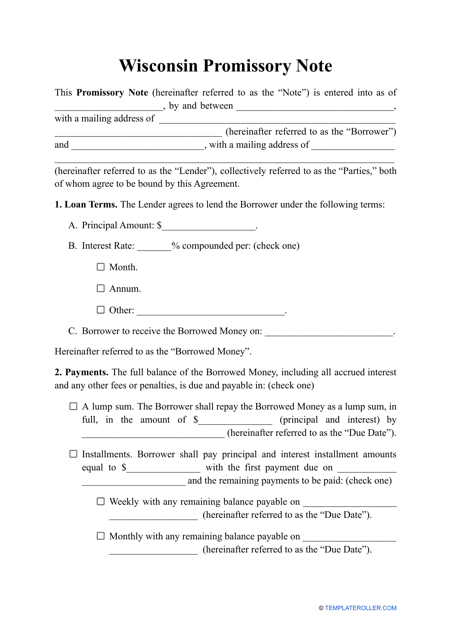

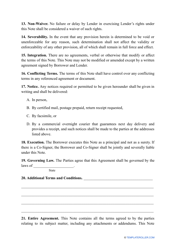

Promissory Note Template - Wisconsin

A Promissory Note Template - Wisconsin is a document that outlines a written promise by a borrower to repay a specific amount of money to a lender. It is used in Wisconsin for various loan transactions between individuals or businesses.

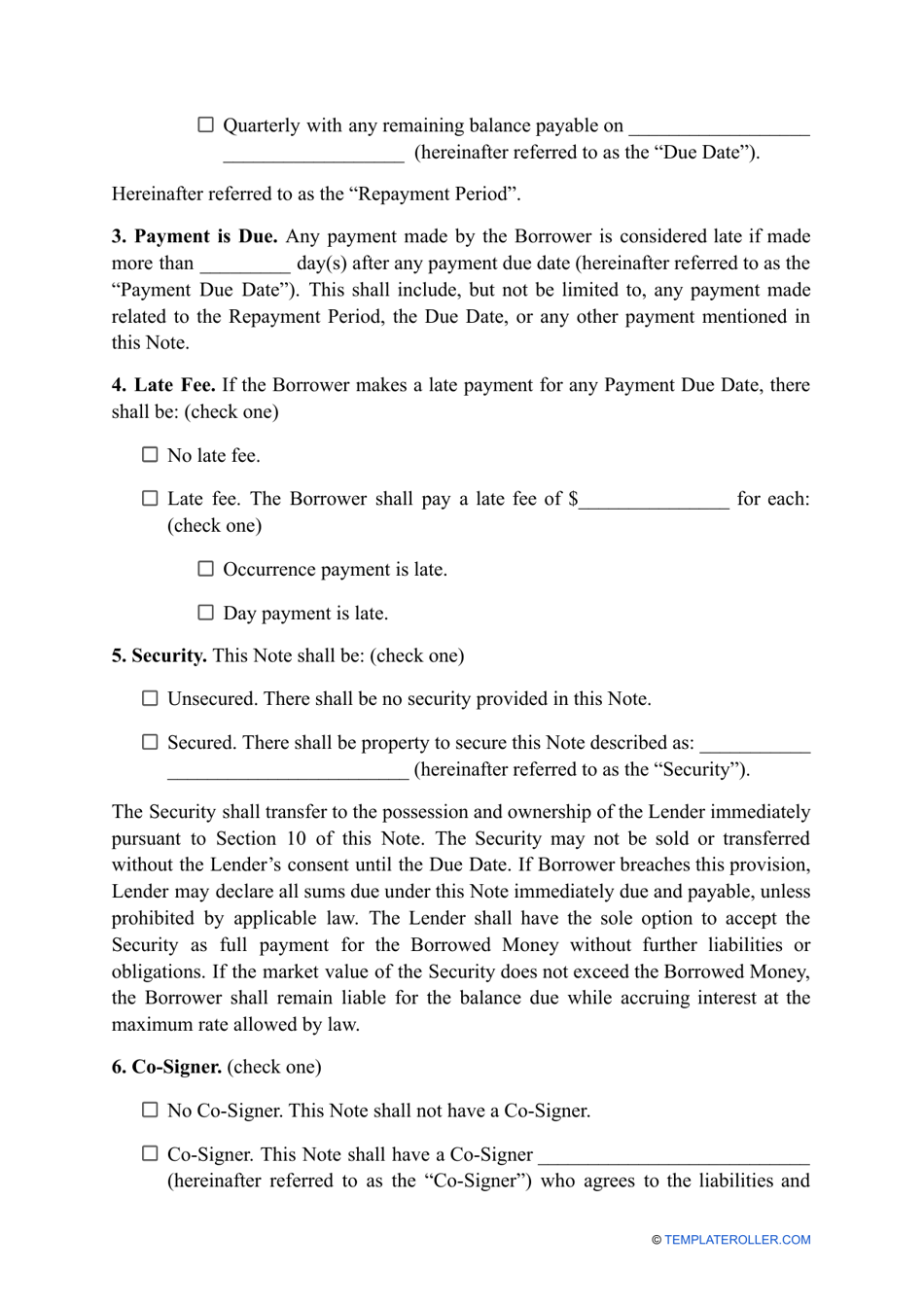

The promissory note template in Wisconsin is typically filled out by the borrower.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that outlines the terms of a loan agreement between a lender and a borrower.

Q: What is the purpose of a promissory note?

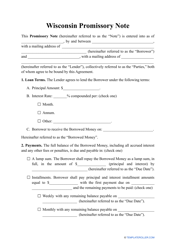

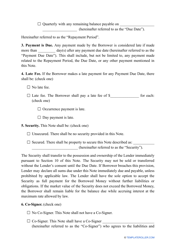

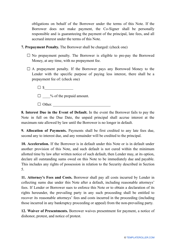

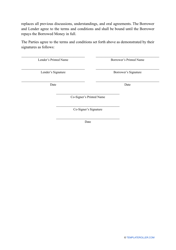

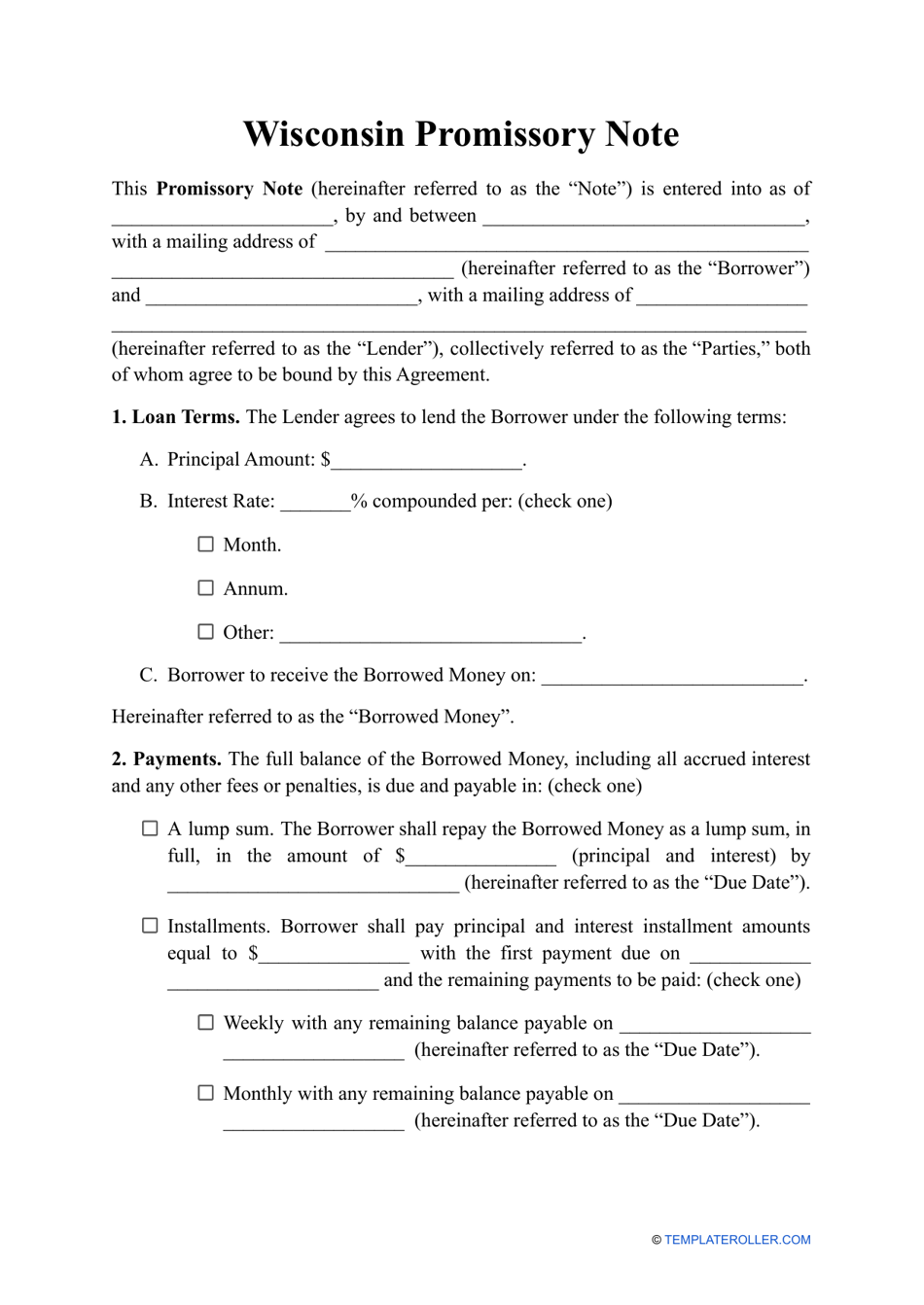

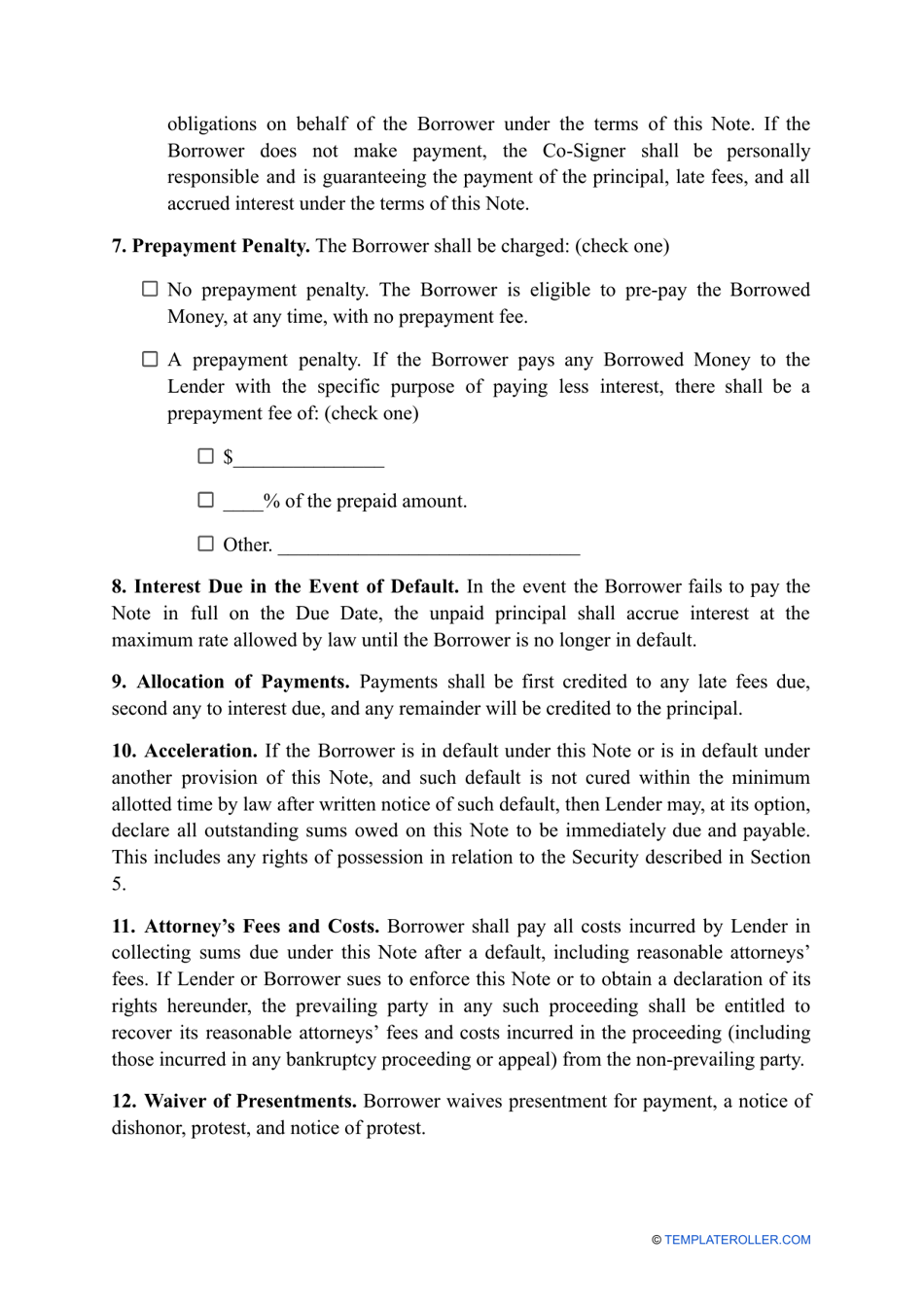

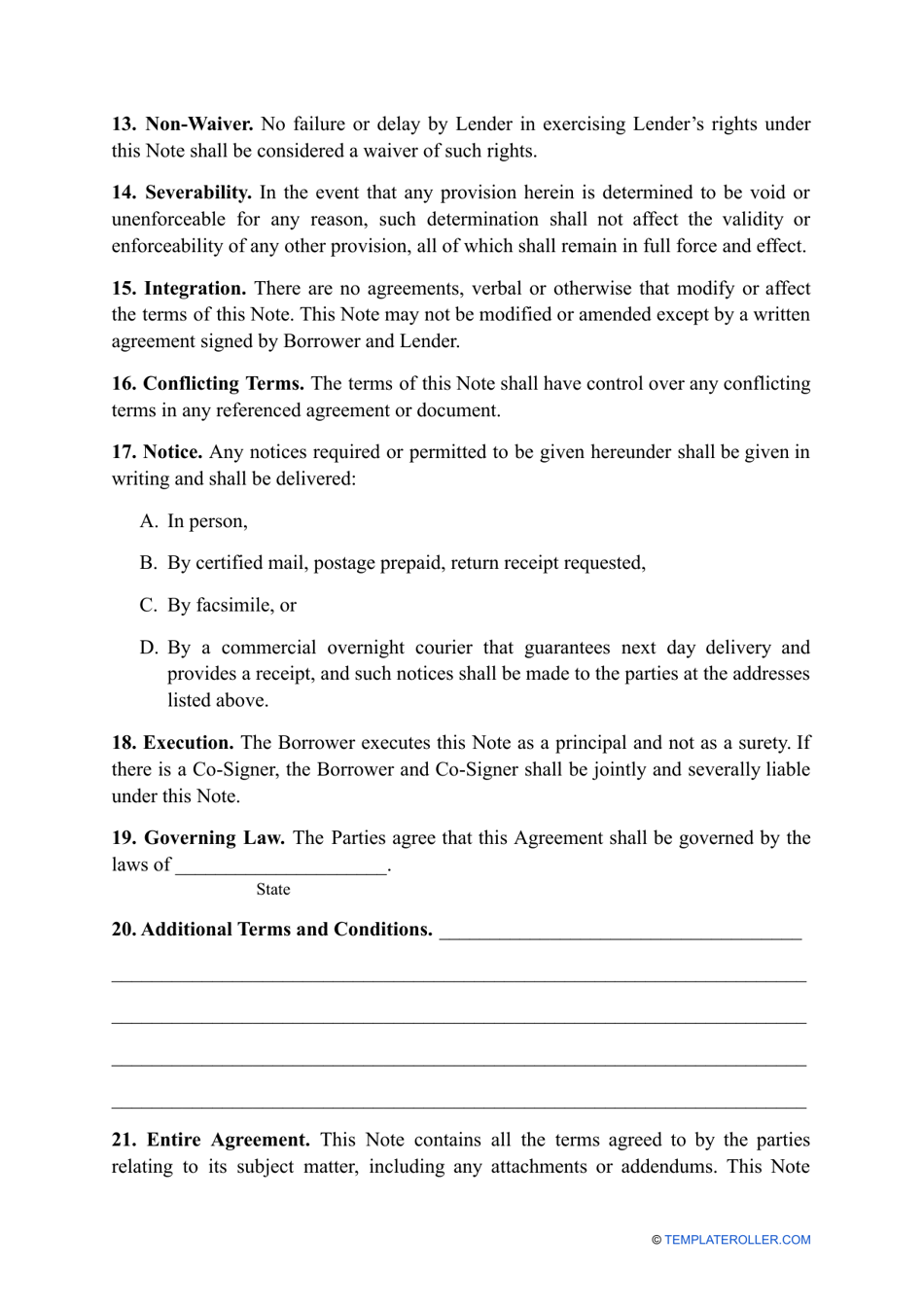

A: The purpose of a promissory note is to establish a written record of a loan, including the amount borrowed, the interest rate, and the repayment terms.

Q: Is a promissory note legally binding in Wisconsin?

A: Yes, a promissory note is legally binding in Wisconsin as long as it meets all the legal requirements for a valid contract.

Q: What information should be included in a promissory note?

A: A promissory note should include the names of the lender and borrower, the loan amount, the interest rate, the repayment schedule, and any other relevant terms and conditions.

Q: Do I need a lawyer to create a promissory note in Wisconsin?

A: While it is not required to have a lawyer create a promissory note in Wisconsin, it is recommended to consult with a legal professional to ensure that all legal requirements are met.

Q: Can a promissory note be modified or canceled?

A: A promissory note can be modified or canceled if both parties agree to the changes and document them in writing.

Q: What happens if a borrower fails to repay a promissory note in Wisconsin?

A: If a borrower fails to repay a promissory note in Wisconsin, the lender may pursue legal action, such as filing a lawsuit to obtain a judgment and recover the amount owed.

Q: Can a promissory note be used for personal loans in Wisconsin?

A: Yes, a promissory note can be used for personal loans in Wisconsin, as well as for other types of loans, such as business loans or student loans.

Q: Can a promissory note be used as collateral for another loan?

A: In some cases, a promissory note can be used as collateral for another loan, depending on the terms and conditions specified in the note and the requirements of the lender.

Q: How long is a promissory note valid in Wisconsin?

A: The validity of a promissory note in Wisconsin depends on the terms specified in the note, such as the repayment schedule. Typically, promissory notes have a specific maturity date.