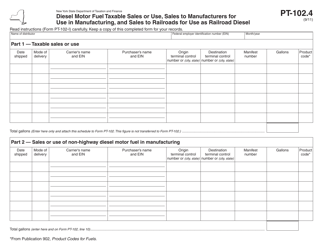

This version of the form is not currently in use and is provided for reference only. Download this version of

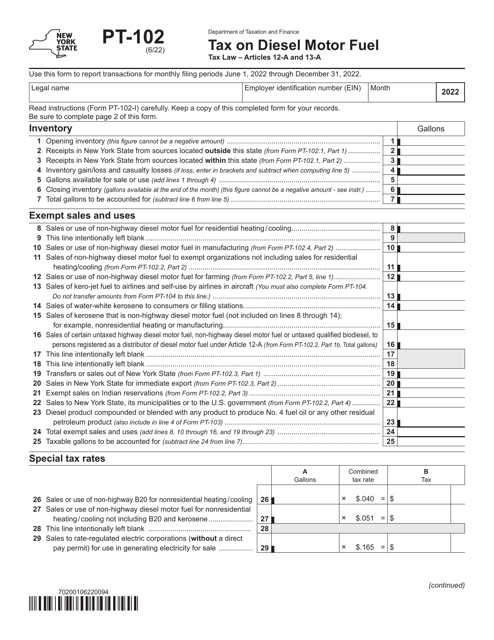

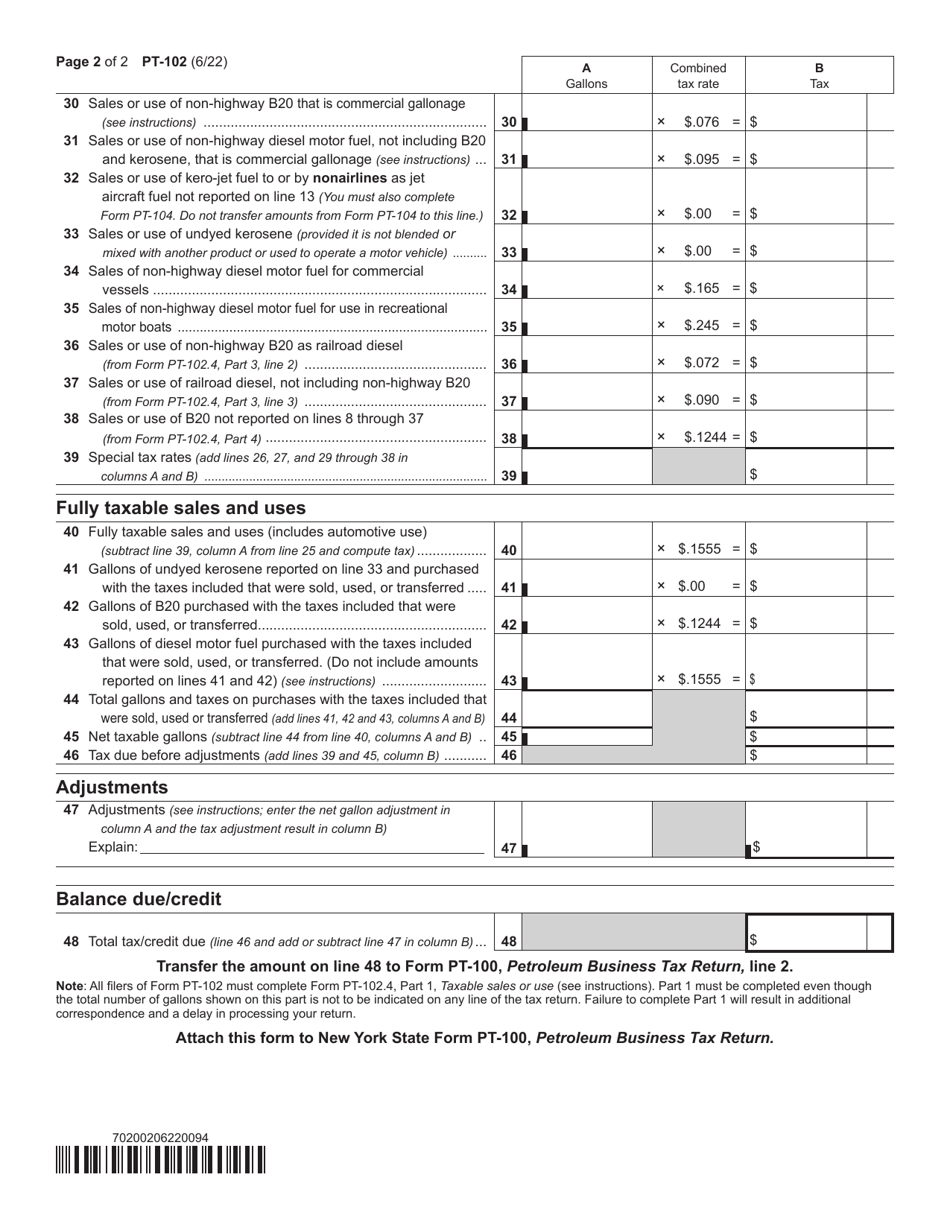

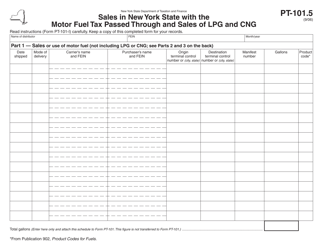

Form PT-102

for the current year.

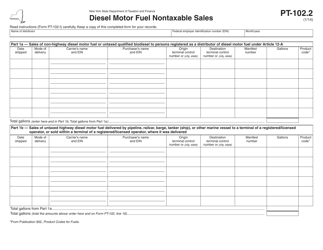

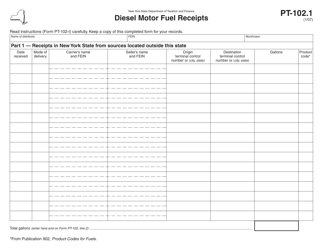

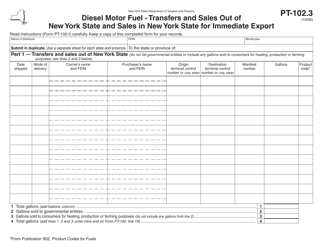

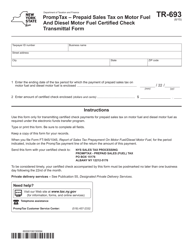

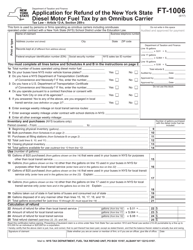

Form PT-102 Tax on Diesel Motor Fuel - New York

What Is Form PT-102?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form PT-102?

A: Form PT-102 is a tax form related to diesel motor fuel in New York.

Q: Who needs to file Form PT-102?

A: Anyone engaged in the distribution or use of diesel motor fuel in New York needs to file Form PT-102.

Q: What is the purpose of Form PT-102?

A: The purpose of Form PT-102 is to report and pay the tax on diesel motor fuel in New York.

Q: When is Form PT-102 due?

A: Form PT-102 is due on a quarterly basis. The due dates are April 30, July 31, October 31, and January 31.

Q: Are there any penalties for not filing Form PT-102?

A: Yes, there are penalties for not filing Form PT-102 or for filing it late. It is important to file the form and pay the tax on time to avoid penalties.

Q: What other requirements are there for diesel motor fuel in New York?

A: In addition to filing Form PT-102, there may be other requirements such as obtaining a license and maintaining records. It is important to familiarize yourself with all applicable regulations.

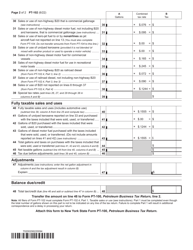

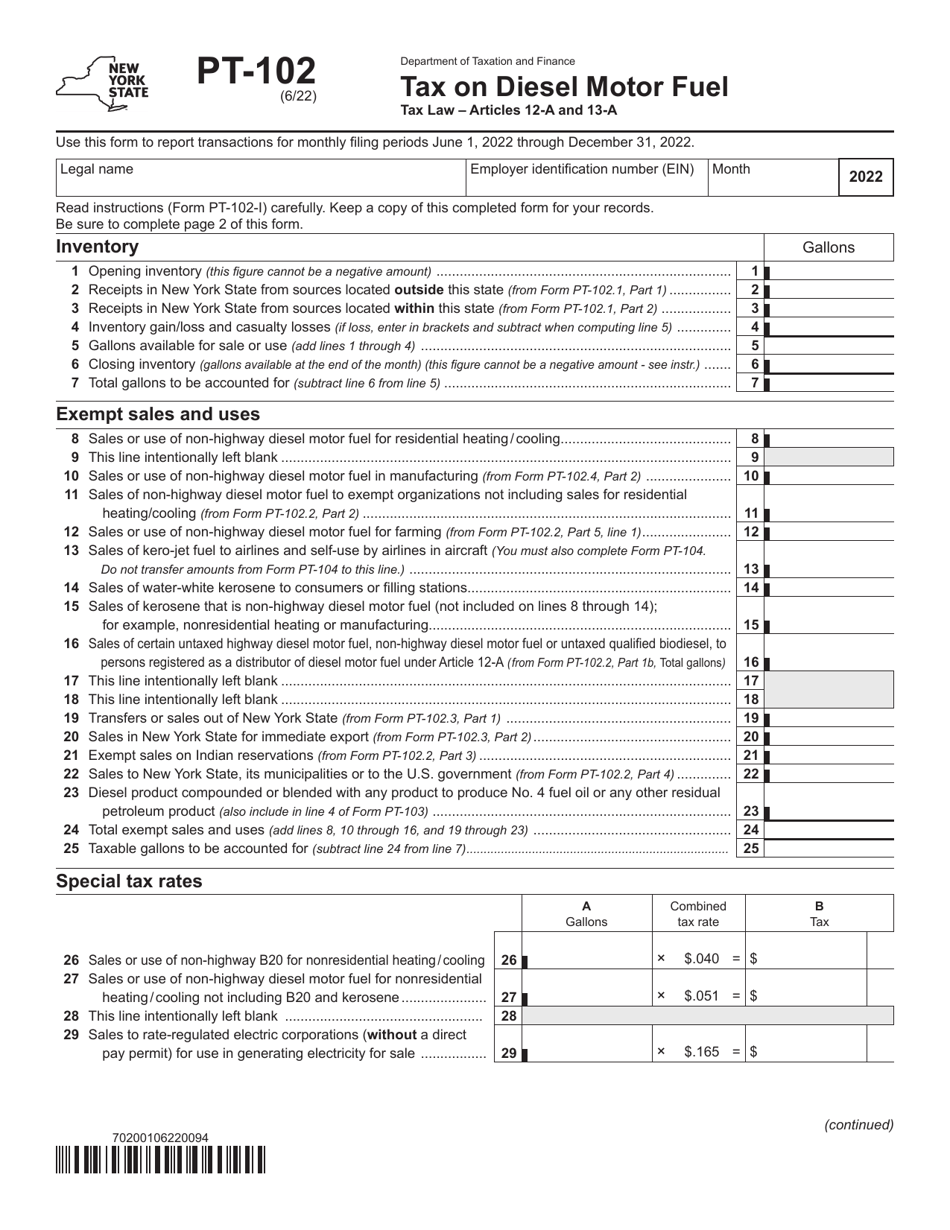

Q: How do I calculate the tax amount on diesel motor fuel?

A: The tax amount on diesel motor fuel is calculated based on the quantity of fuel distributed or used in New York. The tax rates can vary and it is important to refer to the instructions provided with Form PT-102 for the specific calculations.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-102 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.