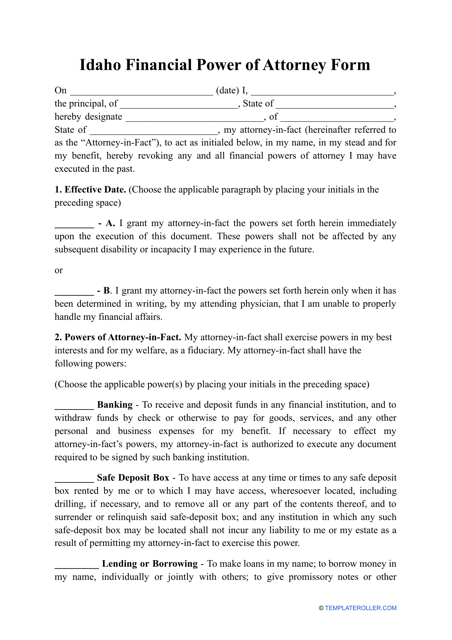

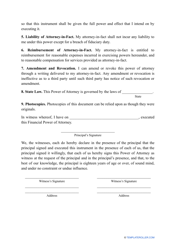

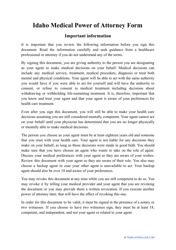

Financial Power of Attorney Form - Idaho

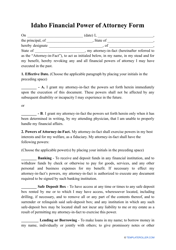

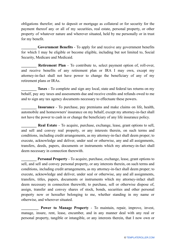

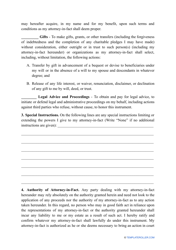

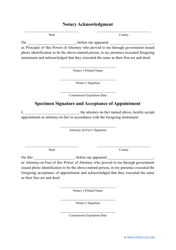

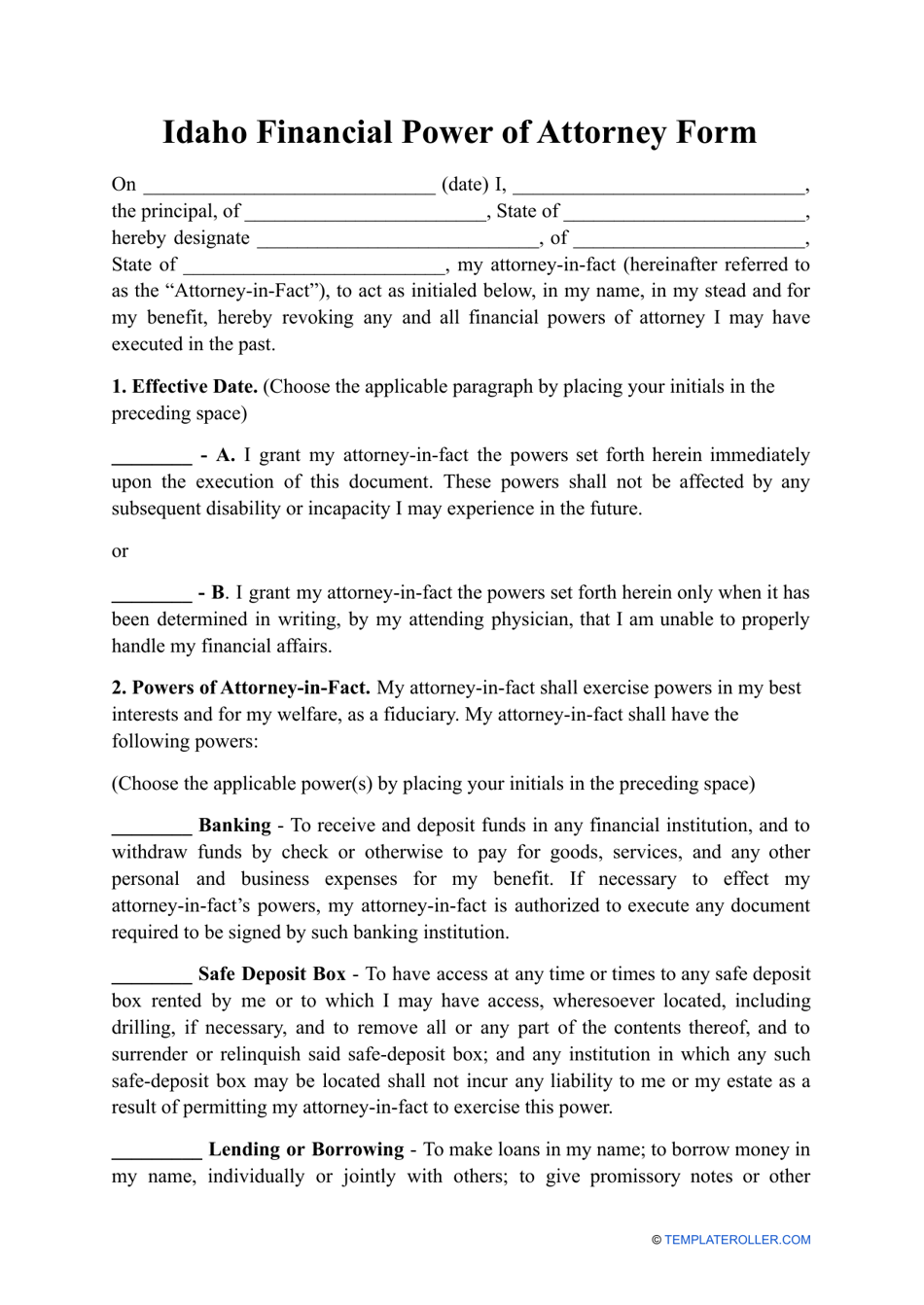

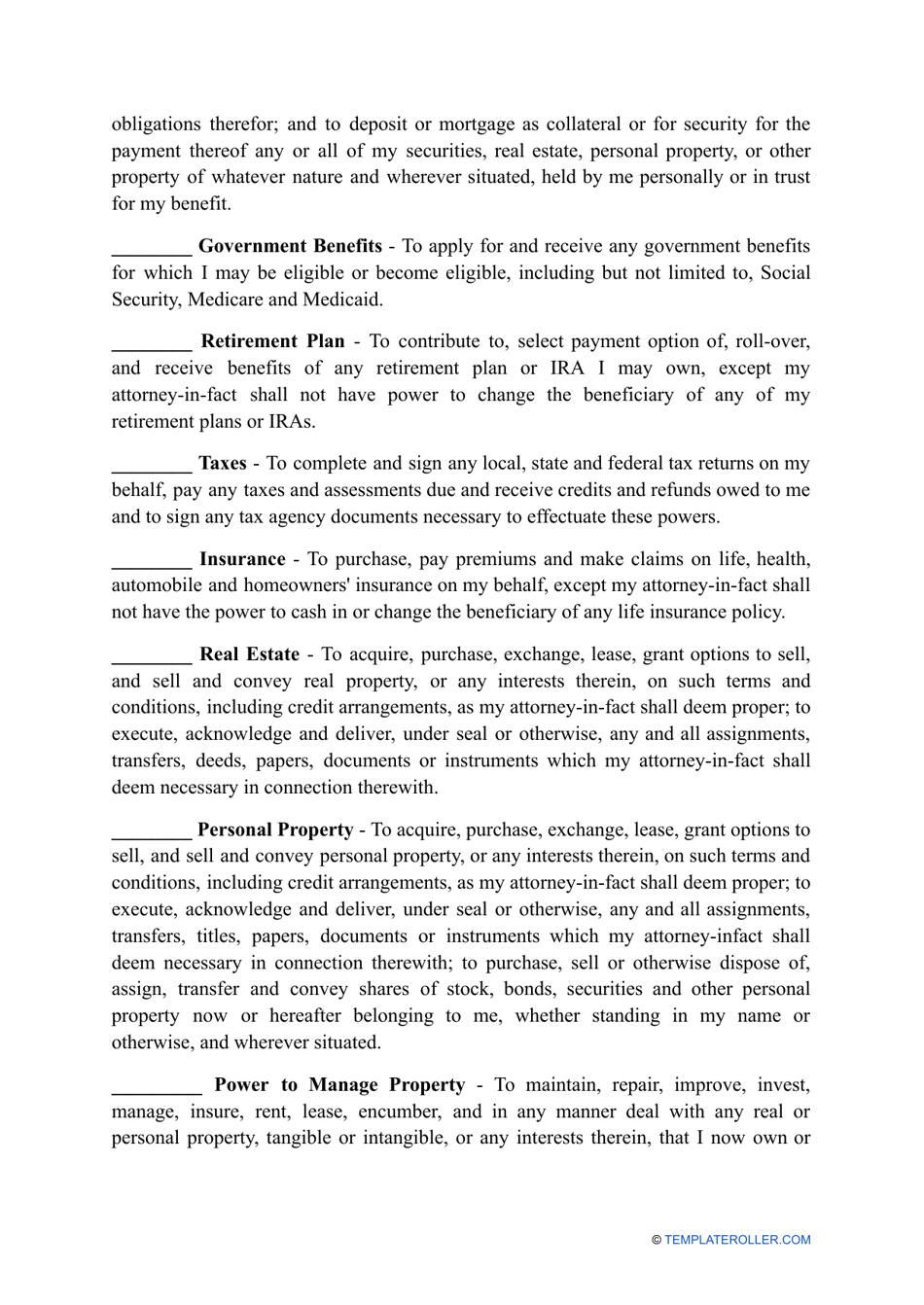

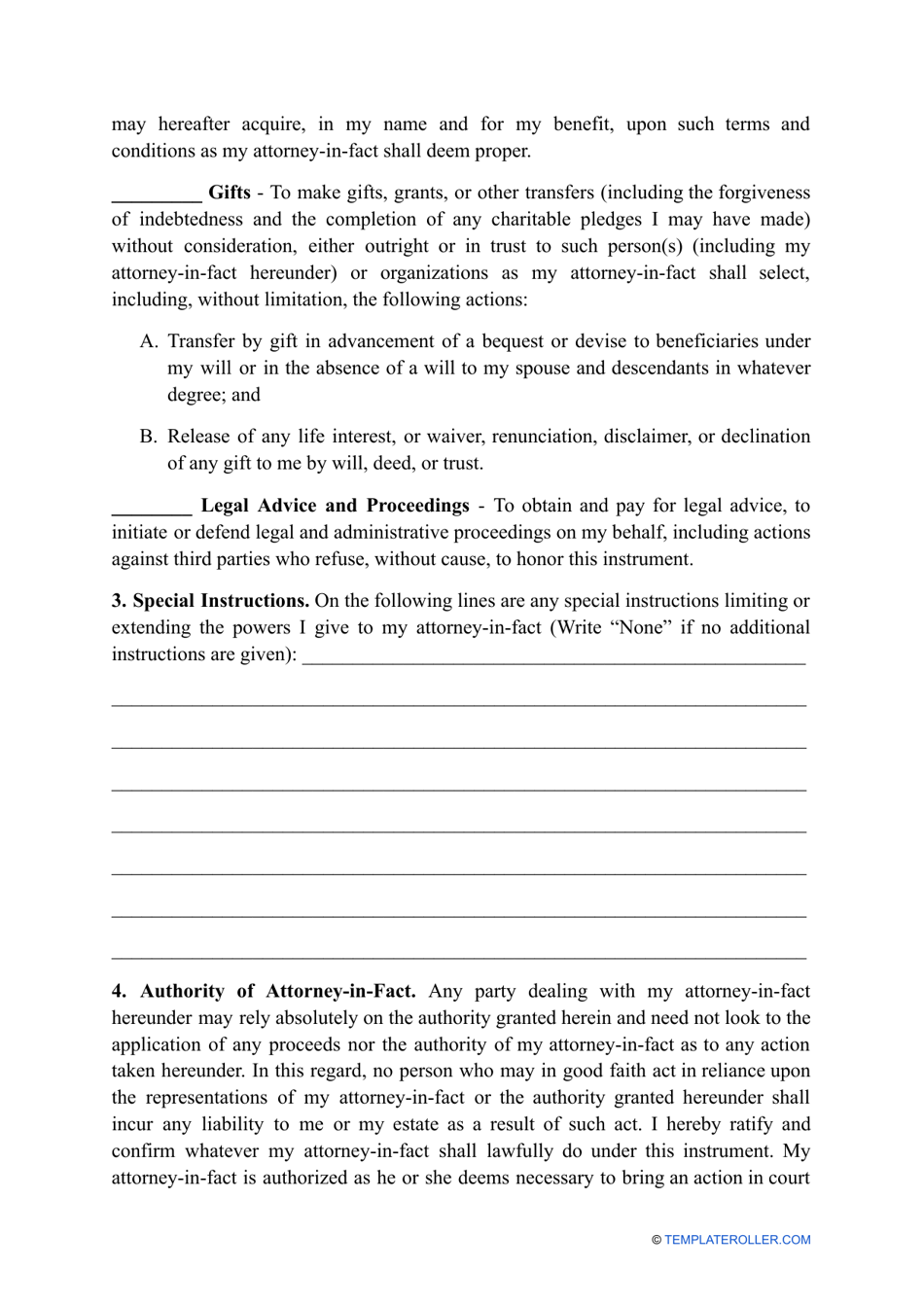

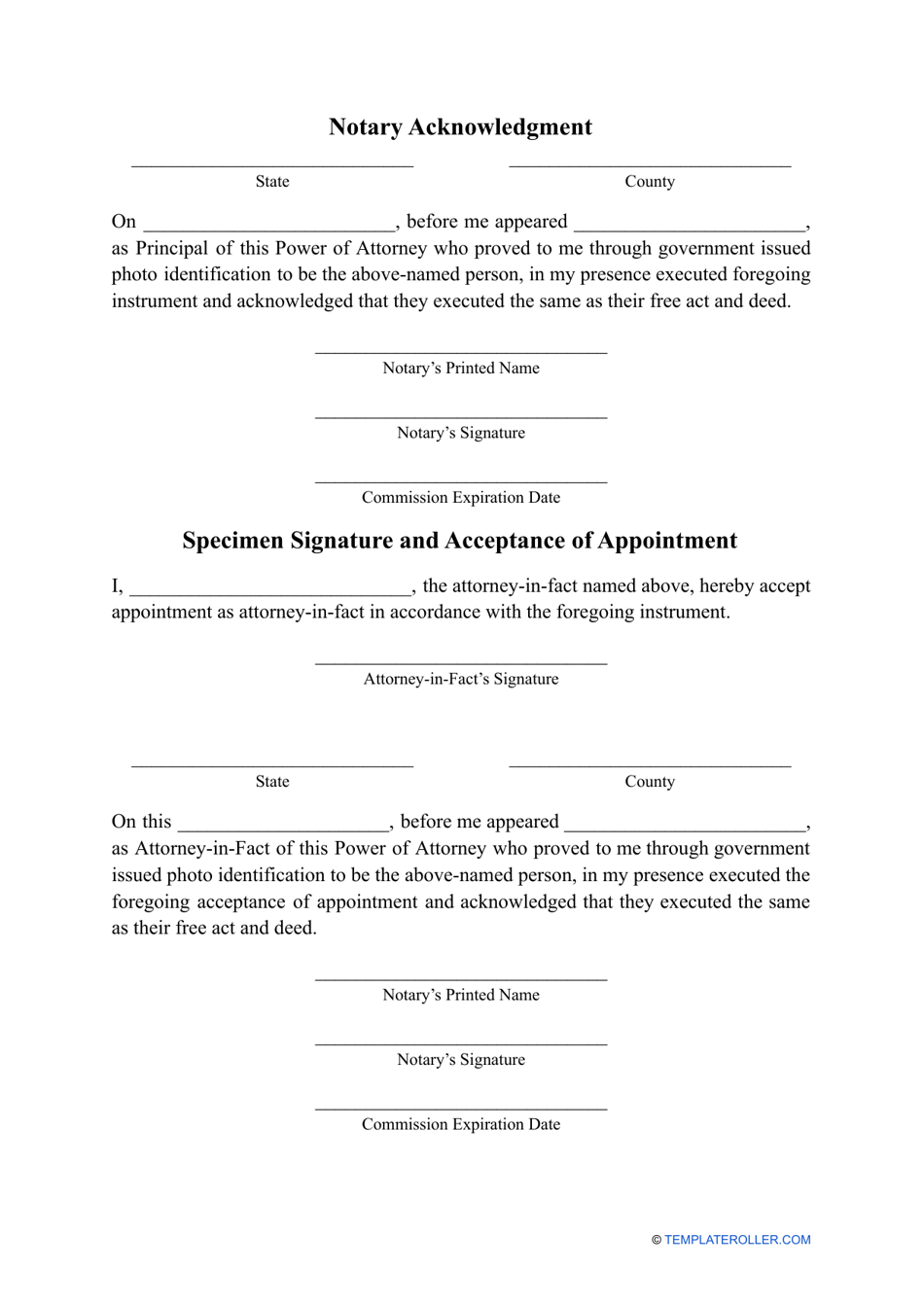

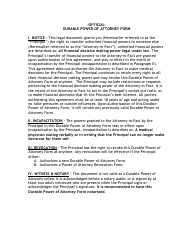

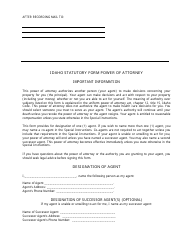

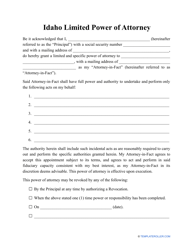

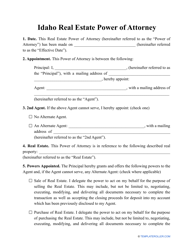

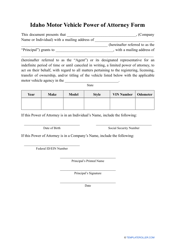

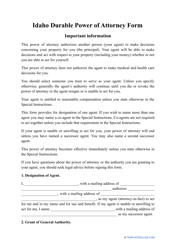

The Financial Power of Attorney Form in Idaho is a legal document that allows someone to appoint another person (an agent or attorney-in-fact) to make financial decisions on their behalf. This can include managing bank accounts, paying bills, and making investment decisions. It is typically used when the person granting the power (the principal) is unable to manage their own finances due to illness, travel, or other reasons.

The Financial Power of Attorney Form in Idaho is typically filed by the person granting the power, known as the "principal."

FAQ

Q: What is a Financial Power of Attorney?

A: A Financial Power of Attorney is a legal document that allows someone to make financial decisions on behalf of another person.

Q: Why would someone need a Financial Power of Attorney?

A: Someone may need a Financial Power of Attorney if they become incapacitated and are unable to manage their own financial affairs.

Q: Who can be appointed as the agent in a Financial Power of Attorney?

A: Any individual over the age of 18 can be appointed as the agent in a Financial Power of Attorney.

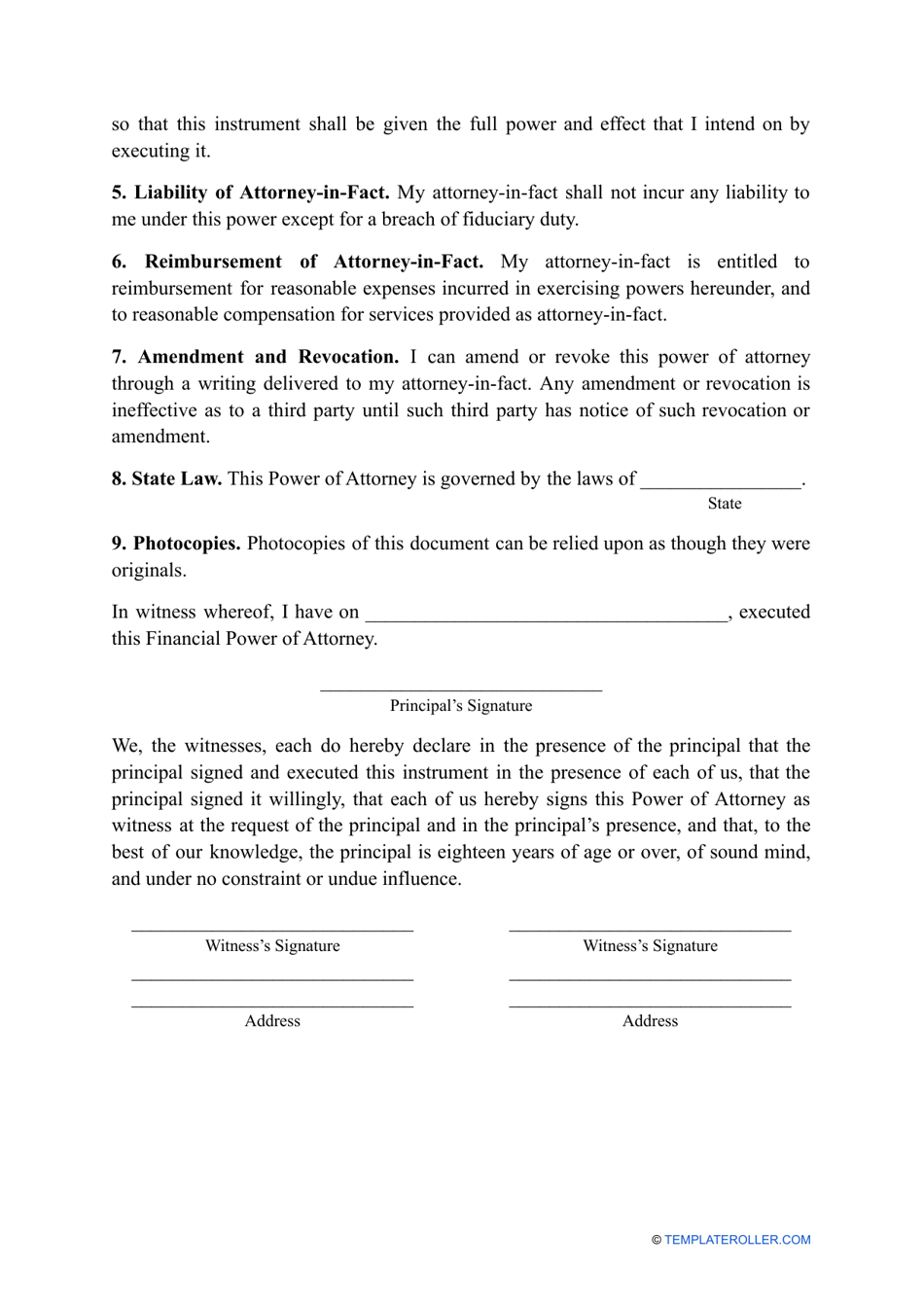

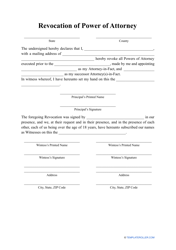

Q: Can a Financial Power of Attorney be revoked?

A: Yes, a Financial Power of Attorney can be revoked at any time as long as the person who created it is still mentally competent.

Q: Do I need a lawyer to create a Financial Power of Attorney?

A: While it is not required to have a lawyer, it is recommended to consult with one to ensure the document is properly executed and meets all legal requirements.

Q: Is a Financial Power of Attorney valid across state lines?

A: Yes, a Financial Power of Attorney is generally valid across state lines, but it's always a good idea to consult with a lawyer to ensure compliance with specific state laws.

Q: What happens if I do not have a Financial Power of Attorney and become incapacitated?

A: If you do not have a Financial Power of Attorney and become incapacitated, the court may appoint a guardian or conservator to manage your financial affairs.

Q: What are the responsibilities of the agent in a Financial Power of Attorney?

A: The agent in a Financial Power of Attorney has a fiduciary duty to act in the best interest of the person who granted the power, manage their financial affairs, and keep detailed records of all transactions.

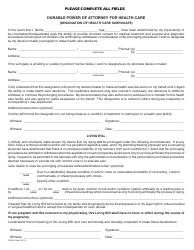

Q: Can a Financial Power of Attorney be used to make medical decisions?

A: No, a Financial Power of Attorney specifically deals with financial matters. For medical decision-making, a separate Healthcare Power of Attorney is needed.

Q: Can a Financial Power of Attorney be used after the death of the person who granted it?

A: No, a Financial Power of Attorney becomes void upon the death of the person who granted it.