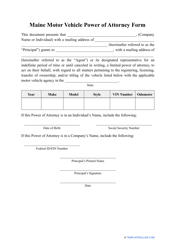

Financial Power of Attorney Form - Maine

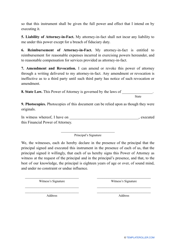

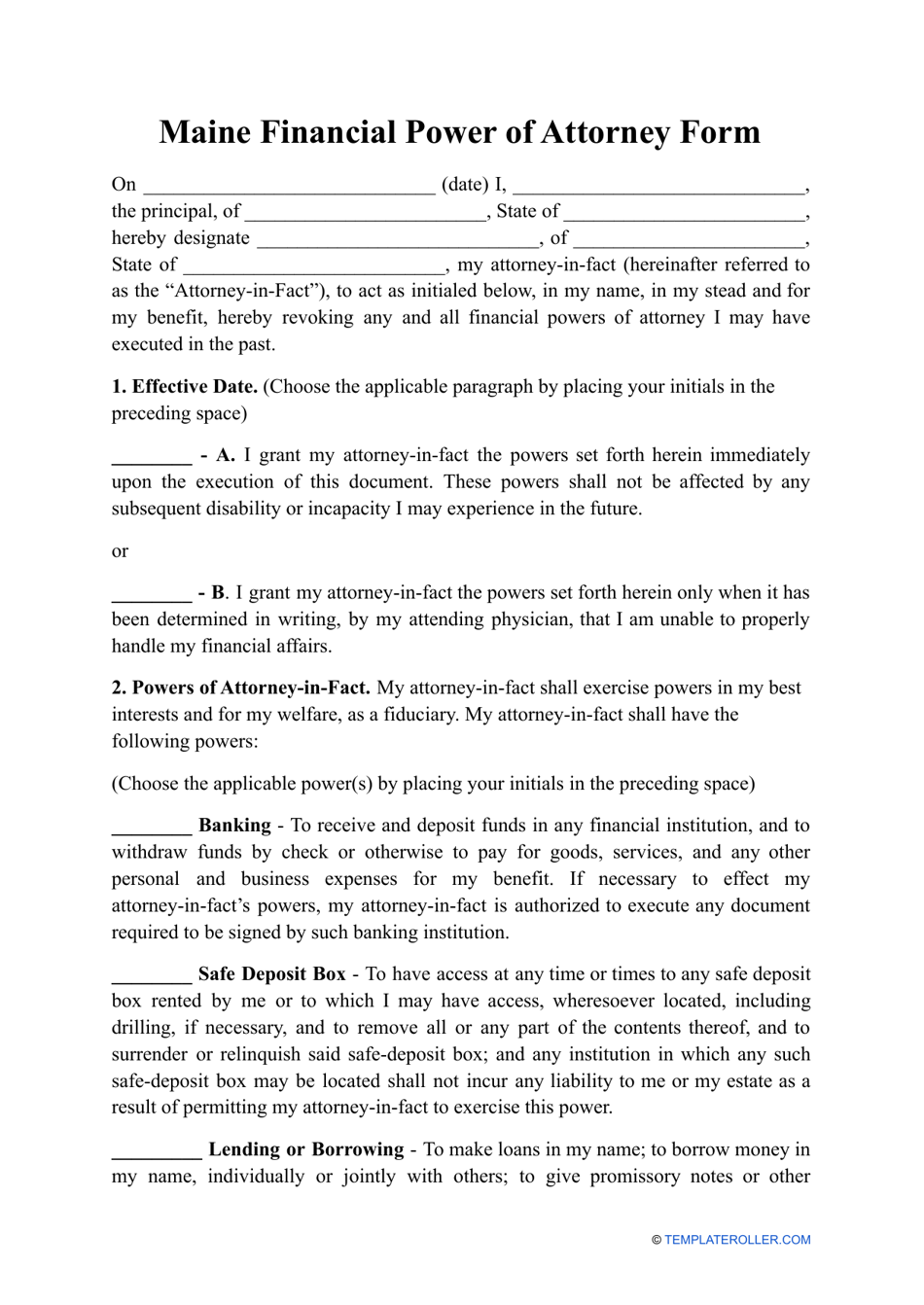

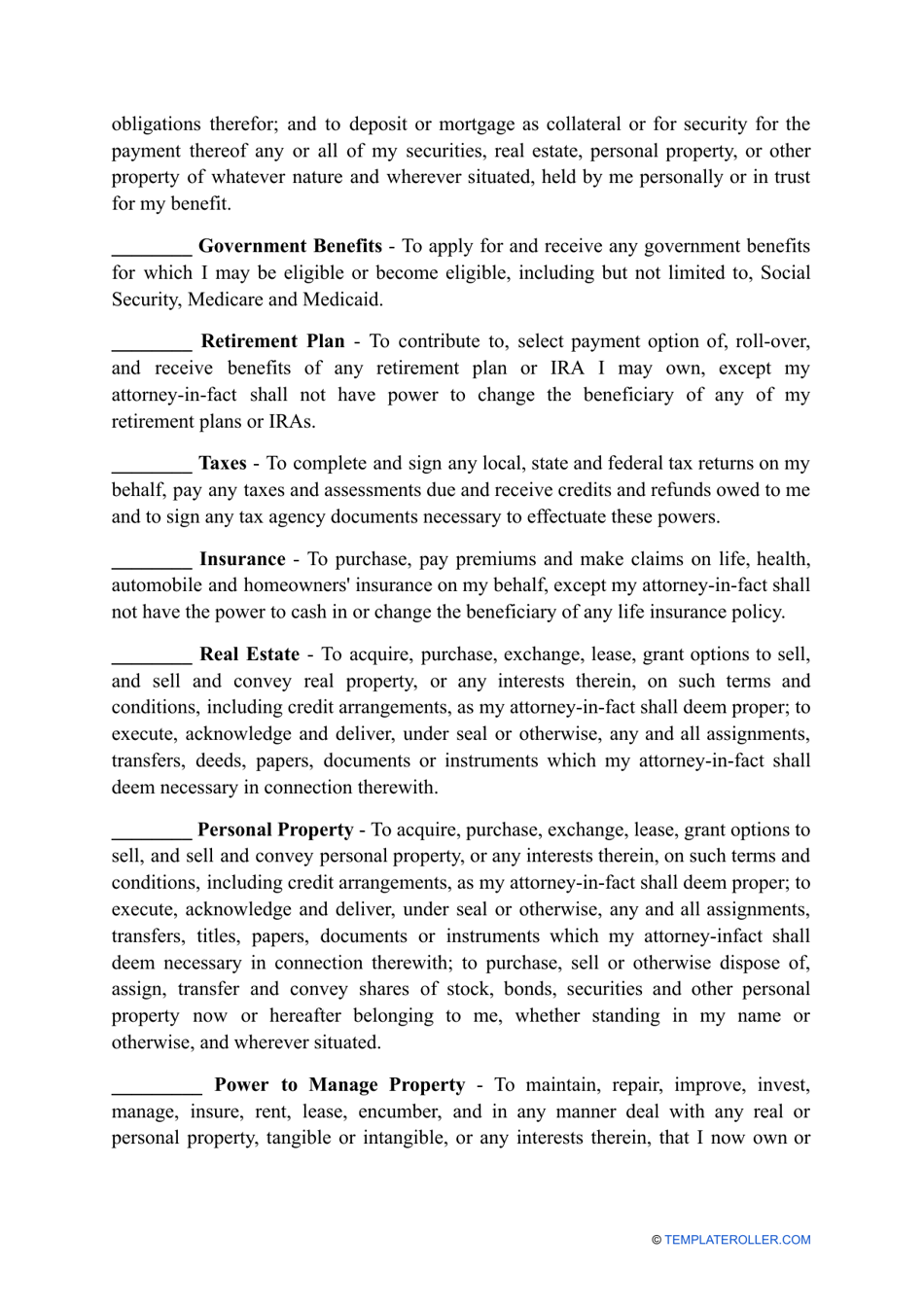

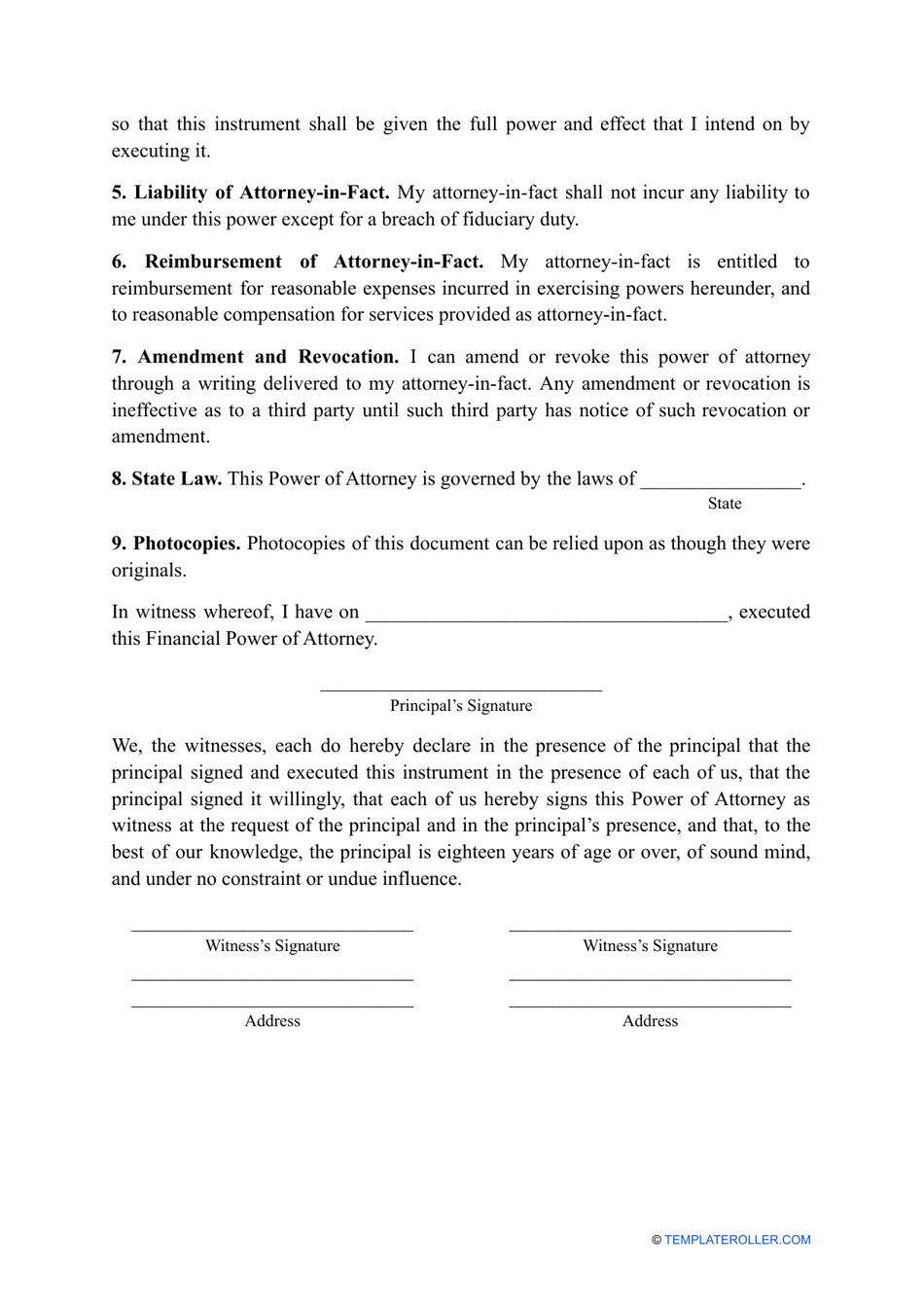

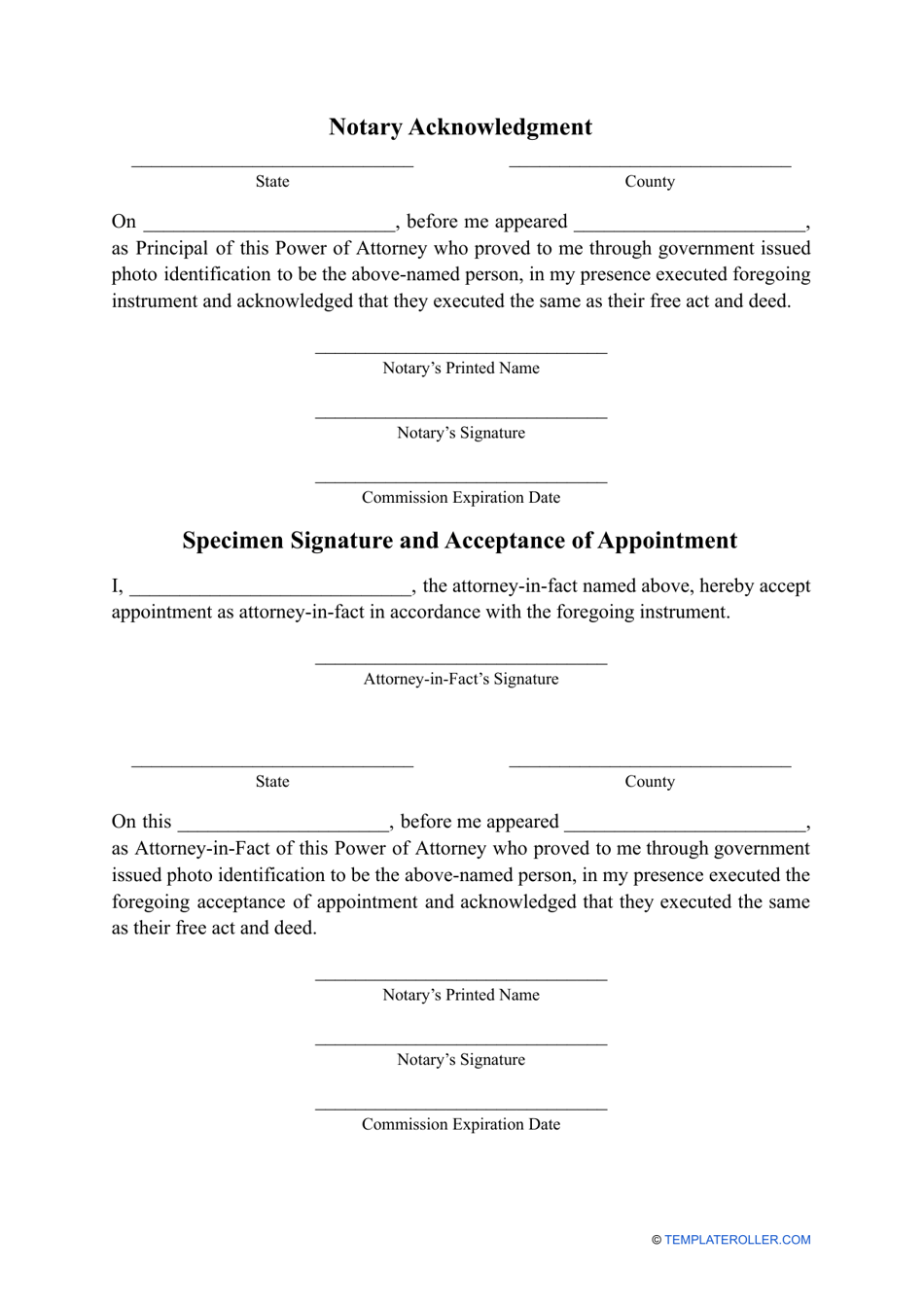

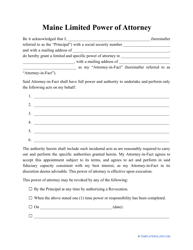

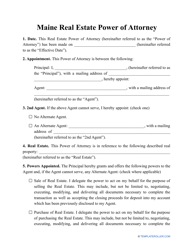

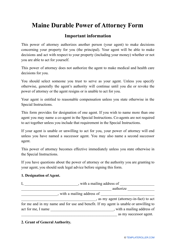

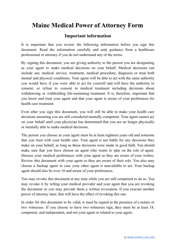

The Financial Power of Attorney Form in Maine is a legal document that allows someone (known as the "principal") to appoint another person (known as the "agent" or "attorney-in-fact") to handle their financial matters and make decisions on their behalf. This can include managing bank accounts, paying bills, filing taxes, and making other financial transactions.

In Maine, the Financial Power of Attorney form is typically filed by the individual who wants to grant someone else the authority to act on their behalf in financial matters.

FAQ

Q: What is a Financial Power of Attorney form?

A: A Financial Power of Attorney form is a legal document that allows someone to make financial decisions on your behalf.

Q: Why would I need a Financial Power of Attorney form?

A: You may need a Financial Power of Attorney form if you become unable to manage your financial affairs due to illness, disability, or absence.

Q: Who can I appoint as my agent in a Financial Power of Attorney form?

A: You can appoint any adult, trusted individual to be your agent in a Financial Power of Attorney form.

Q: Can I still make financial decisions if I have a Financial Power of Attorney?

A: Yes, you can still make financial decisions if you have a Financial Power of Attorney, unless you have specifically stated otherwise in the form.

Q: When does a Financial Power of Attorney form become effective?

A: A Financial Power of Attorney form can become effective immediately upon signing or can be a springing power of attorney, which becomes effective only upon a certain event or condition.

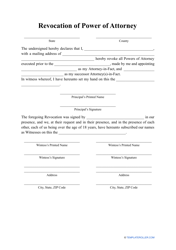

Q: Can I revoke a Financial Power of Attorney?

A: Yes, you can revoke a Financial Power of Attorney by signing a revocation form and delivering it to your agent and other interested parties.

Q: Is a Financial Power of Attorney form valid in other states?

A: A Financial Power of Attorney form may be valid in other states, but it's always recommended to consult an attorney to ensure compliance with the laws of the specific state.