This version of the form is not currently in use and is provided for reference only. Download this version of

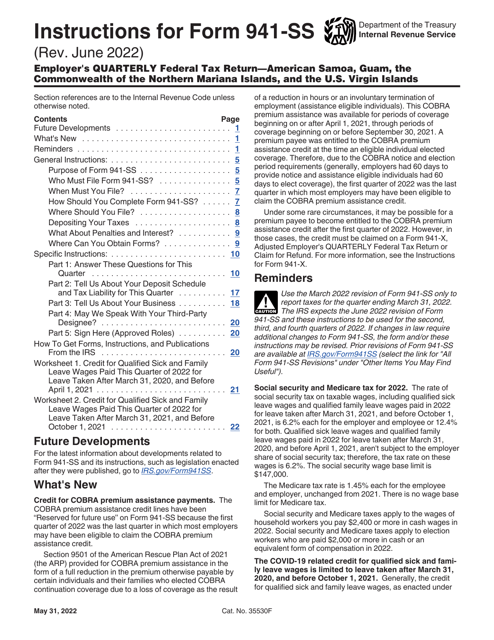

Instructions for IRS Form 941-SS

for the current year.

Instructions for IRS Form 941-SS Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands

This document contains official instructions for IRS Form 941-SS , Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 941-SS?

A: IRS Form 941-SS is the Employer's Quarterly Federal Tax Return specifically for American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands.

Q: Who is required to file IRS Form 941-SS?

A: Employers in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands who have employees must file IRS Form 941-SS.

Q: What is the purpose of IRS Form 941-SS?

A: The purpose of IRS Form 941-SS is to report wages, tips, and other compensation paid to employees, as well as the employer's share of Social Security and Medicare taxes.

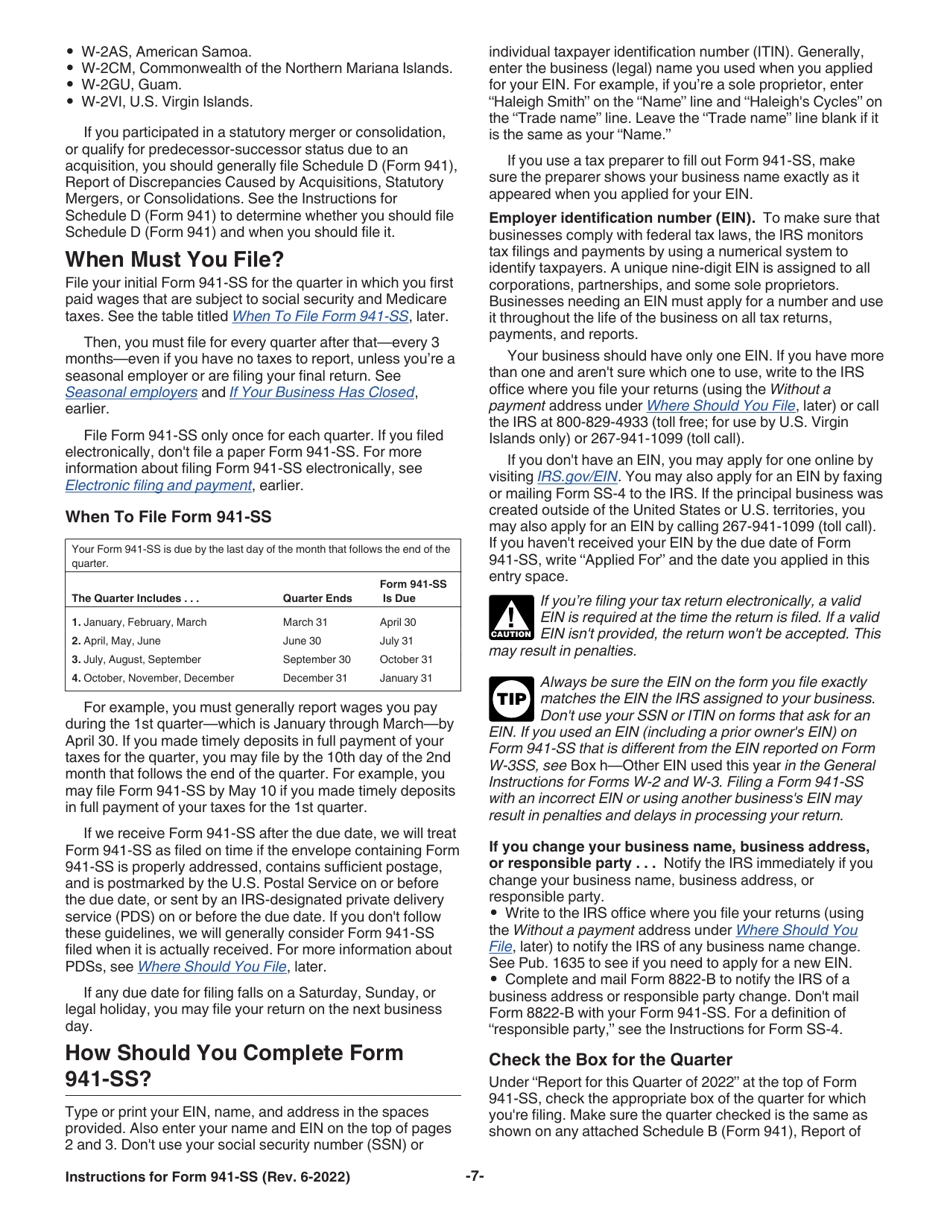

Q: When is IRS Form 941-SS due?

A: IRS Form 941-SS is due at the end of each calendar quarter. The due dates are April 30, July 31, October 31, and January 31.

Q: How do I file IRS Form 941-SS?

A: You can file IRS Form 941-SS electronically or by mail. Electronic filing is recommended for faster processing and to avoid errors.

Instruction Details:

- This 22-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.