This version of the form is not currently in use and is provided for reference only. Download this version of

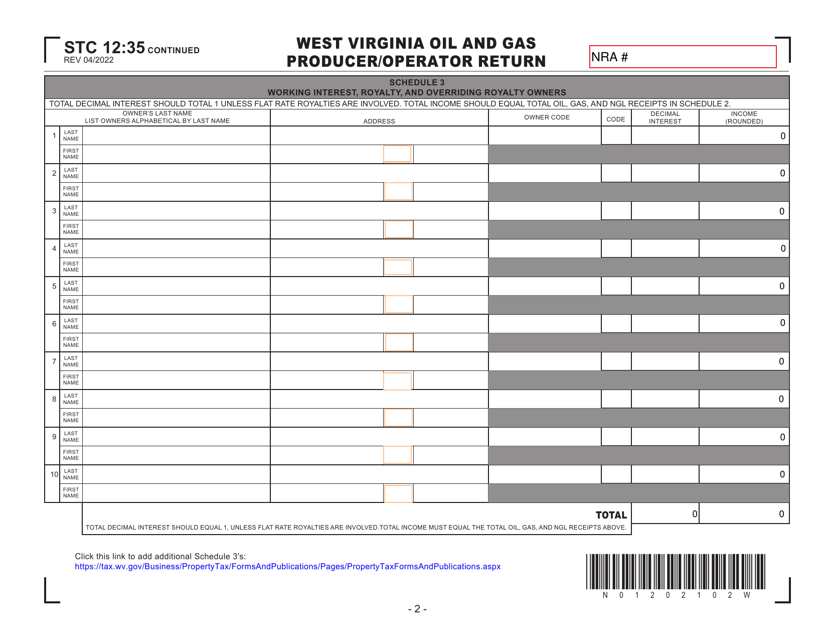

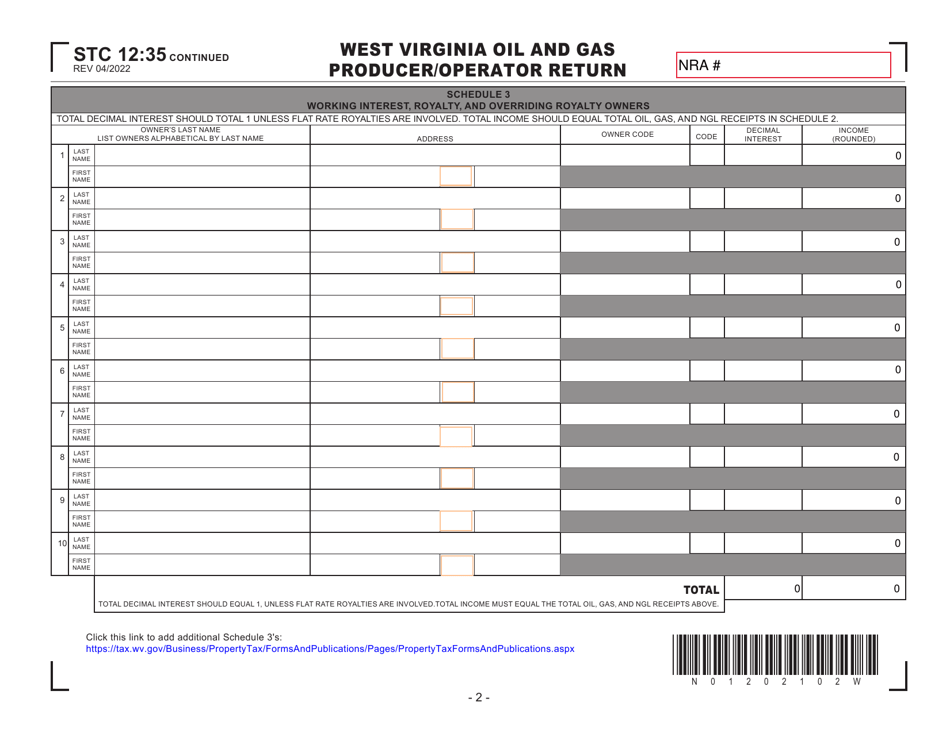

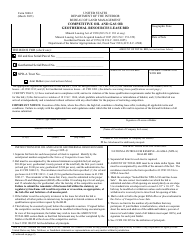

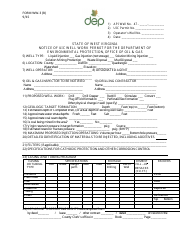

Form STC12:35 Schedule 3

for the current year.

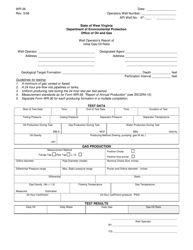

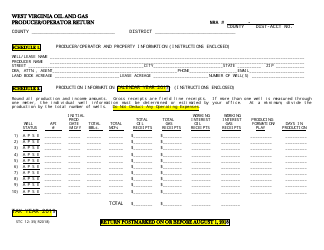

Form STC12:35 Schedule 3 West Virginia Oil and Gas Producer / Operator Return - West Virginia

What Is Form STC12:35 Schedule 3?

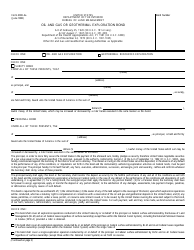

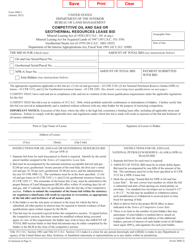

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.The document is a supplement to Form STC12:35, West Virginia Oil and Gas Producer/Operator Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form STC12:35?

A: Form STC12:35 is the Schedule 3 of the West Virginia Oil and Gas Producer/Operator Return.

Q: What is Schedule 3?

A: Schedule 3 is a part of the West Virginia Oil and Gas Producer/Operator Return.

Q: What is the purpose of Form STC12:35?

A: The purpose of Form STC12:35 is to report oil and gas production and operate data in West Virginia.

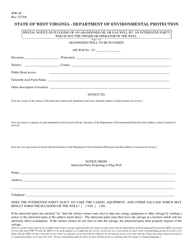

Q: Who needs to file Form STC12:35?

A: Oil and gas producers and operators in West Virginia need to file Form STC12:35.

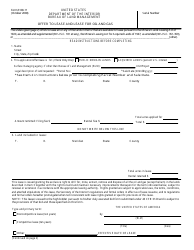

Q: What information should be provided in Form STC12:35?

A: Form STC12:35 requires the reporting of oil and gas production and operating data, including well information and production volumes.

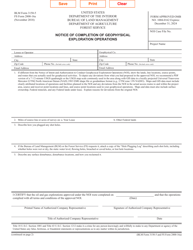

Q: Are there any deadlines for filing Form STC12:35?

A: Yes, Form STC12:35 must be filed annually by the last day of the fourth month following the close of the calendar year.

Q: Are there any penalties for late filing of Form STC12:35?

A: Yes, there are penalties for late filing of Form STC12:35, including interest charges on any unpaid tax amounts.

Q: Is Form STC12:35 only for oil and gas producers?

A: Yes, Form STC12:35 is specifically for oil and gas producers and operators in West Virginia.

Q: Is Form STC12:35 applicable outside of West Virginia?

A: No, Form STC12:35 is specific to West Virginia and its oil and gas industry.

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STC12:35 Schedule 3 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.