This version of the form is not currently in use and is provided for reference only. Download this version of

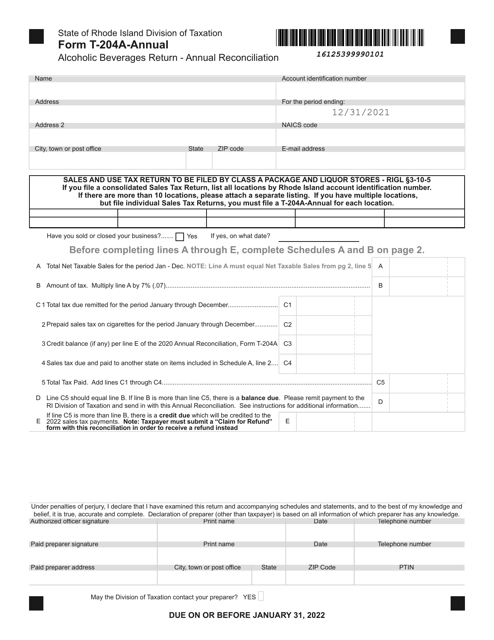

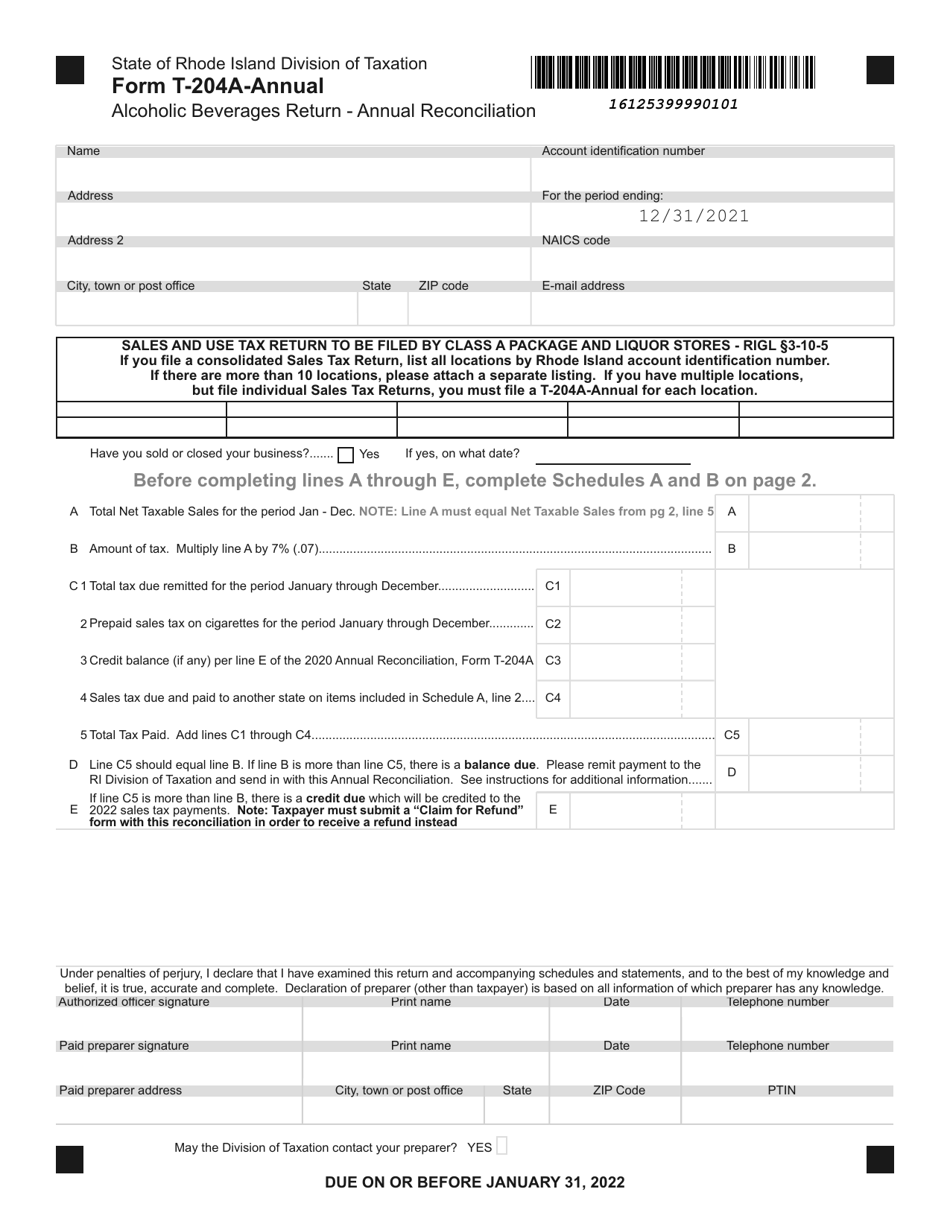

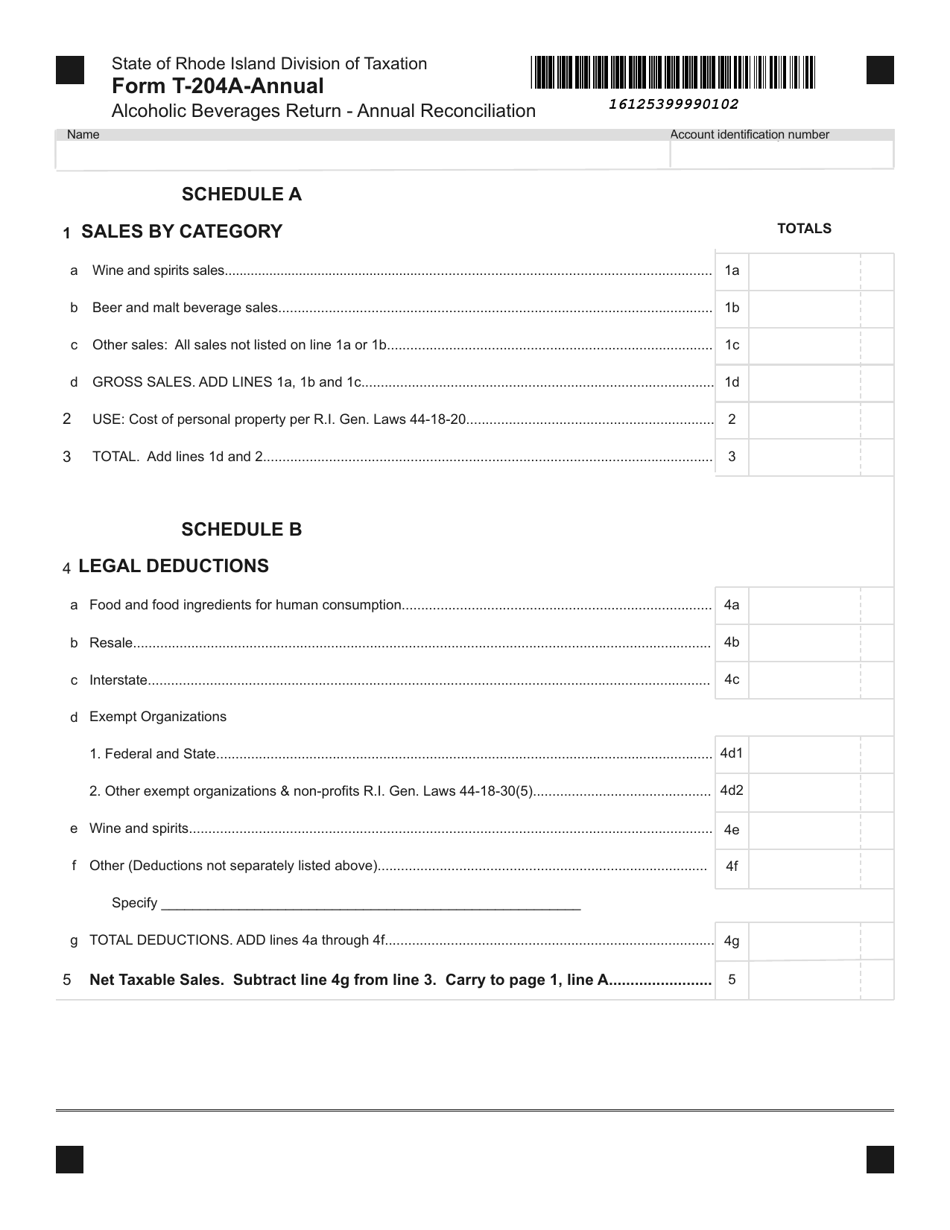

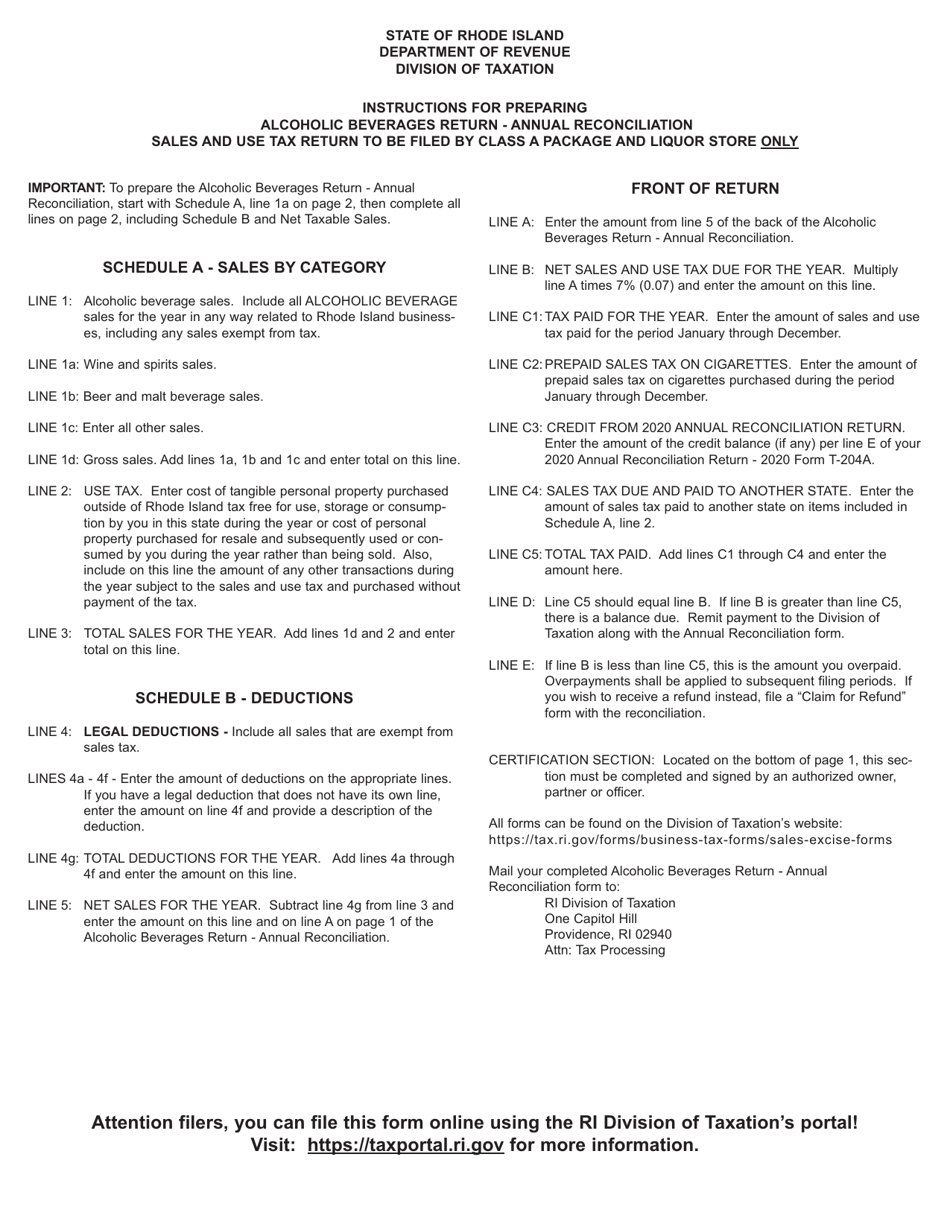

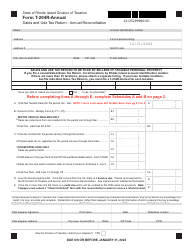

Form T-204A-ANNUAL

for the current year.

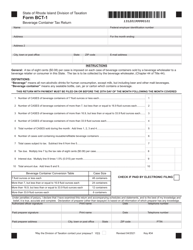

Form T-204A-ANNUAL Alcoholic Beverages Return - Annual Reconciliation - Rhode Island

What Is Form T-204A-ANNUAL?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-204A-ANNUAL?

A: Form T-204A-ANNUAL is an Alcoholic Beverages Return - Annual Reconciliation form used in Rhode Island.

Q: What is the purpose of Form T-204A-ANNUAL?

A: The purpose of Form T-204A-ANNUAL is to report and reconcile annual alcoholic beverage sales in Rhode Island.

Q: Who needs to file Form T-204A-ANNUAL?

A: Businesses selling alcoholic beverages in Rhode Island need to file Form T-204A-ANNUAL.

Q: When is Form T-204A-ANNUAL due?

A: Form T-204A-ANNUAL is due annually on January 31st.

Q: Are there any penalties for late filing of Form T-204A-ANNUAL?

A: Yes, late filing of Form T-204A-ANNUAL may result in penalties and interest.

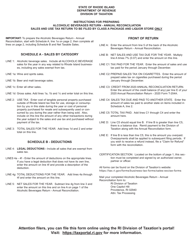

Q: What information do I need to complete Form T-204A-ANNUAL?

A: You will need to provide information about your business, including sales figures and tax amounts.

Q: Can I make corrections to Form T-204A-ANNUAL after filing?

A: Yes, you can make corrections to Form T-204A-ANNUAL by filing an amended return.

Q: Is there a fee for filing Form T-204A-ANNUAL?

A: No, there is no fee for filing Form T-204A-ANNUAL.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-204A-ANNUAL by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.