This version of the form is not currently in use and is provided for reference only. Download this version of

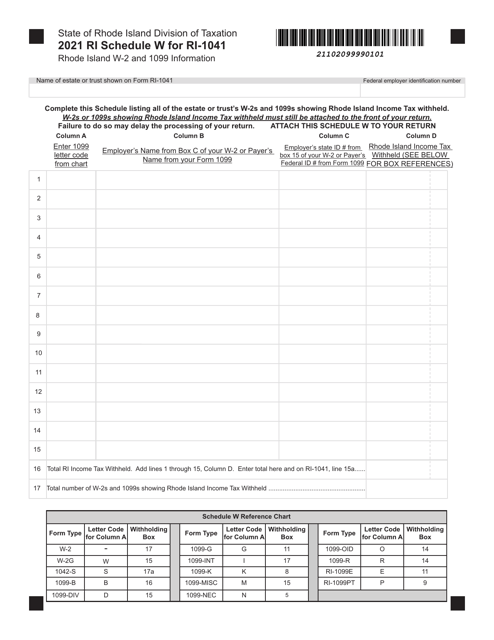

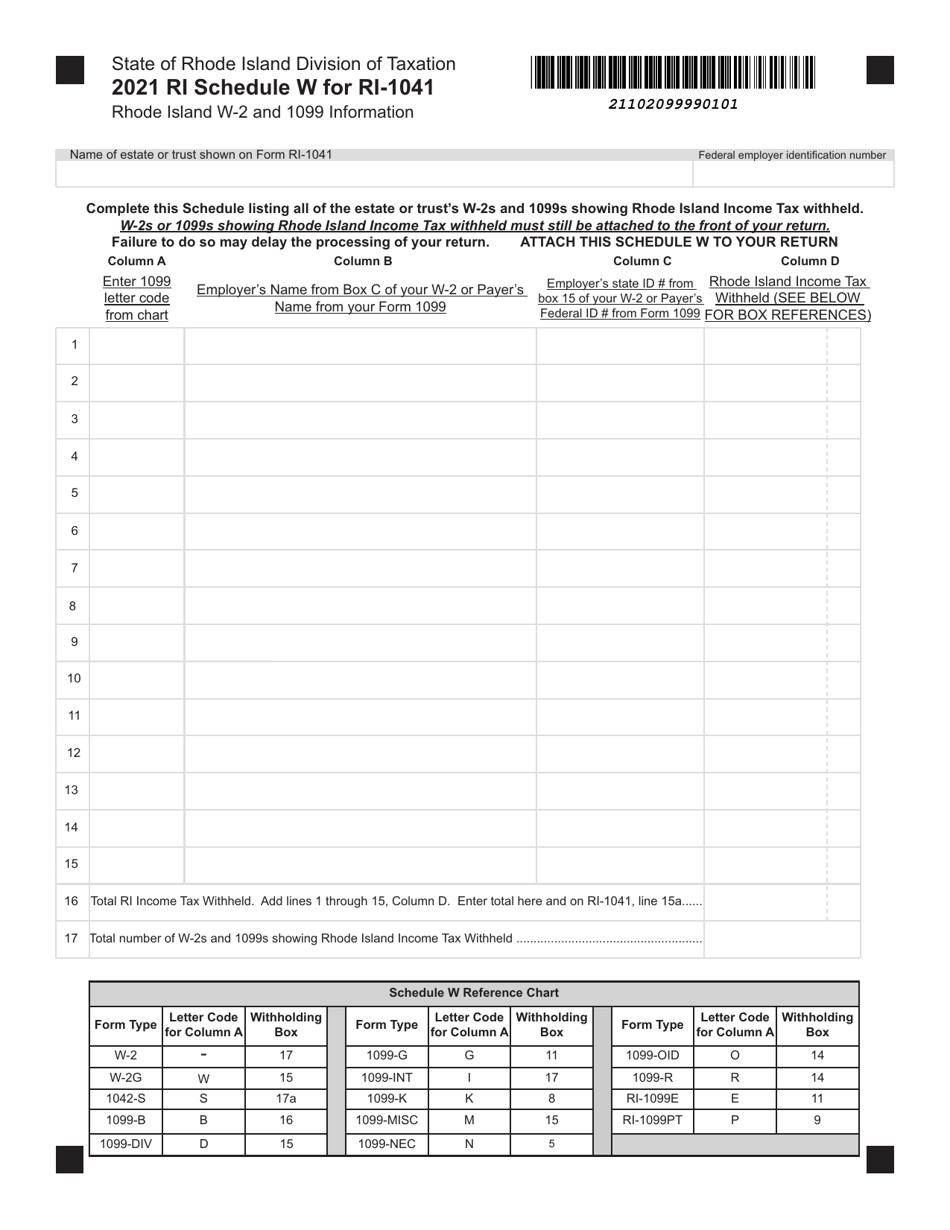

Form RI-1041 Schedule W

for the current year.

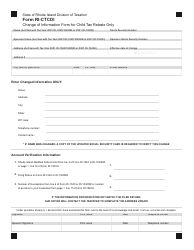

Form RI-1041 Schedule W Rhode Island W-2 and 1099 Information - Rhode Island

What Is Form RI-1041 Schedule W?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.The document is a supplement to Form RI-1041, Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RI-1041 Schedule W?

A: Form RI-1041 Schedule W is a form used in Rhode Island to report W-2 and 1099 information.

Q: What is a W-2?

A: A W-2 is a form that employers use to report wages paid to their employees and the taxes withheld from those wages.

Q: What is a 1099?

A: A 1099 is a form used to report various types of income, such as income from freelance work, rental income, or investment income.

Q: Who needs to file Form RI-1041 Schedule W?

A: Individuals or businesses who have paid wages or made payments to independent contractors in Rhode Island may need to file Form RI-1041 Schedule W.

Q: What information is needed to complete Form RI-1041 Schedule W?

A: To complete Form RI-1041 Schedule W, you will need information from W-2 forms and 1099 forms, including the names, addresses, and Social Security numbers of recipients, as well as the amounts paid and taxes withheld.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1041 Schedule W by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.