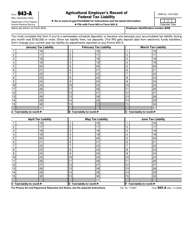

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 941 Schedule B

for the current year.

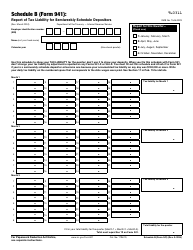

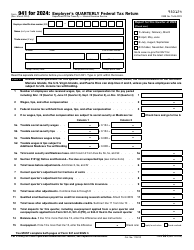

Instructions for IRS Form 941 Schedule B Report of Tax Liability for Semiweekly Schedule Depositors

This document contains official instructions for IRS Form 941 Schedule B, Report of Tax Liability for Semiweekly Schedule Depositors - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 941 Schedule B is available for download through this link.

FAQ

Q: What is IRS Form 941 Schedule B?

A: IRS Form 941 Schedule B is a form used to report tax liability for semiweekly schedule depositors.

Q: Who should use IRS Form 941 Schedule B?

A: Semiweekly schedule depositors should use IRS Form 941 Schedule B to report their tax liability.

Q: What is a semiweekly schedule depositor?

A: A semiweekly schedule depositor is a taxpayer who is required to make deposits more than once a month.

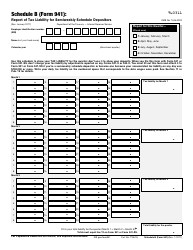

Q: What information is required on IRS Form 941 Schedule B?

A: IRS Form 941 Schedule B requires the taxpayer to provide information about the tax liability for each payroll date.

Q: When is IRS Form 941 Schedule B due?

A: IRS Form 941 Schedule B is due along with Form 941, which is generally filed quarterly.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.