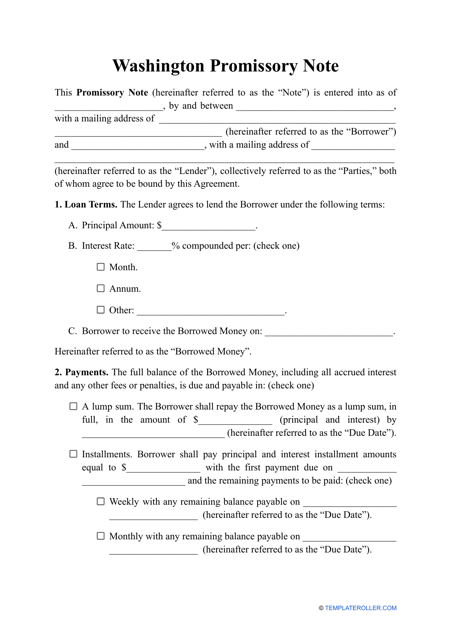

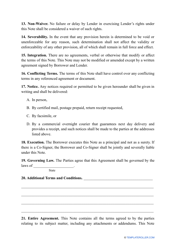

Promissory Note Template - Washington

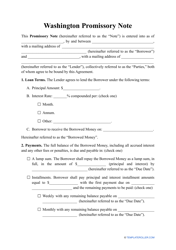

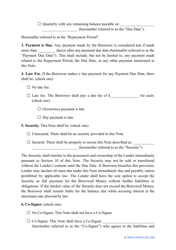

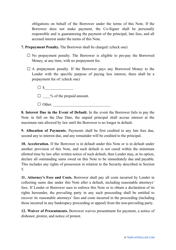

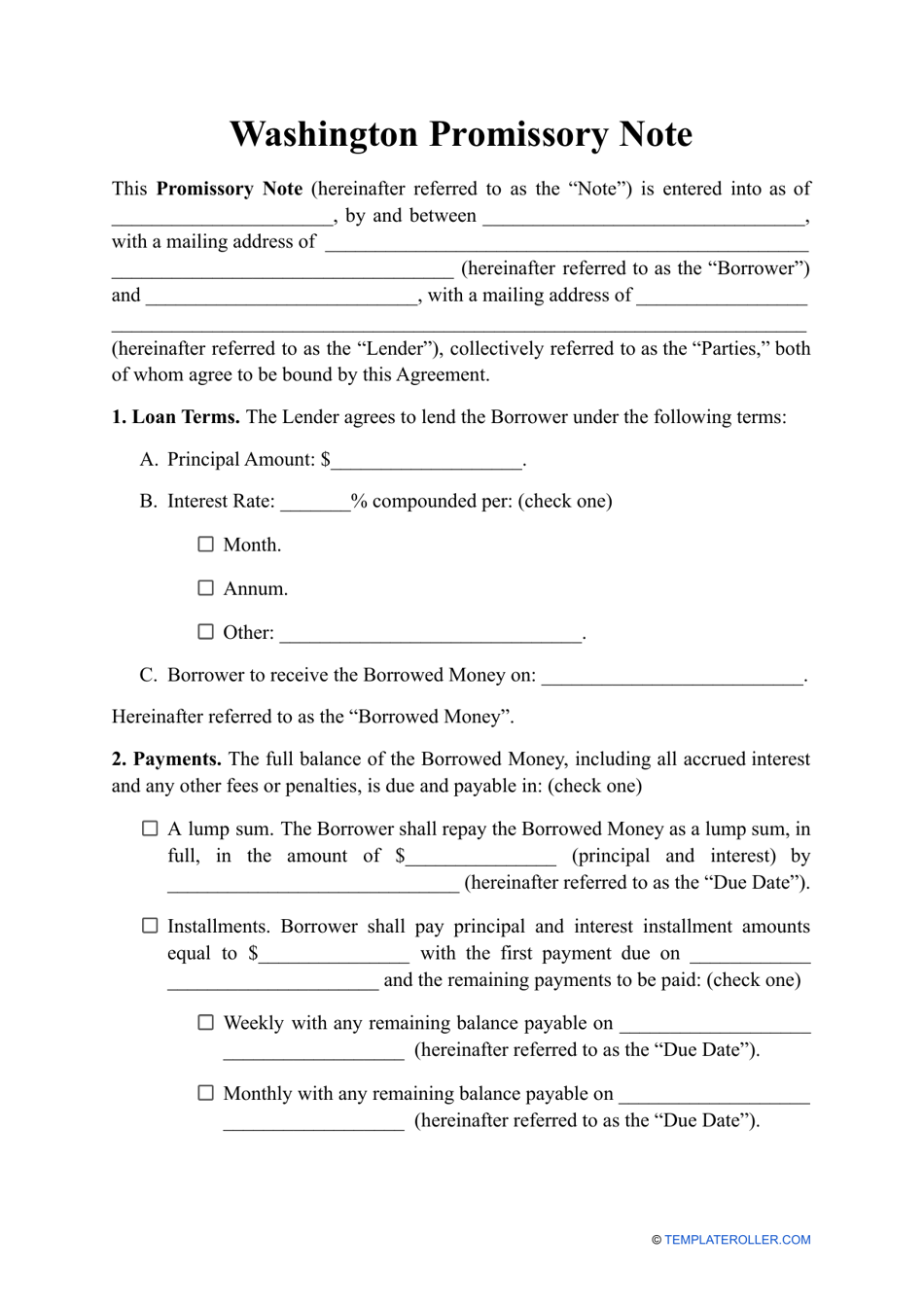

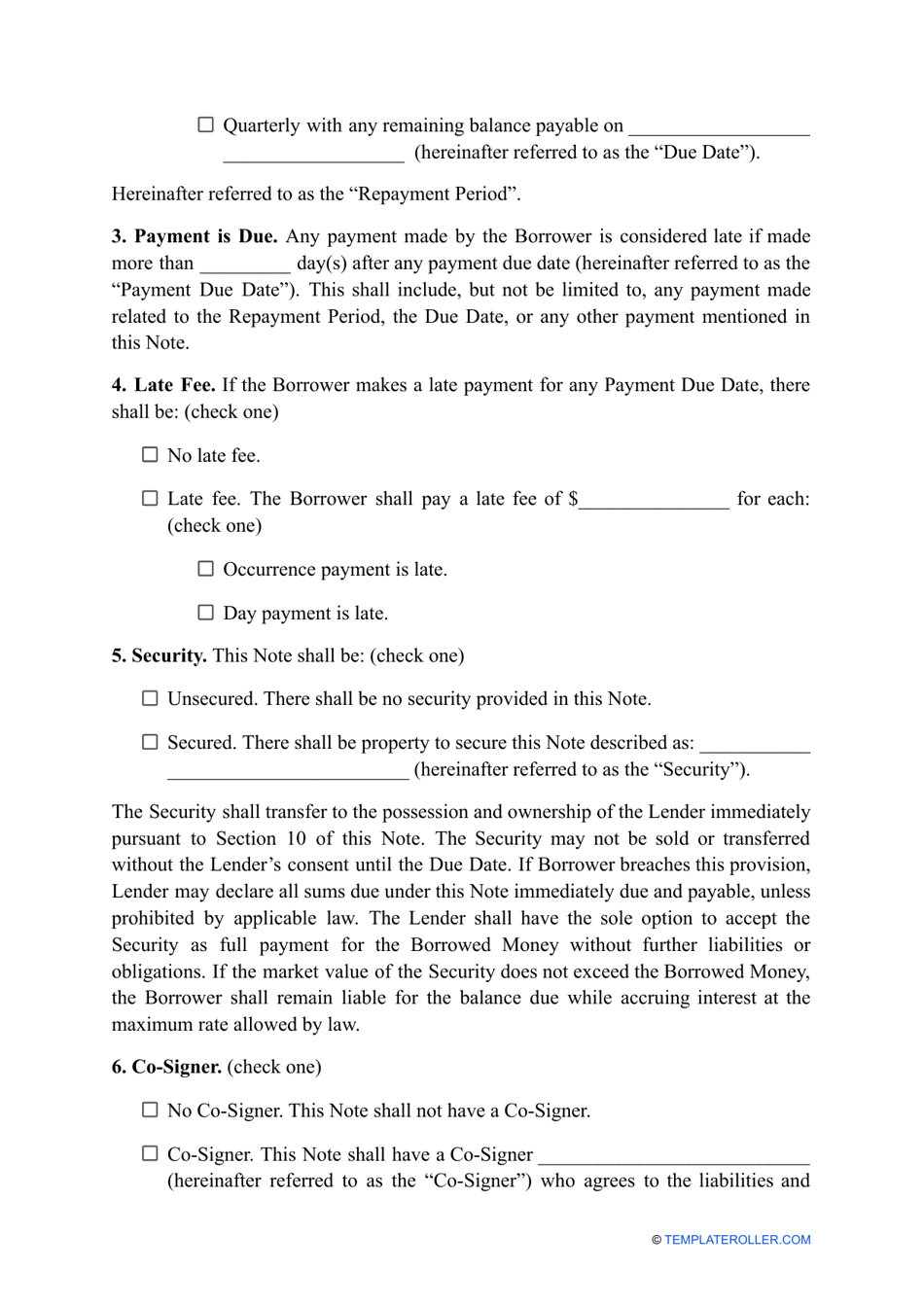

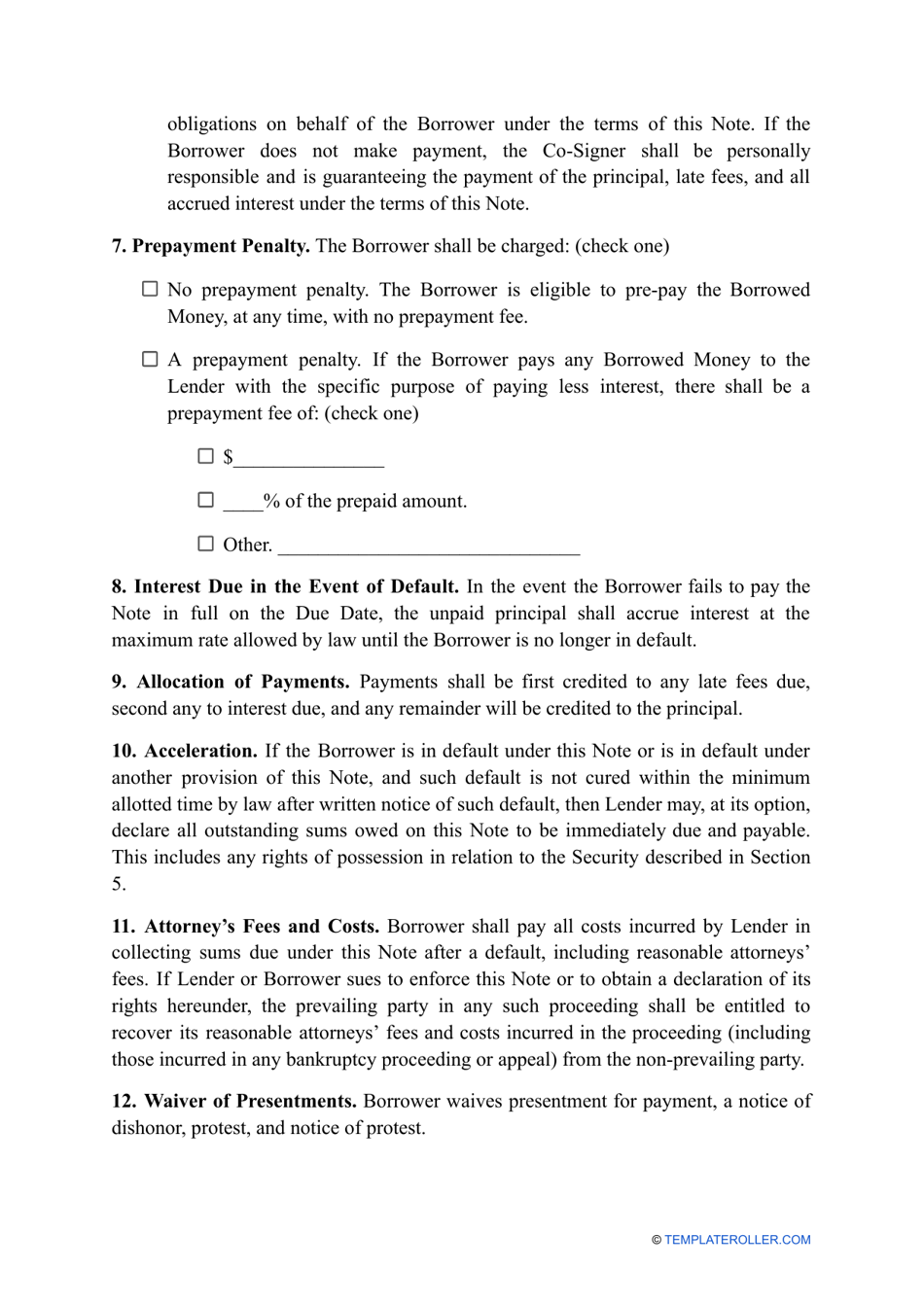

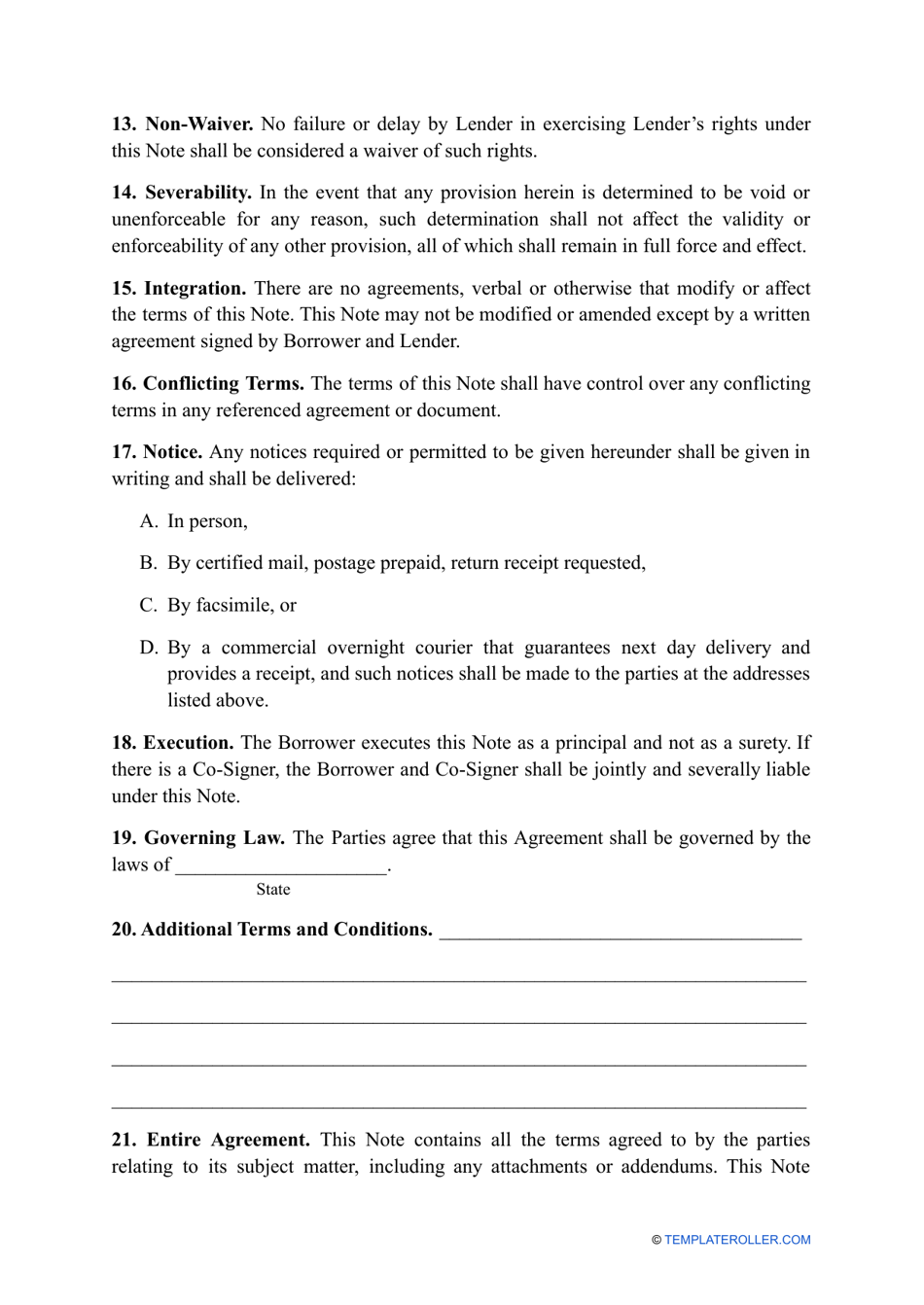

A Promissory Note Template - Washington is a document that outlines a legal agreement between a borrower and a lender regarding a loan. It specifies the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any other relevant details. This template is specifically designed for use in the state of Washington.

The promissory note template in Washington is typically filed by the borrower.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that indicates a promise to repay a loan.

Q: Why is a promissory note important?

A: A promissory note helps establish the terms and conditions of a loan, including the amount borrowed, the repayment terms, and interest.

Q: What information should be included in a promissory note?

A: A promissory note should include the names of the borrower and lender, the loan amount, repayment terms, interest rate, and any collateral.

Q: Is a promissory note enforceable in Washington?

A: Yes, a promissory note is legally enforceable in Washington.

Q: Can I modify a promissory note template?

A: Yes, you can modify a promissory note template to suit your specific loan agreement. However, it is recommended to consult with a legal professional to ensure compliance with applicable laws.

Q: How do I enforce a promissory note in Washington?

A: To enforce a promissory note in Washington, you may need to file a lawsuit in court and seek a judgment for the unpaid amount.

Q: Can I use a promissory note for personal loans?

A: Yes, a promissory note can be used for personal loans between individuals.

Q: Do I need a lawyer to create a promissory note?

A: While it is not required to have a lawyer create a promissory note, it is recommended to consult with a legal professional to ensure the document is legally sound.