This version of the form is not currently in use and is provided for reference only. Download this version of

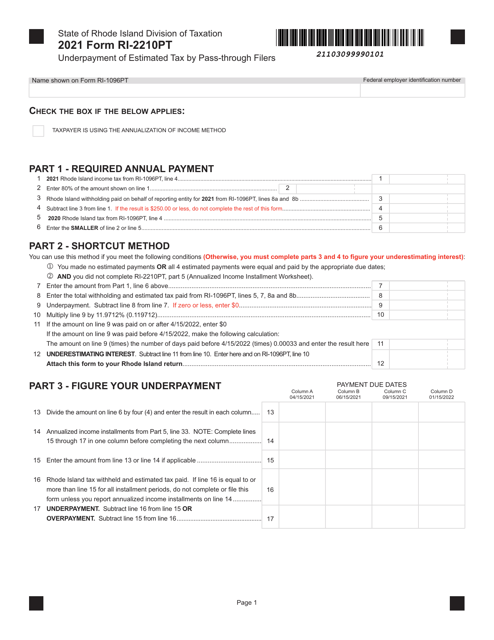

Form RI-2210PT

for the current year.

Form RI-2210PT Underpayment of Estimated Tax by Pass-Through Filers - Rhode Island

What Is Form RI-2210PT?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

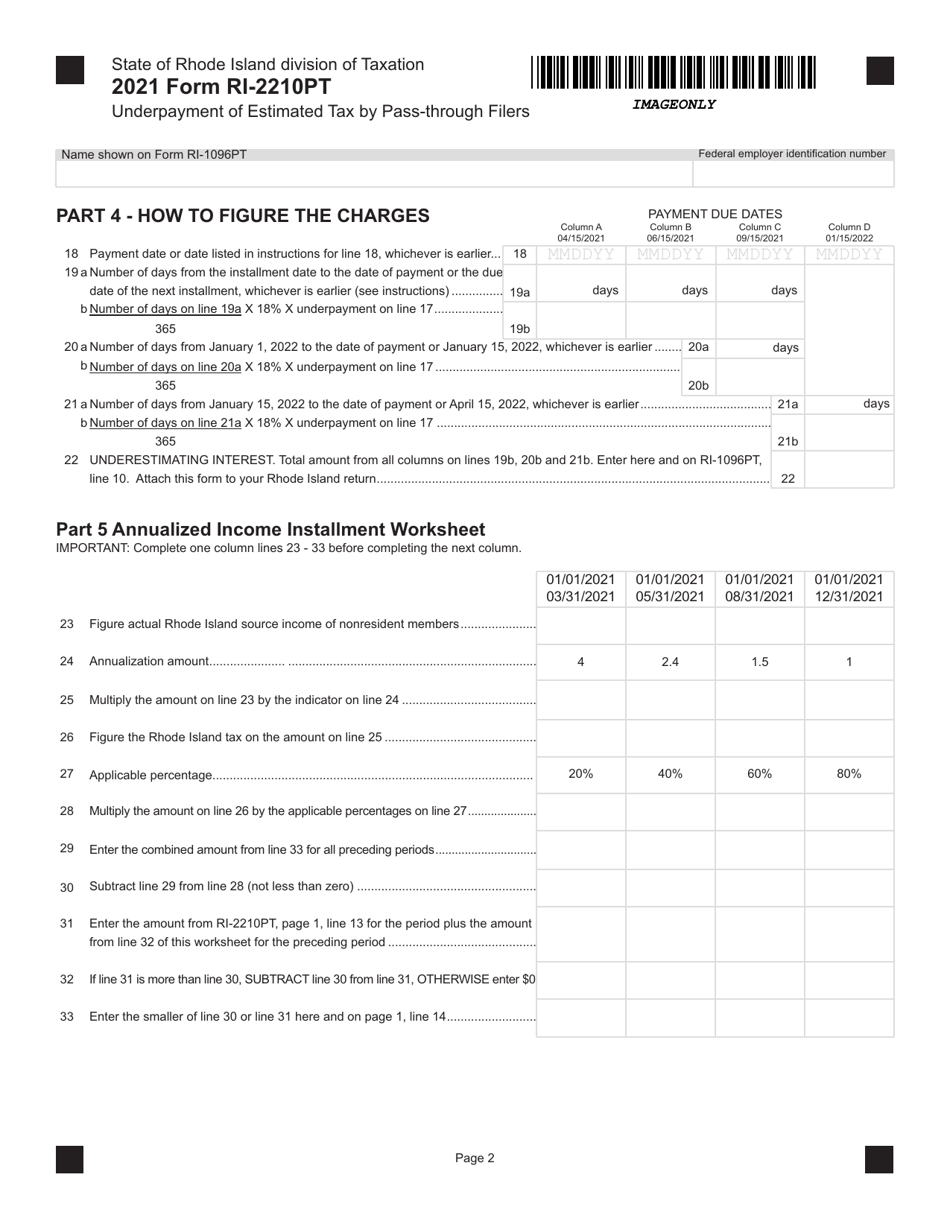

Q: What is Form RI-2210PT?

A: Form RI-2210PT is a tax form used by pass-through filers in Rhode Island to calculate and pay any underpayment of estimated taxes.

Q: Who needs to file Form RI-2210PT?

A: Pass-through filers in Rhode Island who have underpaid their estimated taxes need to file Form RI-2210PT.

Q: What is an underpayment of estimated tax?

A: An underpayment of estimated tax occurs when a taxpayer does not pay enough in estimated taxes throughout the year.

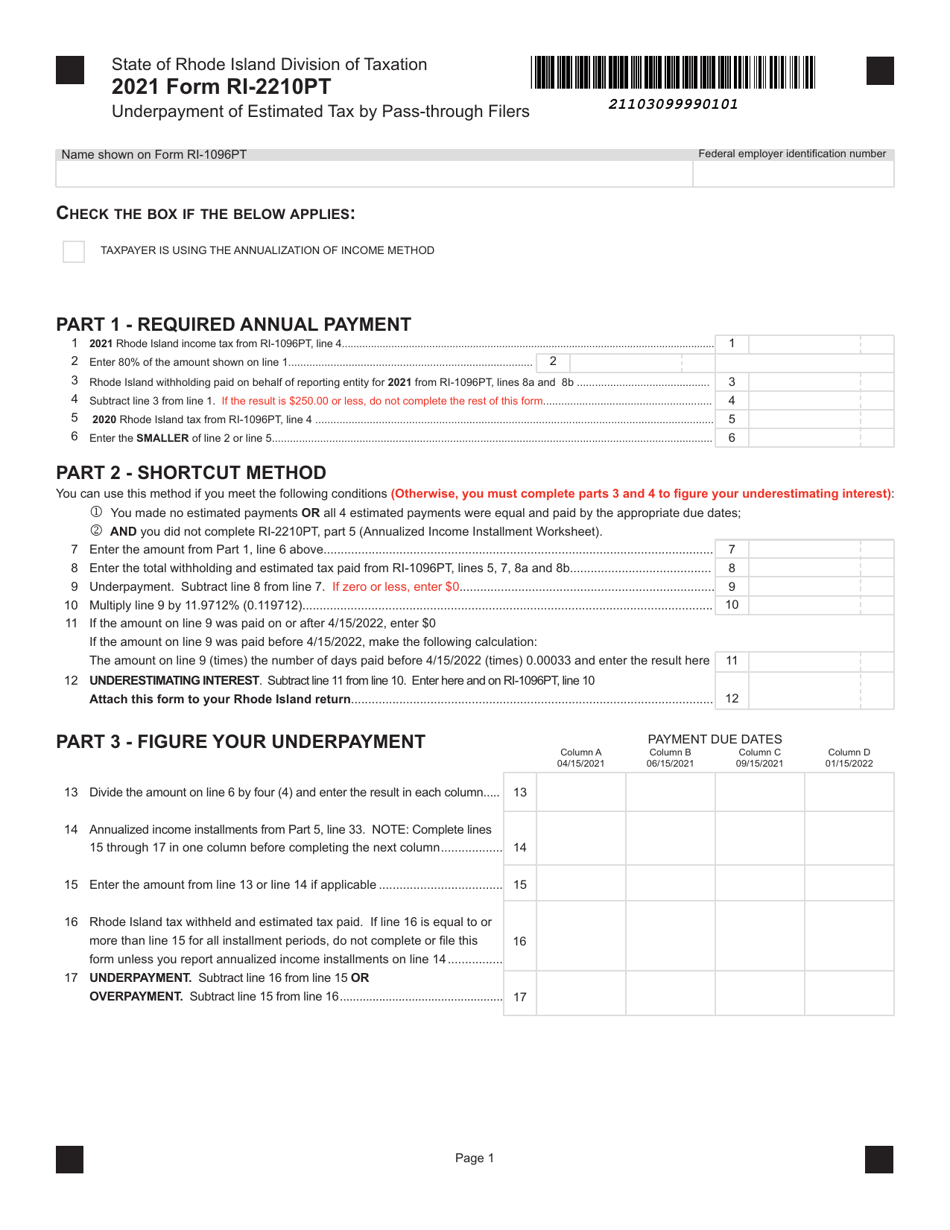

Q: How do I calculate the underpayment of estimated tax?

A: The underpayment of estimated tax is calculated based on the amount of estimated tax paid and the required installment amounts.

Q: When is Form RI-2210PT due?

A: Form RI-2210PT is due on or before the regular due date of the pass-through filer's tax return (including extensions).

Q: What happens if I don't file Form RI-2210PT?

A: If you have underpaid your estimated taxes as a pass-through filer in Rhode Island and fail to file Form RI-2210PT, you may be subject to penalties and interest.

Q: Are there any exemptions or exceptions to filing Form RI-2210PT?

A: Certain exemptions and exceptions may apply, such as if the underpayment is de minimis or if the taxpayer relied on the safe harbor provisions.

Q: What other documents do I need to submit with Form RI-2210PT?

A: In most cases, you will need to submit copies of your federal tax return and any documentation supporting your estimated tax payments.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-2210PT by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.