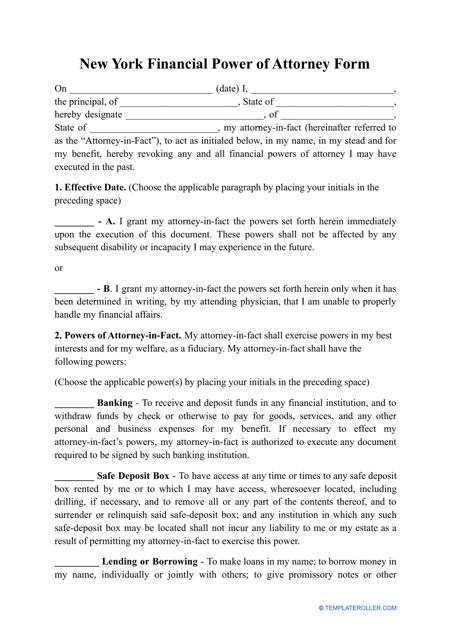

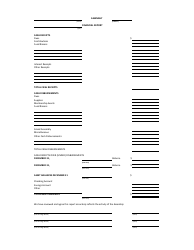

Financial Power of Attorney Form - New York

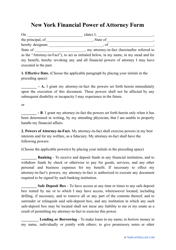

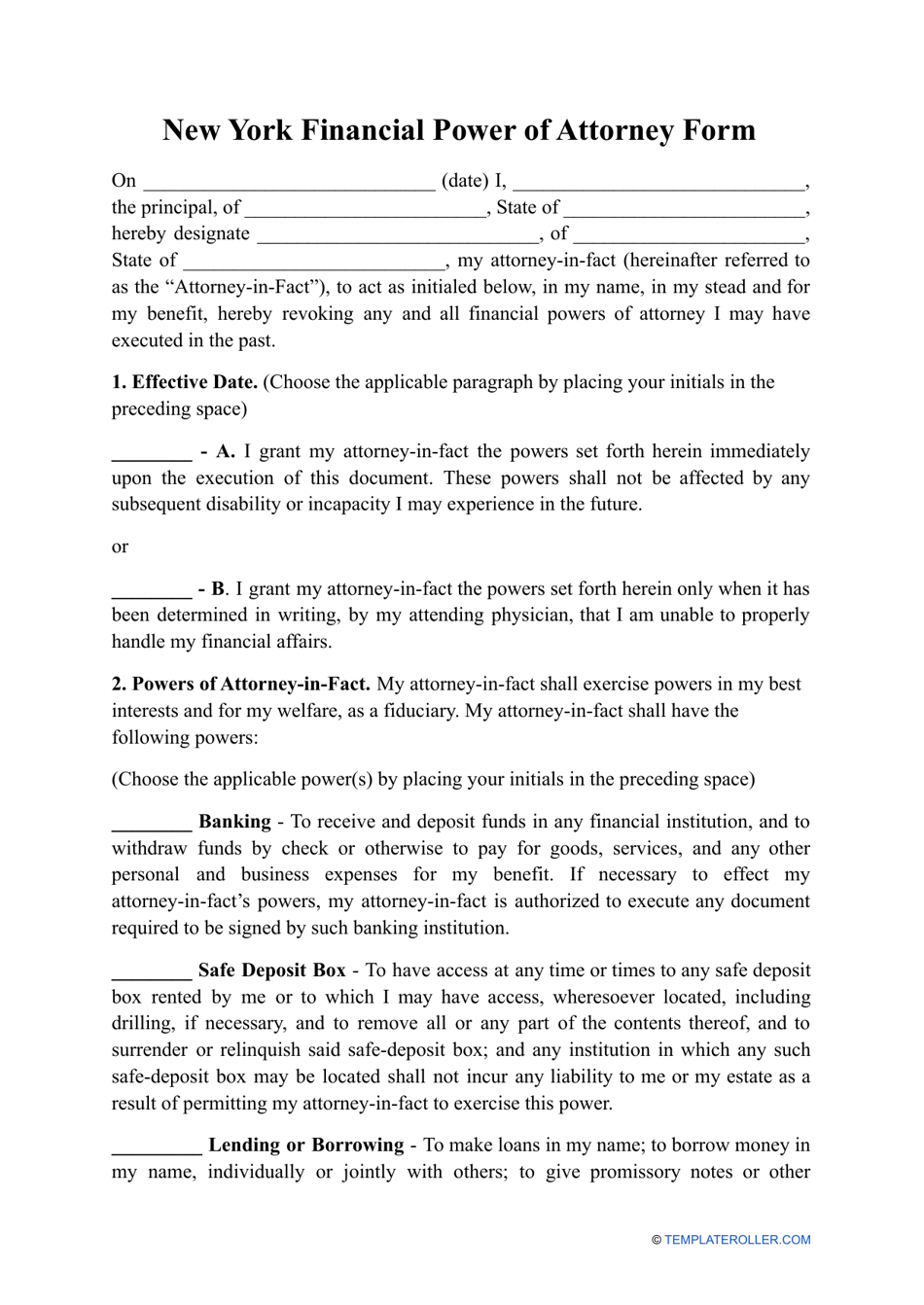

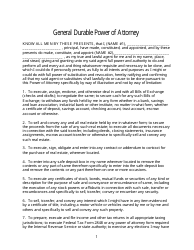

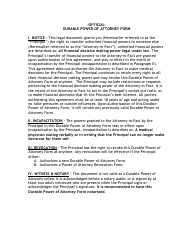

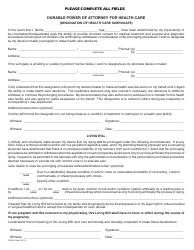

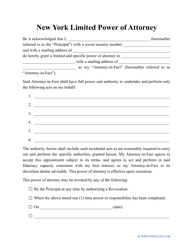

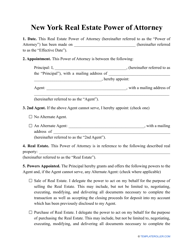

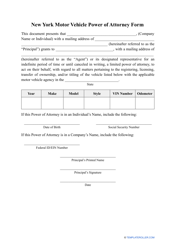

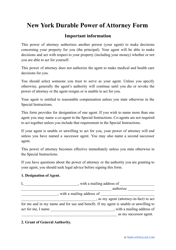

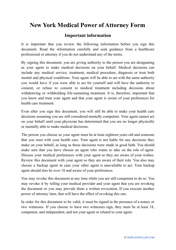

The Financial Power of Attorney Form in New York is a legal document that allows an individual (the principal) to appoint someone (the agent or attorney-in-fact) to make financial decisions on their behalf. This could include managing bank accounts, paying bills, or making investment decisions.

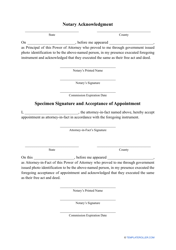

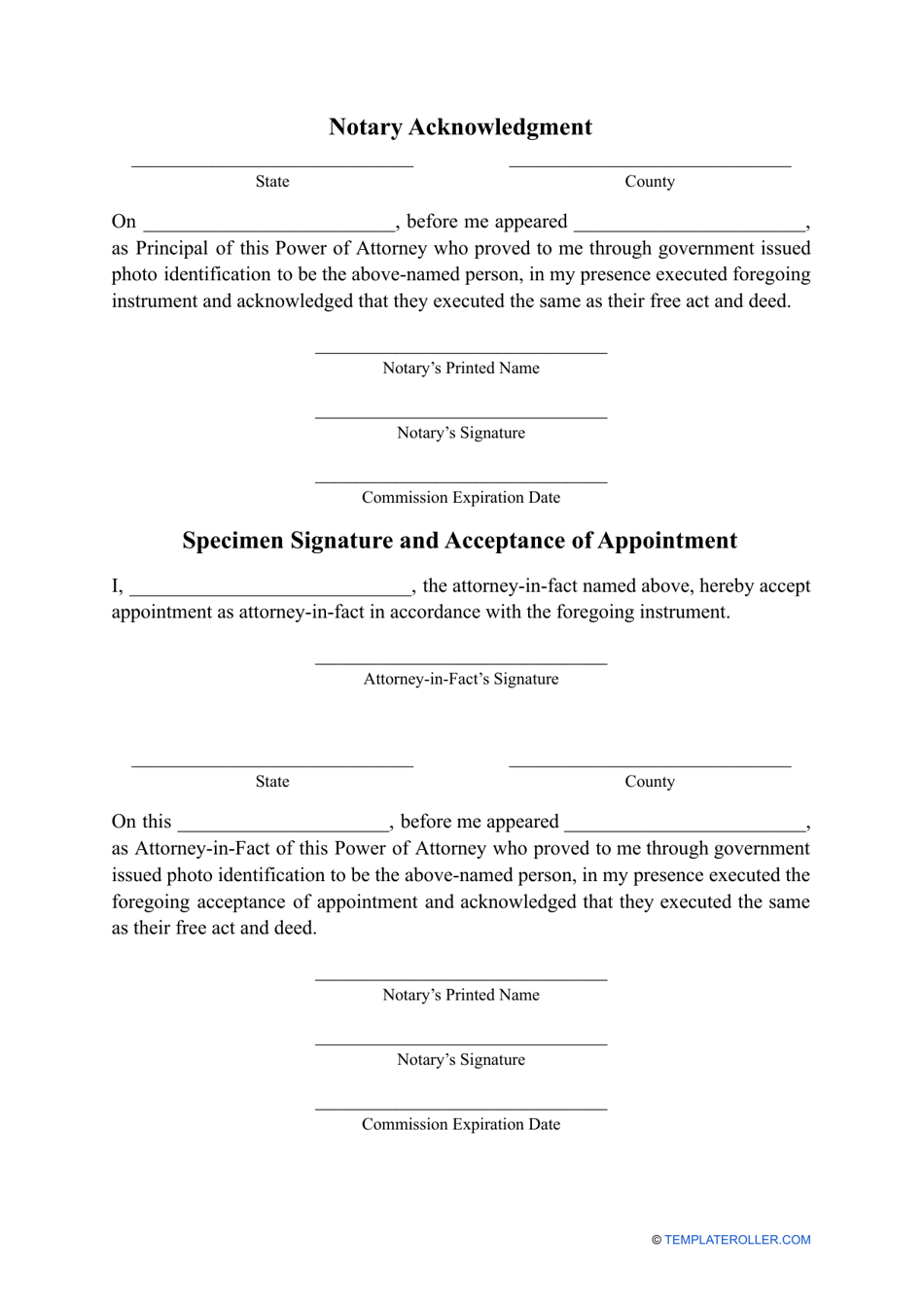

In New York, the Financial Power of Attorney form is typically filed by the person granting the power of attorney, known as the principal. The form is not typically filed with any specific government agency, but it must be signed and notarized.

FAQ

Q: What is a financial power of attorney?

A: A financial power of attorney is a legal document that gives someone else the authority to make financial decisions on your behalf.

Q: Why would I need a financial power of attorney?

A: You may need a financial power of attorney if you become unable to manage your own financial affairs due to illness, disability, or other circumstances.

Q: What can the person I appoint as my agent do with a financial power of attorney?

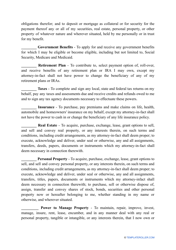

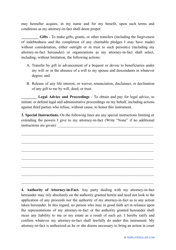

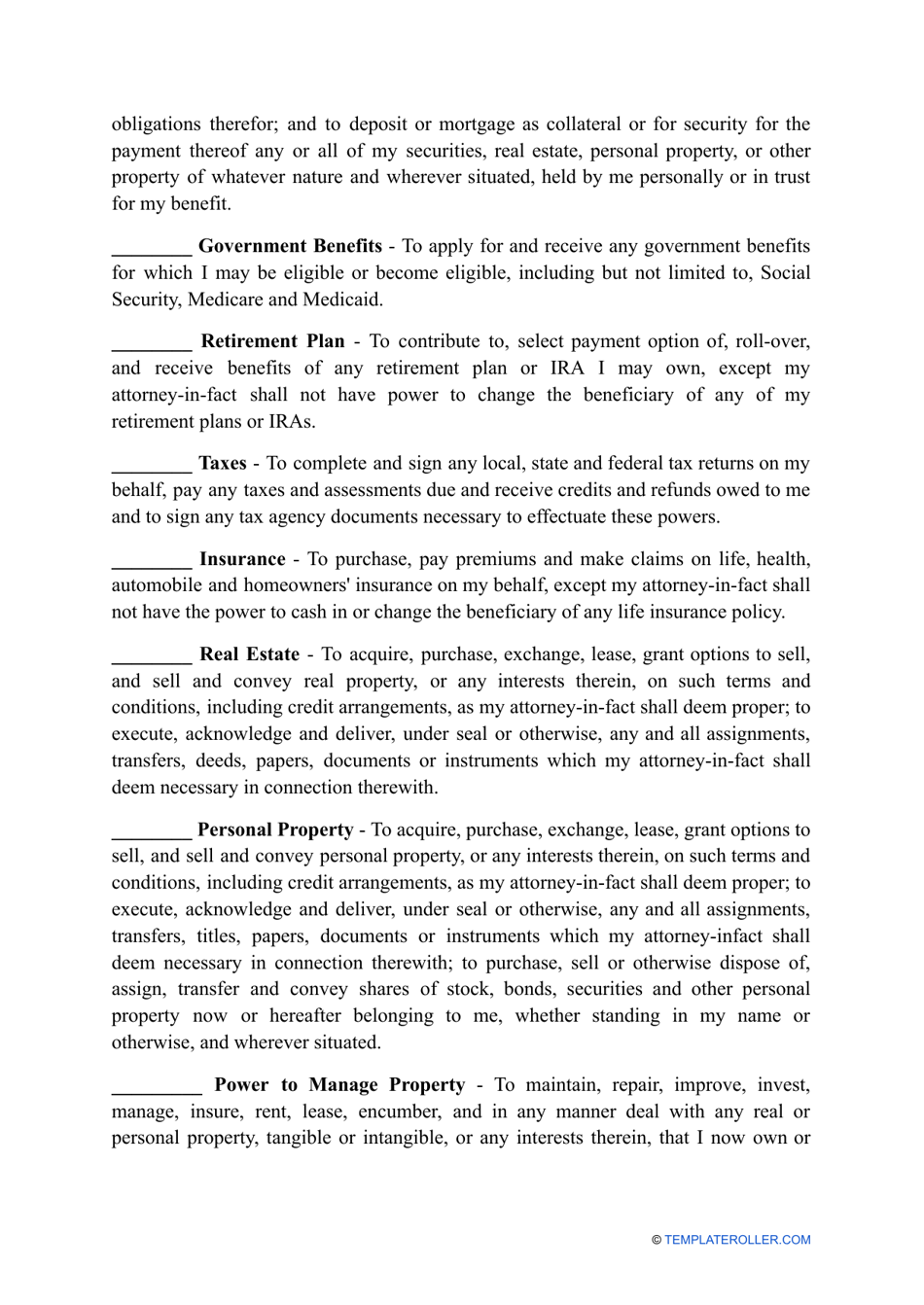

A: The person you appoint as your agent can manage your bank accounts, pay bills, make investment decisions, and handle other financial matters on your behalf.

Q: Can I limit the authority of my agent in a financial power of attorney?

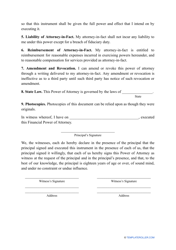

A: Yes, you can include specific instructions or limitations in the financial power of attorney document to restrict the authority of your agent.

Q: When does a financial power of attorney go into effect?

A: A financial power of attorney can either take effect immediately upon signing or can be designed to become effective only if you become incapacitated.

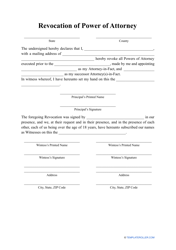

Q: Can I revoke a financial power of attorney?

A: Yes, you can revoke a financial power of attorney at any time, as long as you are still mentally competent.

Q: Do I need a lawyer to create a financial power of attorney?

A: While it is not required by law, it is advisable to consult with a lawyer when creating a financial power of attorney to ensure it meets all legal requirements.