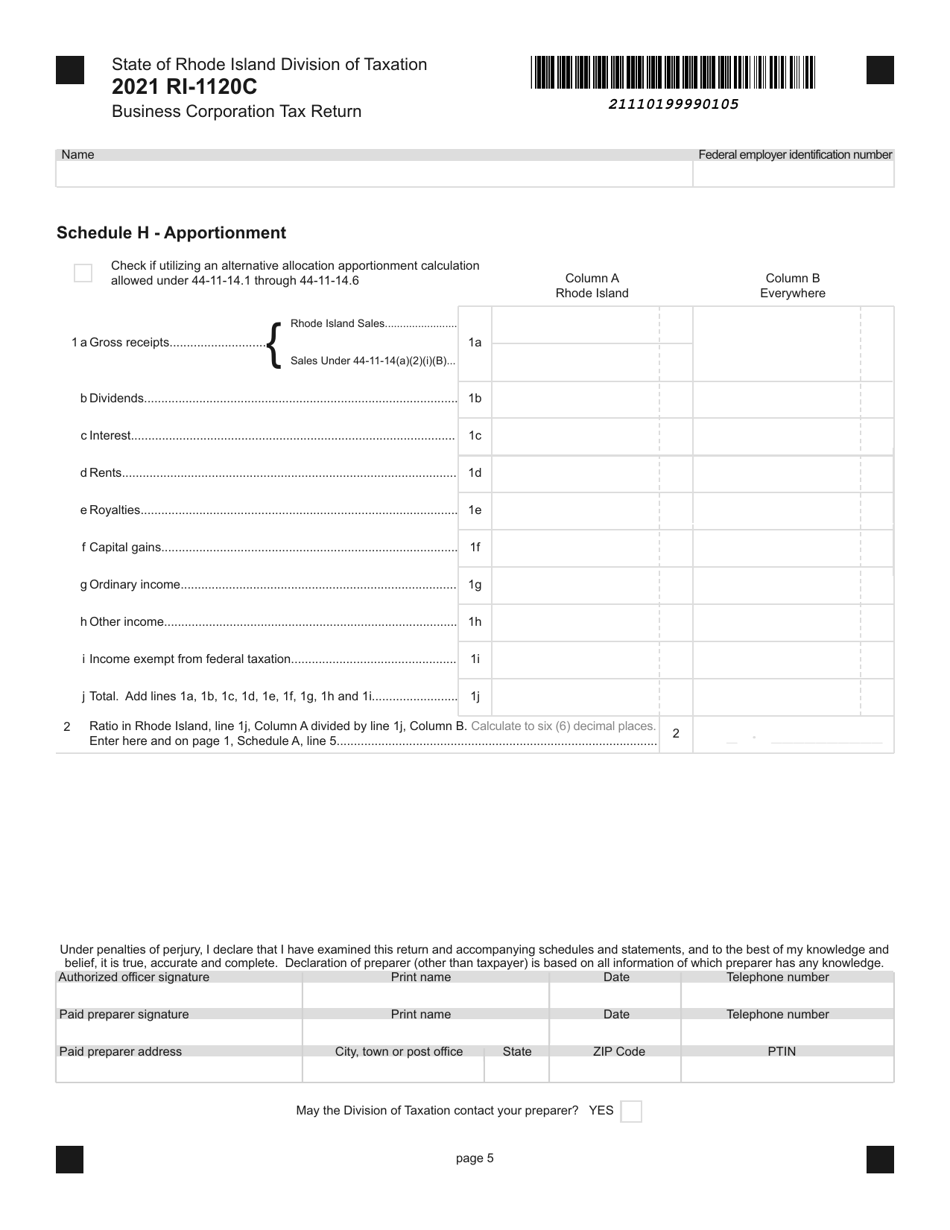

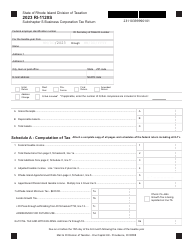

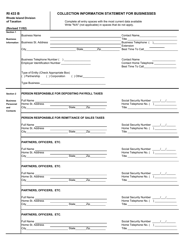

Form RI-1120C

for the current year.

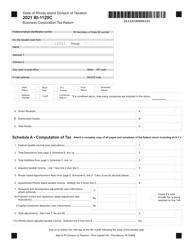

Form RI-1120C Business Corporation Tax Return - Rhode Island

What Is Form RI-1120C?

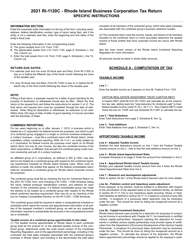

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is a Form RI-1120C?

A: Form RI-1120C is the Business Corporation Tax Return specifically for corporations in Rhode Island.

Q: Who needs to file Form RI-1120C?

A: Corporations operating in Rhode Island need to file Form RI-1120C.

Q: When is the deadline for filing Form RI-1120C?

A: The deadline for filing Form RI-1120C is the 15th day of the 3rd month following the close of the tax year.

Q: Are there any extensions available for filing Form RI-1120C?

A: Yes, corporations may request an extension of time to file Form RI-1120C, but any taxes owed are still due by the original deadline.

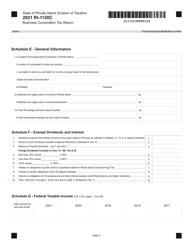

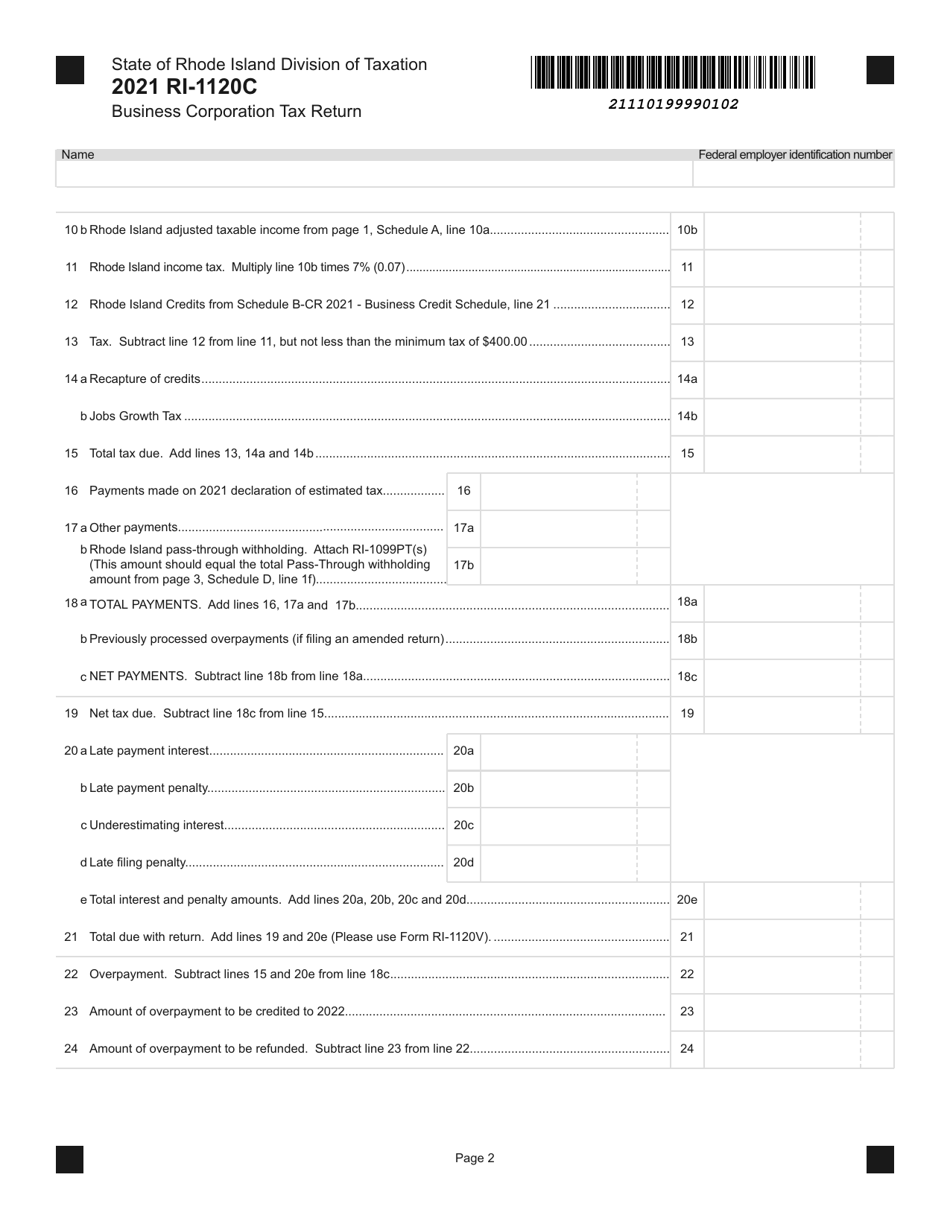

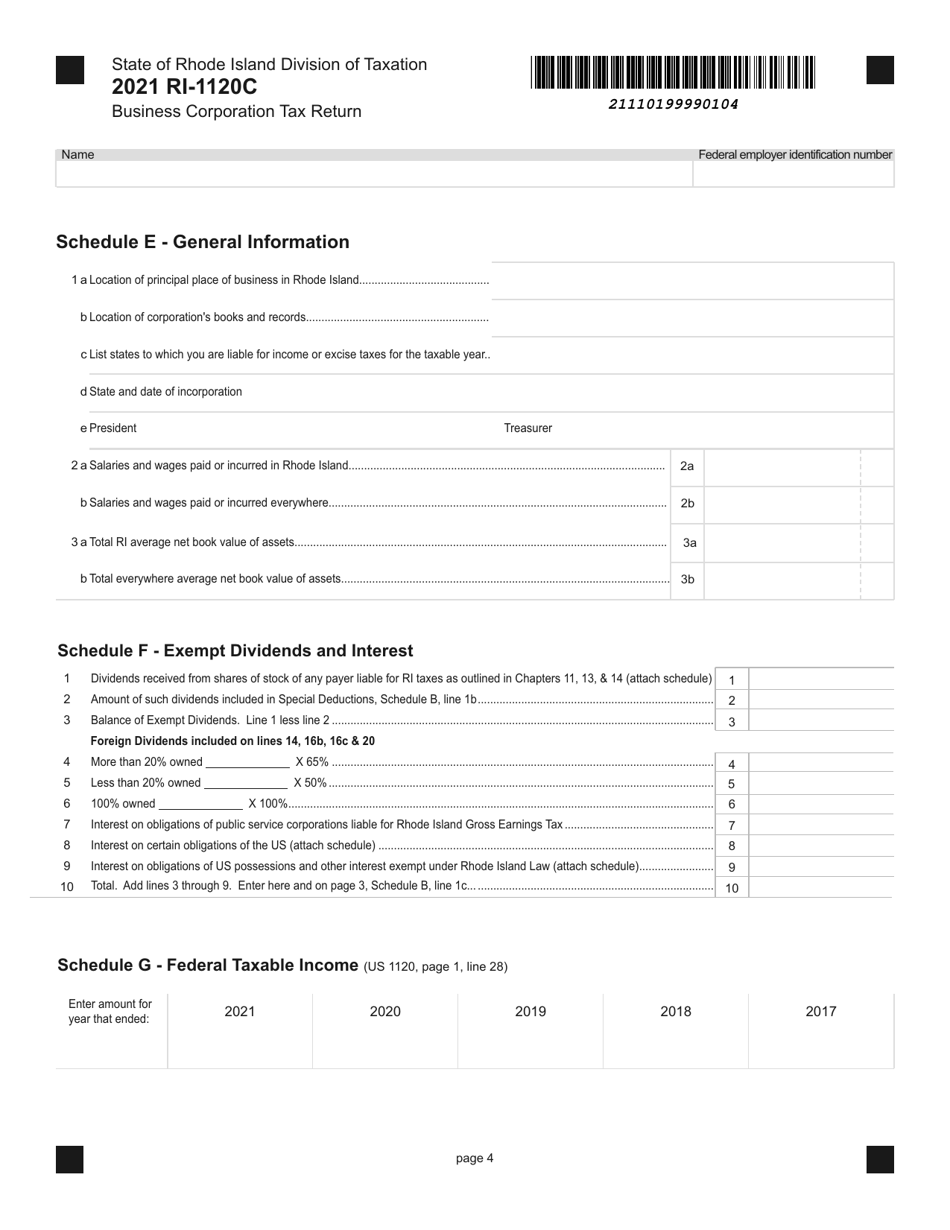

Q: What information is required to complete Form RI-1120C?

A: Form RI-1120C requires information about the corporation's income, deductions, credits, and other relevant financial data.

Q: Is there a fee for filing Form RI-1120C?

A: No, there is no fee for filing Form RI-1120C.

Q: Can Form RI-1120C be filed electronically?

A: Yes, corporations can choose to file Form RI-1120C electronically.

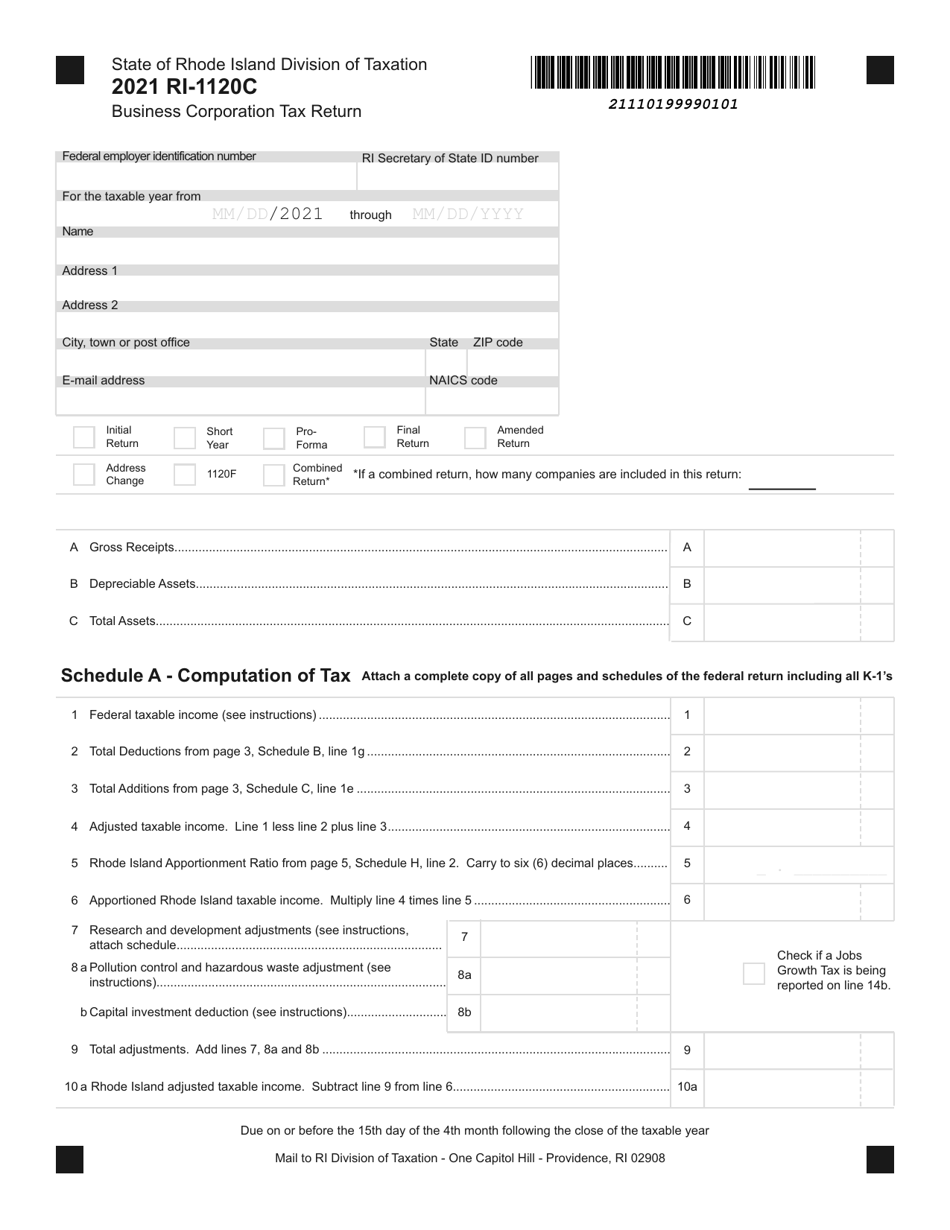

Q: Are there any penalties for late filing of Form RI-1120C?

A: Yes, there may be penalties for late filing or underpayment of taxes owed on Form RI-1120C.

Q: How can I get help with completing Form RI-1120C?

A: You can contact the Rhode Island Division of Taxation for assistance with completing Form RI-1120C.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1120C by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.