This version of the form is not currently in use and is provided for reference only. Download this version of

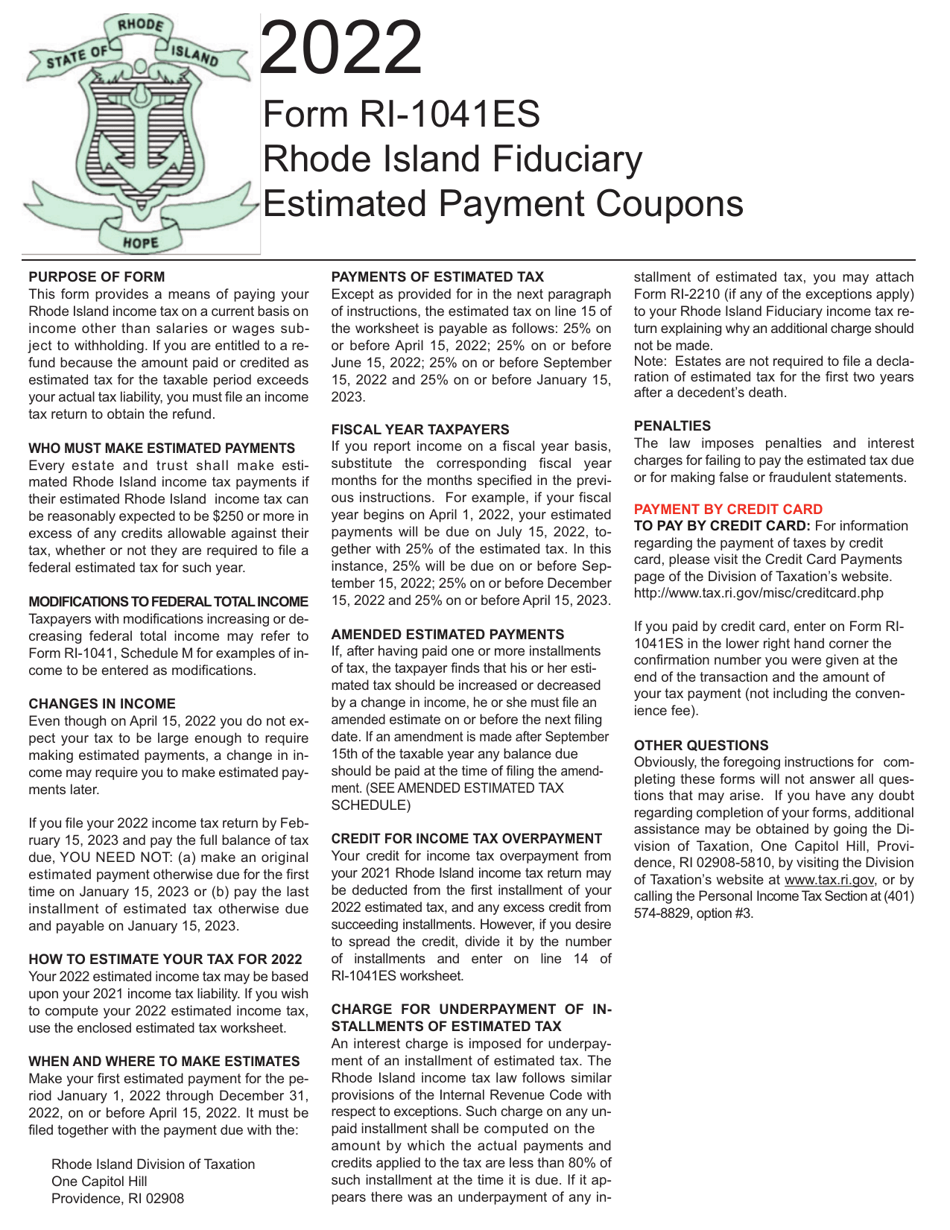

Form RI-1041ES

for the current year.

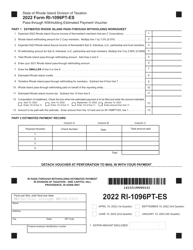

Form RI-1041ES Rhode Island Fiduciary Estimated Payment - Rhode Island

What Is Form RI-1041ES?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1041ES?

A: Form RI-1041ES is the Rhode Island Fiduciary Estimated Payment form.

Q: Who needs to file Form RI-1041ES?

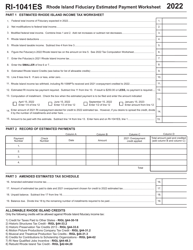

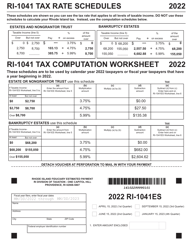

A: Fiduciaries in Rhode Island making estimated tax payments need to file Form RI-1041ES.

Q: What is the purpose of Form RI-1041ES?

A: Form RI-1041ES is used to make estimated tax payments for fiduciaries in Rhode Island.

Q: When is Form RI-1041ES due?

A: Form RI-1041ES is due on a quarterly basis, with payment due dates on April 15, June 15, September 15, and January 15 of the following year.

Q: Are there any penalties for not filing Form RI-1041ES?

A: Yes, failure to file or pay the estimated tax due on Form RI-1041ES may result in penalties and interest.

Q: Do I need to attach any additional forms or documents with Form RI-1041ES?

A: No, you do not need to attach any additional forms or documents with Form RI-1041ES.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1041ES by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.