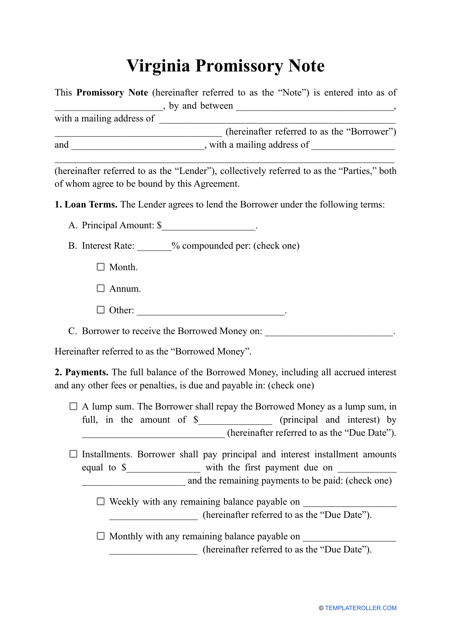

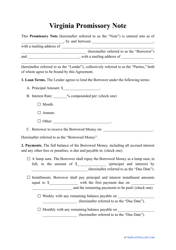

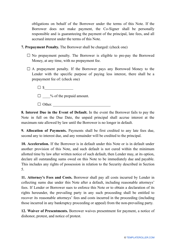

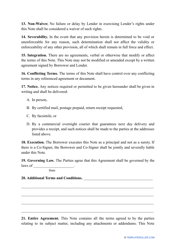

Promissory Note Template - Virginia

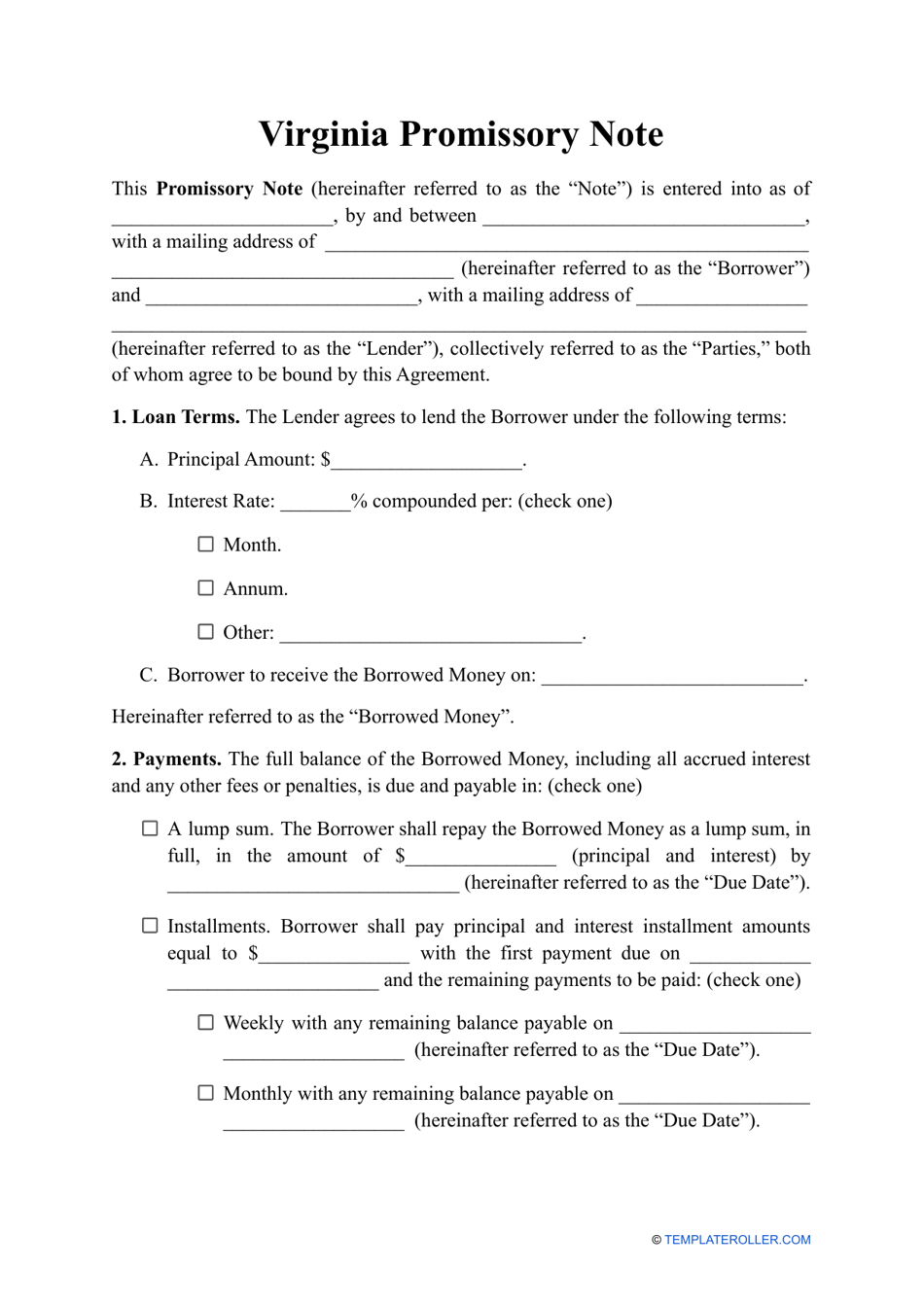

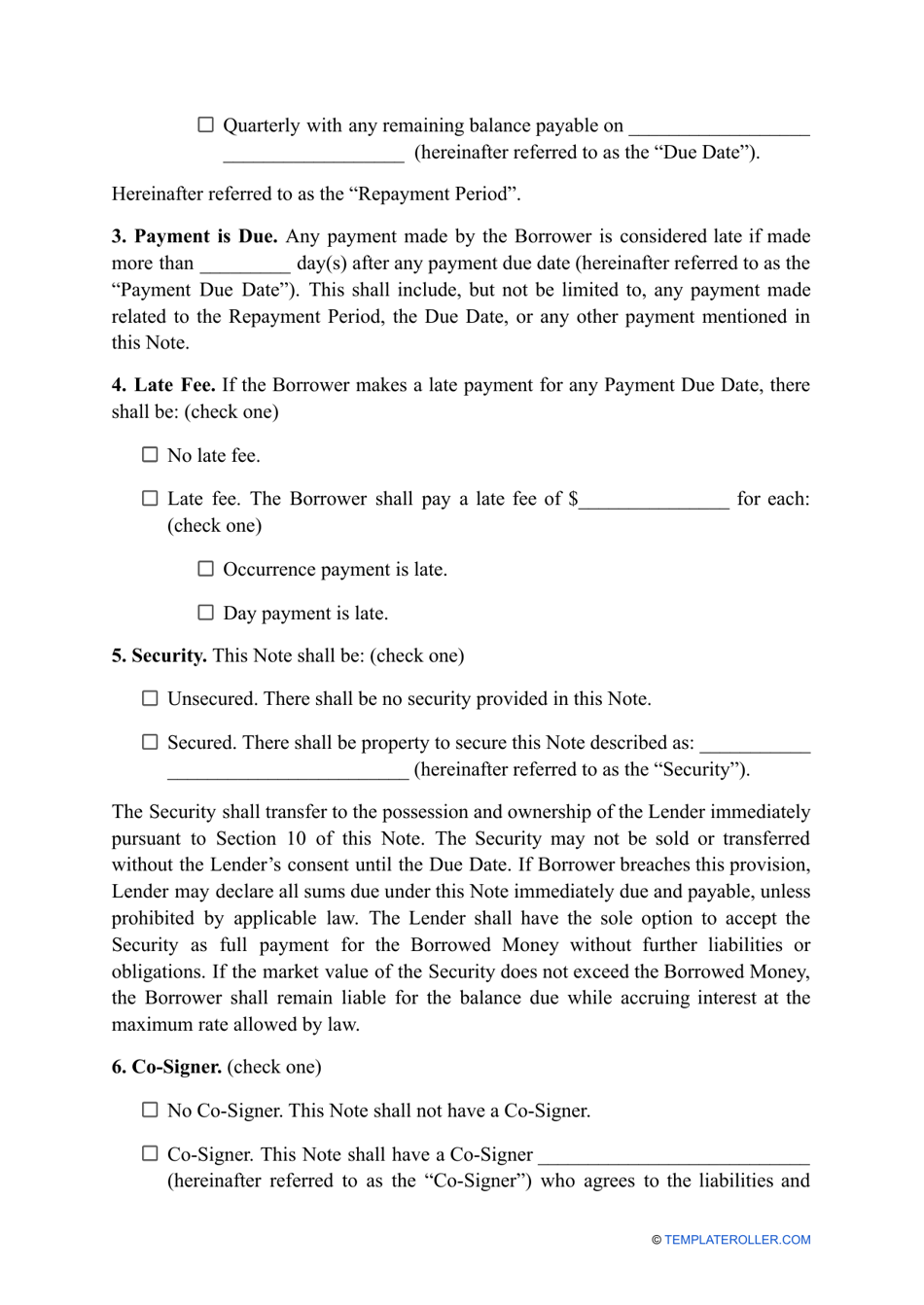

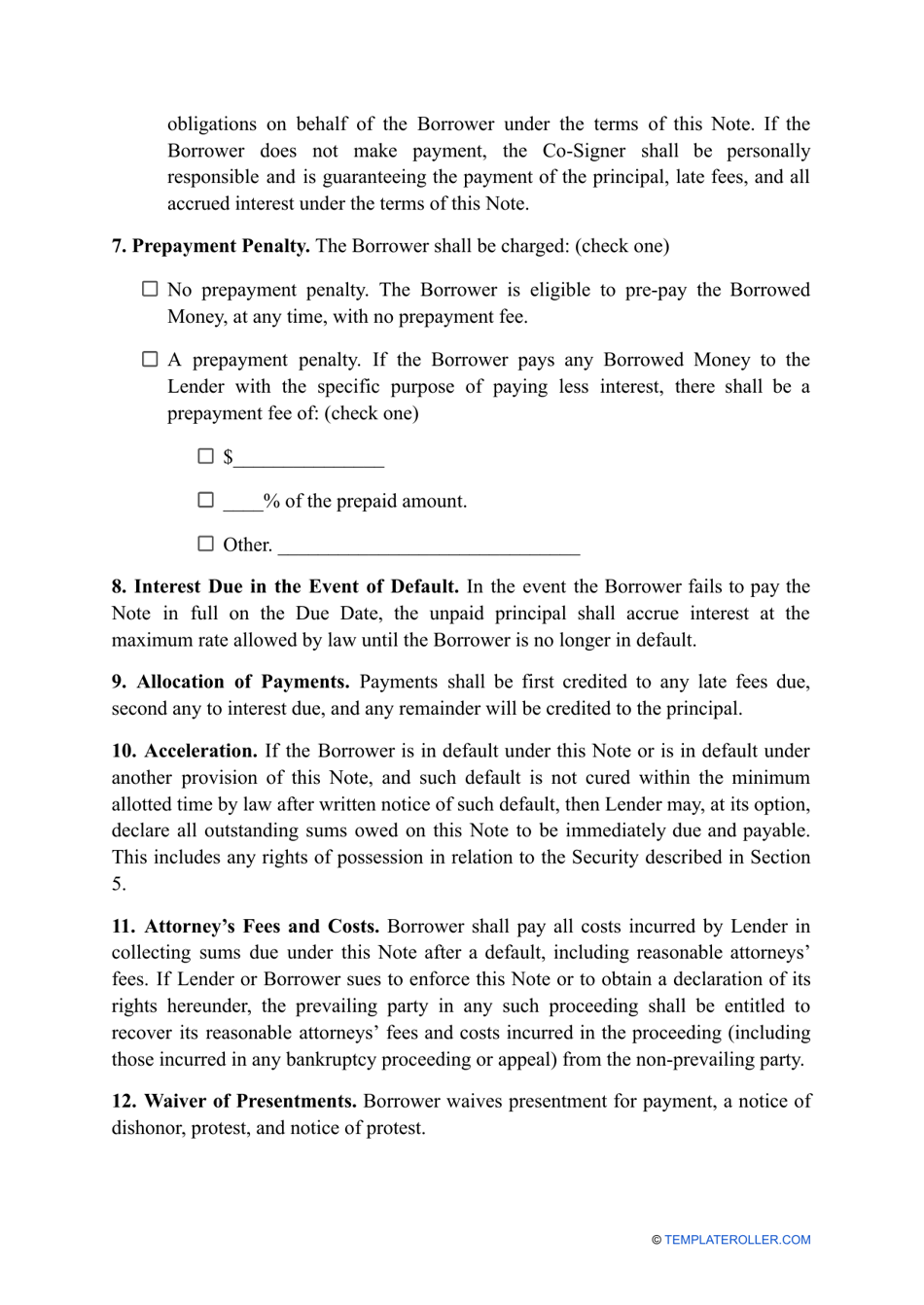

A Promissory Note Template in Virginia is a legal document used to record a promise to repay a loan or debt. It outlines the terms and conditions of the loan, such as the amount borrowed, interest rate, repayment schedule, and security agreement, if any. It is beneficial for both the lender and borrower as it provides clarity and protection in case of default or disputes.

The promissory note template in Virginia is typically filed by the borrower.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that outlines the terms of a loan, including the repayment schedule and interest rate.

Q: Why would I need a promissory note?

A: You would need a promissory note if you are lending or borrowing money and want to establish a formal agreement.

Q: What information should be included in a promissory note?

A: A promissory note should include the names of the parties involved, the amount of the loan, the interest rate, and the repayment terms.

Q: Is a promissory note legally binding?

A: Yes, a promissory note is a legally binding contract.

Q: Can I use a promissory note in Virginia?

A: Yes, promissory notes are commonly used in Virginia for loan agreements.

Q: Can I modify a promissory note template?

A: Yes, you can modify a promissory note template to fit your specific needs, but it's important to ensure that all necessary information is included and the changes are legally valid.

Q: Should I consult a lawyer to create a promissory note?

A: While it's not required, consulting a lawyer can help ensure that your promissory note is legally enforceable and protects your interests.

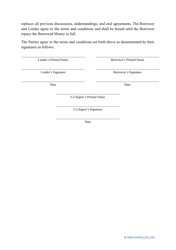

Q: How should a promissory note be signed?

A: A promissory note should be signed and dated by all parties involved to show their agreement to the terms.

Q: What happens if a borrower does not repay a promissory note?

A: If a borrower does not repay a promissory note, the lender may take legal action to recover the debt, which could include seeking a judgment or pursuing collection efforts.