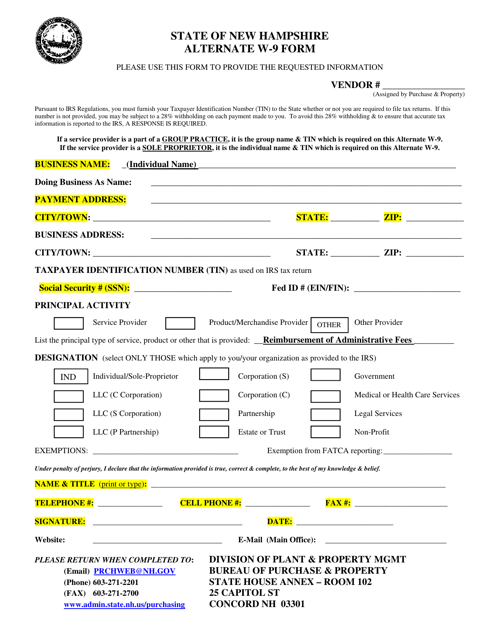

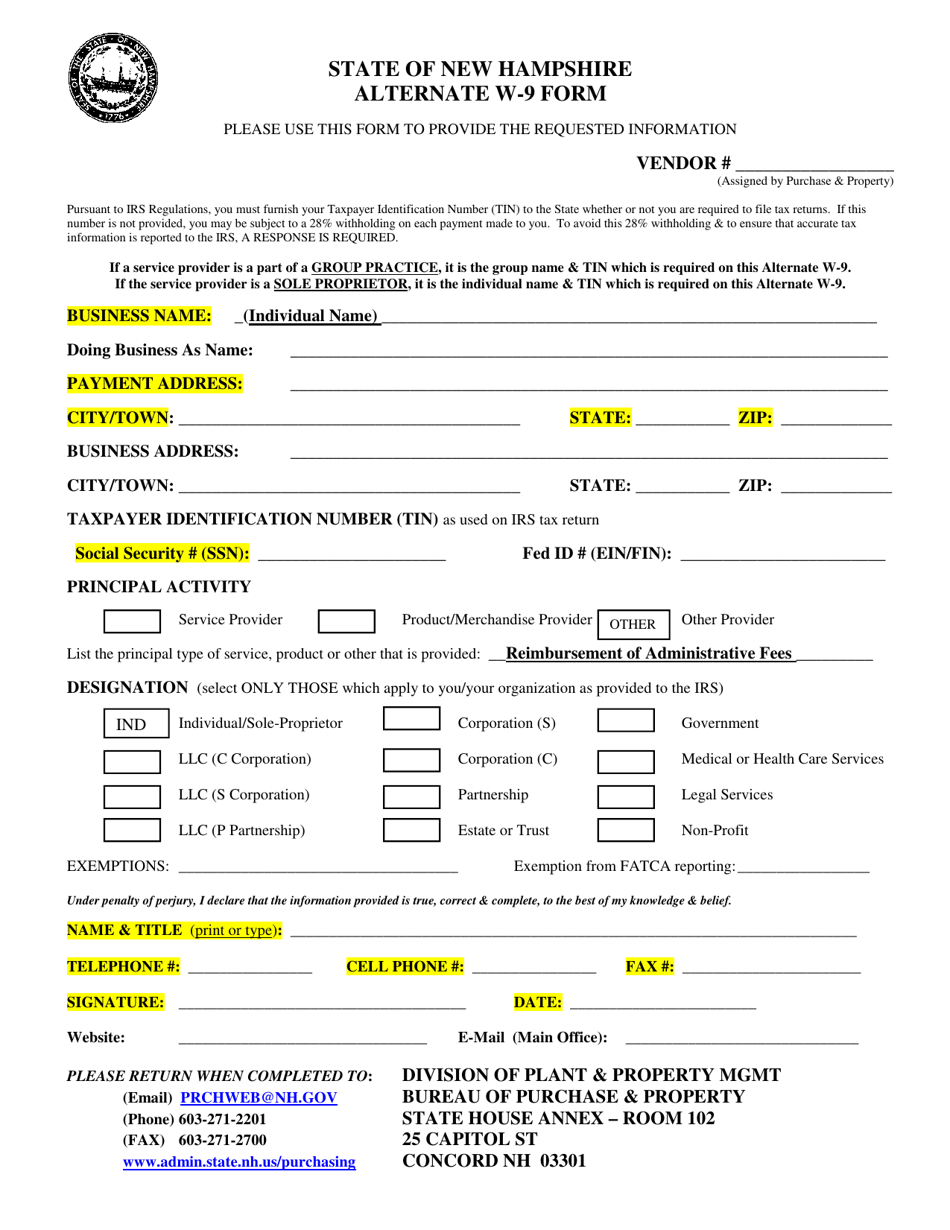

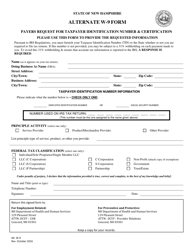

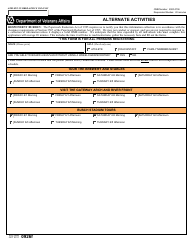

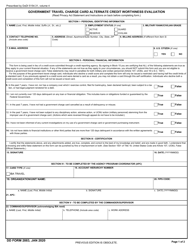

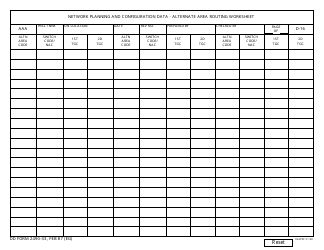

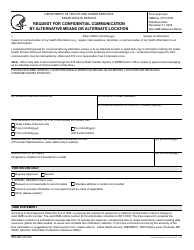

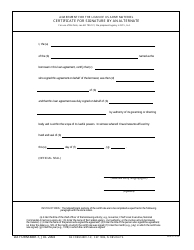

Alternate W-9 Form - New Hampshire

Alternate W-9 Form is a legal document that was released by the New Hampshire Department of Health and Human Services - a government authority operating within New Hampshire.

FAQ

Q: What is an alternate W-9 form?

A: An alternate W-9 form is a form used to provide taxpayer identification information to a requester for certain exemption purposes.

Q: Why would someone need to use an alternate W-9 form?

A: Someone may need to use an alternate W-9 form if they are exempt from the regular W-9 requirements and need to provide their taxpayer identification information for a specific purpose.

Q: What is the purpose of an alternate W-9 form in New Hampshire?

A: In New Hampshire, an alternate W-9 form is used for certain exemption purposes, such as applying for a state tax exemption for interest and dividend income.

Q: Are there any specific instructions for filling out the alternate W-9 form in New Hampshire?

A: Yes, there may be specific instructions provided by the New Hampshire Department of Revenue Administration on how tofill out the alternate W-9 form. It is important to carefully follow these instructions.

Q: Can I use the regular W-9 form instead of the alternate W-9 form in New Hampshire?

A: No, if you are required to use the alternate W-9 form for a specific purpose in New Hampshire, you must use that form instead of the regular W-9 form.

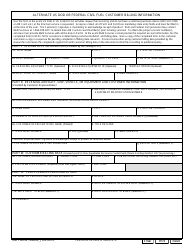

Form Details:

- The latest edition currently provided by the New Hampshire Department of Health and Human Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Health and Human Services.