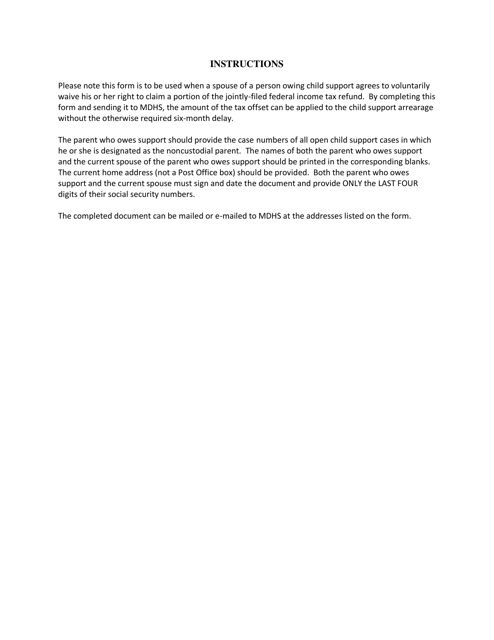

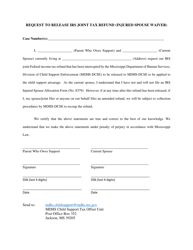

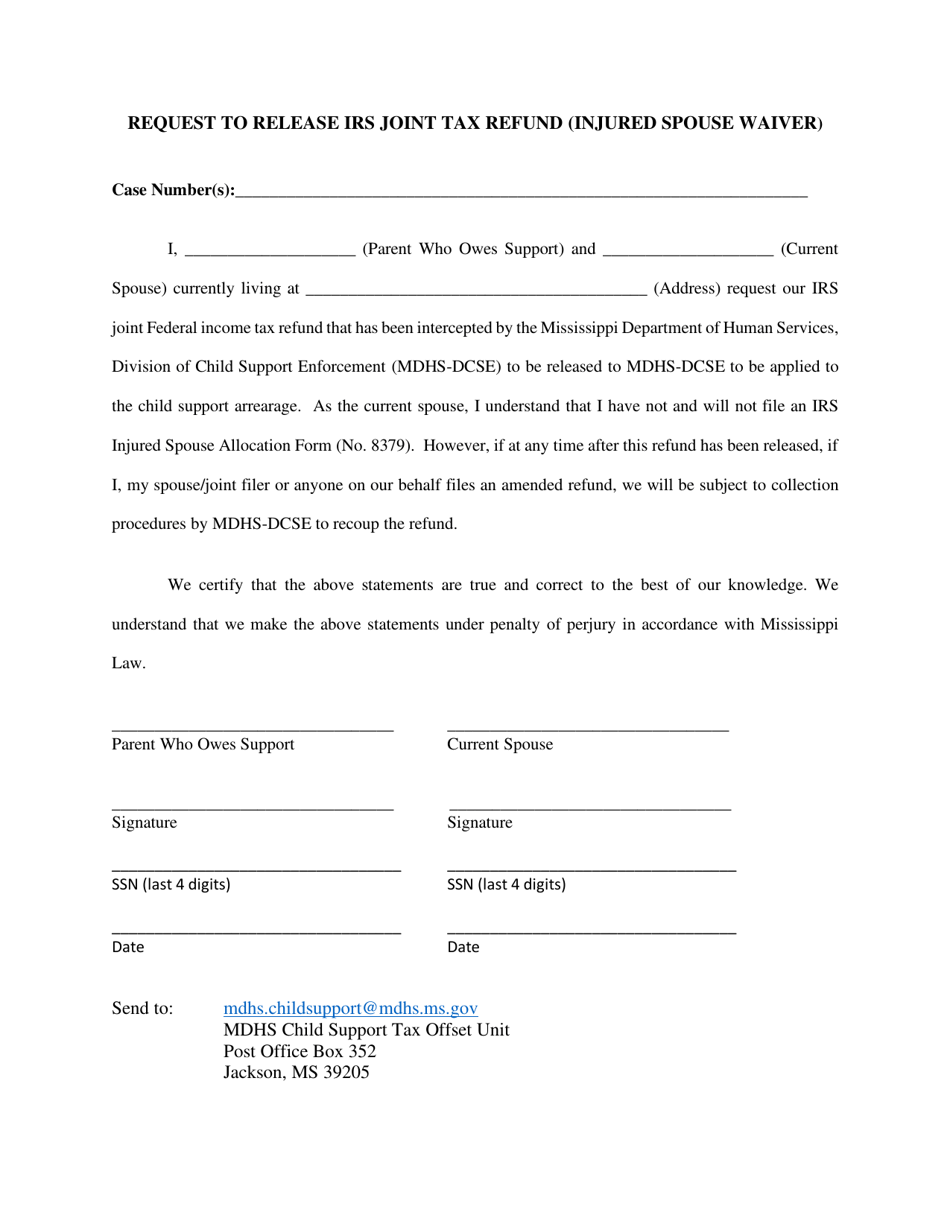

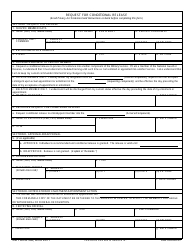

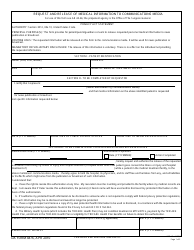

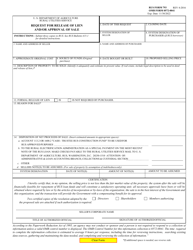

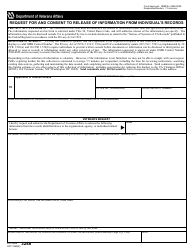

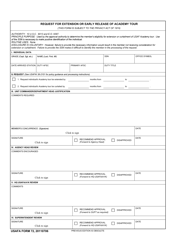

Request to Release IRS Joint Tax Refund (Injured Spouse Waiver) - Mississippi

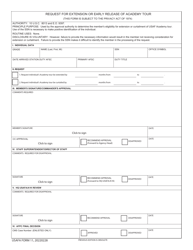

Request to Release IRS Joint Tax Refund (Injured Spouse Waiver) is a legal document that was released by the Mississippi Department of Human Services - a government authority operating within Mississippi.

FAQ

Q: What is an Injured Spouse Waiver?

A: An Injured Spouse Waiver is a request made to the IRS by a taxpayer to protect their portion of a joint tax refund from being offset to satisfy the other spouse's past-due debts.

Q: Why would someone need to request an Injured Spouse Waiver?

A: Someone may need to request an Injured Spouse Waiver if they have filed a joint tax return with their spouse, but their portion of the tax refund is at risk of being withheld due to the other spouse's outstanding debts, such as unpaid child support or federal student loans.

Q: What is the purpose of the Injured Spouse Waiver?

A: The purpose of the Injured Spouse Waiver is to allow an innocent spouse to receive their share of a joint tax refund, even if the other spouse has certain obligations or debts that may result in the offset of the refund.

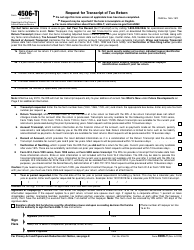

Q: How can someone request an Injured Spouse Waiver?

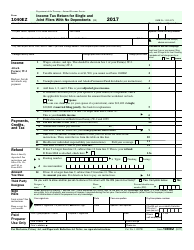

A: To request an Injured Spouse Waiver, the taxpayer must complete and file Form 8379, Injured Spouse Allocation, along with their federal tax return or amended tax return.

Q: Are there any requirements to be eligible for an Injured Spouse Waiver?

A: Yes, there are eligibility requirements for an Injured Spouse Waiver, such as filing a joint tax return, not being responsible for the debt that caused the offset, and having made and reported tax payments or claimed a refundable tax credit.

Q: What happens after submitting the Injured Spouse Waiver?

A: After submitting the Injured Spouse Waiver, the IRS will review the request and determine if the innocent spouse qualifies for relief. They will then allocate the appropriate portion of the refund to the injured spouse.

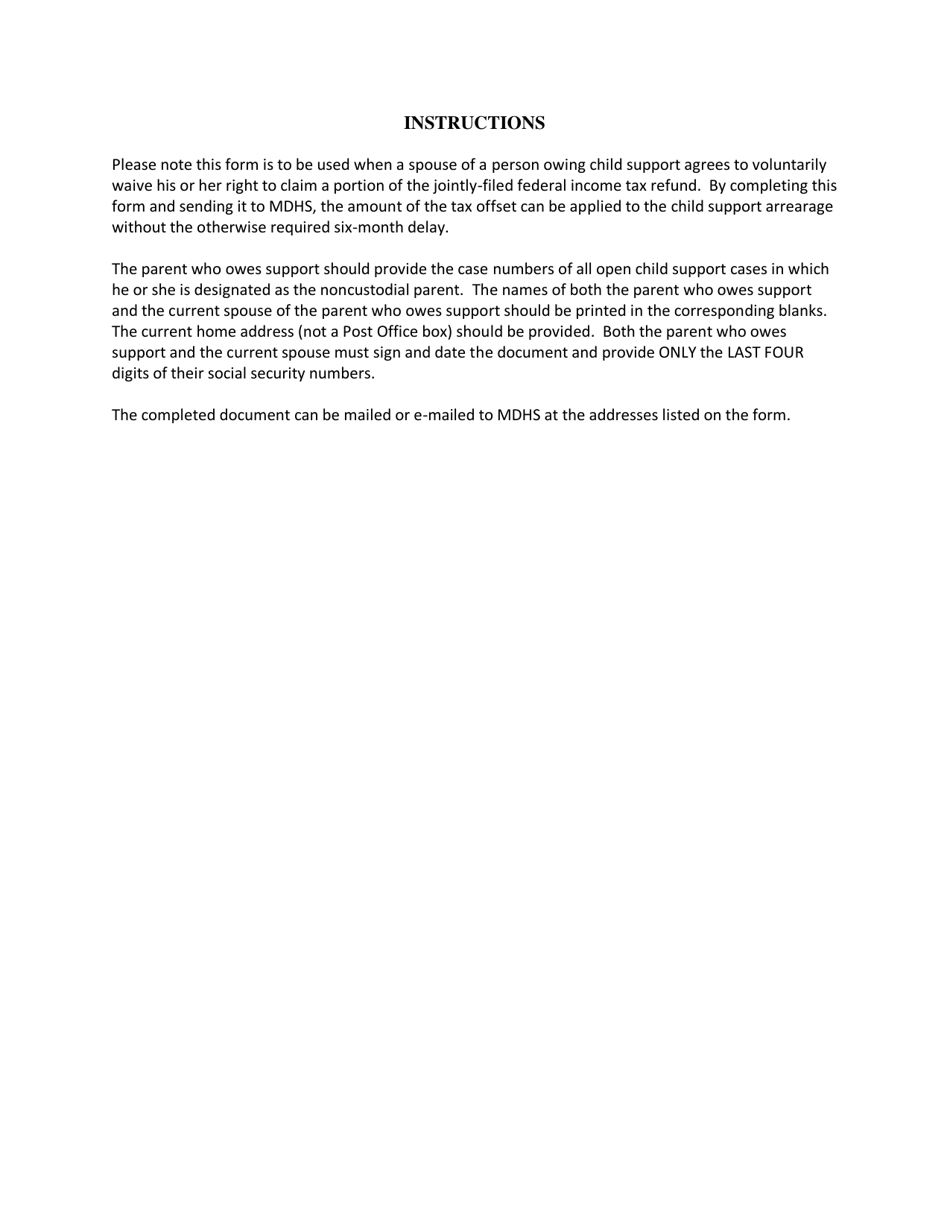

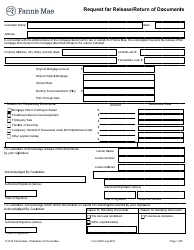

Form Details:

- The latest edition currently provided by the Mississippi Department of Human Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Mississippi Department of Human Services.