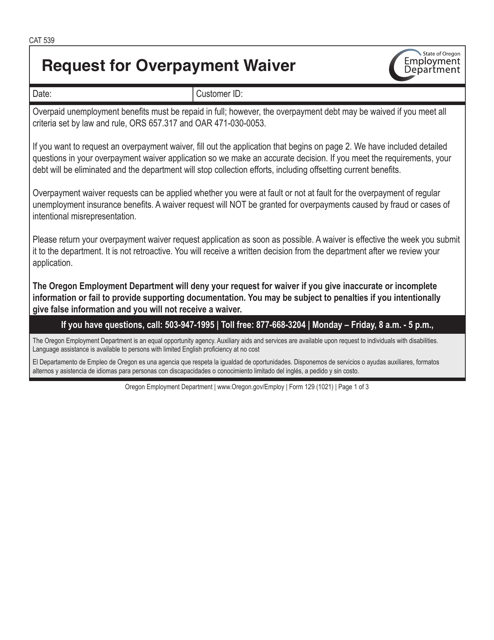

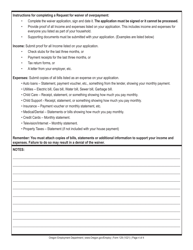

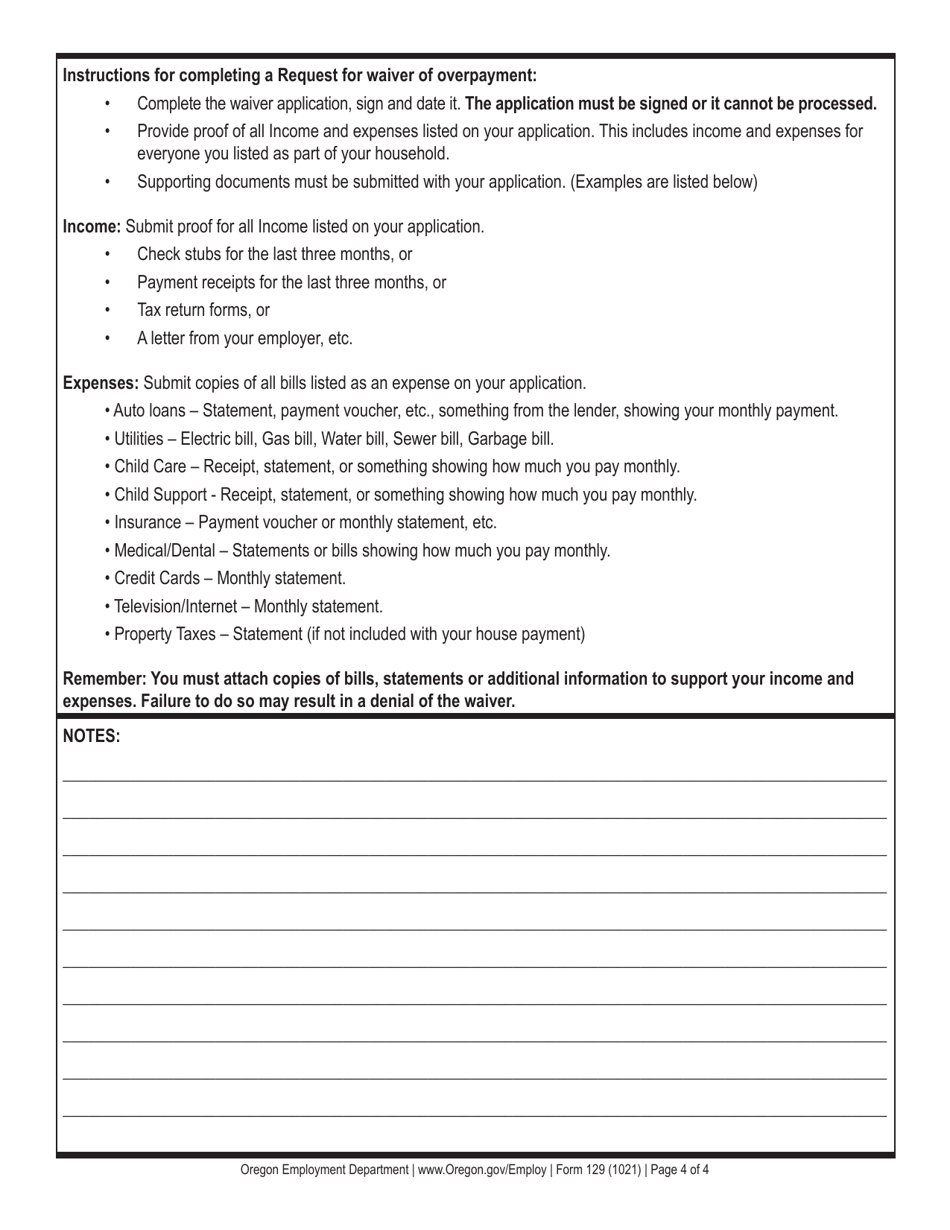

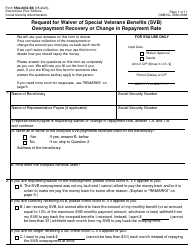

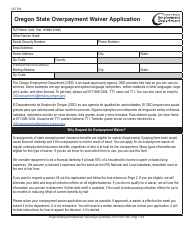

Form 129 Request for Overpayment Waiver - Oregon

What Is Form 129?

This is a legal form that was released by the Oregon Employment Department - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 129?

A: Form 129 is a request for overpayment waiver in Oregon.

Q: What is an overpayment waiver?

A: An overpayment waiver is a request to have a previous overpayment waived or forgiven.

Q: Who can use Form 129?

A: Anyone who has had an overpayment in Oregon can use Form 129.

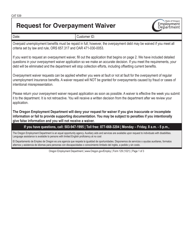

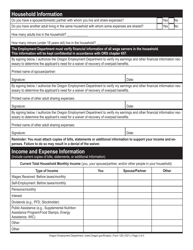

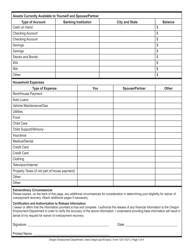

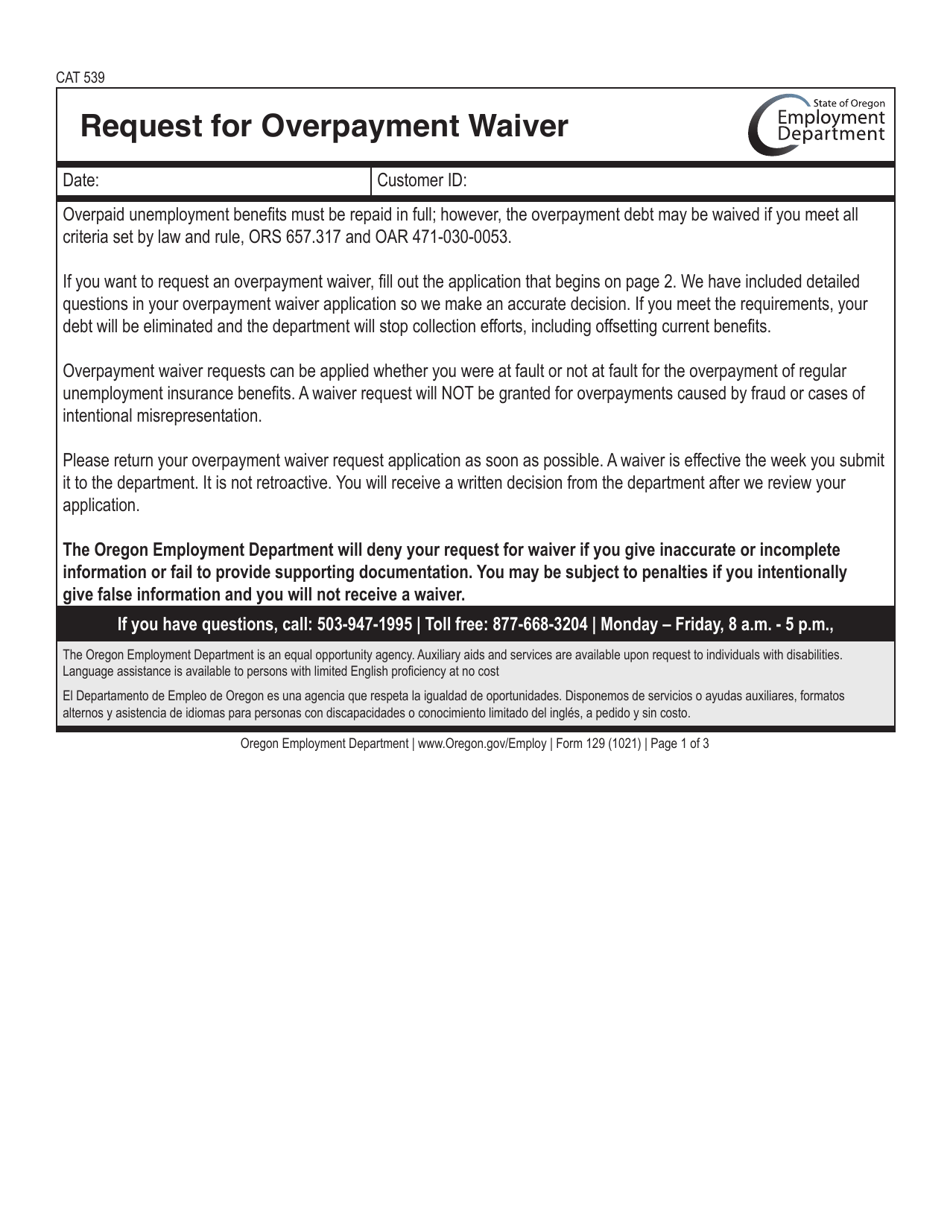

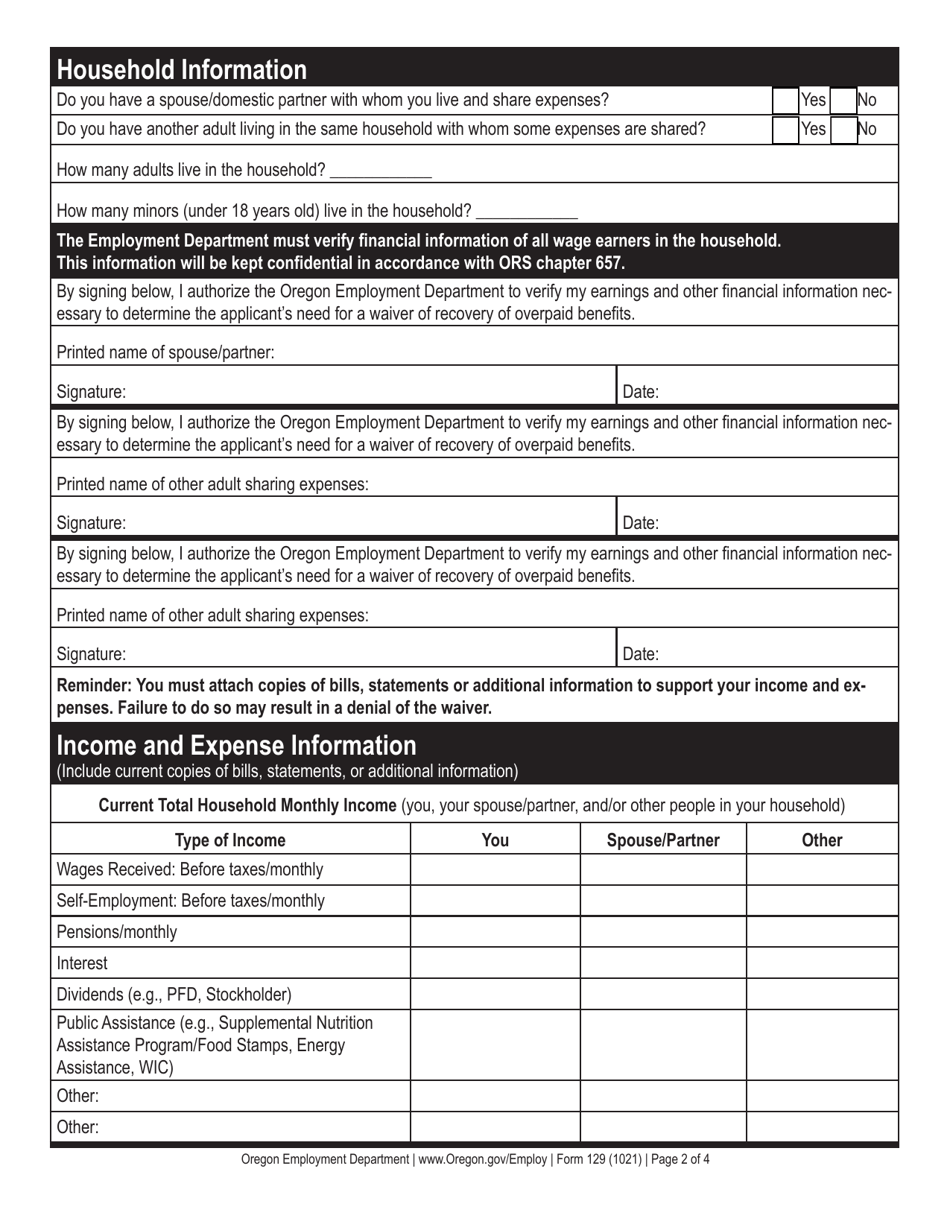

Q: What information do I need to provide on Form 129?

A: You will need to provide your personal information, details about the overpayment, and the reason why you are requesting a waiver.

Q: What happens after I submit Form 129?

A: After you submit Form 129, the Oregon Department of Revenue will review your request and make a decision on whether to grant the waiver.

Q: Can I appeal if my waiver request is denied?

A: Yes, you can appeal the decision if your waiver request is denied. You will need to follow the appeal process outlined by the Oregon Department of Revenue.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Oregon Employment Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 129 by clicking the link below or browse more documents and templates provided by the Oregon Employment Department.