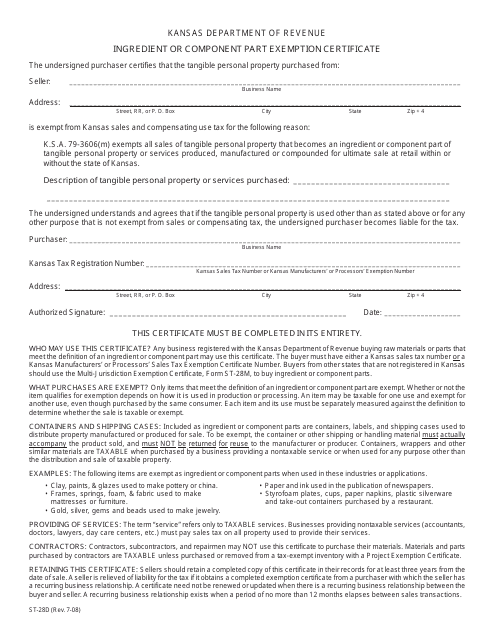

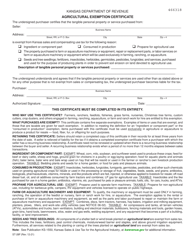

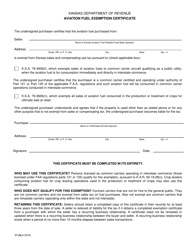

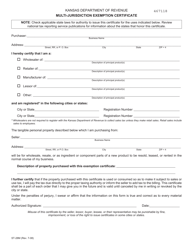

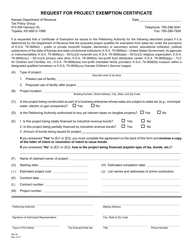

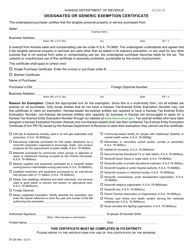

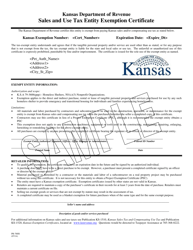

Form ST-28D Ingredient or Component Part Exemption Certificate - Kansas

What Is Form ST-28D?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-28D?

A: Form ST-28D is the Ingredient or Component Part Exemption Certificate in Kansas.

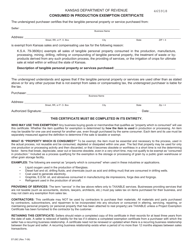

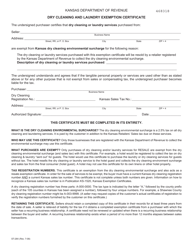

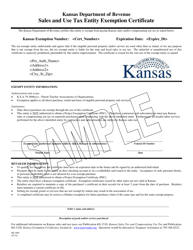

Q: What is the purpose of Form ST-28D?

A: The purpose of Form ST-28D is to certify that a purchase of ingredients or component parts is exempt from Kansas sales tax.

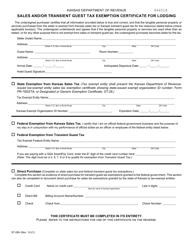

Q: Who should use Form ST-28D?

A: Form ST-28D should be used by businesses or individuals who are purchasing ingredients or component parts that will be used to manufacture or produce a product for sale.

Q: What qualifies as an ingredient or component part?

A: An ingredient or component part is a tangible personal property that becomes an ingredient or component part of a product.

Q: How long is the exemption valid?

A: The exemption is valid for the period specified on the certificate, not to exceed three years.

Q: Do I need to renew the exemption certificate?

A: No, the certificate does not need to be renewed as long as the purchase remains eligible for exemption.

Q: Are there any penalties for misuse of the exemption certificate?

A: Yes, penalties may apply for misuse of the exemption certificate, including possible payment of the sales tax due and interest.

Q: Can the exemption be claimed on purchases made out of state?

A: No, the exemption only applies to purchases of ingredients or component parts made within the state of Kansas.

Q: What other documentation may be required to support the exemption?

A: Additional supporting documentation, such as purchase invoices or other records, may be required to substantiate the exemption claim.

Form Details:

- Released on July 1, 2008;

- The latest edition provided by the Kansas Department of Revenue;

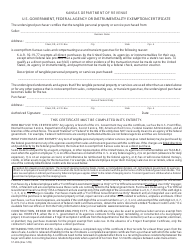

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-28D by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.