This version of the form is not currently in use and is provided for reference only. Download this version of

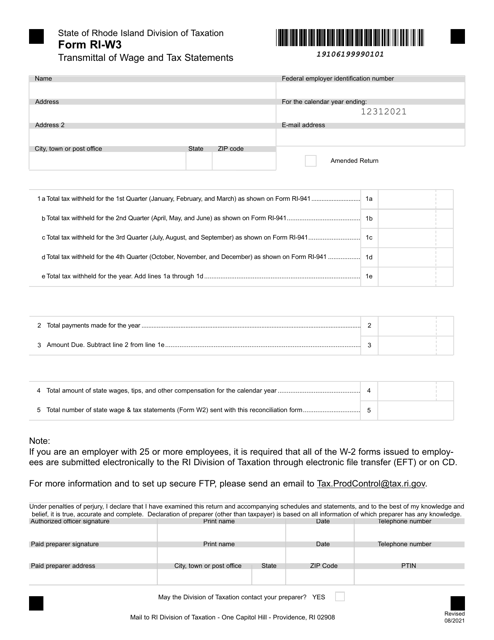

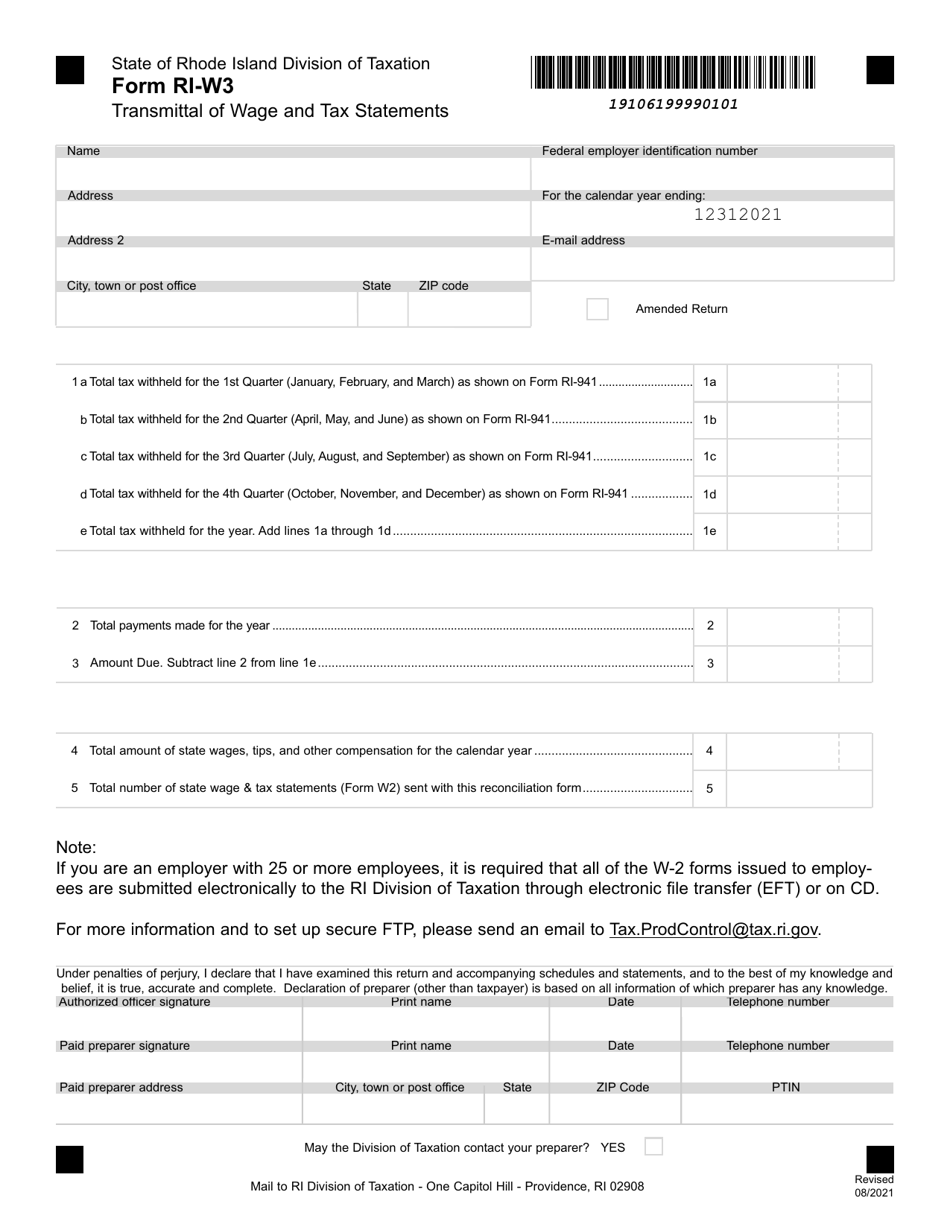

Form RI-W3

for the current year.

Form RI-W3 Transmittal of Wage and Tax Statements - Rhode Island

What Is Form RI-W3?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the RI-W3 form?

A: The RI-W3 form is the Transmittal of Wage and Tax Statements form used in Rhode Island.

Q: Who needs to file the RI-W3 form?

A: Employers in Rhode Island who have filed W-2 forms for their employees need to file the RI-W3 form.

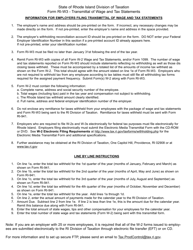

Q: When is the deadline to file the RI-W3 form?

A: The RI-W3 form must be filed by January 31st of each year.

Q: Do I need to include copies of W-2 forms with the RI-W3 form?

A: No, you do not need to include copies of W-2 forms with the RI-W3 form. However, you should keep copies of the W-2 forms for your own records.

Q: Is there a penalty for filing the RI-W3 form late?

A: Yes, there may be penalties for filing the RI-W3 form late. It is important to file by the deadline to avoid any penalties.

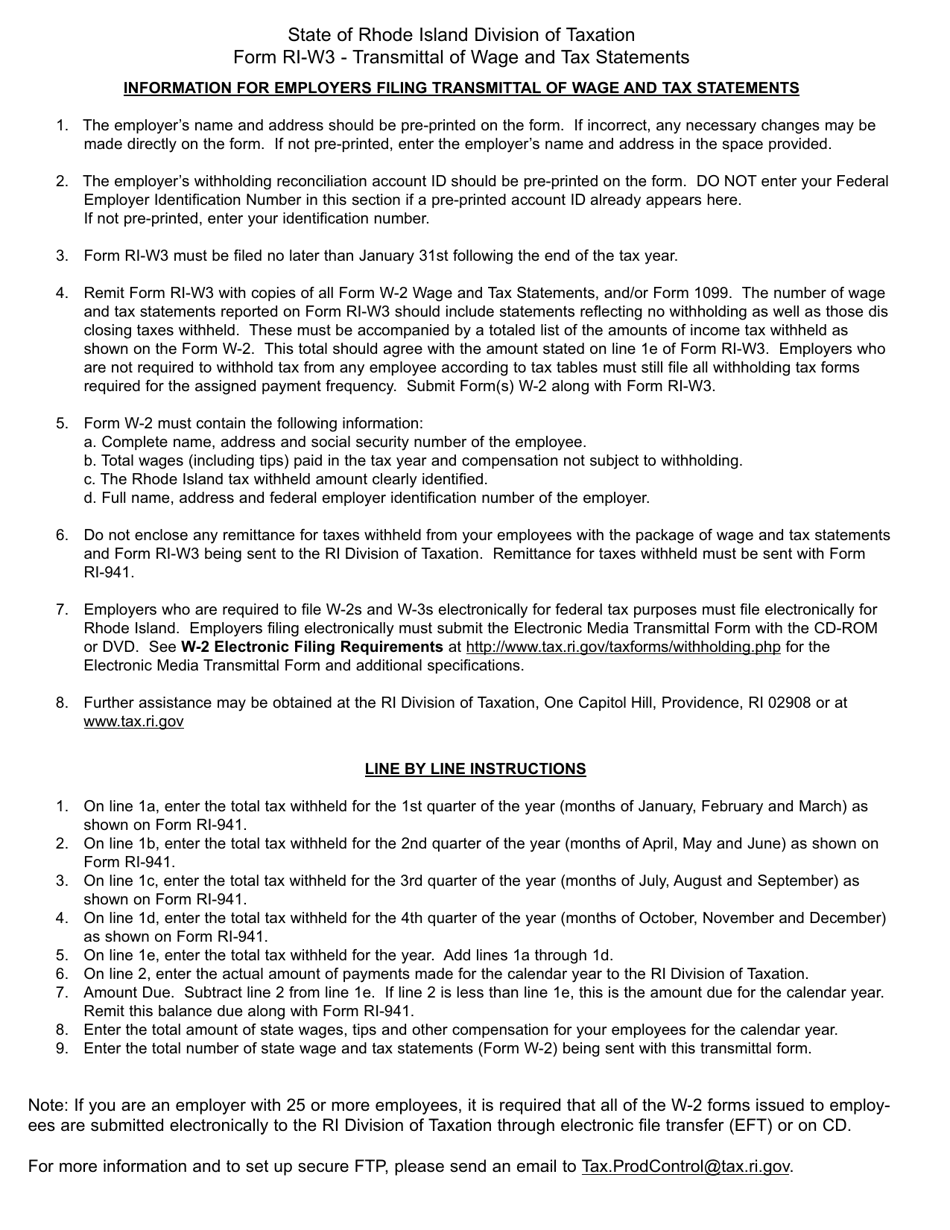

Q: Are there any special instructions for filling out the RI-W3 form?

A: Yes, there are specific instructions provided with the form. Make sure to read and follow these instructions carefully when filling out the RI-W3 form.

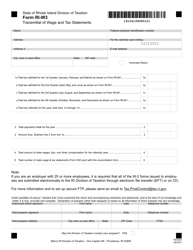

Q: Can I file the RI-W3 form electronically?

A: Yes, the Rhode Island Division of Taxation encourages employers to file the RI-W3 form electronically.

Q: Is the RI-W3 form only for employees in Rhode Island?

A: Yes, the RI-W3 form is specifically for employees who worked in Rhode Island.

Q: What information do I need to include on the RI-W3 form?

A: You need to include the total number of W-2 forms filed, total wages paid, total withheld tax, and other applicable information on the RI-W3 form.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-W3 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.