This version of the form is not currently in use and is provided for reference only. Download this version of

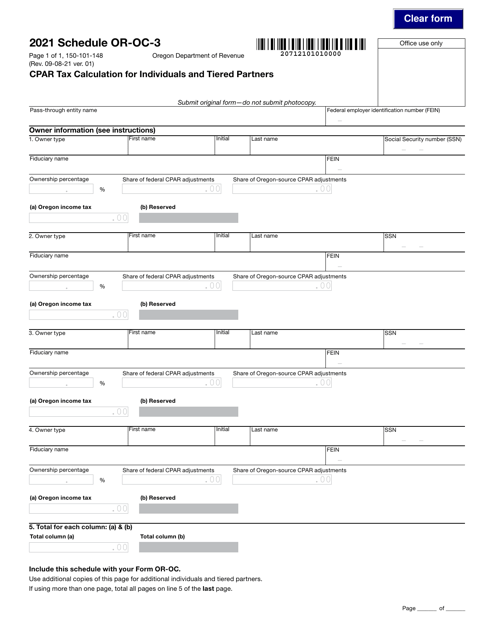

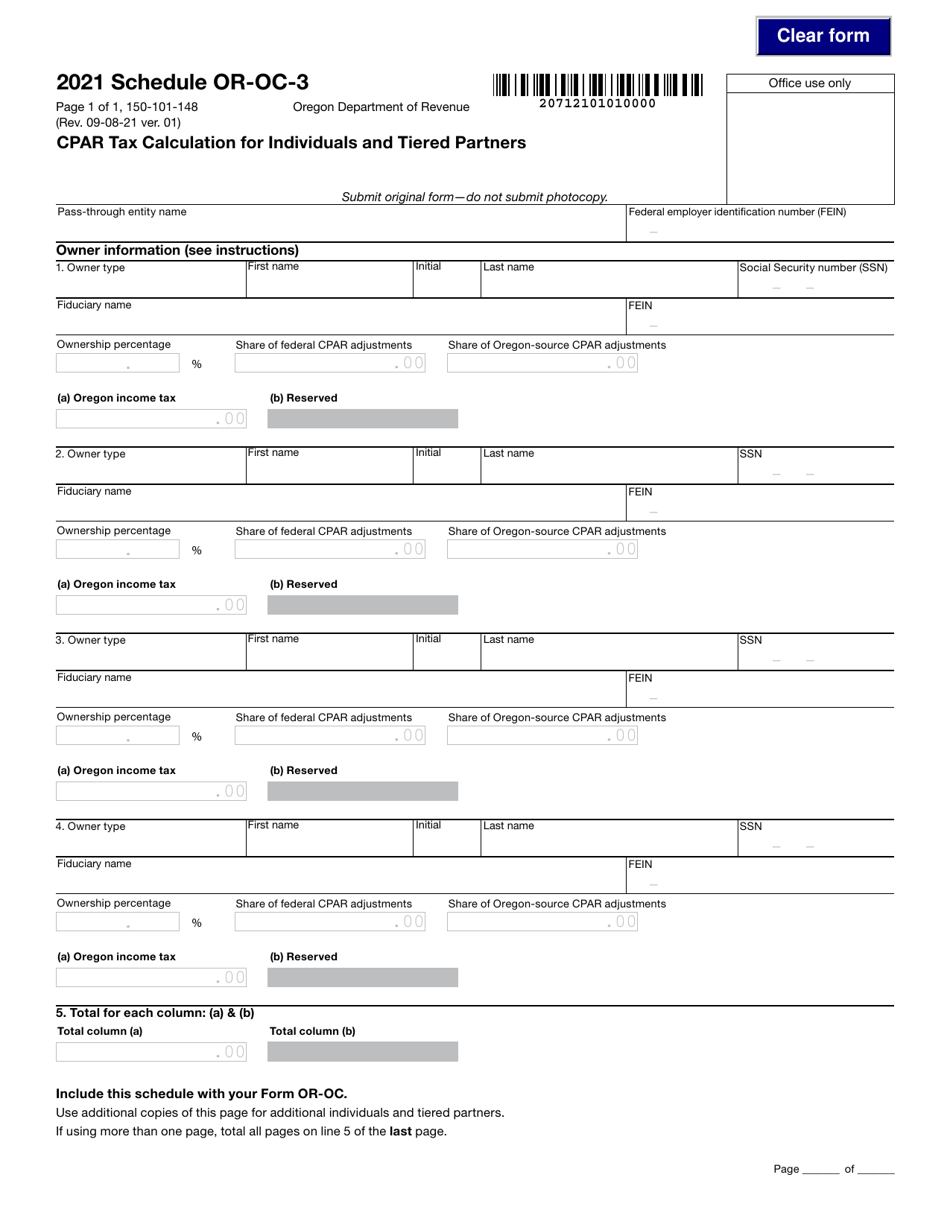

Form 150-101-148 Schedule OR-OC-3

for the current year.

Form 150-101-148 Schedule OR-OC-3 Cpar Tax Calculation for Individuals and Tiered Partners - Oregon

What Is Form 150-101-148 Schedule OR-OC-3?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-148?

A: Form 150-101-148 is a tax calculation form for individuals and tiered partners in Oregon.

Q: Who needs to file Form 150-101-148?

A: Individuals and tiered partners in Oregon who need to calculate their CPAR tax.

Q: What is CPAR tax?

A: CPAR tax stands for Corporate Public Affairs Replacement tax. It is a tax imposed on certain businesses and individuals in Oregon.

Q: What information is required to fill out Form 150-101-148?

A: You will need information about your income, deductions, and tax credits to fill out the form.

Q: Are there instructions for filling out Form 150-101-148?

A: Yes, the Oregon Department of Revenue provides instructions for filling out Form 150-101-148.

Q: When is the deadline to file Form 150-101-148?

A: The deadline to file Form 150-101-148 is the same as the deadline for filing your Oregon income tax return, which is typically April 15th.

Q: Do I need to include any supporting documents with Form 150-101-148?

A: You may need to include supporting documents such as W-2 forms or 1099 forms, depending on your individual circumstances.

Q: What happens after I submit Form 150-101-148?

A: After you submit Form 150-101-148, the Oregon Department of Revenue will process your information and determine your CPAR tax liability.

Form Details:

- Released on September 8, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-148 Schedule OR-OC-3 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.