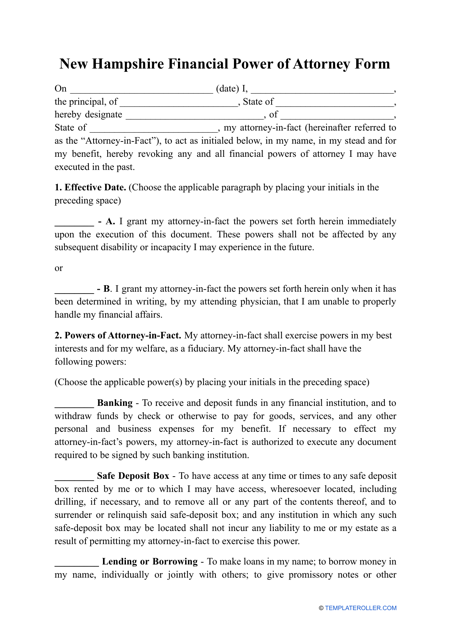

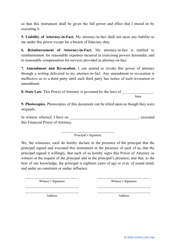

Financial Power of Attorney Form - New Hampshire

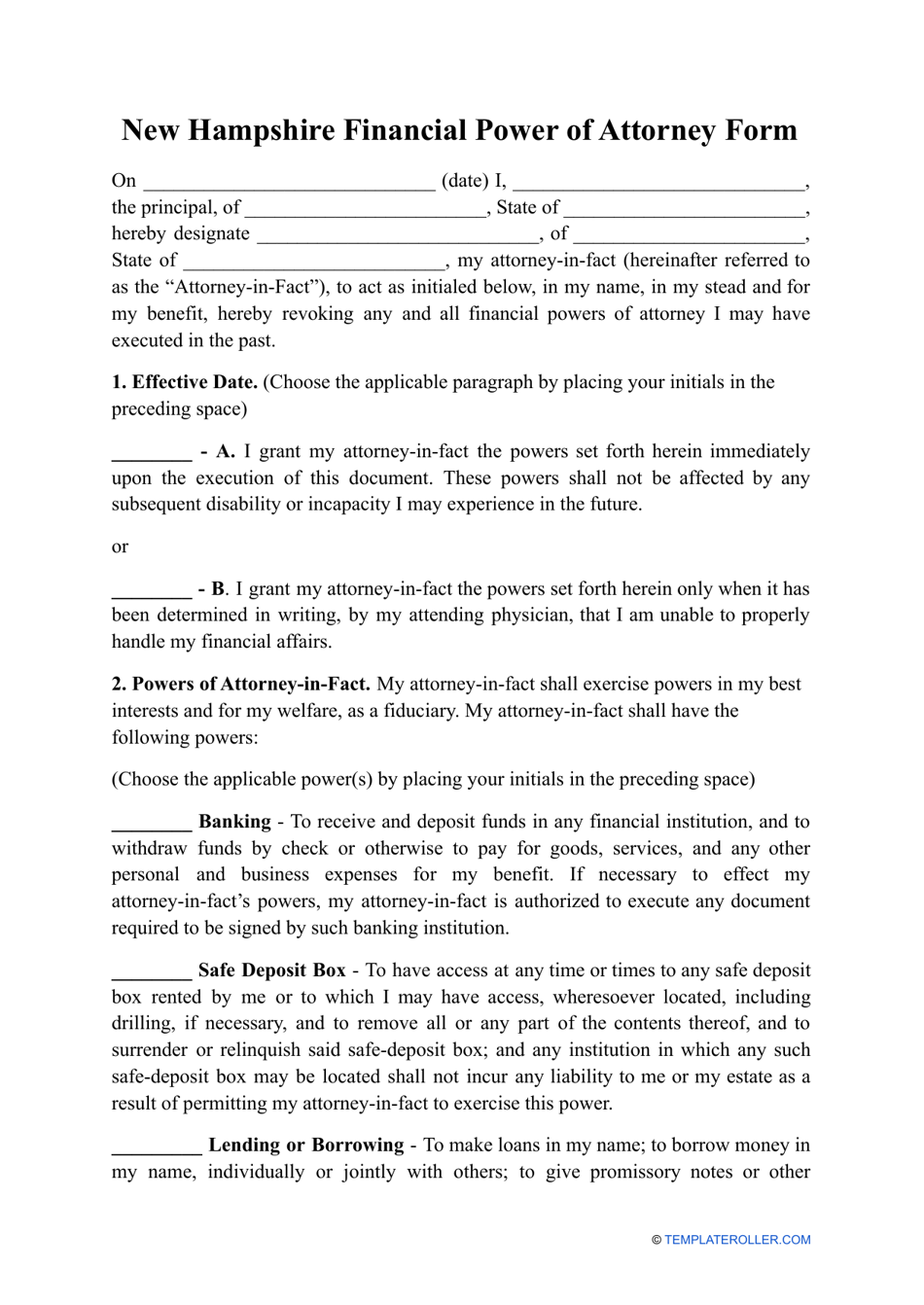

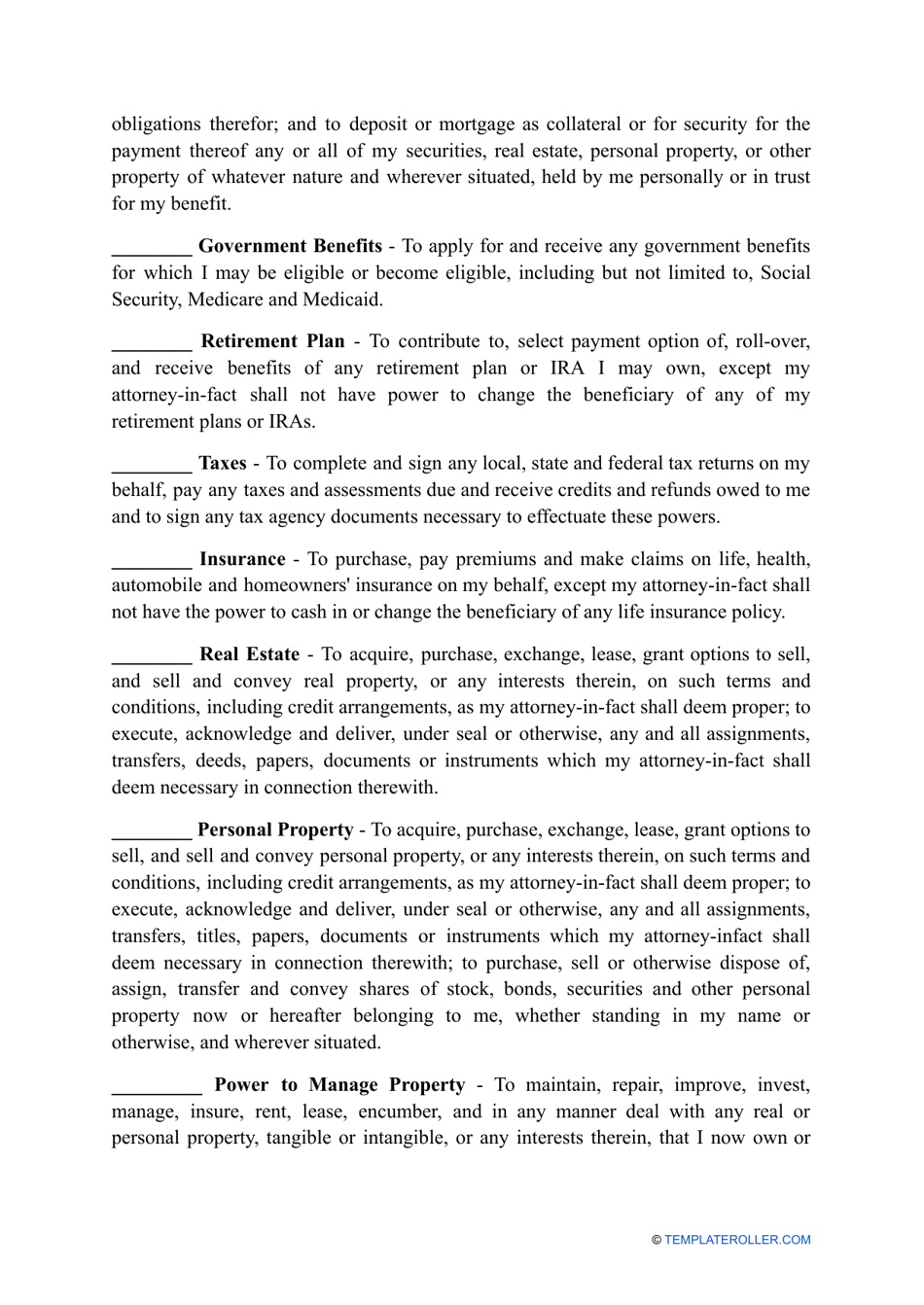

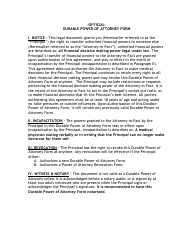

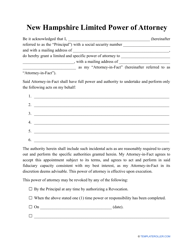

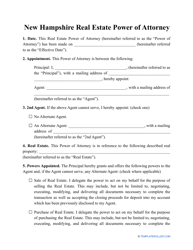

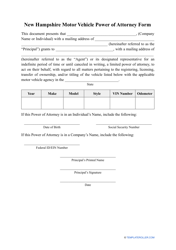

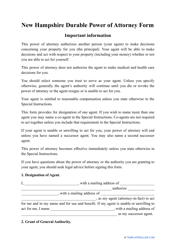

The Financial Power of Attorney Form in New Hampshire is a legal document that allows someone to appoint another person, called the "agent," to make financial decisions and manage their financial affairs on their behalf. This form is typically used when an individual becomes unable to handle their finances due to illness, disability, or absence. The agent will have the authority to pay bills, manage investments, and handle any other financial matters specified in the form.

In New Hampshire, the person appointing someone to act as their financial power of attorney files the form.

FAQ

Q: What is a Financial Power of Attorney Form?

A: A Financial Power of Attorney Form is a legal document that allows someone (the "principal") to grant another person (the "agent" or "attorney-in-fact") the authority to make financial decisions and actions on their behalf.

Q: Why would I need a Financial Power of Attorney Form?

A: You may need a Financial Power of Attorney Form if you want to ensure that someone you trust can manage your financial affairs if you become unable to do so yourself due to illness, disability, or other circumstances.

Q: Is a Financial Power of Attorney Form valid in New Hampshire?

A: Yes, a Financial Power of Attorney Form is valid in New Hampshire as long as it meets the requirements set forth by state law. It is advisable to consult with an attorney to ensure that your form is legally binding.

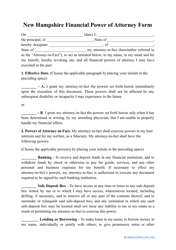

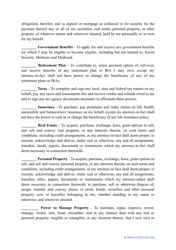

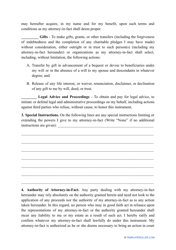

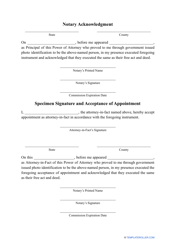

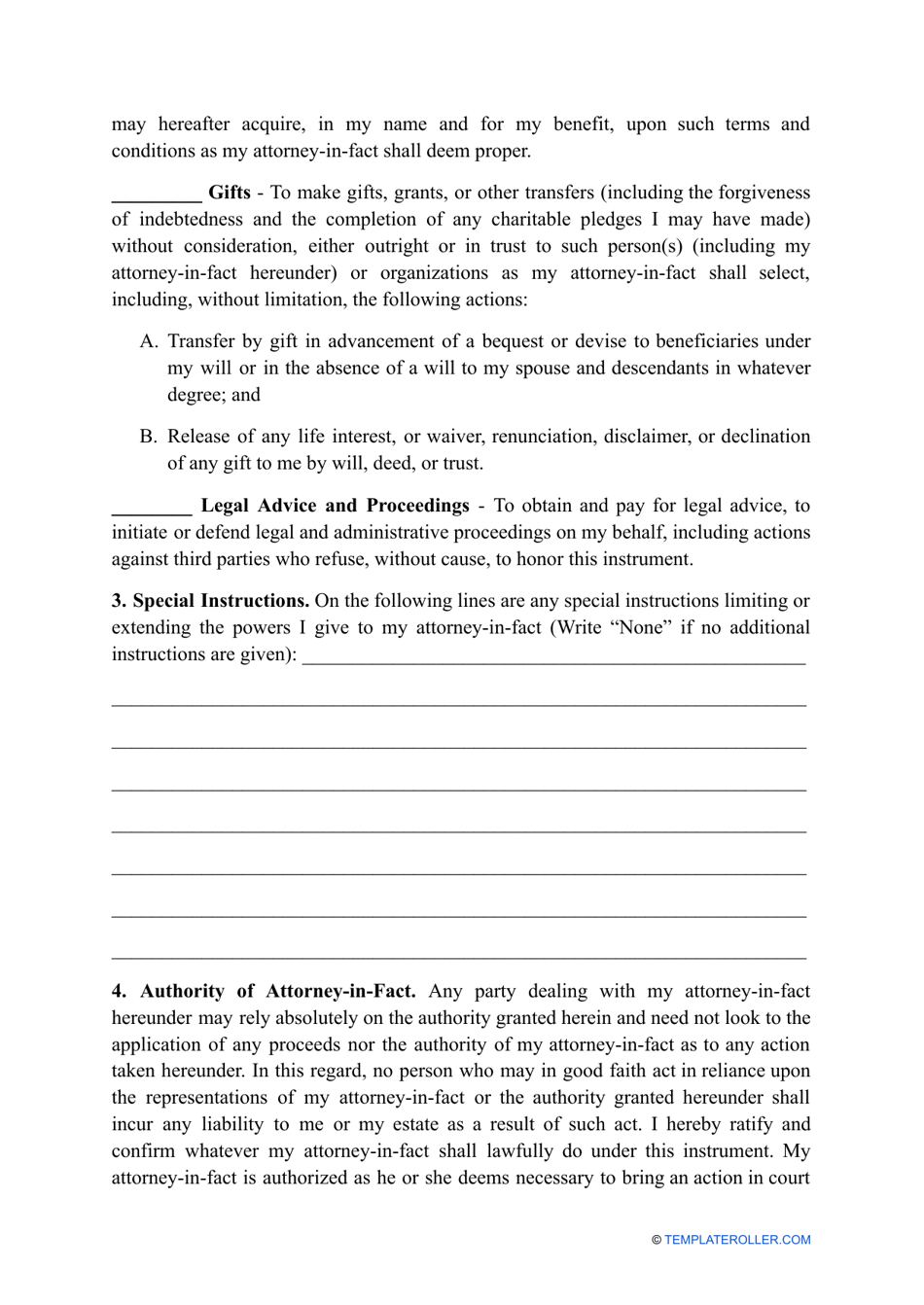

Q: What powers can I grant in a Financial Power of Attorney Form?

A: You can grant various powers to your agent in a Financial Power of Attorney Form, such as managing bank accounts, paying bills, buying or selling property, filing taxes, and making investment decisions.

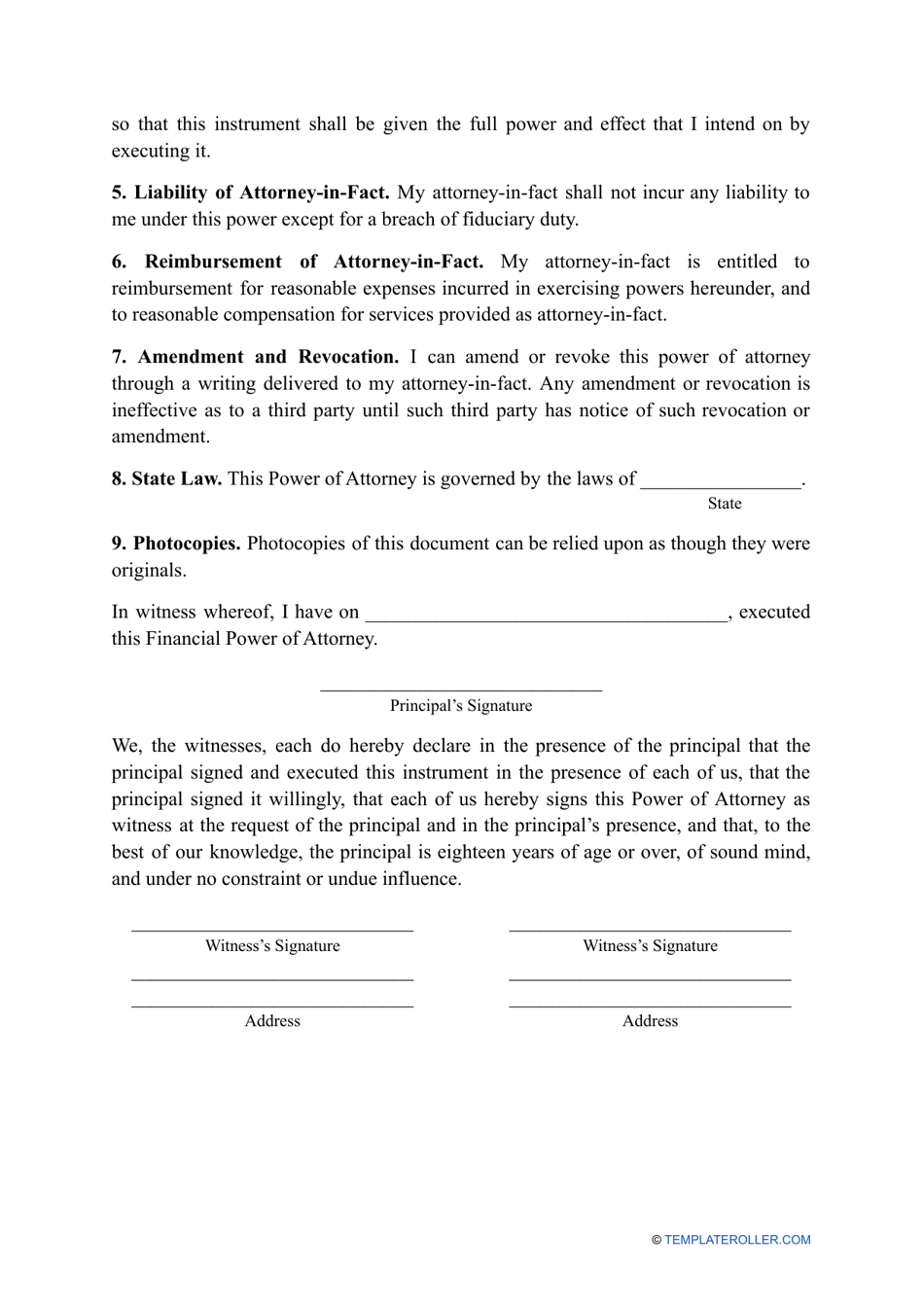

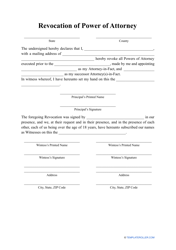

Q: Can I revoke a Financial Power of Attorney Form?

A: Yes, you can revoke a Financial Power of Attorney Form at any time, as long as you are mentally competent to do so. It is recommended to notify your agent and any relevant institutions in writing.

Q: Do I need a lawyer to create a Financial Power of Attorney Form?

A: While it is not required to have a lawyer, it is highly recommended to consult with an attorney to ensure that your form meets all legal requirements and addresses your specific needs.

Q: Can I have multiple agents in a Financial Power of Attorney Form?

A: Yes, you can appoint multiple agents in a Financial Power of Attorney Form. You can specify whether they can act jointly (together) or severally (independently) when making decisions on your behalf.

Q: When does a Financial Power of Attorney Form become effective?

A: A Financial Power of Attorney Form can become effective immediately upon signing, or it can specify a future date or triggering event upon which it becomes effective.

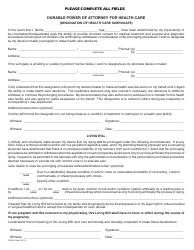

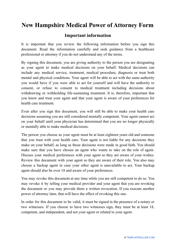

Q: Can a Financial Power of Attorney Form be used for healthcare decisions?

A: No, a Financial Power of Attorney Form specifically grants authority over financial matters. If you want to grant someone the power to make healthcare decisions on your behalf, you would need a separate document called a Healthcare Power of Attorney or Advance Directive.