This version of the form is not currently in use and is provided for reference only. Download this version of

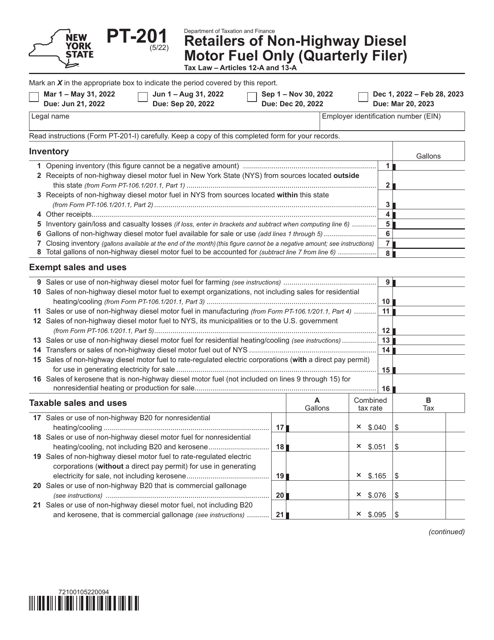

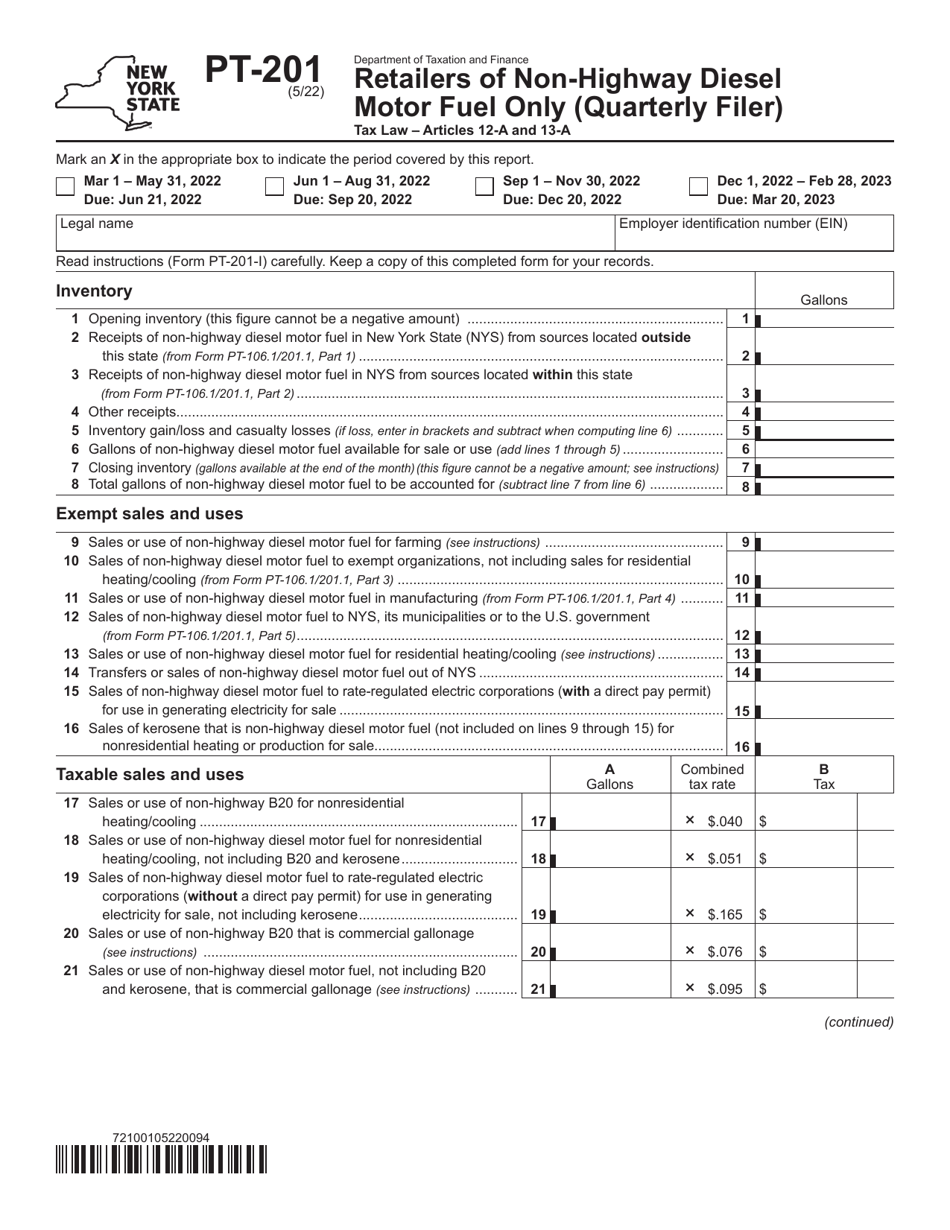

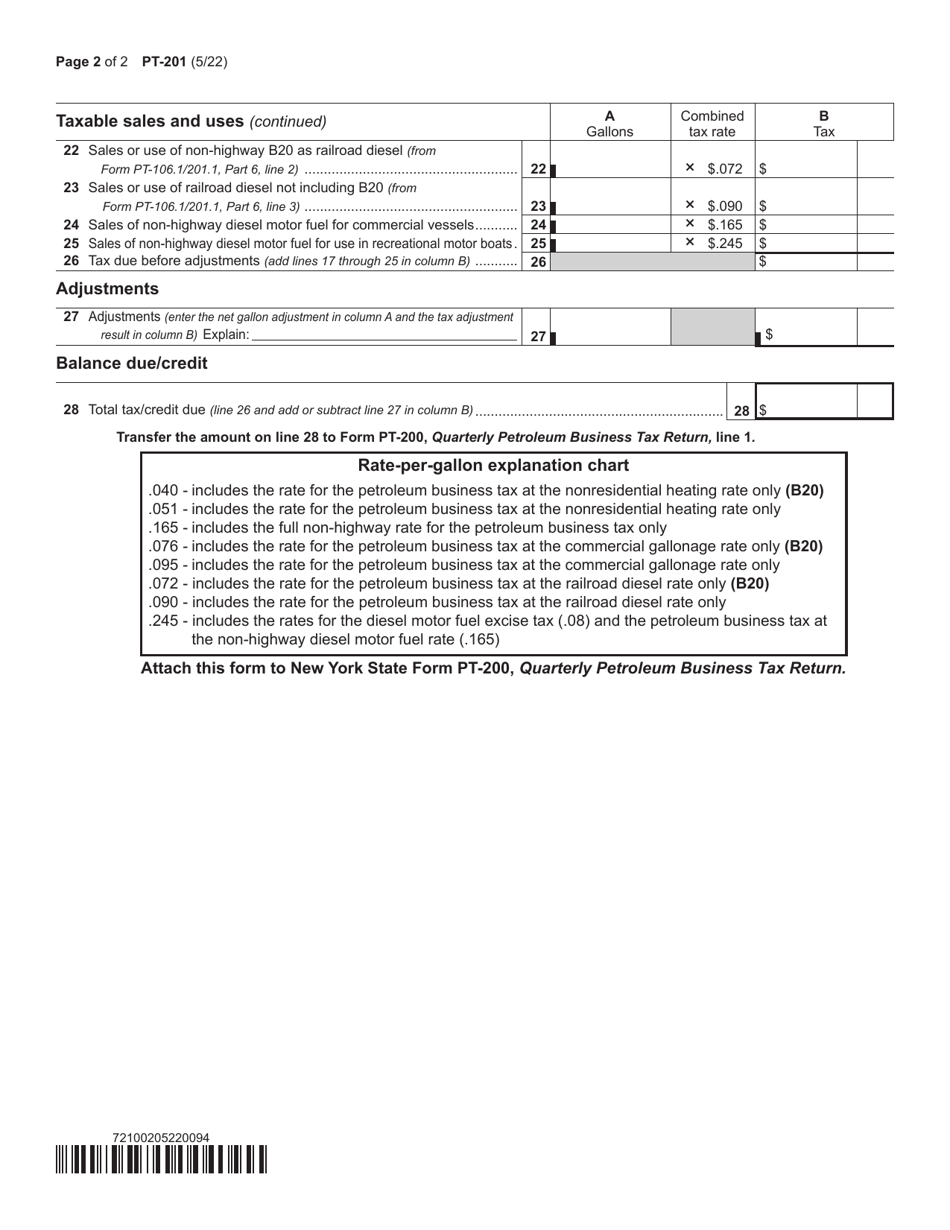

Form PT-201

for the current year.

Form PT-201 Retailers of Non-highway Diesel Motor Fuel Only (Quarterly Filer) - New York

What Is Form PT-201?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-201?

A: Form PT-201 is a tax form for retailers of non-highway diesel motor fuel only in New York.

Q: Who needs to file Form PT-201?

A: Retailers who sell non-highway diesel motor fuel only in New York need to file Form PT-201 quarterly.

Q: How often do I need to file Form PT-201?

A: Form PT-201 needs to be filed quarterly.

Q: What is non-highway diesel motor fuel?

A: Non-highway diesel motor fuel refers to diesel fuel that is not used in vehicles or equipment operated on public highways.

Q: What is the purpose of Form PT-201?

A: Form PT-201 is used to report and pay the tax on non-highway diesel motor fuel sales in New York.

Q: Is there a deadline for filing Form PT-201?

A: Yes, Form PT-201 must be filed by the last day of the month following the end of the quarter.

Q: What happens if I don't file Form PT-201?

A: Failure to file Form PT-201 may result in penalties and interest charges.

Q: Are there any exemptions or deductions available for Form PT-201?

A: Yes, there are certain exemptions and deductions available for retailers filing Form PT-201. These can be found in the instructions for the form.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-201 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.