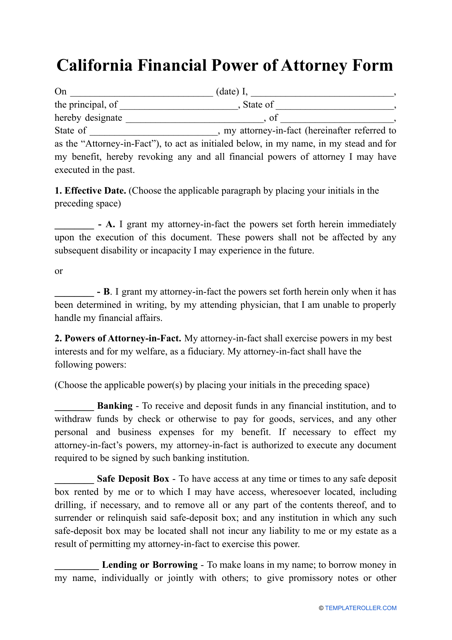

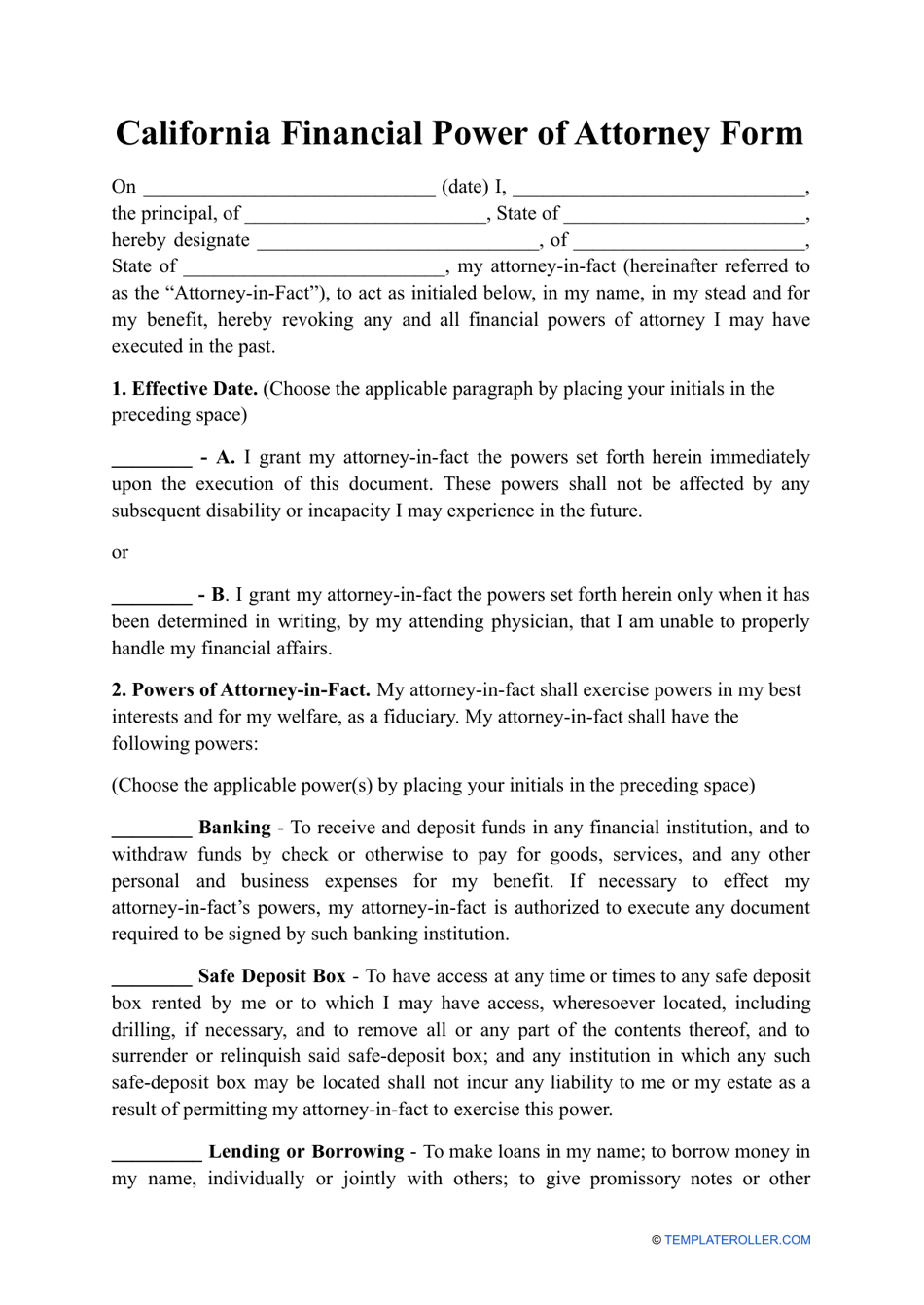

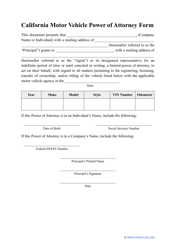

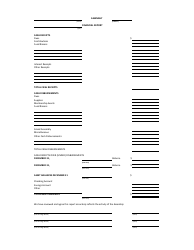

Financial Power of Attorney Form - California

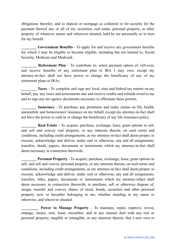

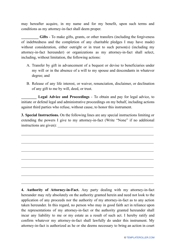

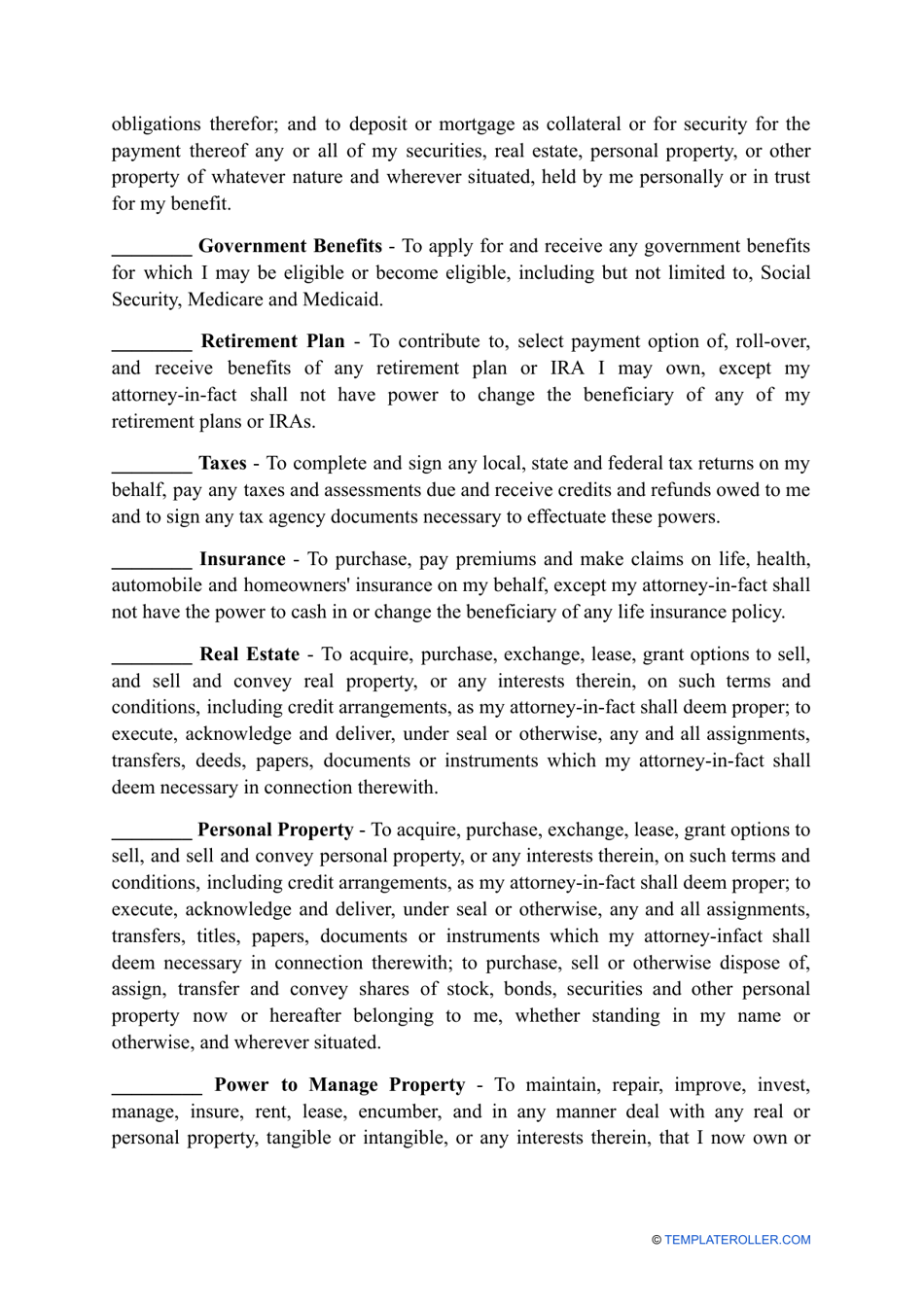

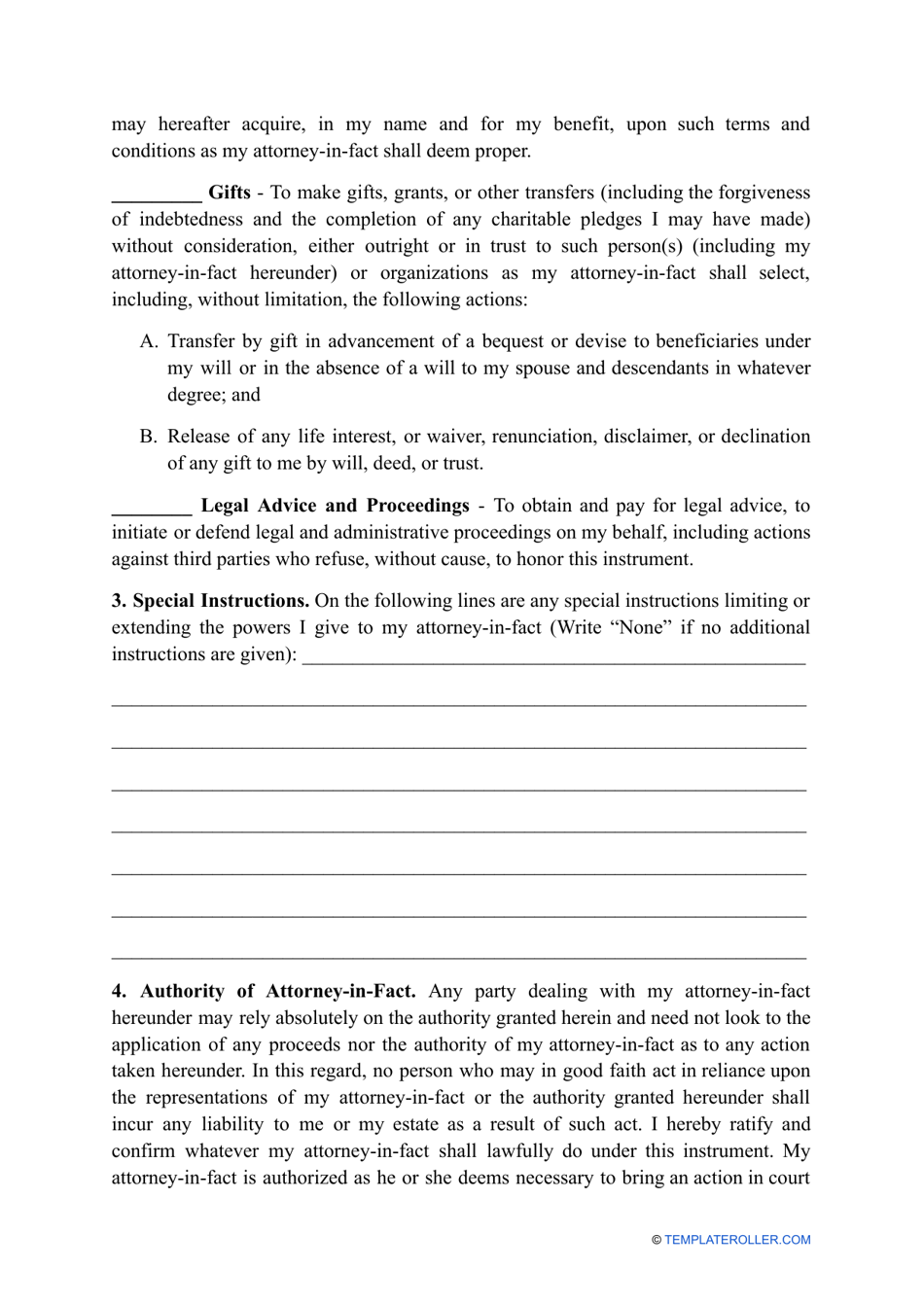

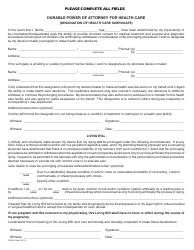

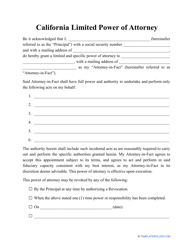

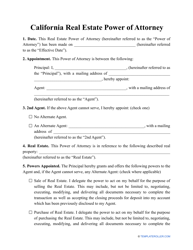

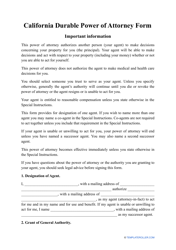

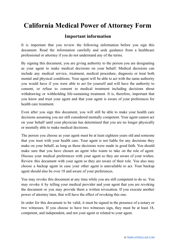

The Financial Power of Attorney Form in California allows you to designate someone to make financial decisions on your behalf if you are unable to do so. This person, known as the agent, will have the authority to handle your financial matters, such as managing bank accounts, paying bills, and making investment decisions.

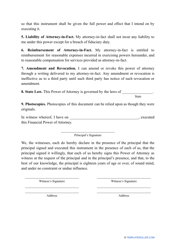

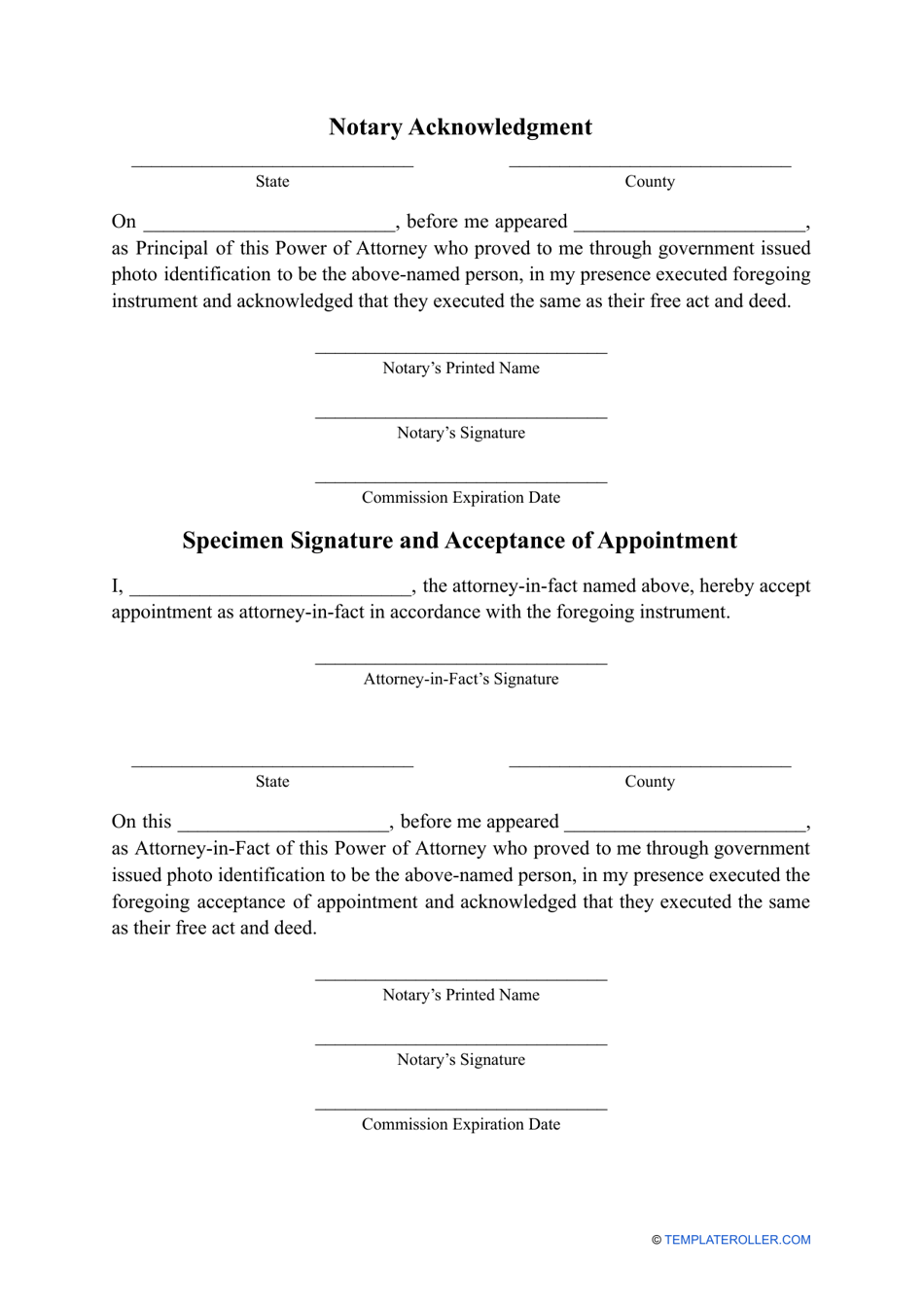

The Financial Power of Attorney form in California is typically filed by the person granting the power (also known as the principal).

FAQ

Q: What is a Financial Power of Attorney?

A: A Financial Power of Attorney is a legal document that allows you to appoint someone to make financial decisions on your behalf.

Q: Why would I need a Financial Power of Attorney?

A: You may need a Financial Power of Attorney if you become incapacitated and are unable to make financial decisions for yourself.

Q: Who can I appoint as my attorney-in-fact?

A: You can appoint any trustworthy adult as your attorney-in-fact, such as a family member or close friend.

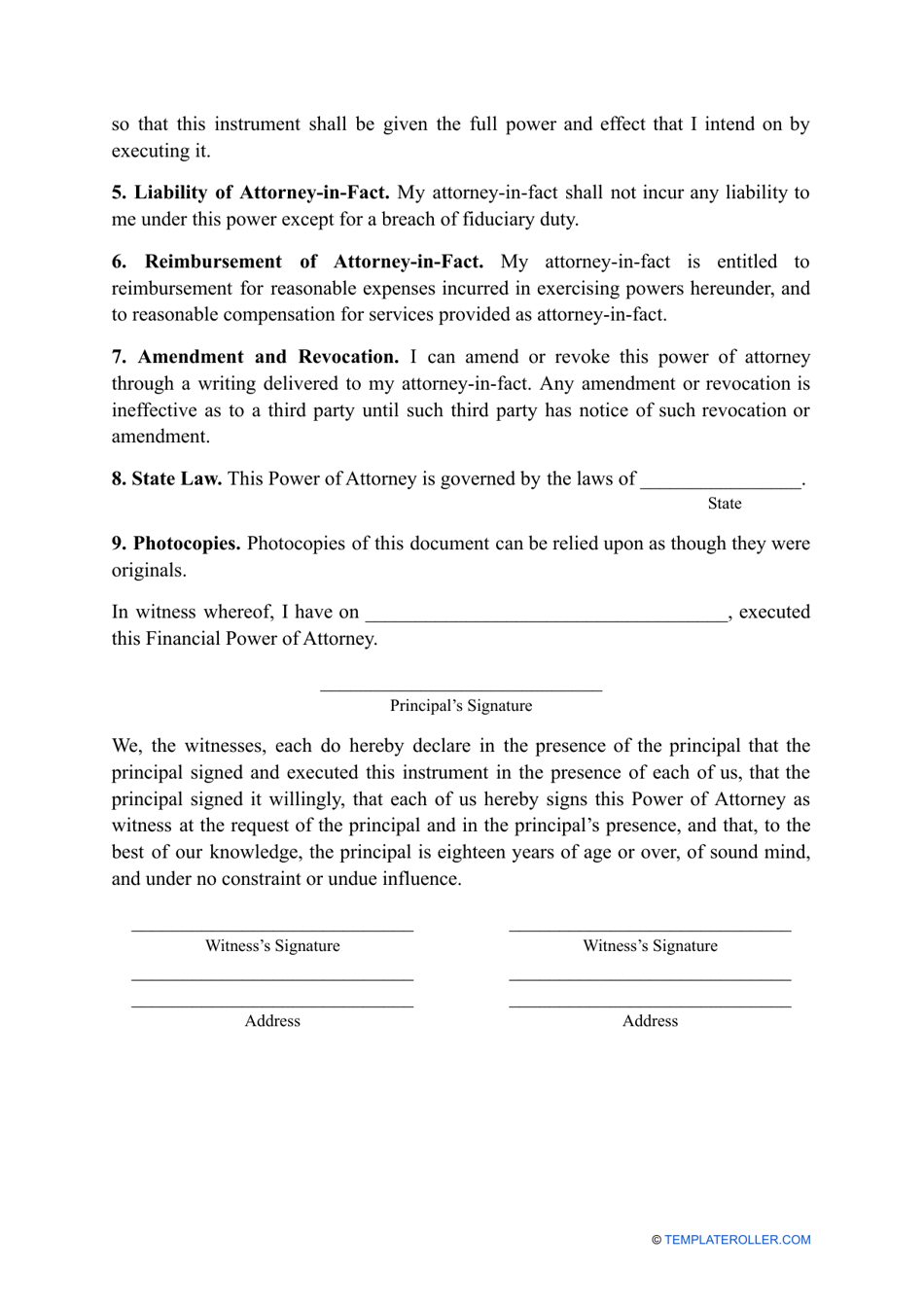

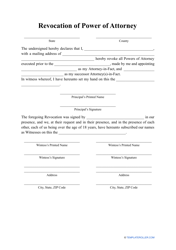

Q: Can I revoke a Financial Power of Attorney?

A: Yes, you can revoke a Financial Power of Attorney at any time, as long as you are mentally capable of making that decision.

Q: Do I need a lawyer to create a Financial Power of Attorney?

A: While it is not required to have a lawyer, it is recommended to consult with an attorney to ensure that your document is legally valid and meets your specific needs.

Q: Are there different types of Financial Power of Attorney?

A: Yes, there are different types of Financial Power of Attorney, such as limited or durable power of attorney, depending on your specific requirements.