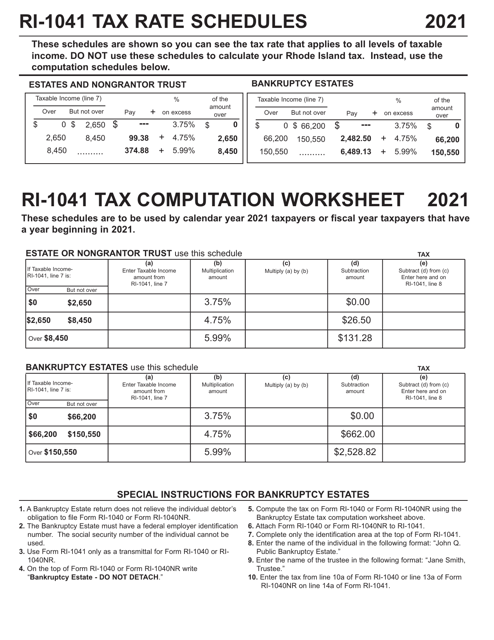

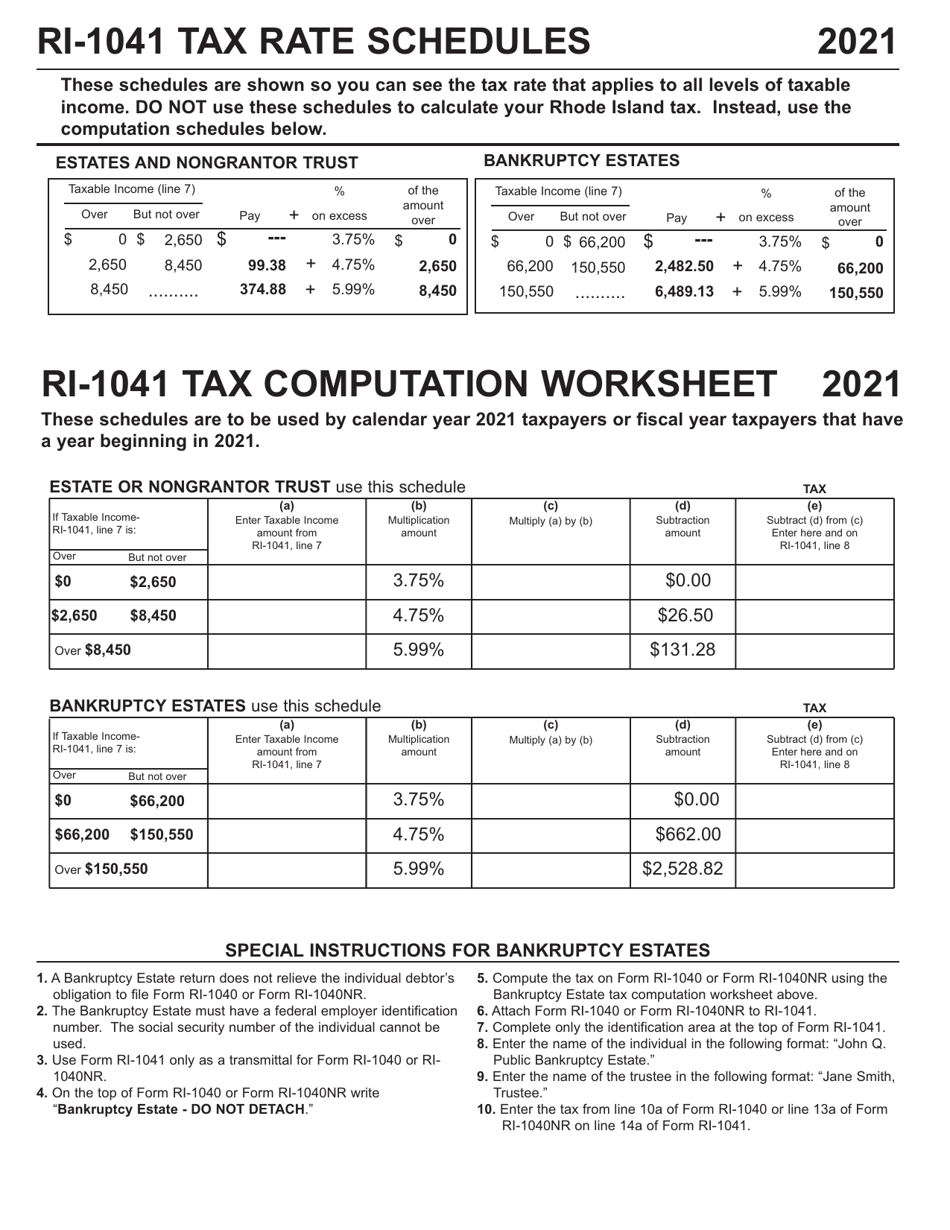

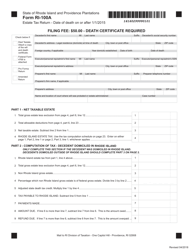

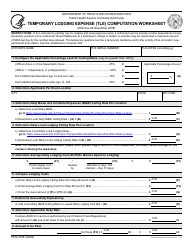

Ri-1041 Tax Computation Worksheet - Rhode Island

Ri-1041 Tax Computation Worksheet is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is the RI-1041 Tax Computation Worksheet?

A: The RI-1041 Tax Computation Worksheet is a form used to calculate the tax liability for Rhode Island taxpayers who file Form RI-1041, the Rhode Island Fiduciary Income Tax Return.

Q: Who needs to use the RI-1041 Tax Computation Worksheet?

A: Anyone who is filing Form RI-1041, the Rhode Island Fiduciary Income Tax Return, needs to use the RI-1041 Tax Computation Worksheet to calculate their tax liability.

Q: What information do I need to complete the RI-1041 Tax Computation Worksheet?

A: To complete the RI-1041 Tax Computation Worksheet, you will need information about your income, deductions, and credits for the tax year.

Form Details:

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.