This version of the form is not currently in use and is provided for reference only. Download this version of

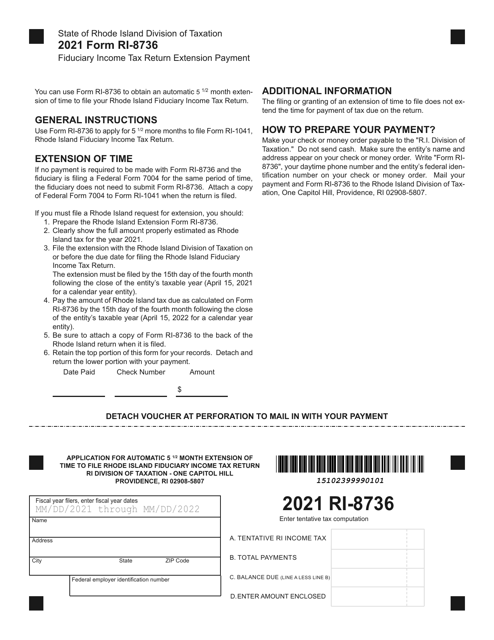

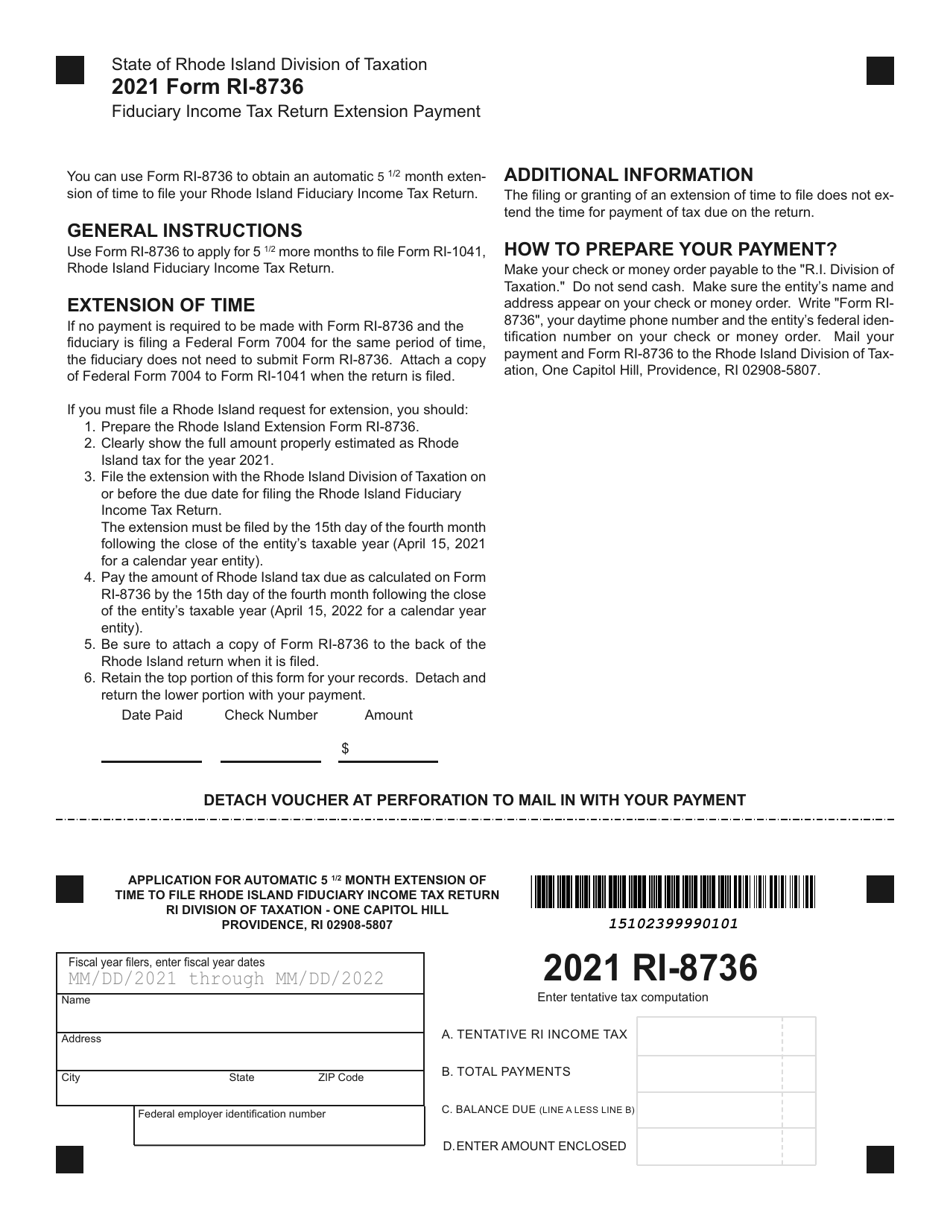

Form RI-8736

for the current year.

Form RI-8736 Fiduciary Income Tax Return Extension Payment - Rhode Island

What Is Form RI-8736?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-8736?

A: Form RI-8736 is the Fiduciary IncomeTax Return Extension Payment form for Rhode Island.

Q: What is a Fiduciary Income Tax Return?

A: A Fiduciary Income Tax Return is a tax form used to report the income, deductions, and tax liabilities of an estate or trust.

Q: Who needs to file Form RI-8736?

A: Form RI-8736 must be filed by fiduciaries who are requesting an extension to file their Rhode Island Fiduciary Income Tax Return.

Q: What is the purpose of Form RI-8736?

A: The purpose of Form RI-8736 is to make an extension payment for the Fiduciary Income Tax Return in Rhode Island.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-8736 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.