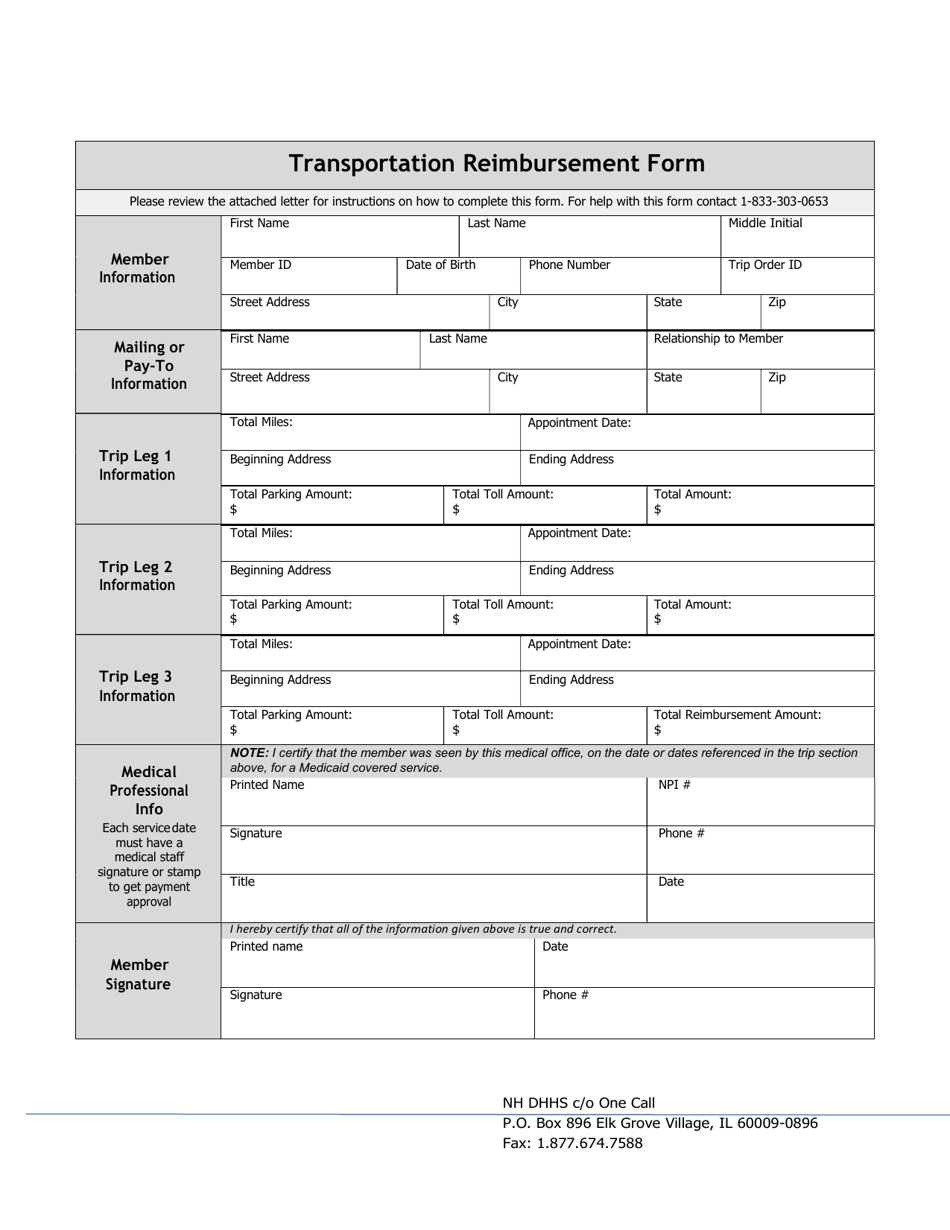

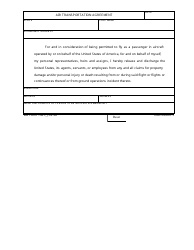

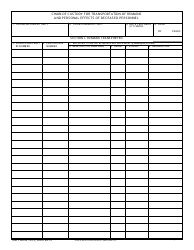

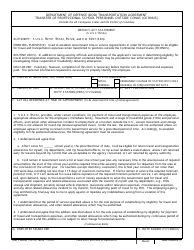

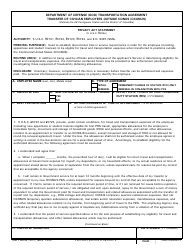

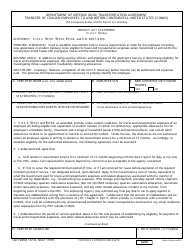

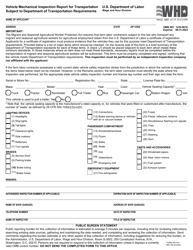

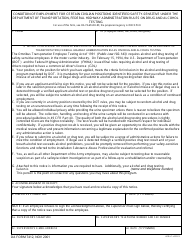

Transportation Reimbursement Form - New Hampshire

Transportation Reimbursement Form is a legal document that was released by the New Hampshire Department of Health and Human Services - a government authority operating within New Hampshire.

FAQ

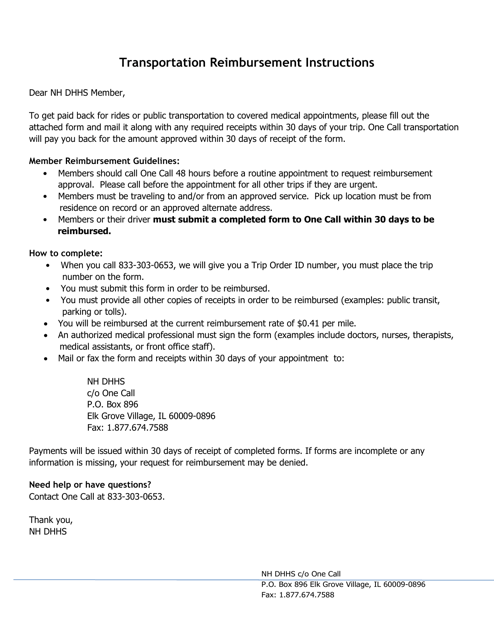

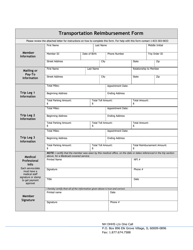

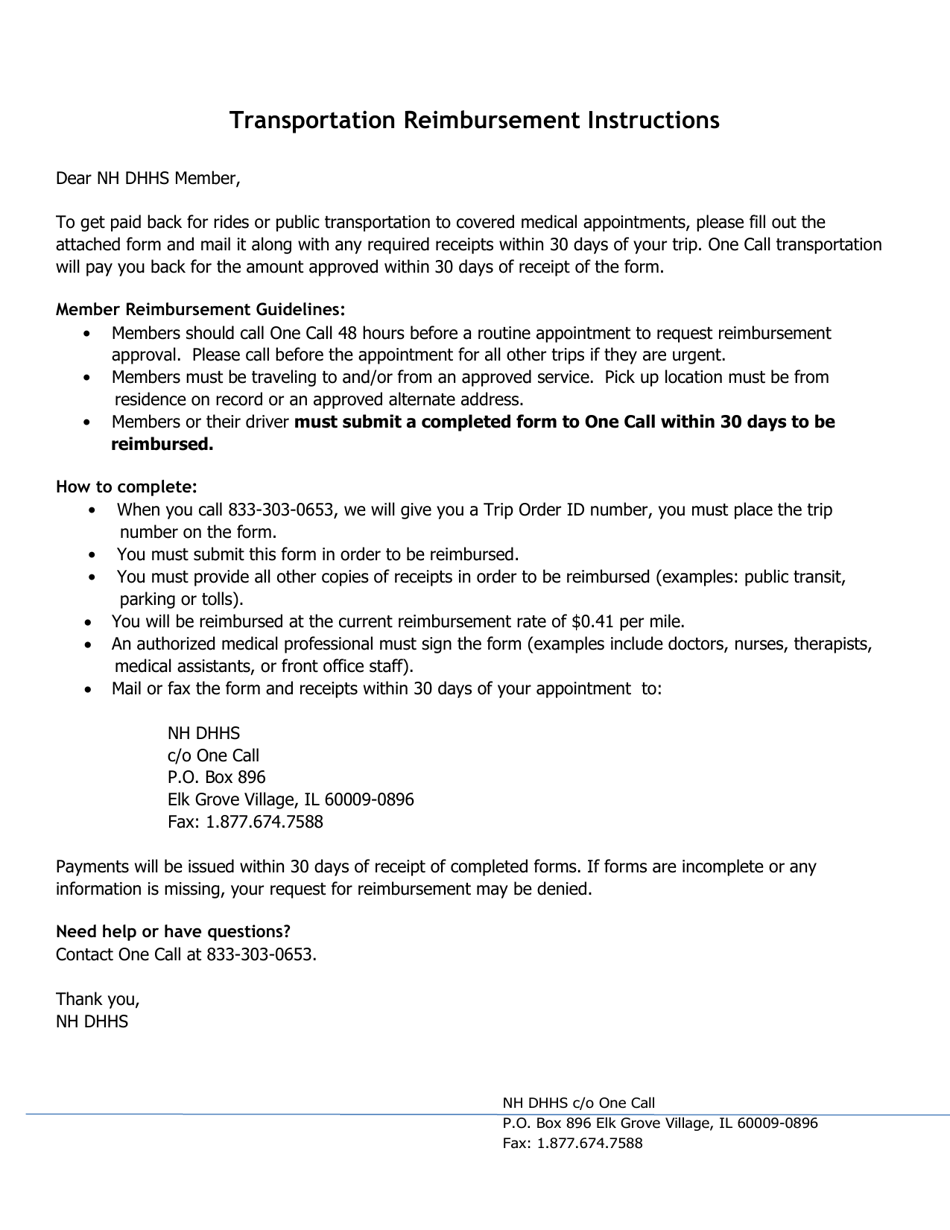

Q: What is the Transportation Reimbursement Form?

A: The Transportation Reimbursement Form is a document used to request reimbursement for eligible transportation expenses.

Q: How do I obtain the Transportation Reimbursement Form?

A: You can obtain the Transportation Reimbursement Form from your employer or from the New Hampshire Department of Labor.

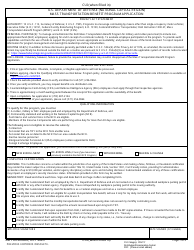

Q: Who is eligible to use the Transportation Reimbursement Form?

A: Employees who incur transportation expenses related to their job duties and are authorized by their employer to do so are eligible to use the Transportation Reimbursement Form.

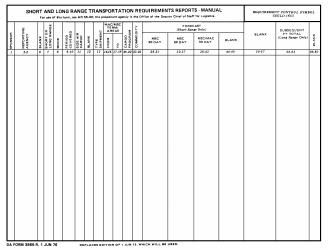

Q: What type of transportation expenses can be reimbursed?

A: Eligible transportation expenses may include mileage, parking fees, tolls, and public transportation fares.

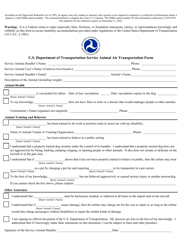

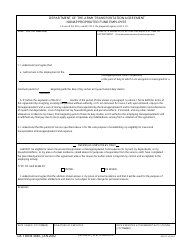

Q: How do I submit the Transportation Reimbursement Form?

A: You should submit the completed Transportation Reimbursement Form to your employer along with any supporting documentation, such as receipts or logs of mileage.

Q: When will I receive reimbursement for my transportation expenses?

A: The timing of reimbursement may vary depending on your employer's policies, but you should generally expect to receive reimbursement within a reasonable timeframe.

Q: Are there any limitations on the amount of reimbursement I can receive?

A: There may be certain limitations or caps on the amount of reimbursement you can receive for specific types of transportation expenses. You should consult with your employer or refer to the reimbursement policy to determine any limitations.

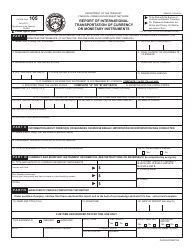

Q: Do I need to pay taxes on the reimbursement I receive?

A: In general, transportation reimbursement is considered a non-taxable fringe benefit. However, you should consult with a tax professional or refer to IRS guidelines to determine if any portion of the reimbursement may be subject to taxes.

Q: What should I do if my employer denies my reimbursement request?

A: If your employer denies your reimbursement request, you should consult with your human resources department or refer to your company's policies for further guidance on how to address the issue.

Q: Are there any specific rules or regulations regarding transportation reimbursement in New Hampshire?

A: Yes, there may be specific rules or regulations regarding transportation reimbursement in New Hampshire. You should consult with the New Hampshire Department of Labor or refer to state laws for more information.

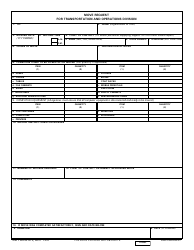

Form Details:

- The latest edition currently provided by the New Hampshire Department of Health and Human Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Health and Human Services.