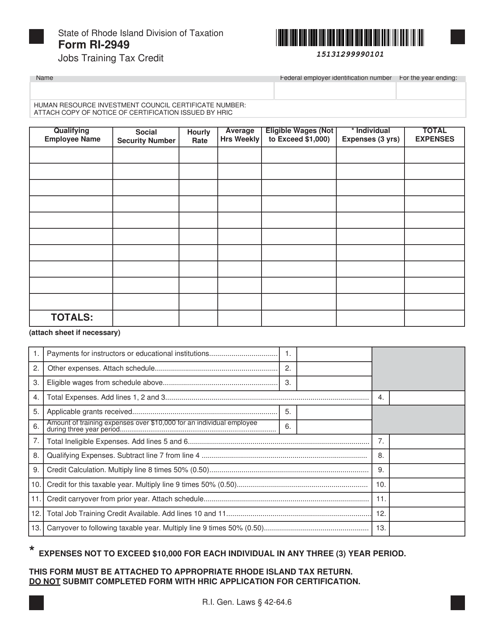

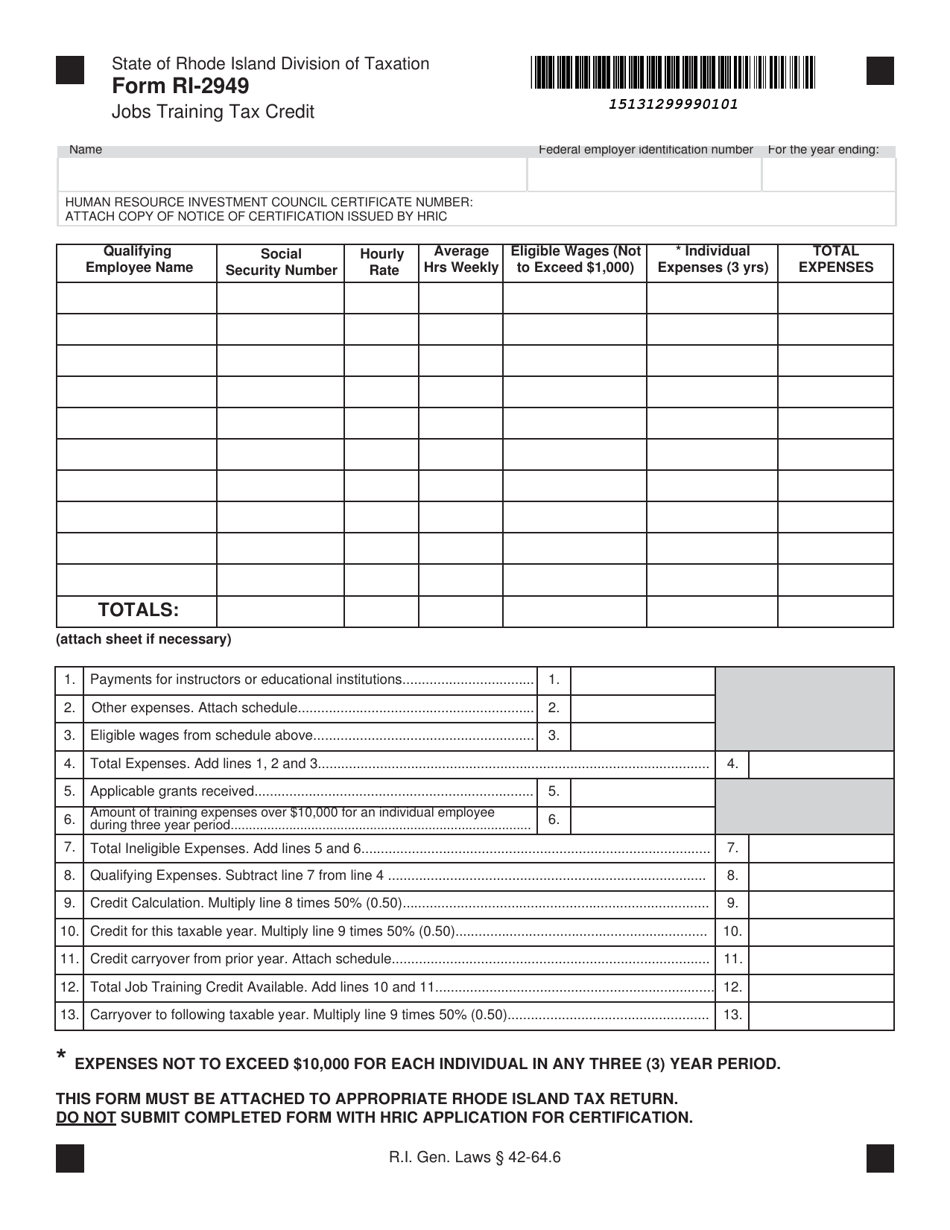

Form RI-2949 Jobs Training Tax Credit - Rhode Island

What Is Form RI-2949?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-2949?

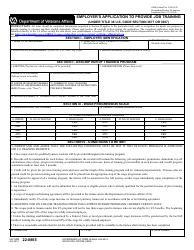

A: Form RI-2949 is a document used to claim the Jobs Training Tax Credit in Rhode Island.

Q: What is the Jobs Training Tax Credit?

A: The Jobs Training Tax Credit is a tax credit offered by the state of Rhode Island to businesses that provide job training to their employees.

Q: How can I claim the Jobs Training Tax Credit?

A: To claim the Jobs Training Tax Credit, you need to complete and submit Form RI-2949 to the Rhode Island Division of Taxation.

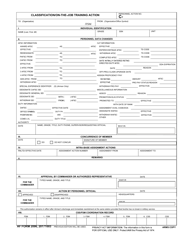

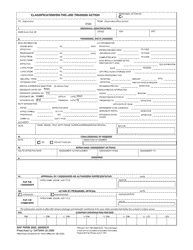

Q: What information do I need to complete Form RI-2949?

A: You will need to provide information about your business, the employees receiving training, and the training program itself.

Q: Are there any deadlines for filing Form RI-2949?

A: Yes, Form RI-2949 must be filed within 90 days after the completion of the job training program.

Q: What is the benefit of claiming the Jobs Training Tax Credit?

A: The Jobs Training Tax Credit allows businesses to offset their state tax liability by an amount equal to 50% of the training costs.

Q: Can the Jobs Training Tax Credit be carried forward or transferred?

A: No, the Jobs Training Tax Credit cannot be carried forward to future years or transferred to another taxpayer.

Q: Are there any limitations or restrictions for claiming the Jobs Training Tax Credit?

A: Yes, there are certain limitations and restrictions, such as a maximum credit amount per employee and a cap on the total credits claimed by all taxpayers.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-2949 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.