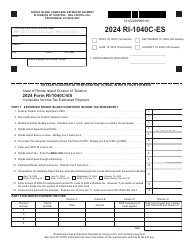

This version of the form is not currently in use and is provided for reference only. Download this version of

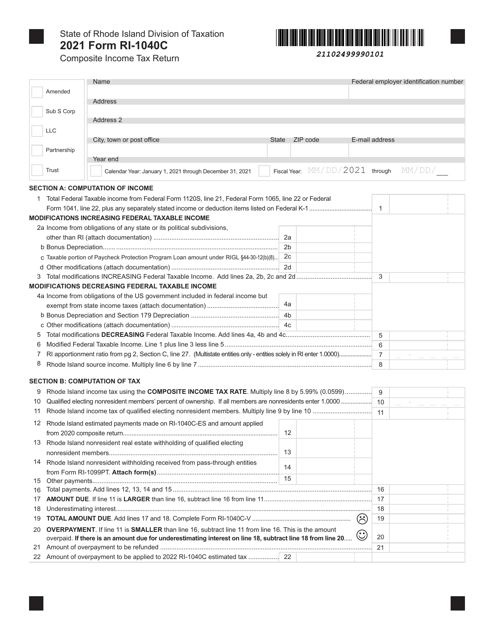

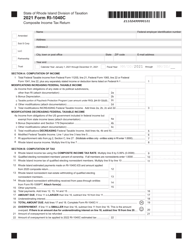

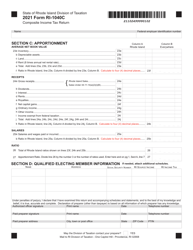

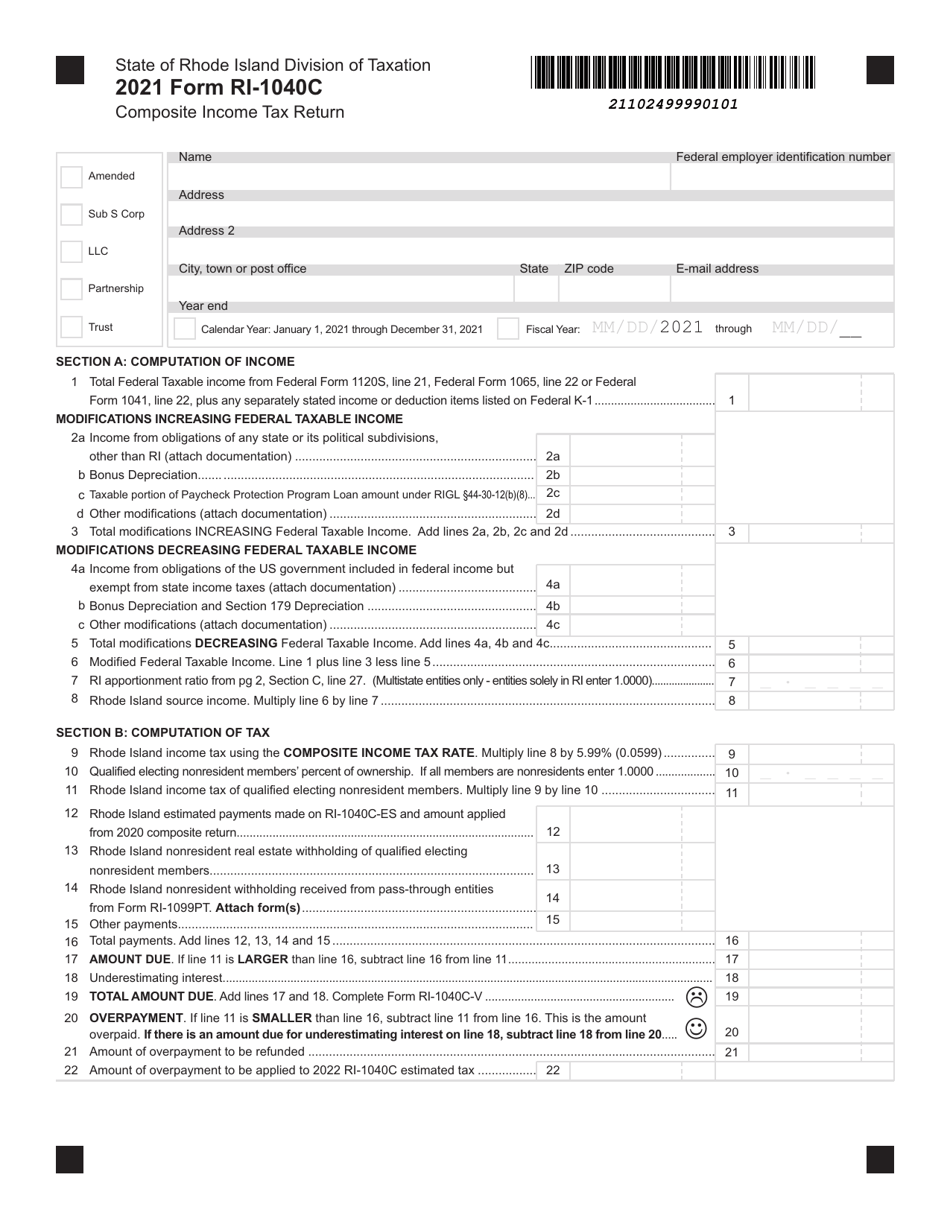

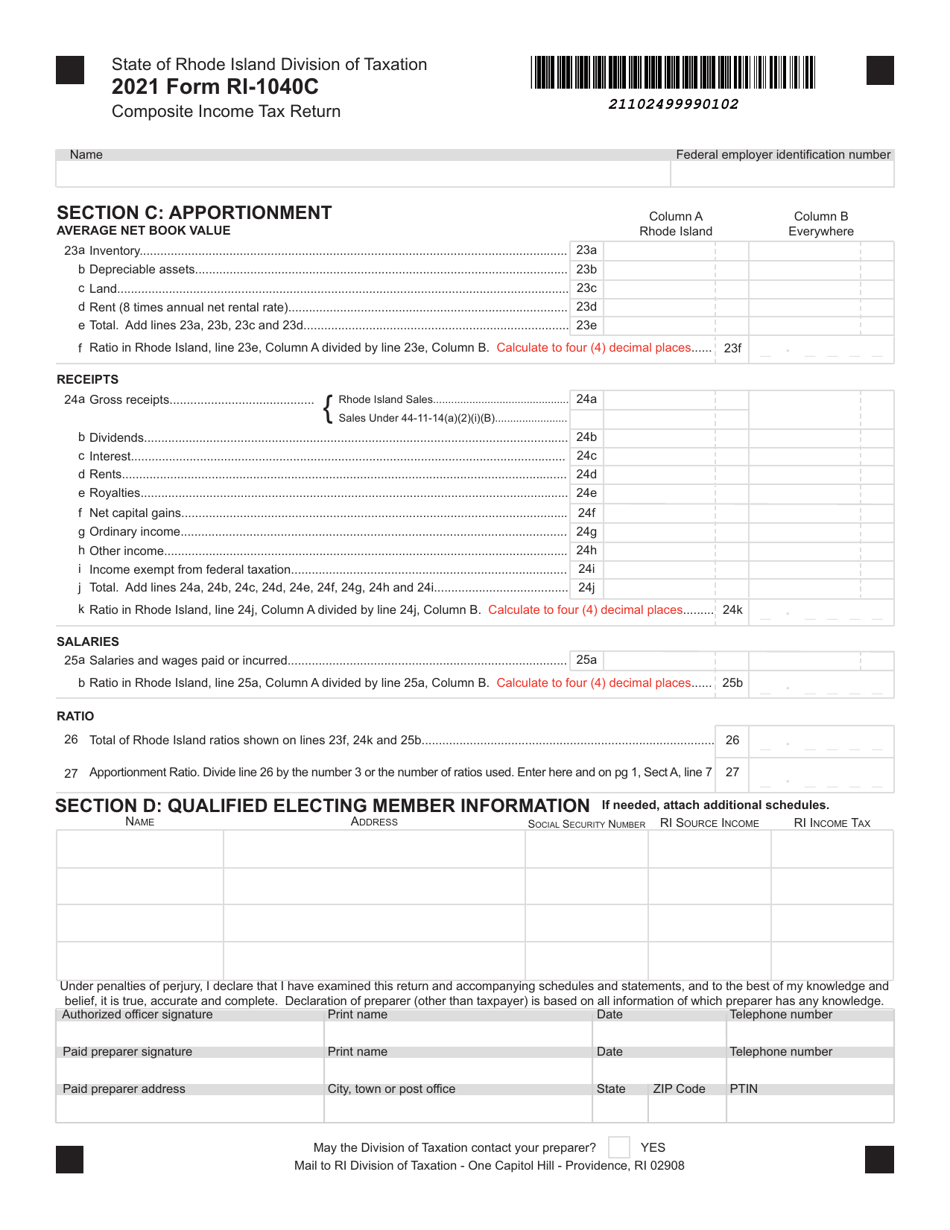

Form RI-1040C

for the current year.

Form RI-1040C Composite Income Tax(return - Rhode Island

What Is Form RI-1040C?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the RI-1040C Form?

A: RI-1040C is the Composite Income Tax Form used in Rhode Island.

Q: Who needs to file the RI-1040C Form?

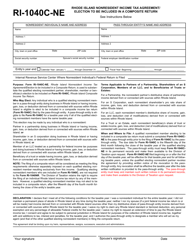

A: The RI-1040C Form is for nonresident individuals or entities who are members of a pass-through entity (partnership or S corporation) doing business in Rhode Island.

Q: What is a composite income tax return?

A: A composite income tax return is a single tax return filed on behalf of multiple nonresident members of a pass-through entity.

Q: Are nonresident members required to file individual income tax returns in Rhode Island?

A: No, nonresident members do not need to file individual income tax returns in Rhode Island if their only Rhode Island income is from a pass-through entity.

Q: What information do I need to include on the RI-1040C Form?

A: You need to include the pass-through entity's name, address, federal identification number, and the name and identification number of each nonresident member.

Q: When is the deadline to file the RI-1040C Form?

A: The RI-1040C Form is due on or before the original due date of the pass-through entity's income tax return.

Q: Do I need to include payment with the RI-1040C Form?

A: Yes, you need to include full payment of the Rhode Island income tax liability with the RI-1040C Form.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040C by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.