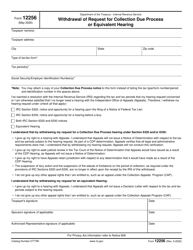

This version of the form is not currently in use and is provided for reference only. Download this version of

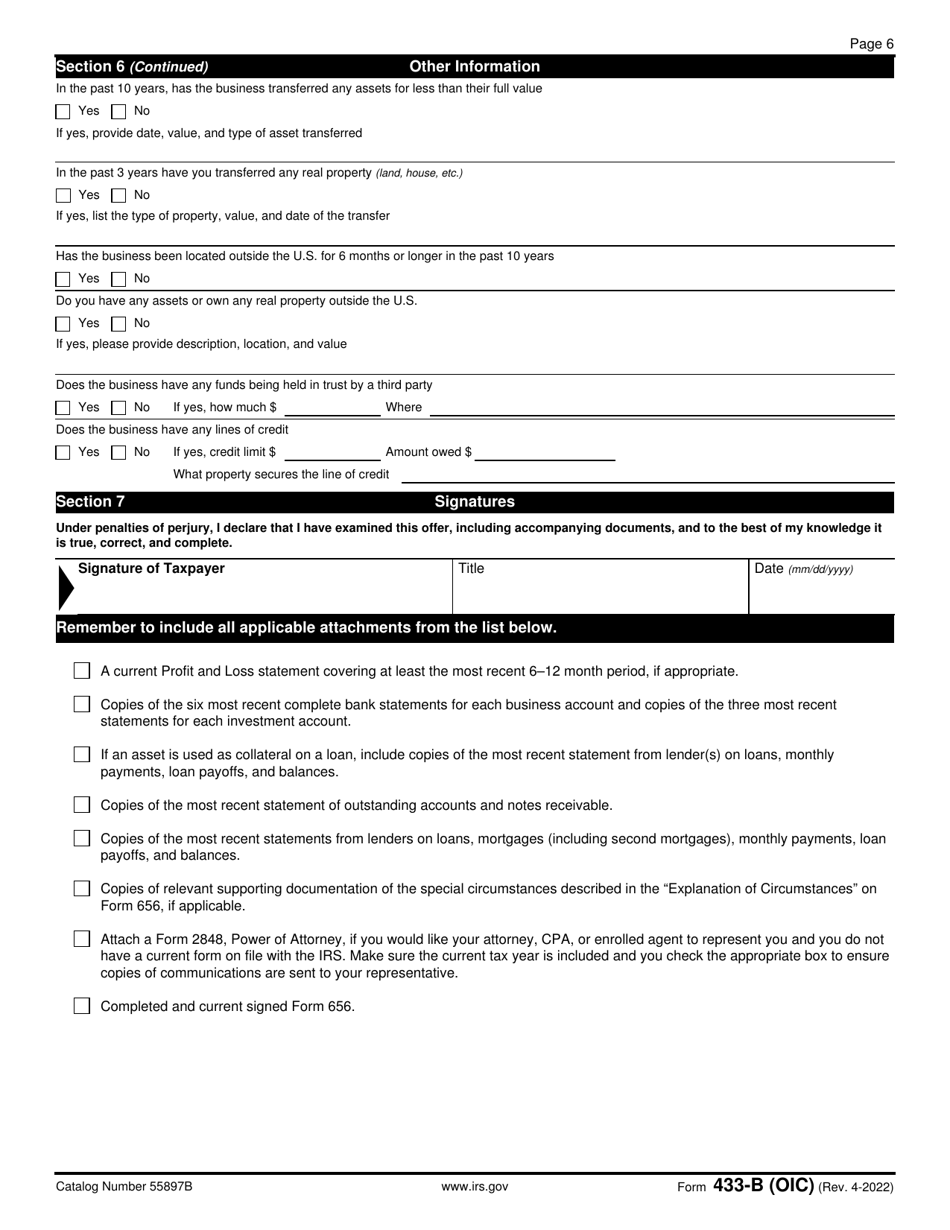

IRS Form 433-B (OIC)

for the current year.

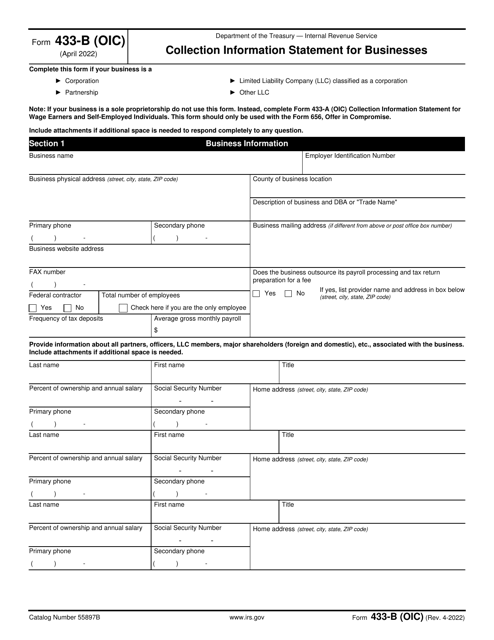

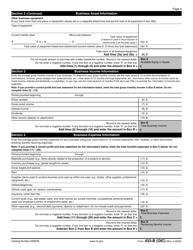

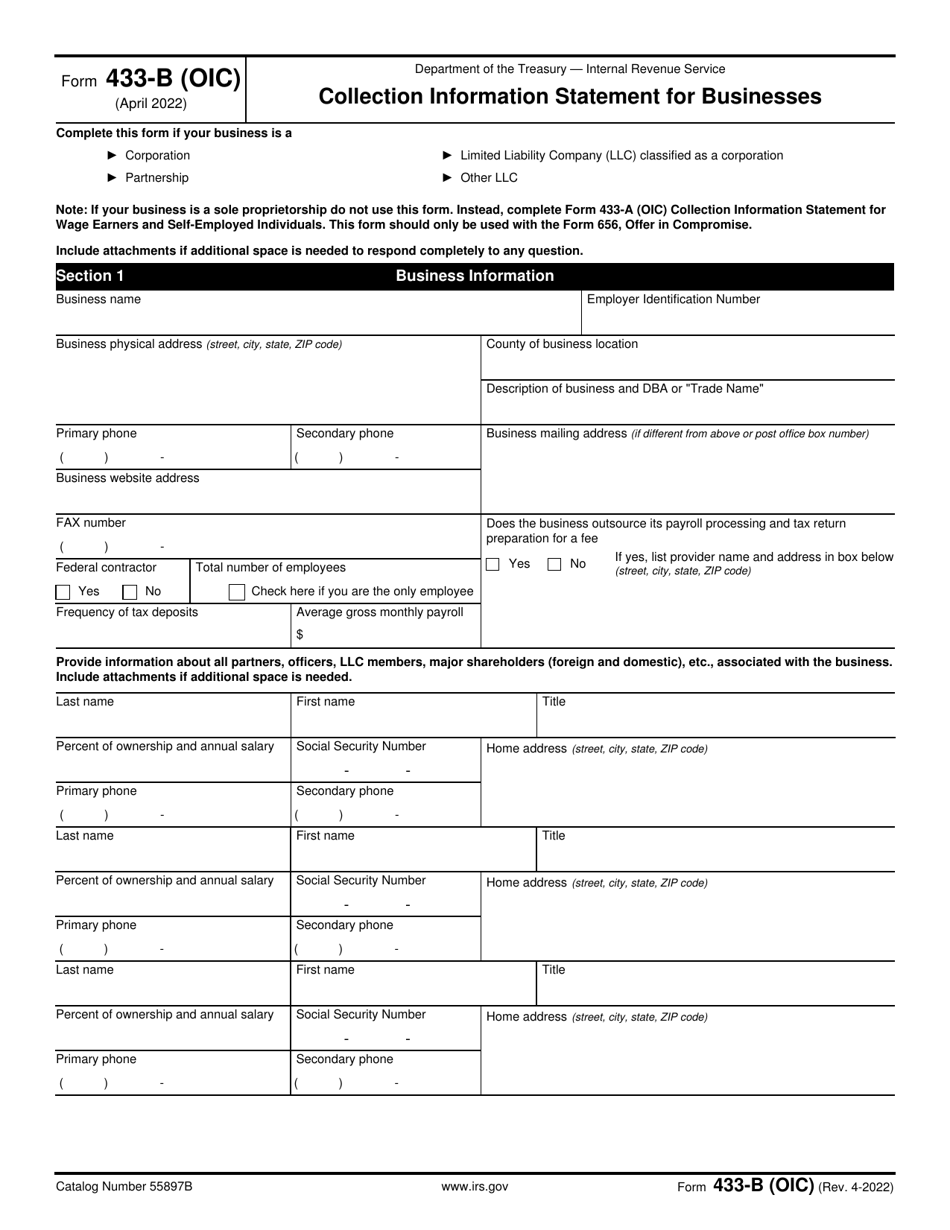

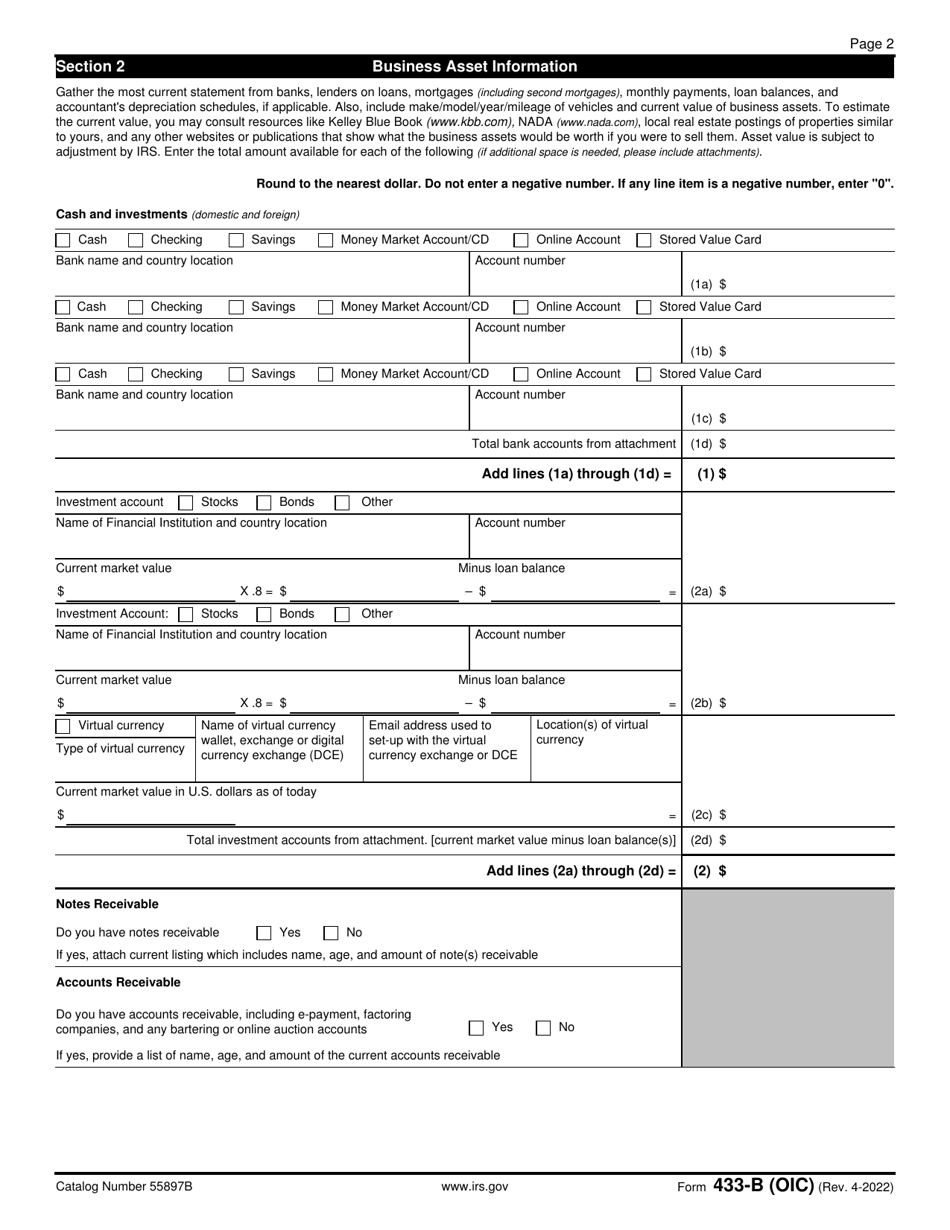

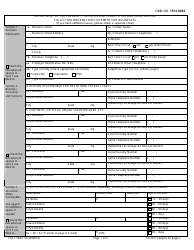

IRS Form 433-B (OIC) Collection Information Statement for Businesses

What Is IRS Form 433-B (OIC)?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2022. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 433-B?

A: IRS Form 433-B is a Collection Information Statement specifically designed for businesses.

Q: What is the purpose of IRS Form 433-B?

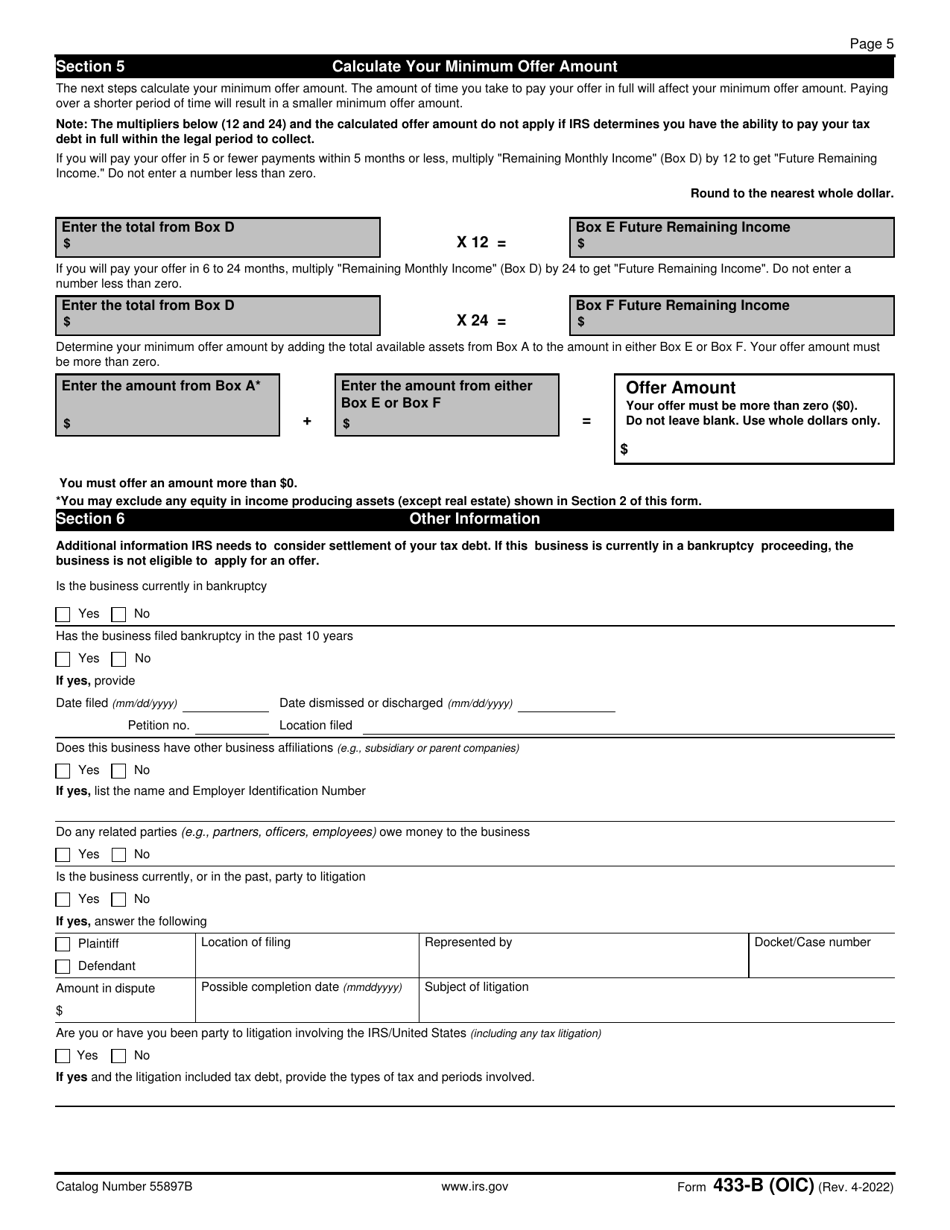

A: The purpose of IRS Form 433-B is to provide the IRS with detailed financial information about a business when making an Offer in Compromise (OIC) to settle tax debts.

Q: Who needs to fill out IRS Form 433-B?

A: Business owners or representatives who wish to apply for an Offer in Compromise and have tax debts to settle.

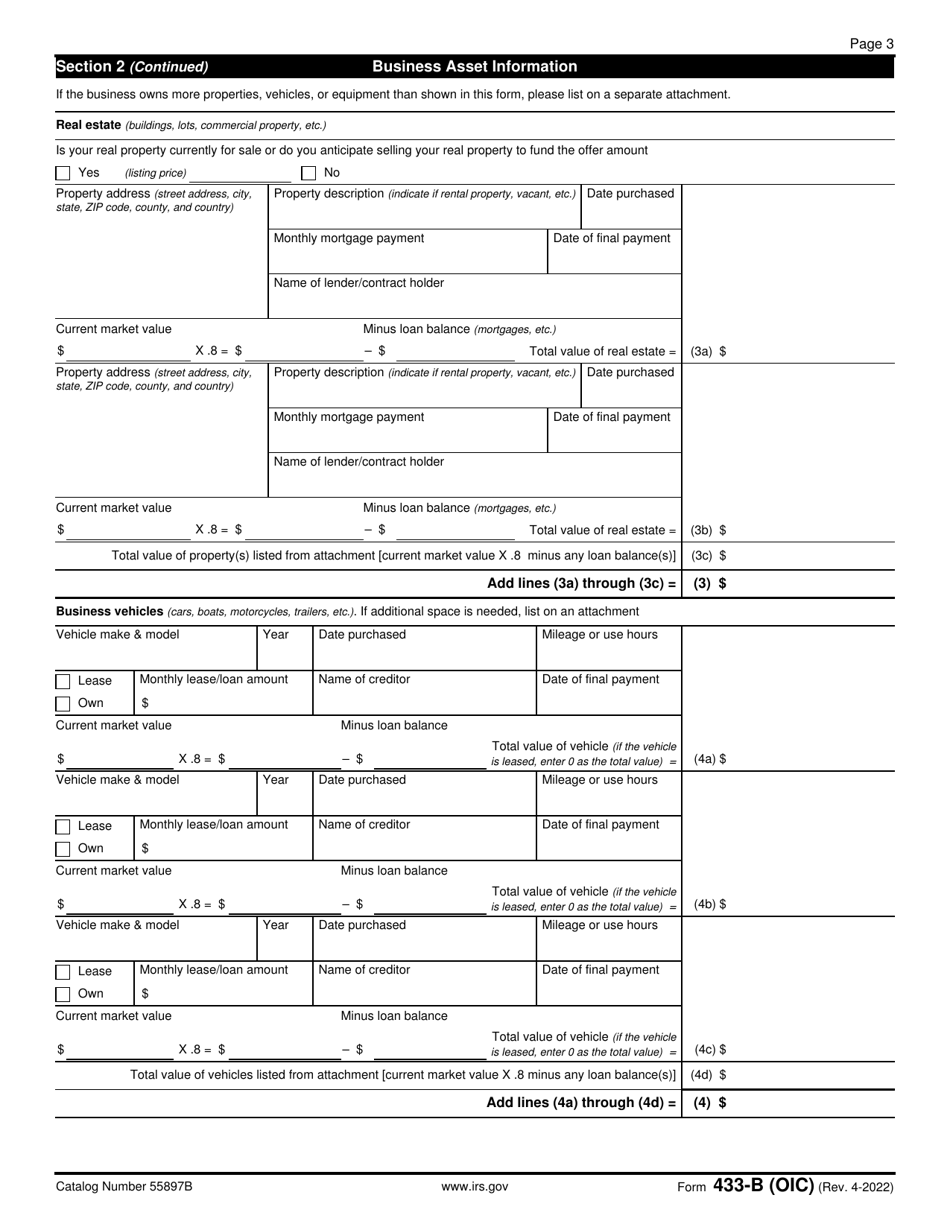

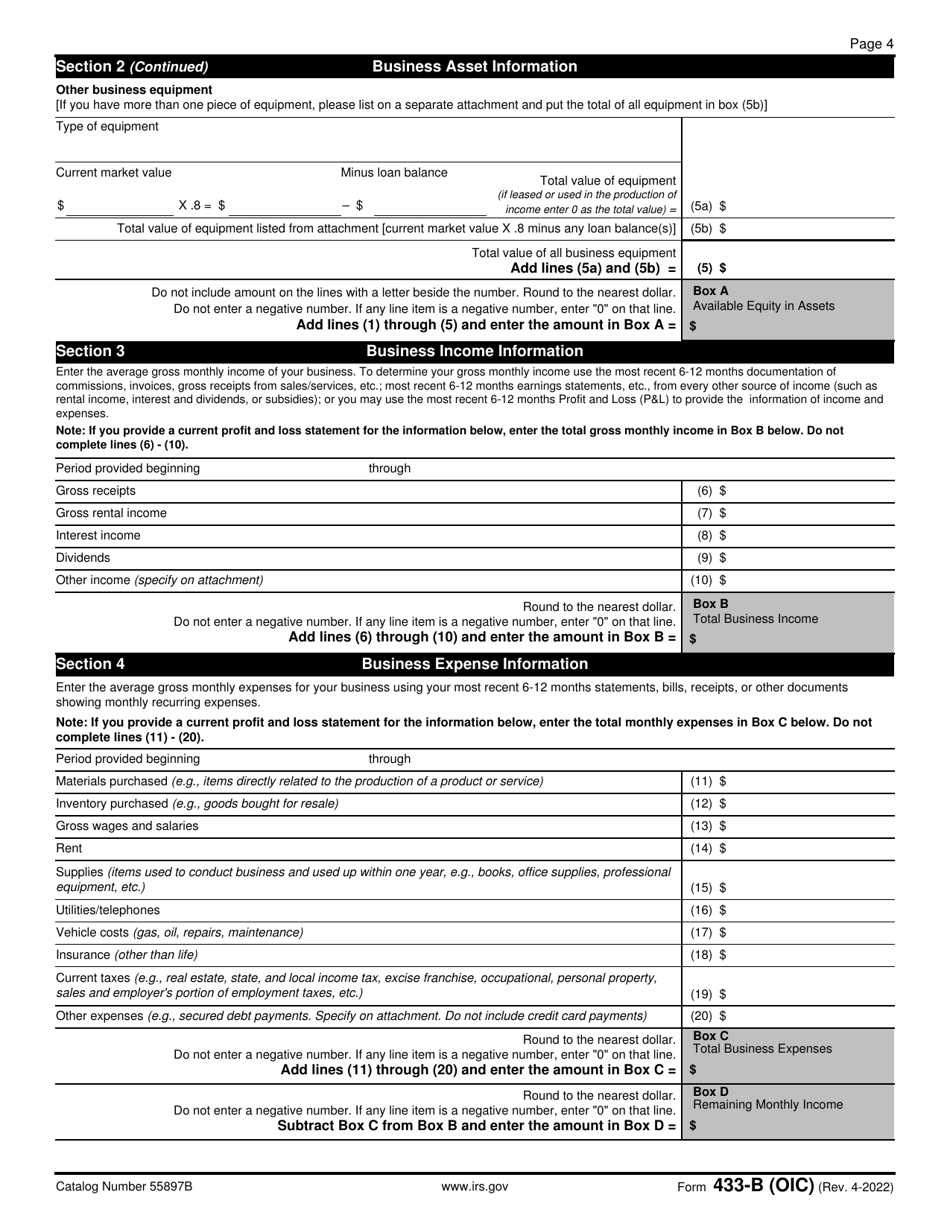

Q: What information is required on IRS Form 433-B?

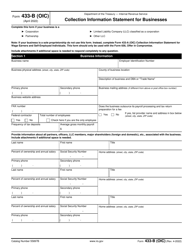

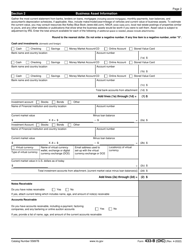

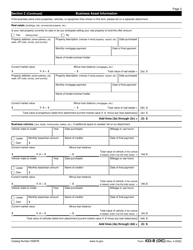

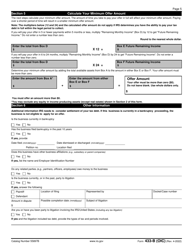

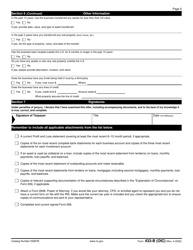

A: IRS Form 433-B requires detailed financial information about the business, including income, expenses, assets, and liabilities.

Q: Are there any fees associated with submitting IRS Form 433-B?

A: No, there are no fees associated with submitting IRS Form 433-B.

Q: What happens after submitting IRS Form 433-B?

A: After submitting IRS Form 433-B, the IRS will review the financial information provided and determine if an Offer in Compromise (OIC) is a viable option for settling the tax debts.

Q: Can I negotiate the terms of an Offer in Compromise after submitting IRS Form 433-B?

A: It is possible to negotiate the terms of an Offer in Compromise after submitting IRS Form 433-B, depending on the individual circumstances and the IRS's assessment of the financial situation.

Form Details:

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- A Spanish version of IRS Form 433-B (OIC) is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 433-B (OIC) through the link below or browse more documents in our library of IRS Forms.