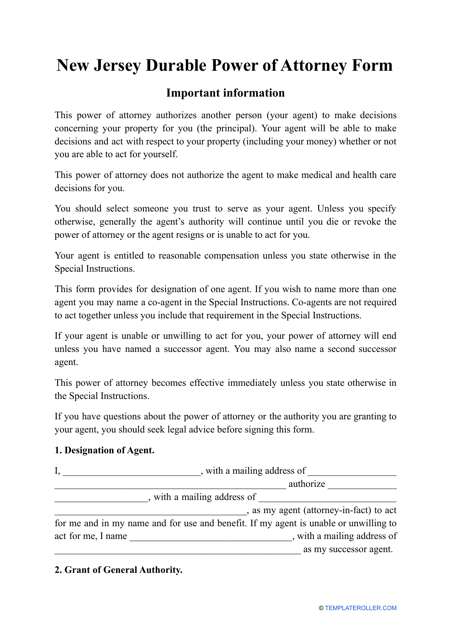

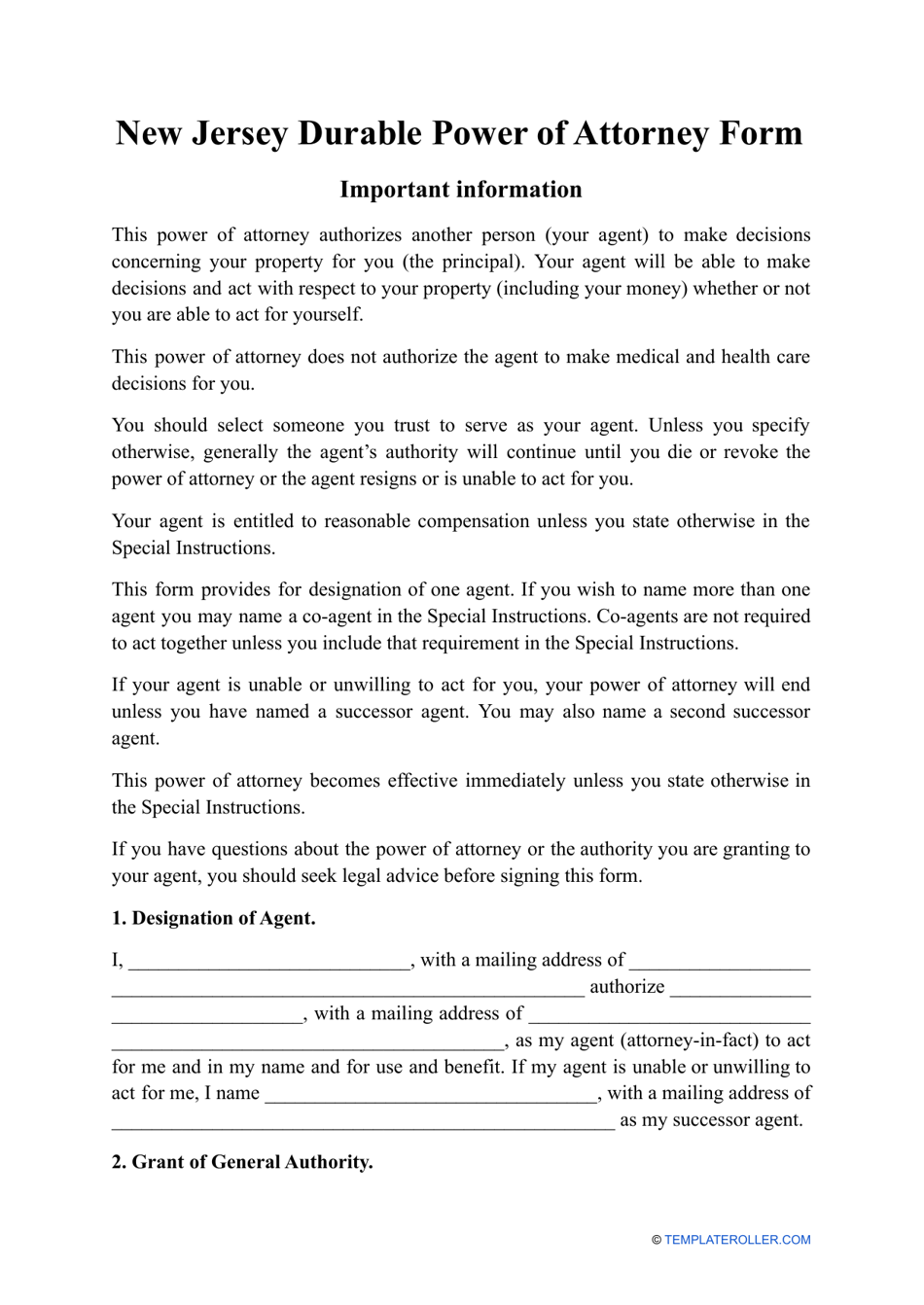

Durable Power of Attorney Form - New Jersey

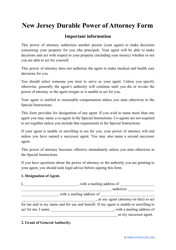

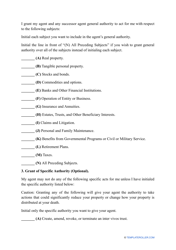

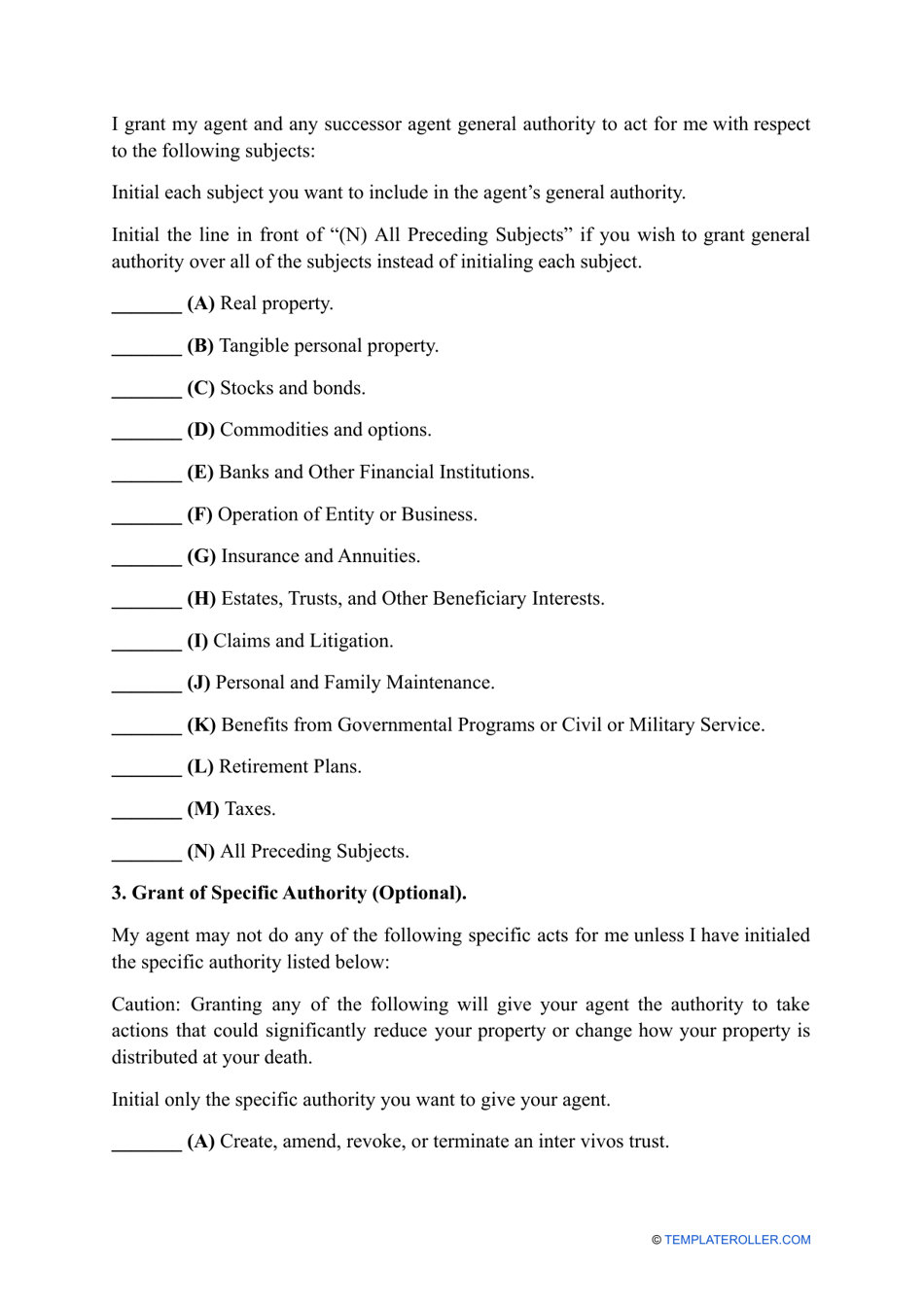

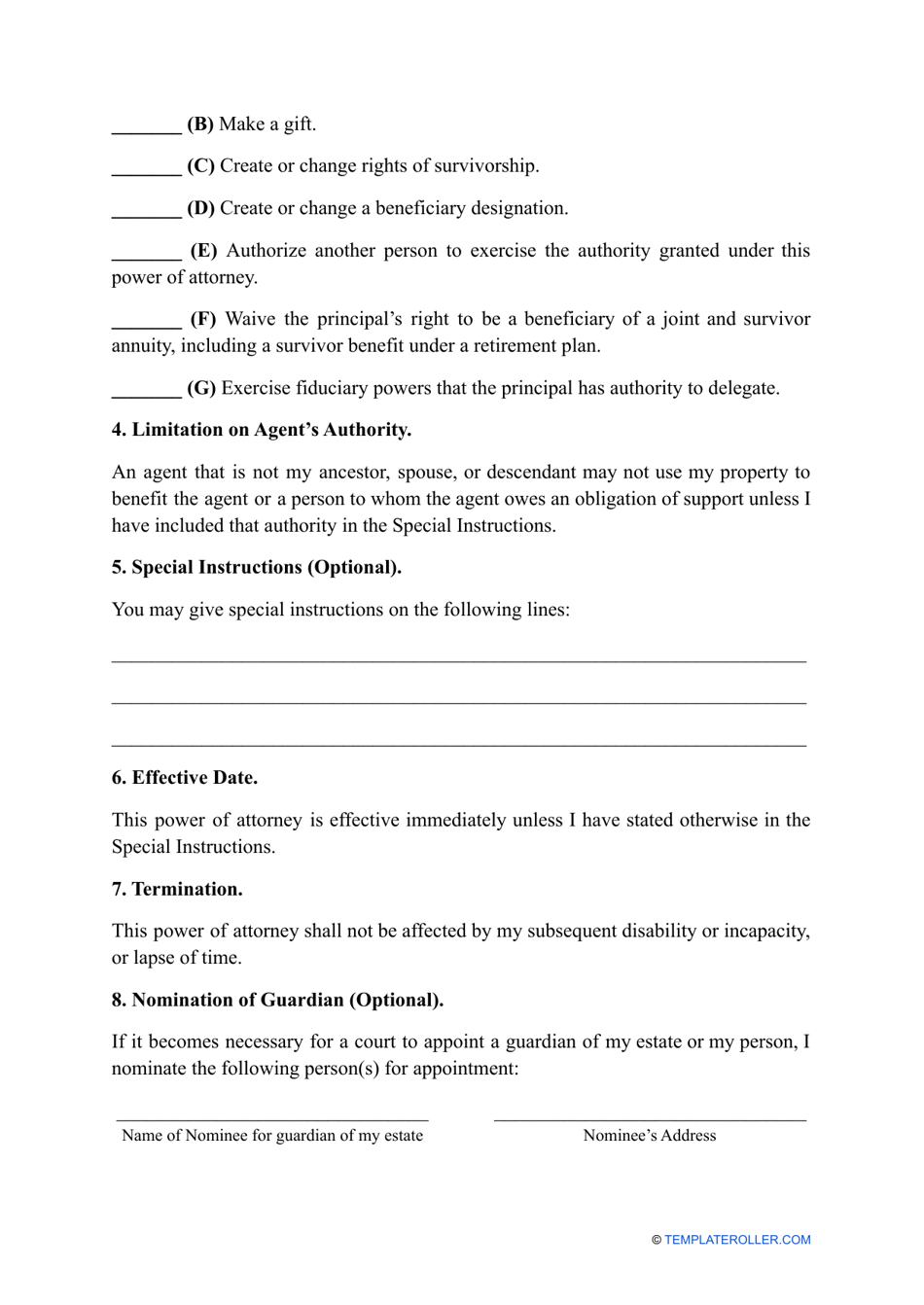

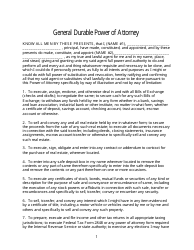

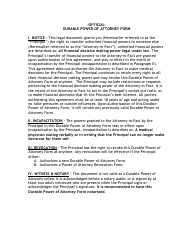

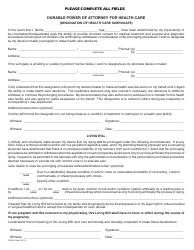

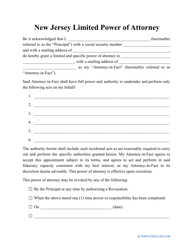

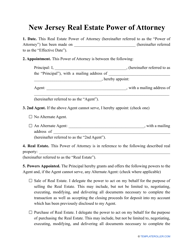

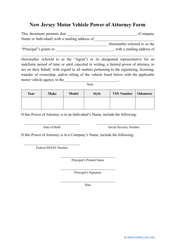

The Durable Power of Attorney Form in New Jersey allows you to legally appoint someone to make financial and legal decisions on your behalf if you become incapacitated or unable to make decisions yourself. It grants them the authority to handle matters such as financial transactions, real estate transactions, and managing your assets.

In New Jersey, the person filling out the Durable Power of Attorney form is known as the "Principal." This form is typically filled out by the Principal themselves.

FAQ

Q: What is a durable power of attorney form?

A: A durable power of attorney form is a legal document that allows someone (the agent) to act on behalf of another person (the principal) in financial and legal matters.

Q: Why would someone need a durable power of attorney form?

A: A durable power of attorney form is useful when someone becomes incapacitated or unable to make decisions on their own. It allows their chosen agent to manage their affairs and make decisions on their behalf.

Q: What can a durable power of attorney do?

A: A durable power of attorney can handle various tasks, including managing bank accounts, paying bills, making investment decisions, and selling property, among other financial and legal matters.

Q: Who can act as an agent in a durable power of attorney?

A: The agent can be a trusted family member, friend, or a professional such as an attorney or financial advisor. It is important to choose someone responsible and capable of handling the responsibilities.

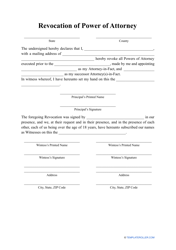

Q: Is a durable power of attorney valid after the principal's death?

A: No, the authority of the agent under a durable power of attorney ends upon the death of the principal. After the principal's death, a different legal process, such as probate, may be necessary to handle their affairs.