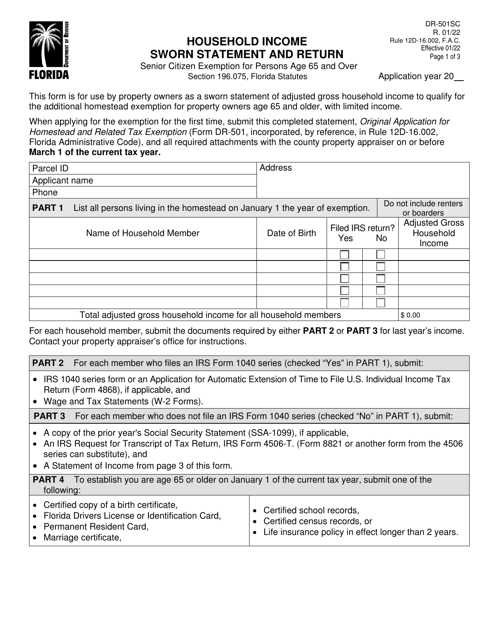

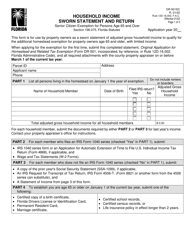

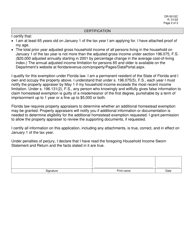

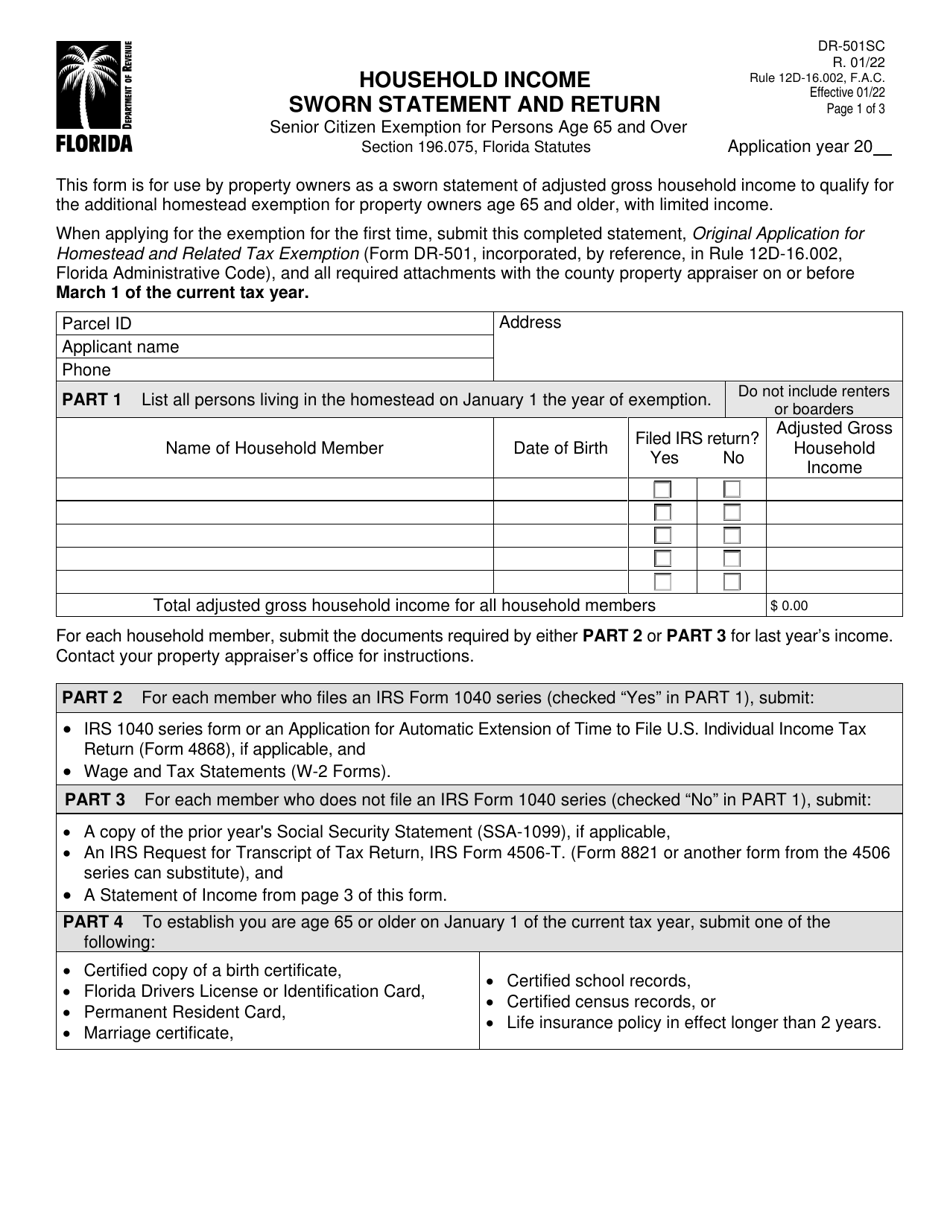

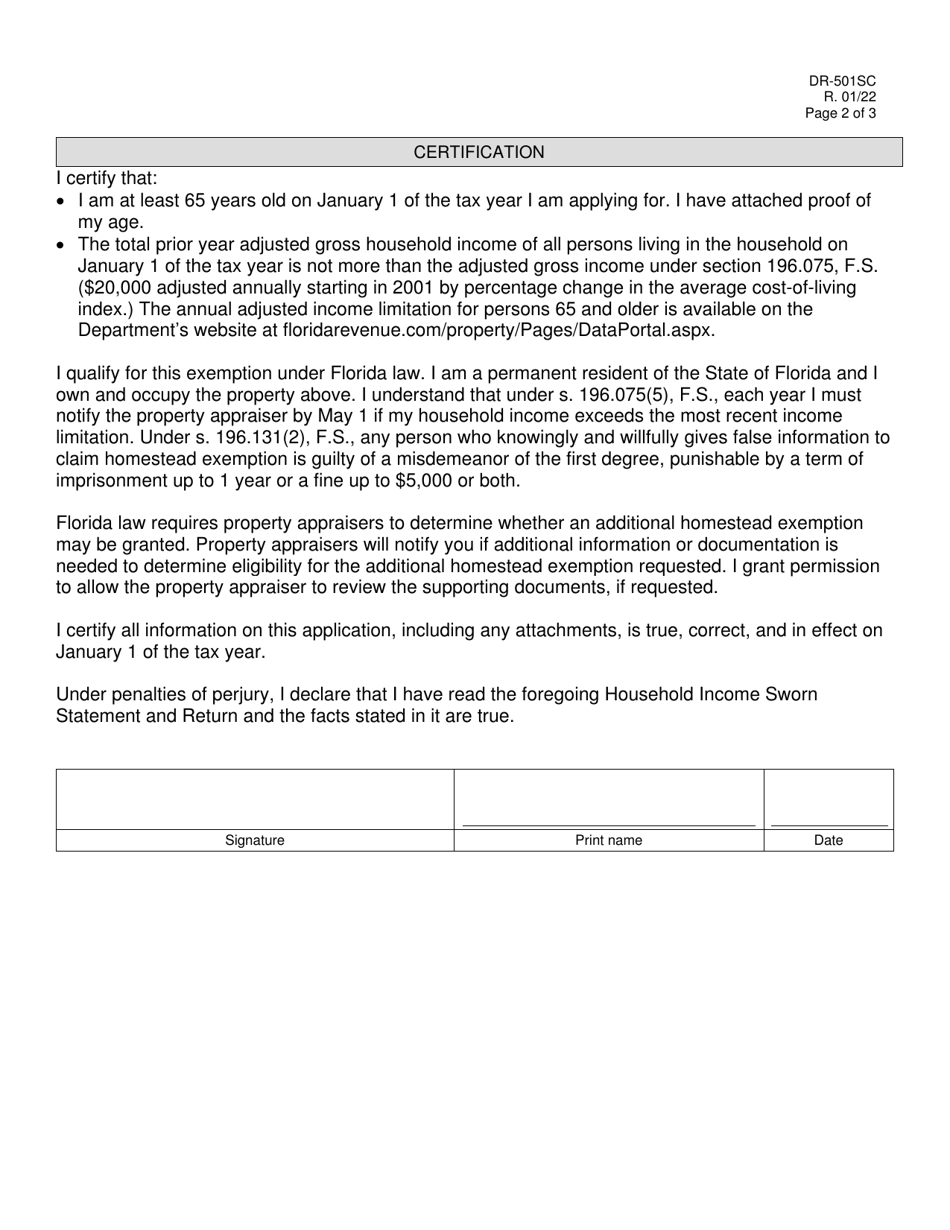

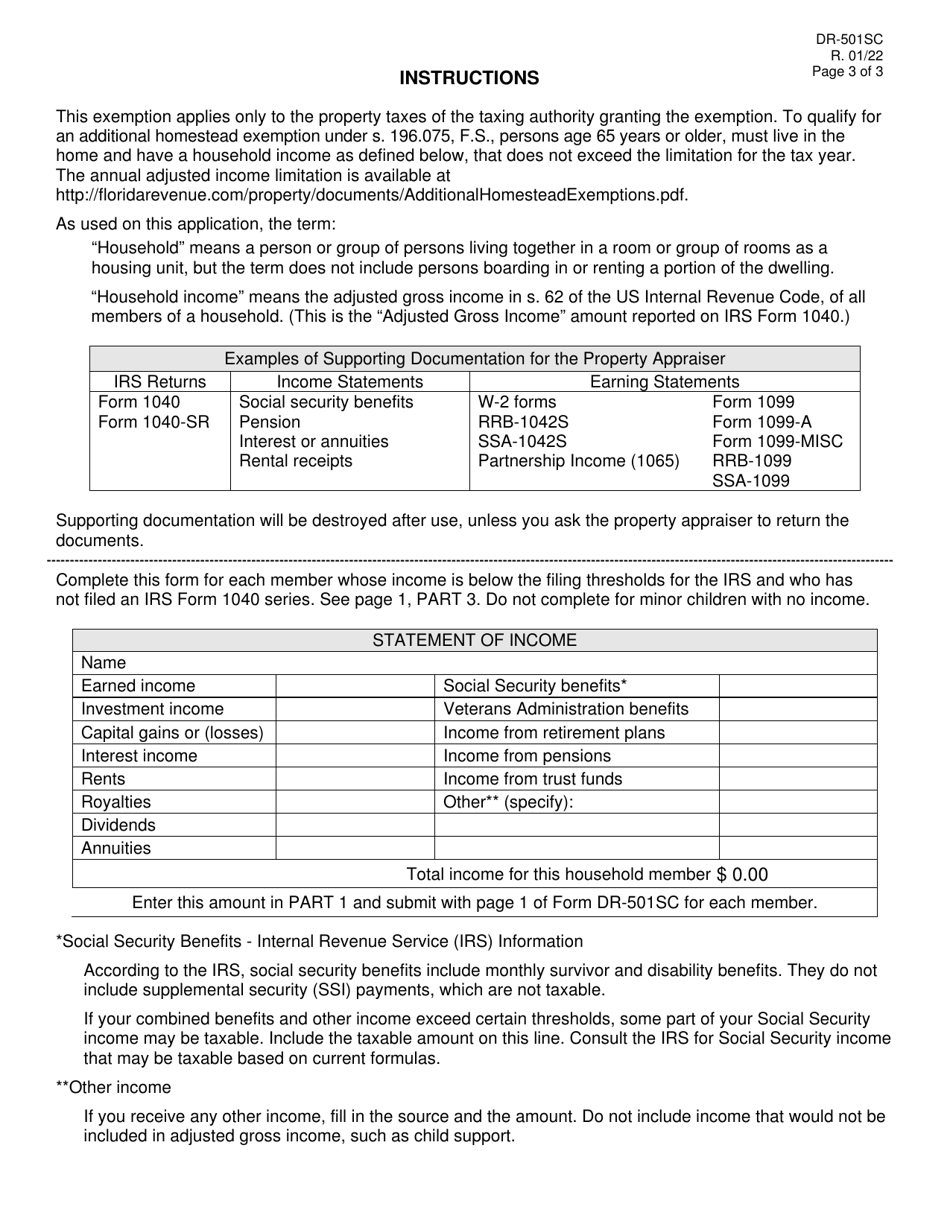

Form DR-501SC Household Income Sworn Statement and Return - Senior Citizen Exemption for Persons Age 65 and Over - Florida

What Is Form DR-501SC?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DR-501SC?

A: DR-501SC is the form for the Household Income Sworn Statement and Return - Senior Citizen Exemption for Persons Age 65 and Over in Florida.

Q: Who is eligible for the Senior Citizen Exemption in Florida?

A: Individuals who are 65 years old or older may be eligible for the Senior Citizen Exemption in Florida.

Q: What is the purpose of the DR-501SC form?

A: The purpose of the DR-501SC form is to determine if a senior citizen meets the income requirements for the exemption.

Q: What information is needed on the DR-501SC form?

A: The DR-501SC form requires the senior citizen to provide information about their household income.

Q: Are there any deadlines for submitting the DR-501SC form?

A: Yes, the DR-501SC form must be submitted by March 1st of each year to receive the exemption for that tax year.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-501SC by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.