This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR1786

for the current year.

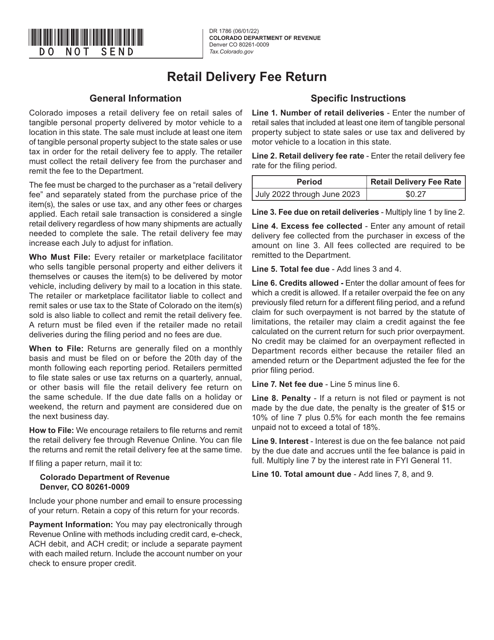

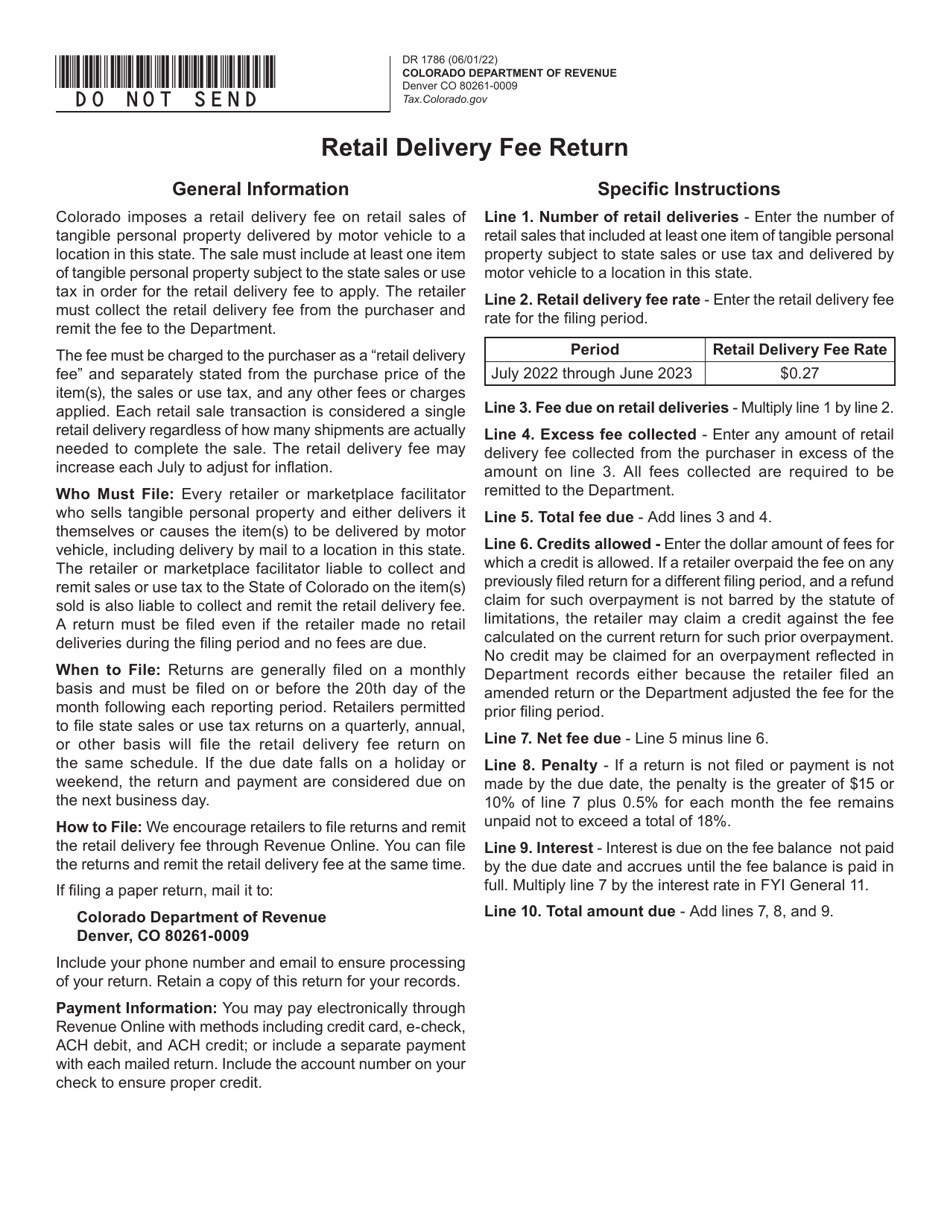

Form DR1786 Retail Delivery Fee Return - Colorado

What Is Form DR1786?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR1786?

A: Form DR1786 is the Retail Delivery Fee Return for the state of Colorado.

Q: Who needs to file Form DR1786?

A: Any business that charges a retail delivery fee in Colorado needs to file Form DR1786.

Q: What is a retail delivery fee?

A: A retail delivery fee is a charge imposed by a business for the delivery of goods to customers.

Q: How often is Form DR1786 filed?

A: Form DR1786 is filed on a quarterly basis. It needs to be filed by the 20th day of the month following the end of each quarter.

Q: Is there a penalty for late filing?

A: Yes, there is a penalty for late filing. The penalty amount depends on the length of the delay.

Q: Are there any exemptions from filing Form DR1786?

A: Yes, certain businesses are exempt from filing Form DR1786. It is recommended to consult the official instructions or seek professional advice to determine if you qualify for an exemption.

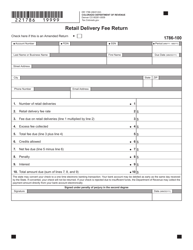

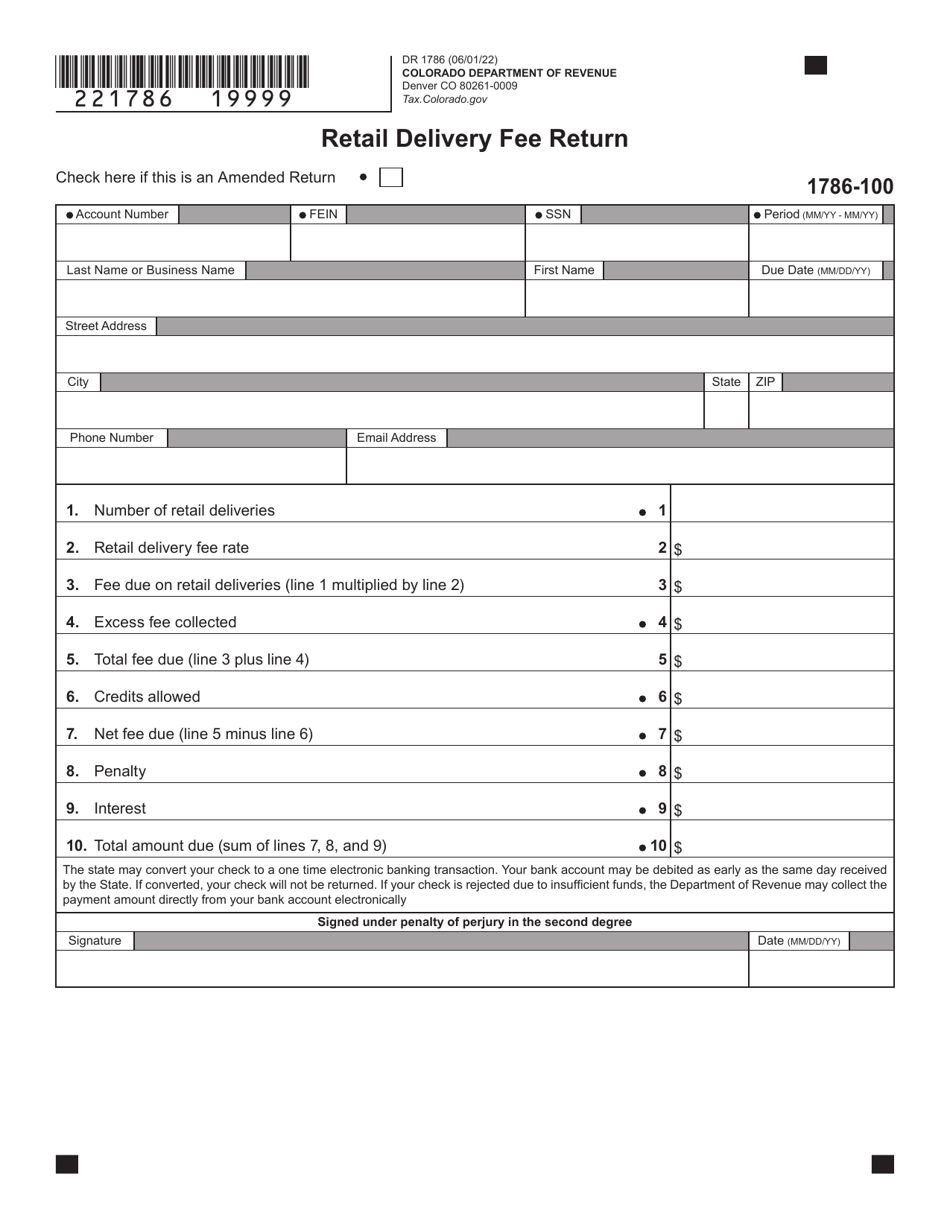

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR1786 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.