This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 941-X

for the current year.

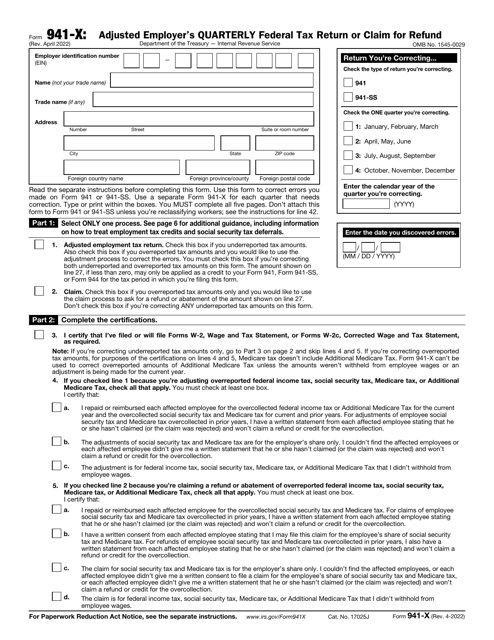

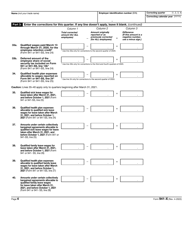

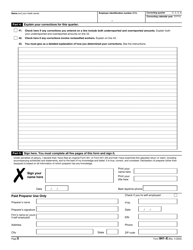

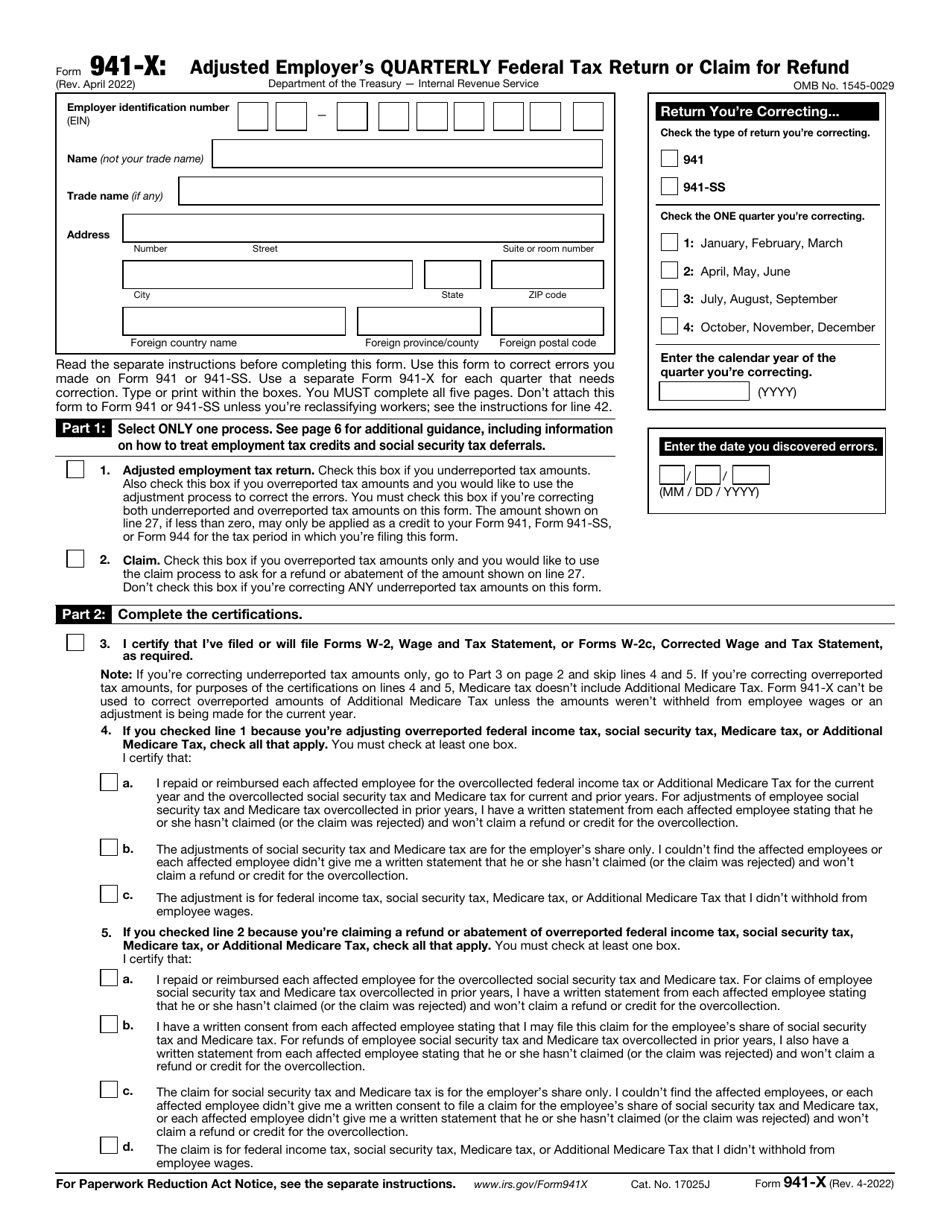

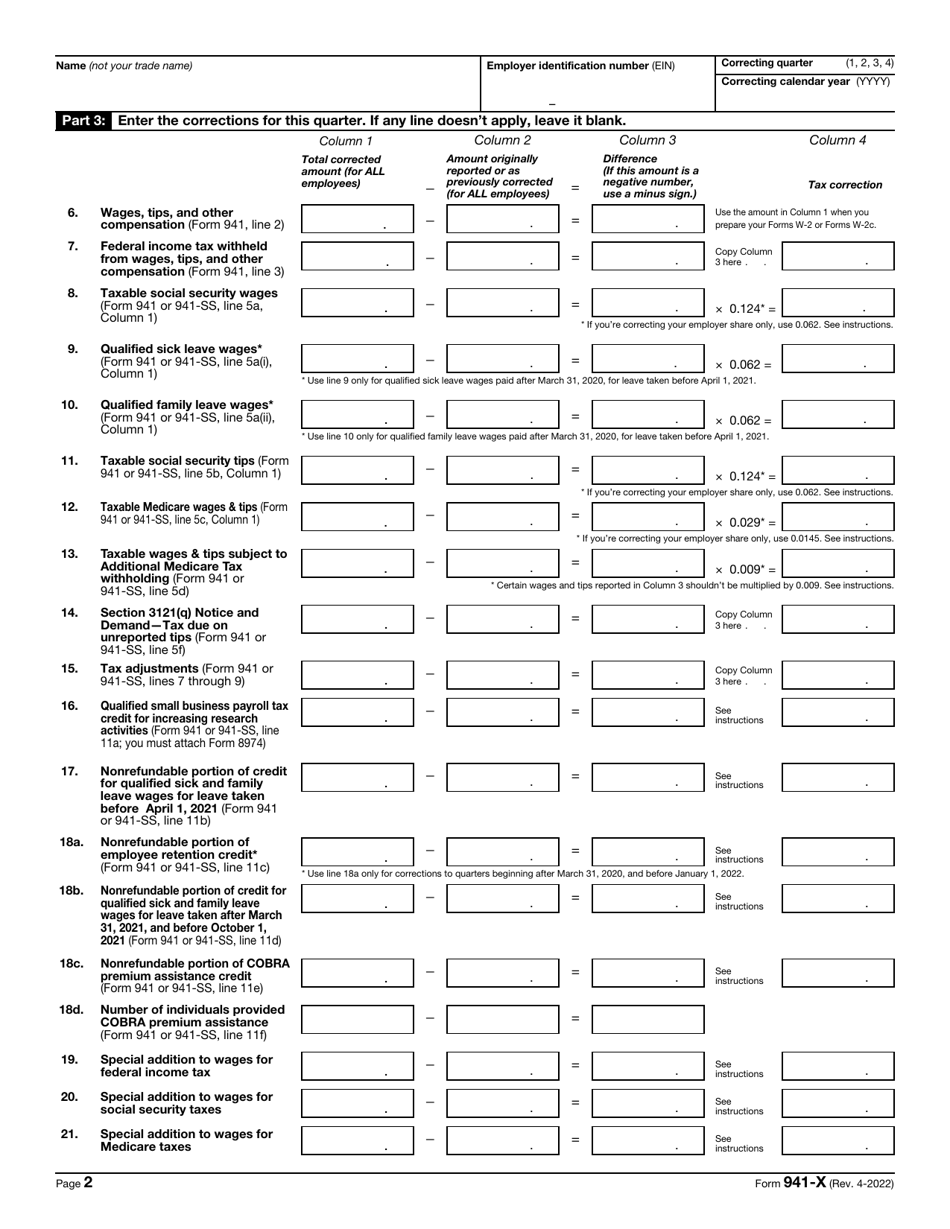

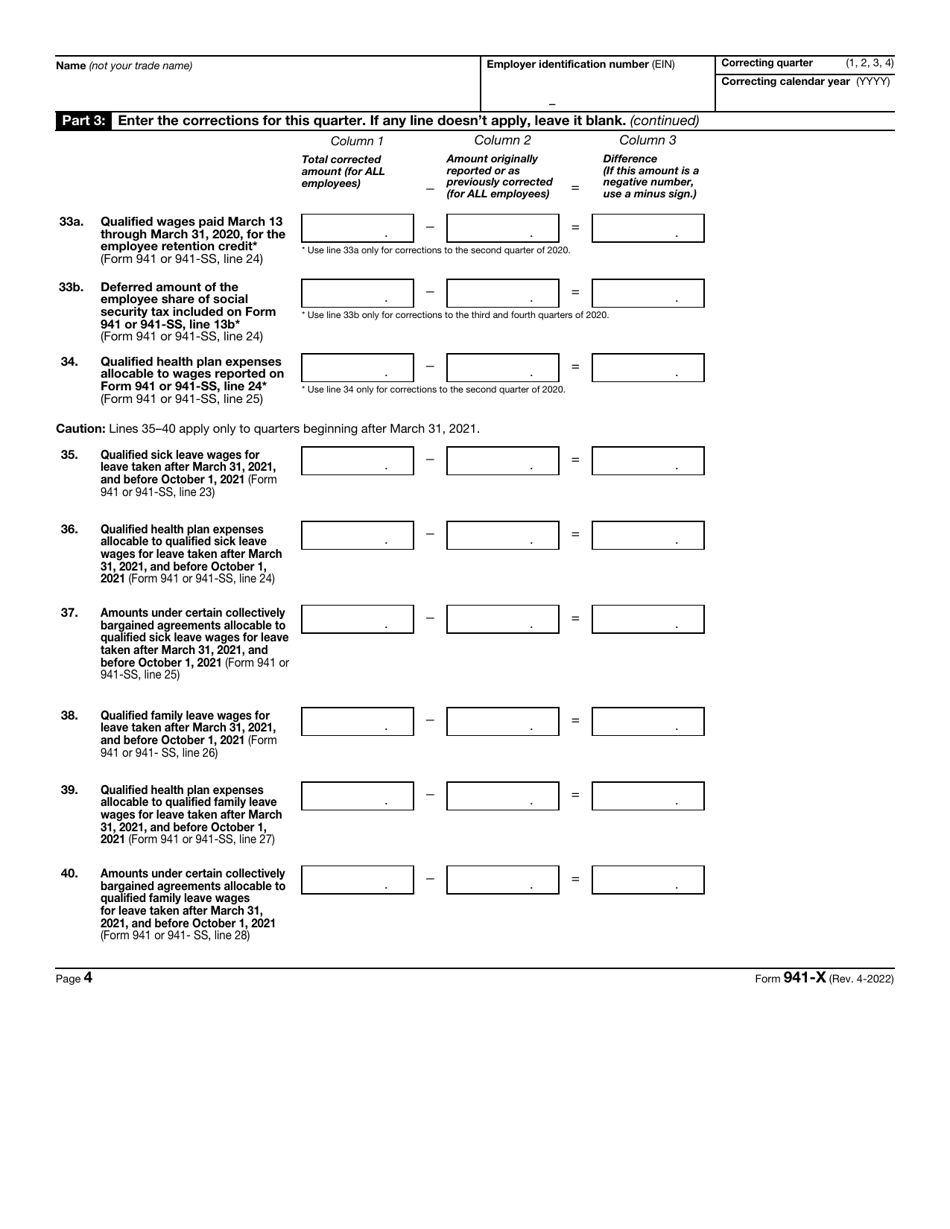

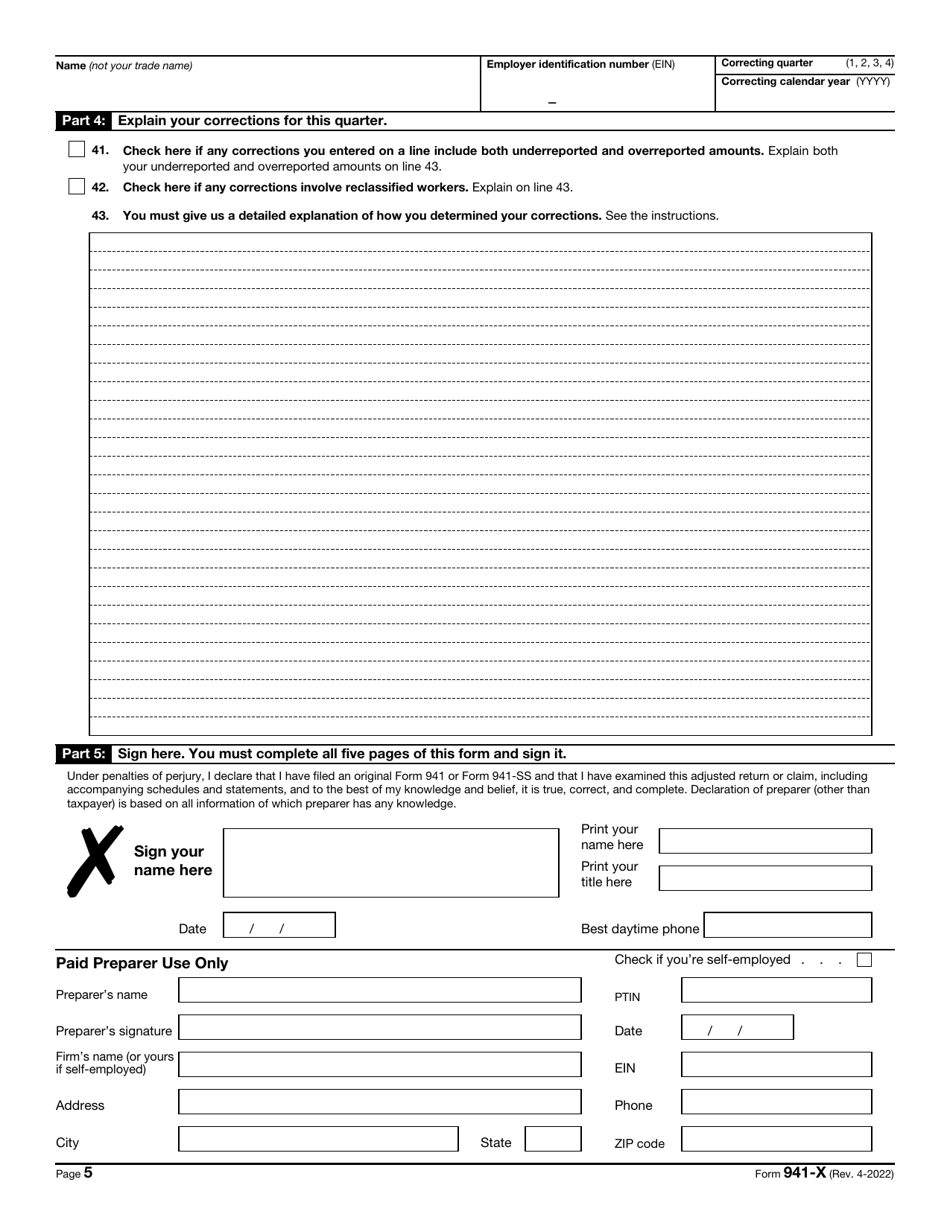

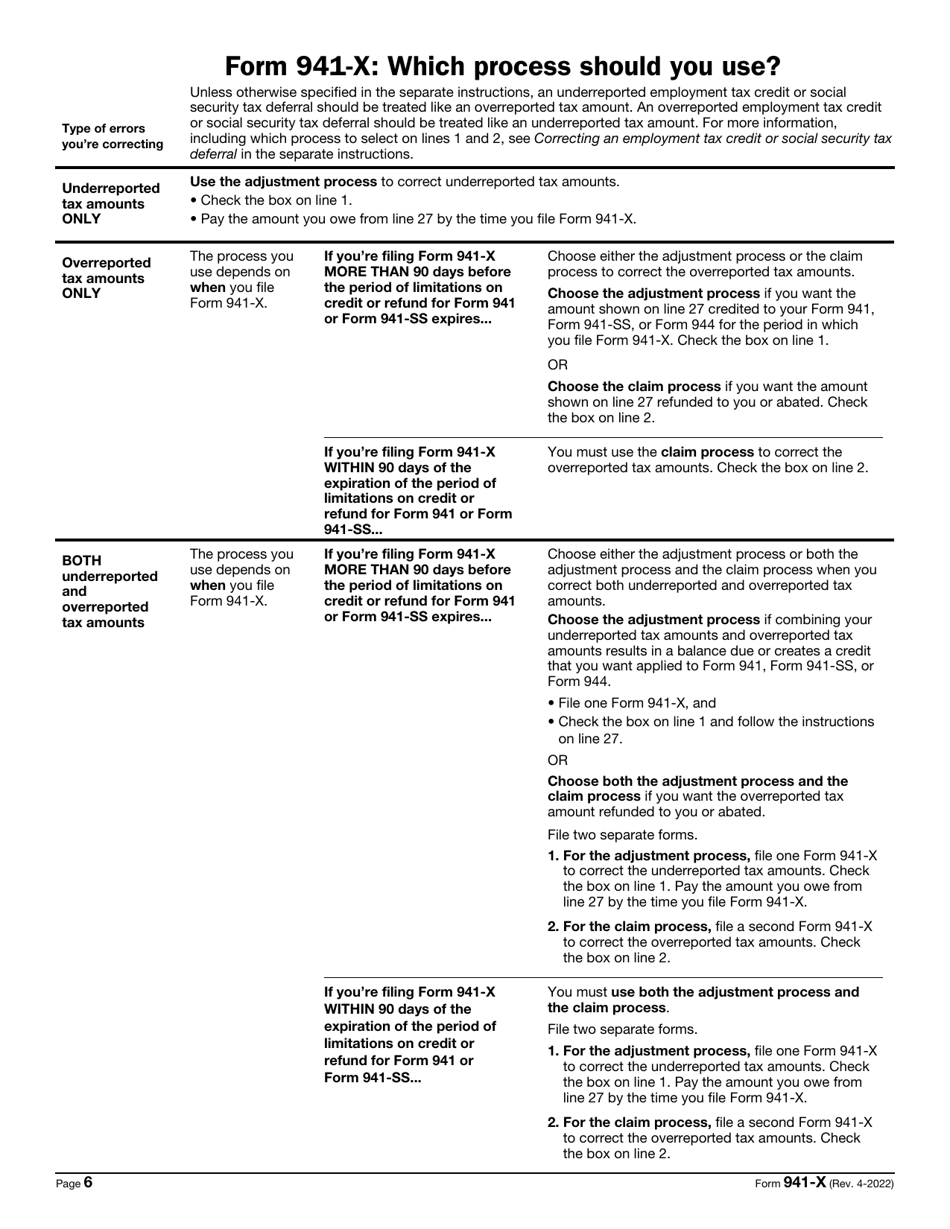

IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

What Is IRS Form 941-X?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2022. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 941-X?

A: IRS Form 941-X is the Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund.

Q: Who should file IRS Form 941-X?

A: Employers who need to make adjustments or claim a refund on their previously filed Form 941.

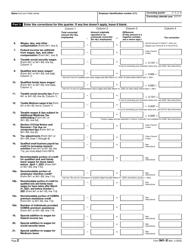

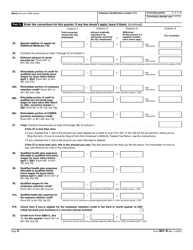

Q: What can be corrected on IRS Form 941-X?

A: Errors or omissions in wages, taxes, and adjustments reported on previously filed Form 941.

Q: Can IRS Form 941-X be filed electronically?

A: No, Form 941-X must be filed on paper and mailed to the IRS.

Q: What is the deadline for filing IRS Form 941-X?

A: Form 941-X must be filed within 3 years from the date you filed the original Form 941 or 2 years from the date you paid the tax, whichever is later.

Form Details:

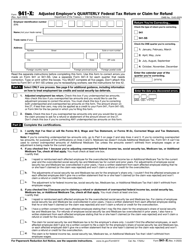

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 941-X through the link below or browse more documents in our library of IRS Forms.